With the benefit of hindsight, the title of this QT certainly applied to 2022. It was a tough year for investors. The consensus view is that 2023 could be as tough:

(1) A December NYT opinion piece by Peter Coy is titled, "A Strong Signal That Recession Is Looming." He focuses on the inverted yield curve, which often in the past accurately predicted a financial crisis that morphed into an economy-wide credit crunch and recession.

(2) A December 21 Fox Business article is titled, "Is the US economy headed for a recession in 2023? Majority of economists say yes." The article noted that the "probability of a downturn in 2023 climbed to 70% in December, according to the latest Bloomberg monthly survey of economists, up from 65% in November. The poll, conducted between December 12-16, surveyed 38 economists.

(3) A December 23 CNBC article is titled, "Why everyone thinks a recession is coming in 2023." A December 25 Bloomberg article is titled, "World Economy Is Headed for a Recession in 2023."

The bearish narrative is that inflation may remain too high next year forcing the Fed to raise the federal funds rate much higher until it causes a credit crunch and a recession. Or else, the Fed will make the mistake of tightening more than necessary to bring inflation down, thus causing a recession. Another energy shock would send oil prices higher, boosting inflation. China's current Covid crisis could worsen and disrupt global supply chains contributing to global stagflation. The Ukraine war has turned into a proxy war between the US and Russia with unpredictable consequences.

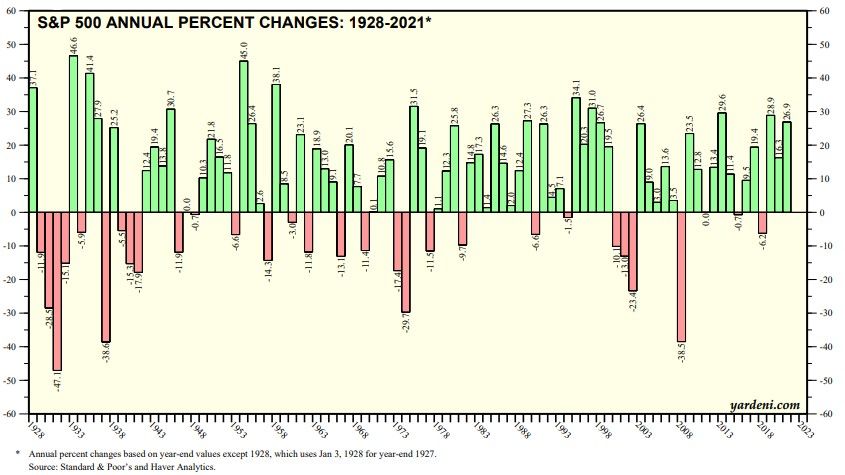

2022 was the year that valuation multiples caused the bear market in stocks, while earnings held up surprisingly well. According to the bears, 2023 will be the year that earnings fall, driving valuation multiples and stock prices lower. Since 1928, there have been 29 down years for the S&P 500 with 16 of them followed by rising stock prices and five of them followed by at least another consecutive down year (chart).

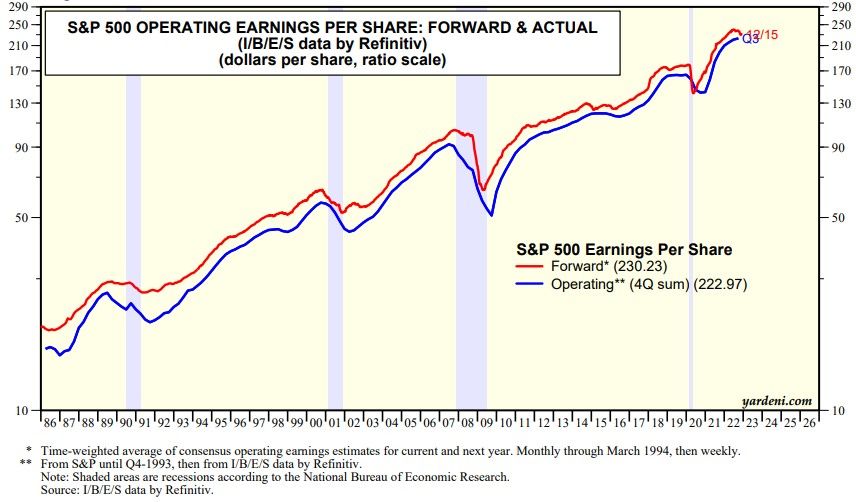

The S&P 500 is currently down 19.3% for 2022. We think 2023 will be an up year. That's because we are anticipating 60% odds of a soft landing and 40% of a hard landing in 2023. We think that the economy is much more resilient than it was in the past and much less prone to a credit crunch. We think that the economy is already experiencing a "rolling recession" with inflation moderating. So we don't expect a hard landing for earnings (chart).

In addition, the stock market discounts the future and by the end of 2023 the prospects for the economy and earnings should be much brighter than they are currently.

There is no shortage of articles about what could go wrong in 2023. We could talk ourselves into a recession, since so many economists and strategists are pessimistic. From a contrarian perspective, that's supportive of the what-could-go-right alternative for 2023.