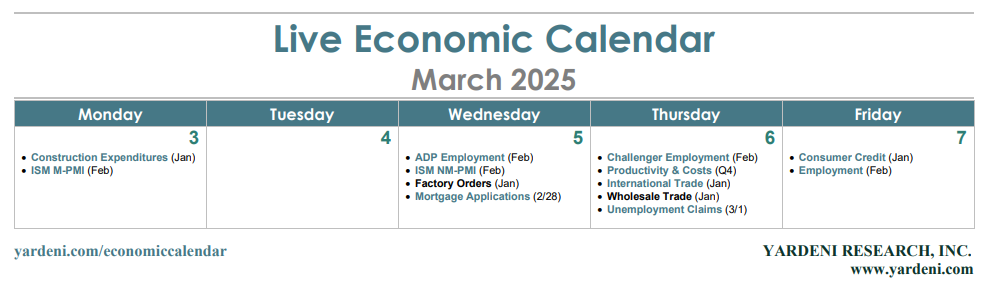

February's batch of economic indicators for January was mostly downbeat, the sort of numbers suggestive of a severe economic slowdown. They caused a few economists to raise their odds of a recession but not us. Indeed, the Citigroup Economic Surprise Index fell to -16.5, the weakest since the summer of 2024 (chart). The 10-year Treasury bond yield fell to 4.24% on Friday from a peak of 4.81% in January.

We think much of this soft patch was caused by January's ice patch, which was the coldest January since 1988. If so, then February's batch of economic indicators is likely to be mostly stronger than expected.

Let's review the outlook for some of the key economic indicators coming out this week:

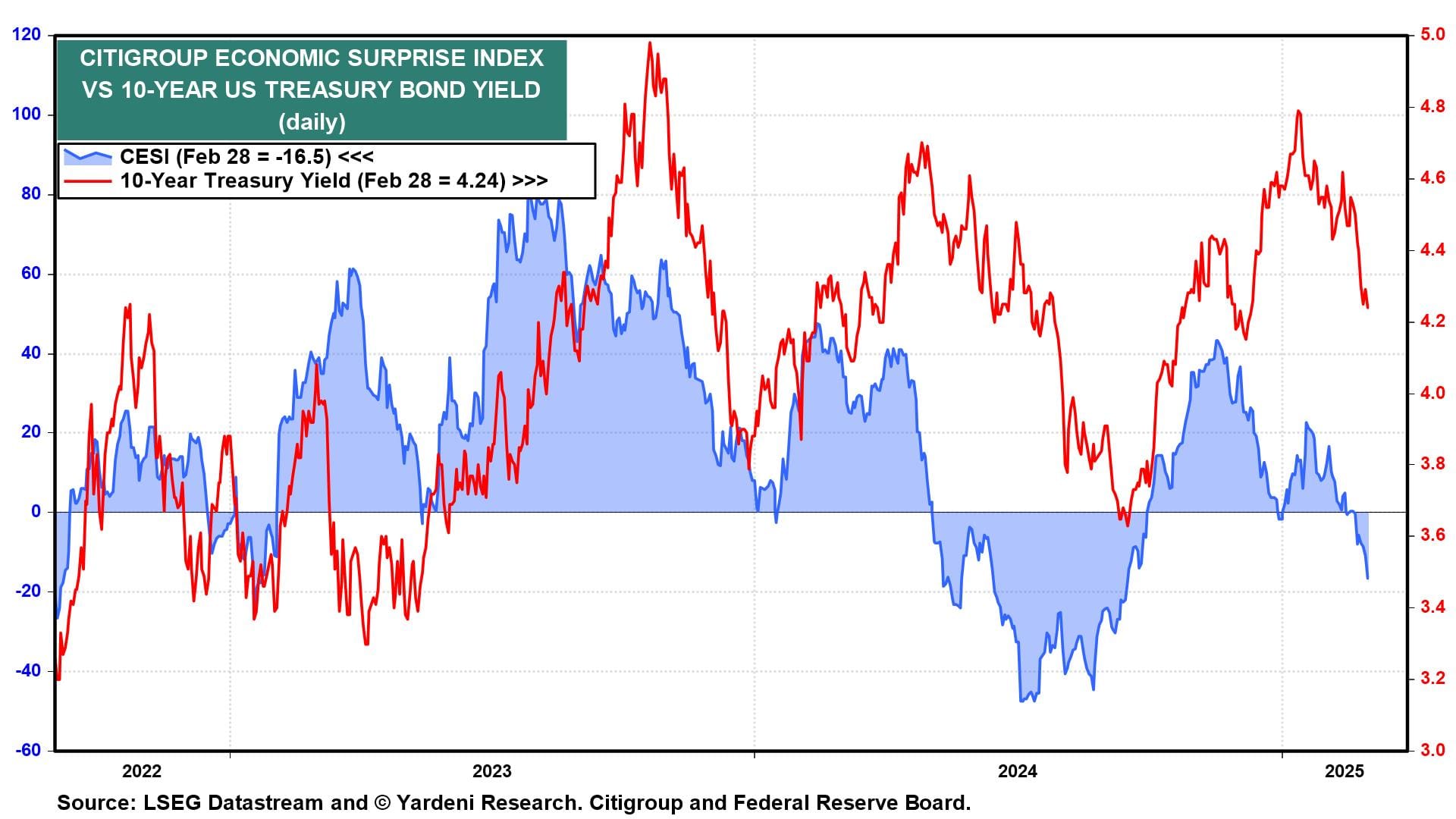

(1) Purchasing Managers Indexes. The average M-PMI of the regional business surveys conducted by five of the 12 Federal Reserve district banks edged down in February but remained solidly in positive territory for the second month in a row. That suggests that the national ISM M-PMI (Mon) remained above 50.0 for the second month in a row.

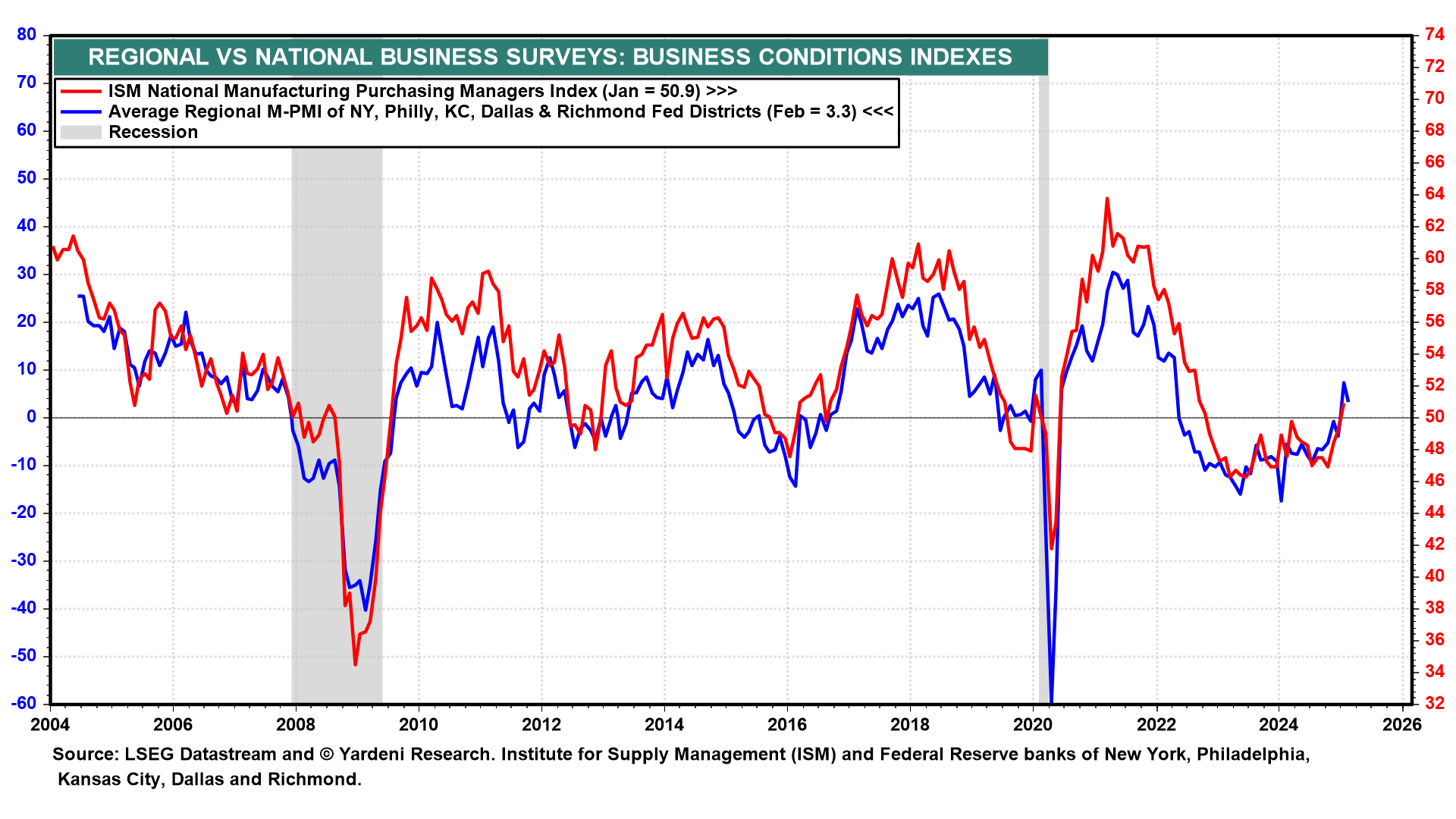

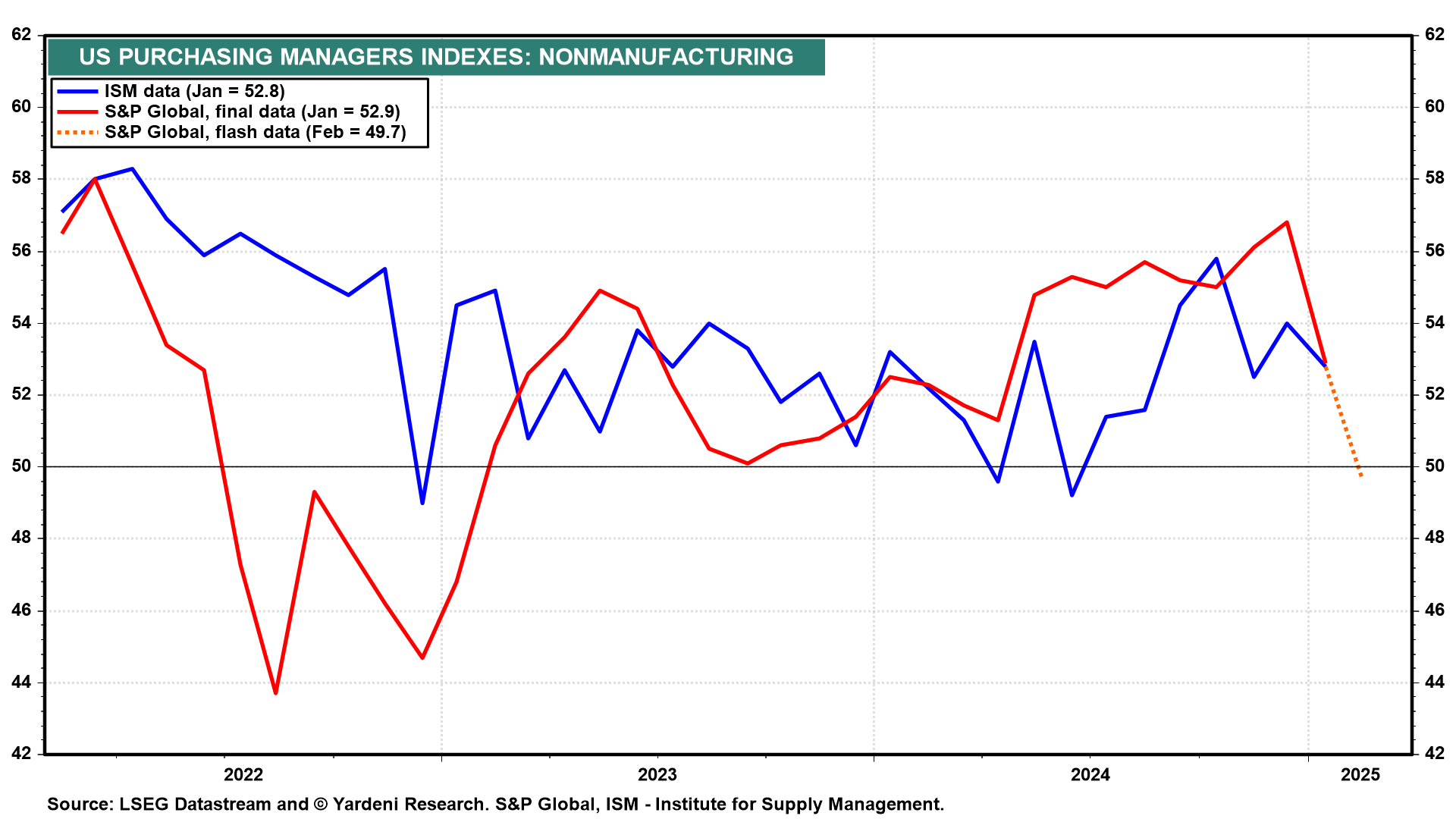

Contributing to the recent selloff in the S&P 500 from its record high on February 19 was S&P Global's January Non-Manufacturing PMI, which was released on February 21. It dropped slightly below 50.0 for the first time since the pandemic (chart). We aren't convinced that the services economy was that weak in February. We expect that the ISM NM-PMI (Wed) will show more strength.

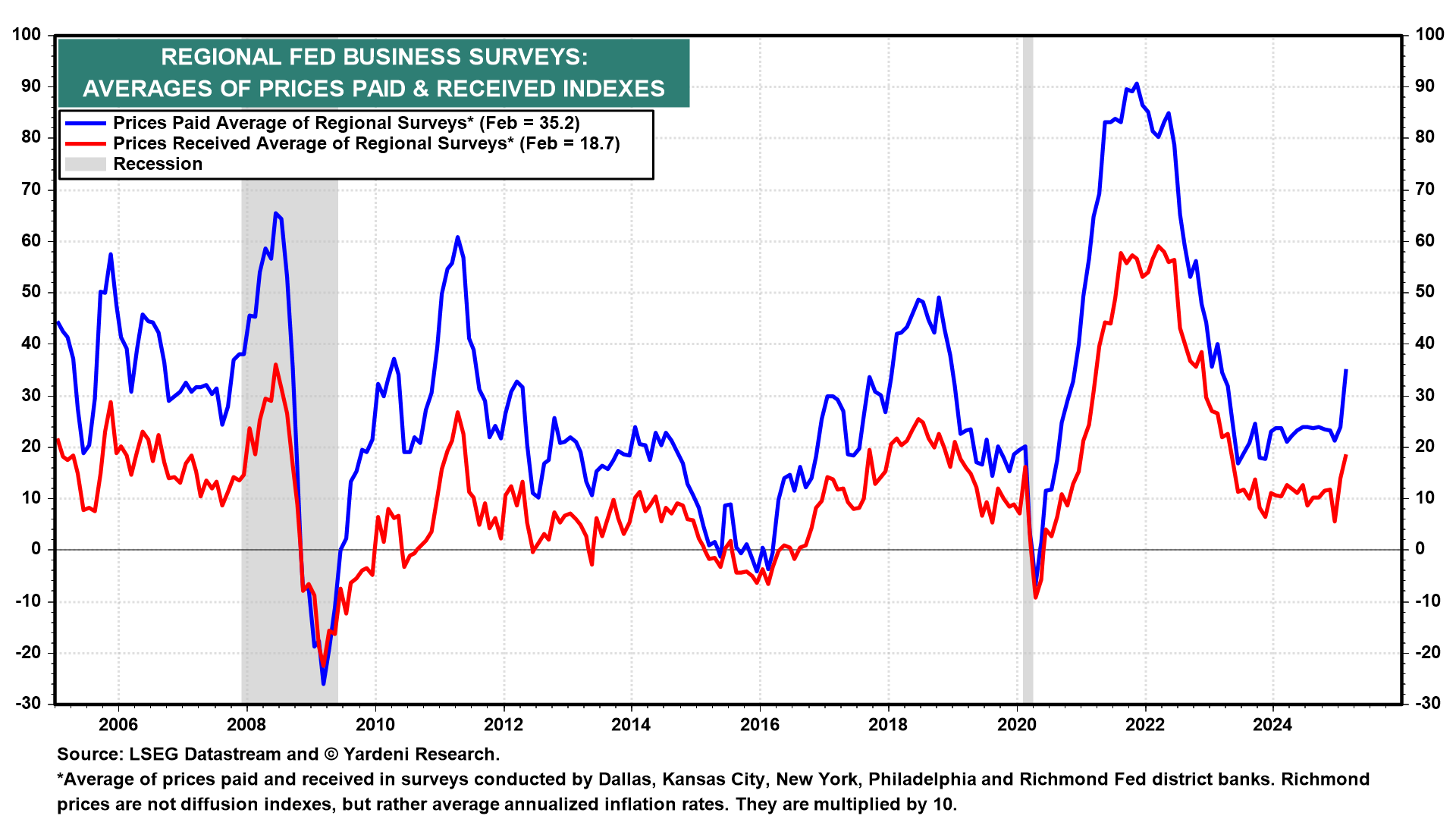

The bad news is that February's prices-paid indexes in both the M-PMI and NM-PMI reports are likely to show that Trump 2.0's tariffs are already heating up inflation, at least on a temporary basis. That's the message from the regional business surveys (chart).

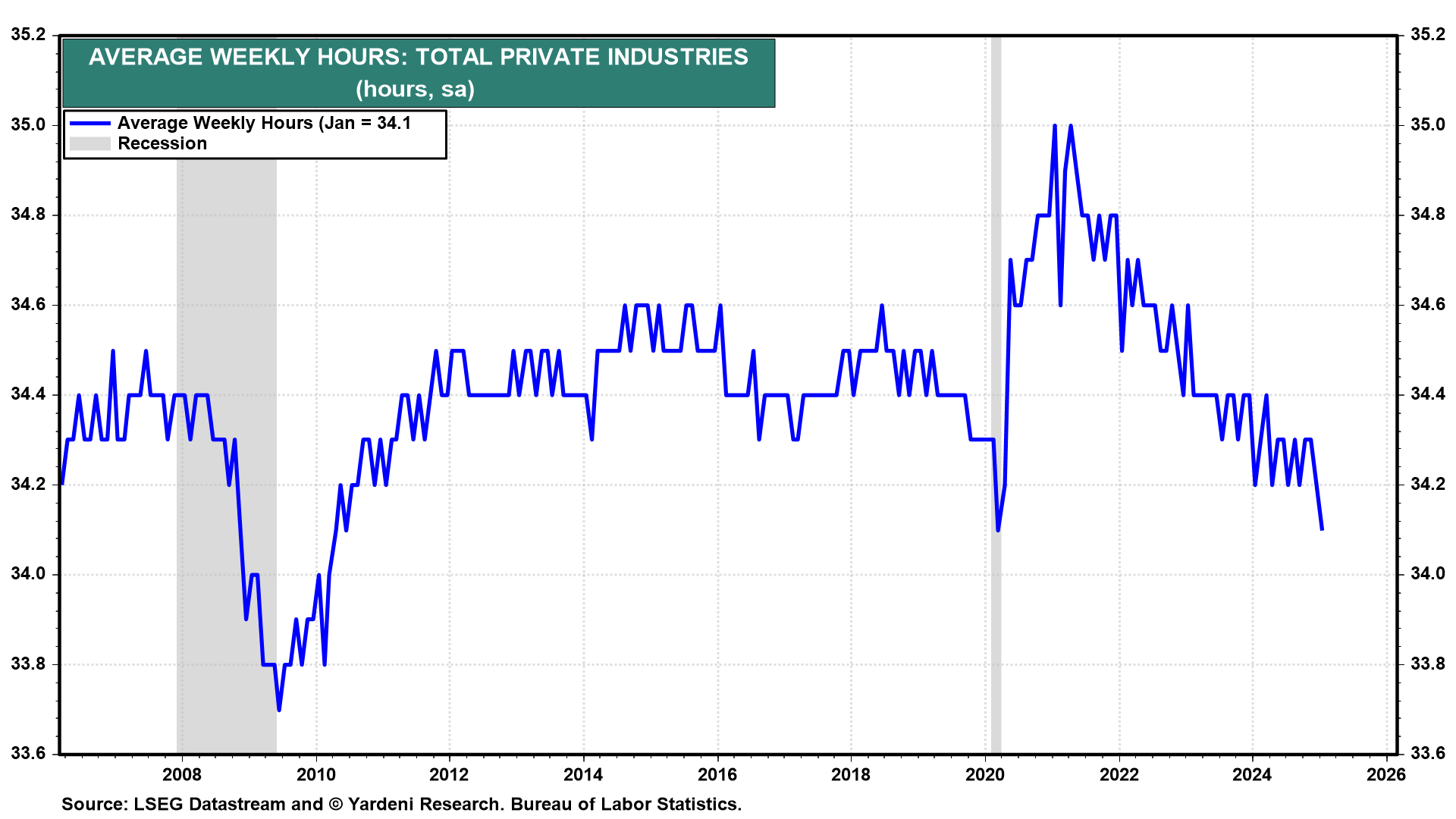

(2) Employment. January's labor market indicators were almost certainly weakened by January's Arctic blast, which brought record-breaking low temperatures and fueled a winter storm that dropped historic snowfall for parts of the South. Payroll employment rose only 143,000, and the average workweek fell (chart). Both should show rebounds in February's employment report (Fri). We are expecting that federal job loses attributable to the DOGE Boys won't show up until the March employment report. But they did start to show up in initial unemployment claims during the February 21 week.

On balance, we are expecting that the first batch of February economic indicators this week will push the bond yield higher. Stocks might also have a relief rally on better-than-expected economic indicators. Then again, President Donald Trump said on Thursday that 25% tariffs on goods imported from Canada and Mexico would go into effect Tuesday, alongside yet another 10% layer of duties on China following the one that took effect this month.