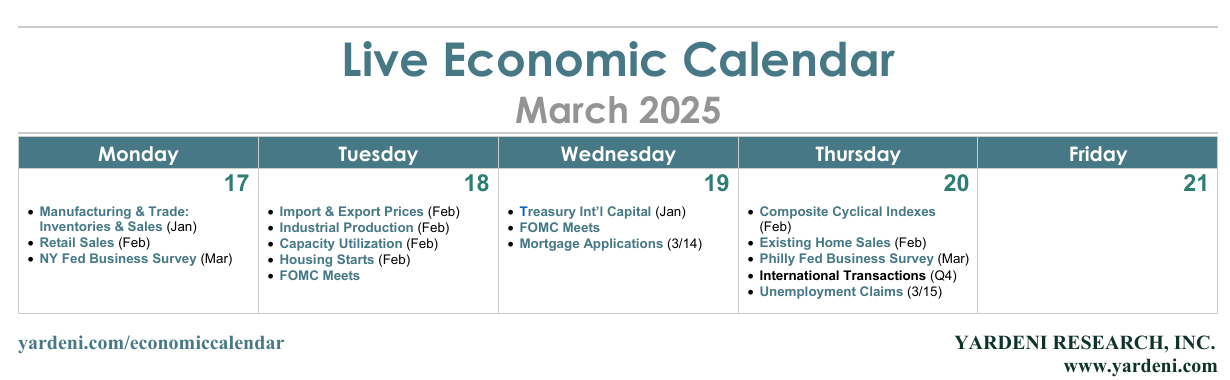

In the week ahead, lots of economic data will be packed into the first two days, followed by the FOMC meeting decision and Fed Chair Jerome Powell's press conference on Wednesday. The FOMC is widely expected to hold rates steady at 4.25%-4.50%, though the tone of Powell's presser may depend on how February's batch of economic indicators released on Monday and Tuesday turns out. Barring much weaker-than-expected data, we anticipate Powell will continue to suggest that the economy is in decent shape and does not require additional monetary policy support. However, he's likely to maintain the Fed's dovish bias to lower interest rates if the labor market cools significantly.

The federal funds rate is currently just above the unemployment rate, as it was during the late 1990s soft landing (chart). That suggests to us that the policy rate is roughly neutral.