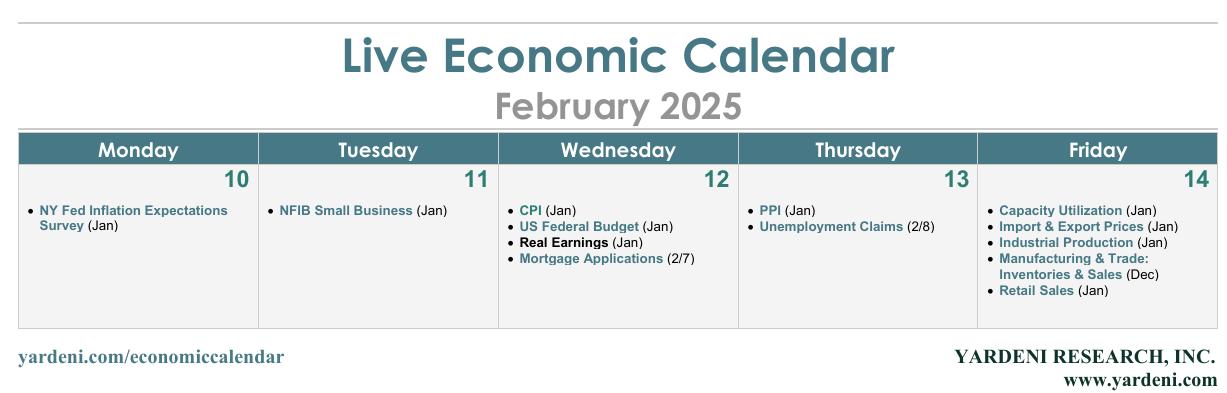

The focus of the economic week ahead will be inflation. Businesses tend to raise prices at the beginning of the year; that could result in January CPI and PPI releases (Wed and Thu) that are hotter than expected even though both are seasonally adjusted. A few Fed officials recently worried out loud that tariffs could interrupt the progress toward the Fed's 2.0% inflation target. We expect Trump 2.0 will generate more noise than signal in the upcoming inflation news, as the economy is buffeted by four “D”s: deregulation, deportations, duties, and de-bureaucratization.

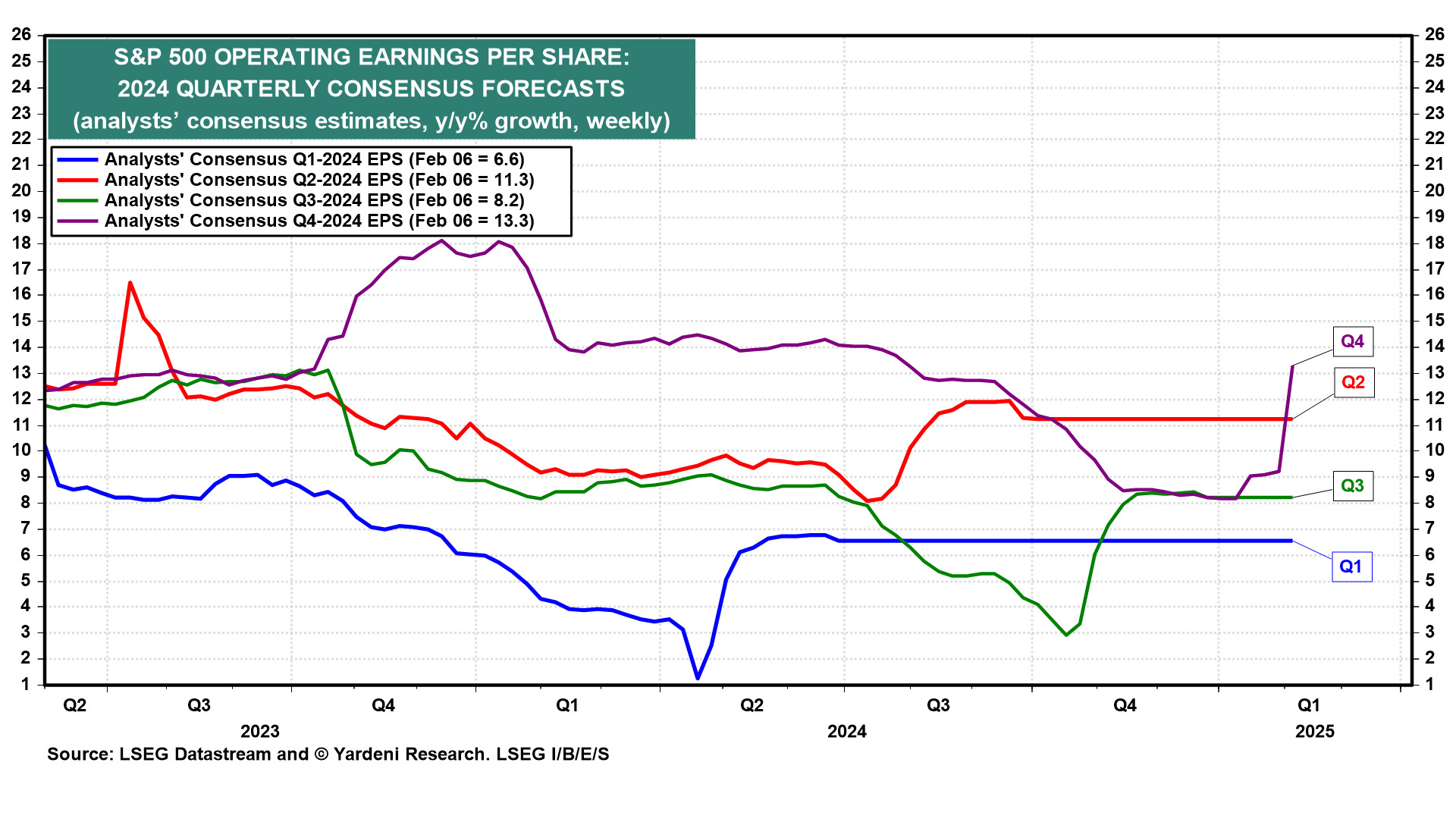

We believe that the economy's stellar performance will continue notwithstanding all the commotion coming out of Washington. On that note, Q4's earnings season is shaping up to beat even our very bullish expectations of 12.0% y/y EPS growth. Analysts entered earnings season expecting 8.2% y/y EPS growth; after big-tech earnings reports, that's now 13.3% (chart).