This week's data are likely to confirm that consumer sentiment (Fri) remained sour this month. The housing market is unlikely to have thawed last month given that mortgage rates remain high and building costs will increase with tariffs and a shortage of immigrant labor. Even some incremental good news on durable goods orders (Thu) would likely be chalked up to tariff front-running, especially as we expect regional Fed M-PMIs (Tue & Thu) to show that output expectations are falling fast.

Stock prices are down sharply today because of President Donald Trump's attacks on Fed Chair Jerome Powell, who won't resign and probably can't be fired. The Fed is unlikely to cut interest rates unless a significant financial crisis emerges.

In any case, here's what we're expecting this week:

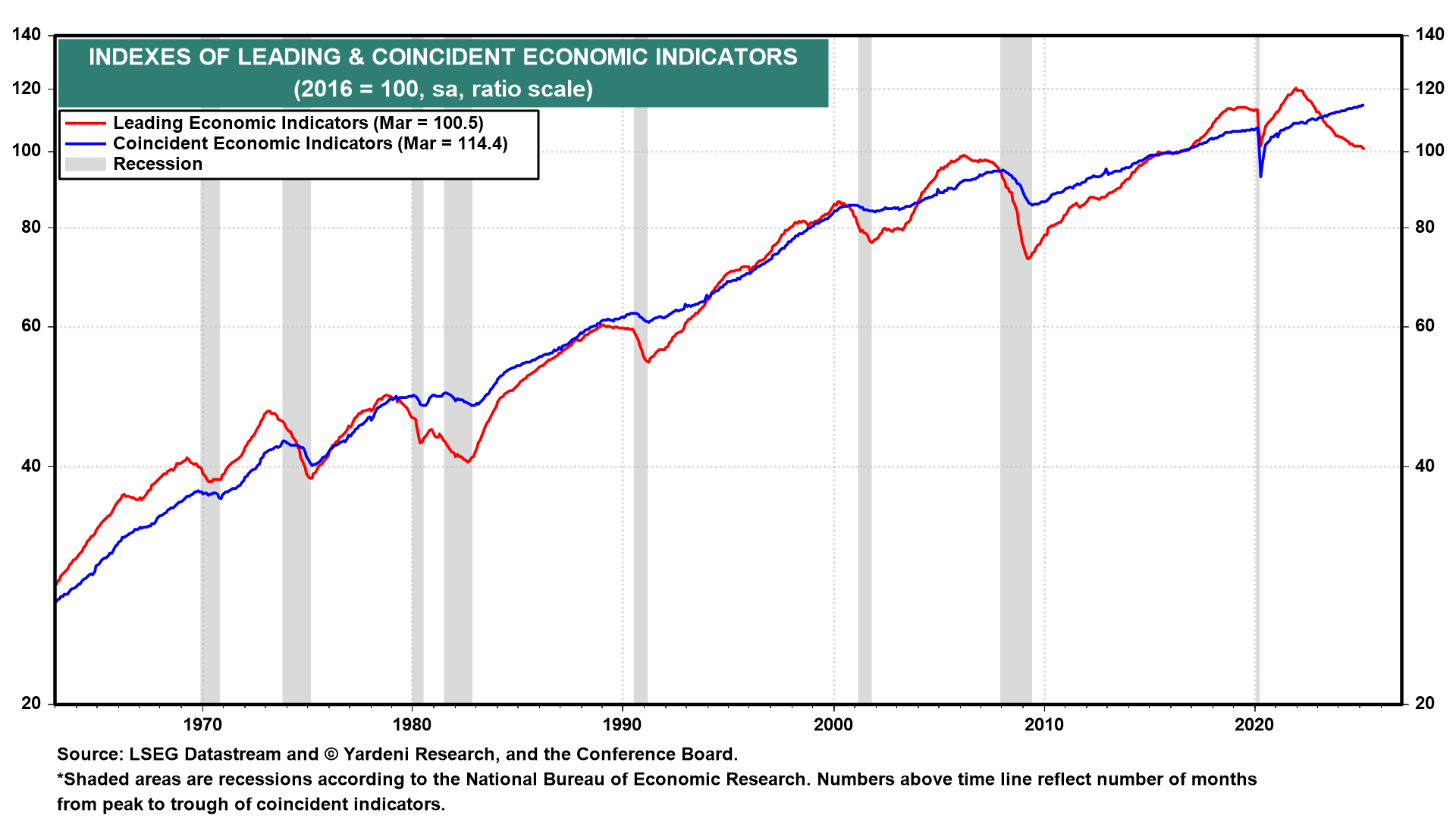

(1) Composite economic indexes. The Index of Leading Economic Indicators (LEI) continued to decline, falling 0.7% in March, while the Index of Coincident Economic Indicators (CEI) rose 0.1% to a new record high (chart).

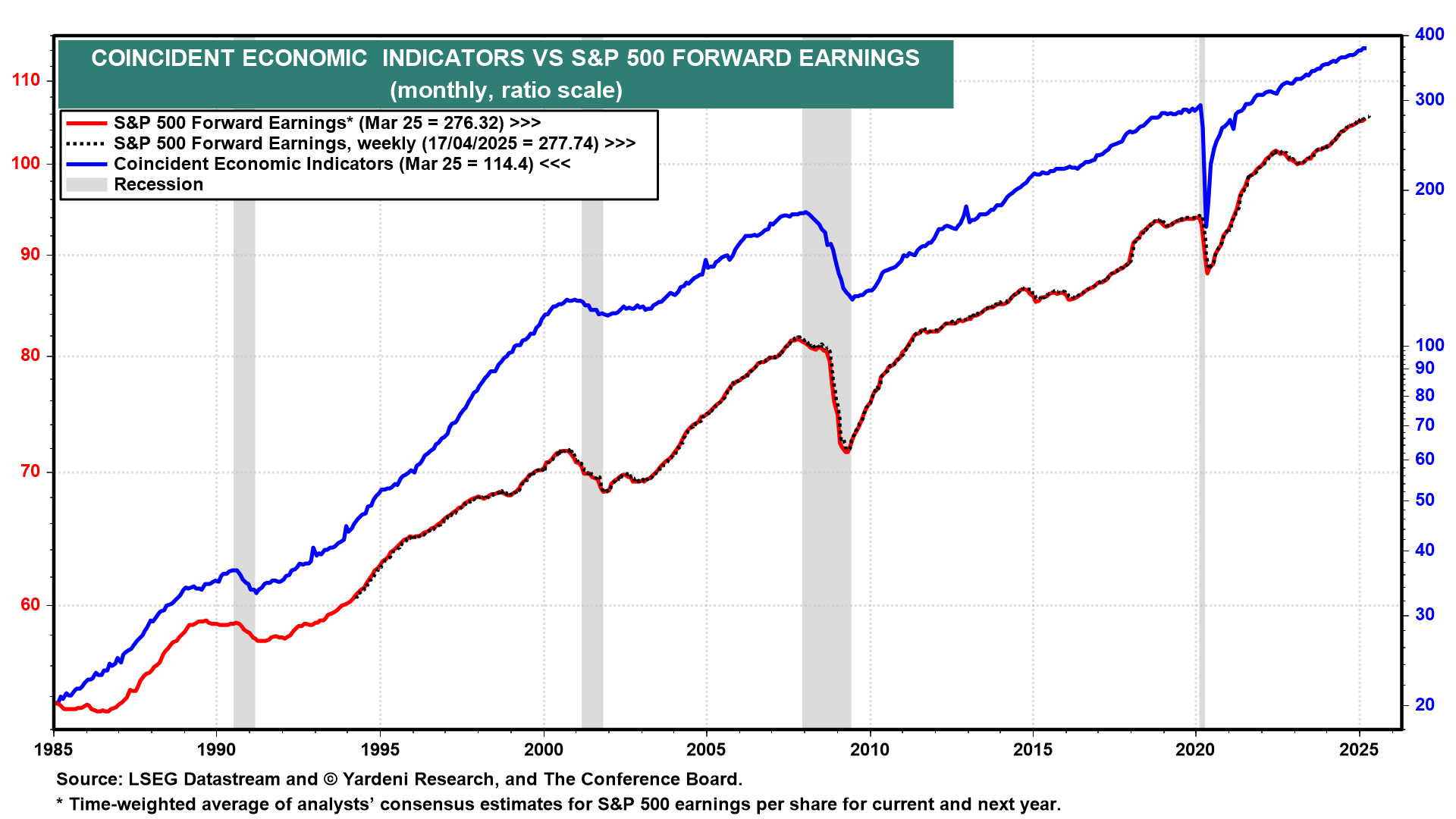

The CEI is highly correlated with S&P 500 forward earnings (chart). The CEI consists of payroll employment, real personal income (less transfers), real manufacturing and trade sales, and industrial production. So its trajectory depends on whether tariffs stimulate more American manufacturing or whether higher prices and less trade reduce overall growth in the goods-producing sector.

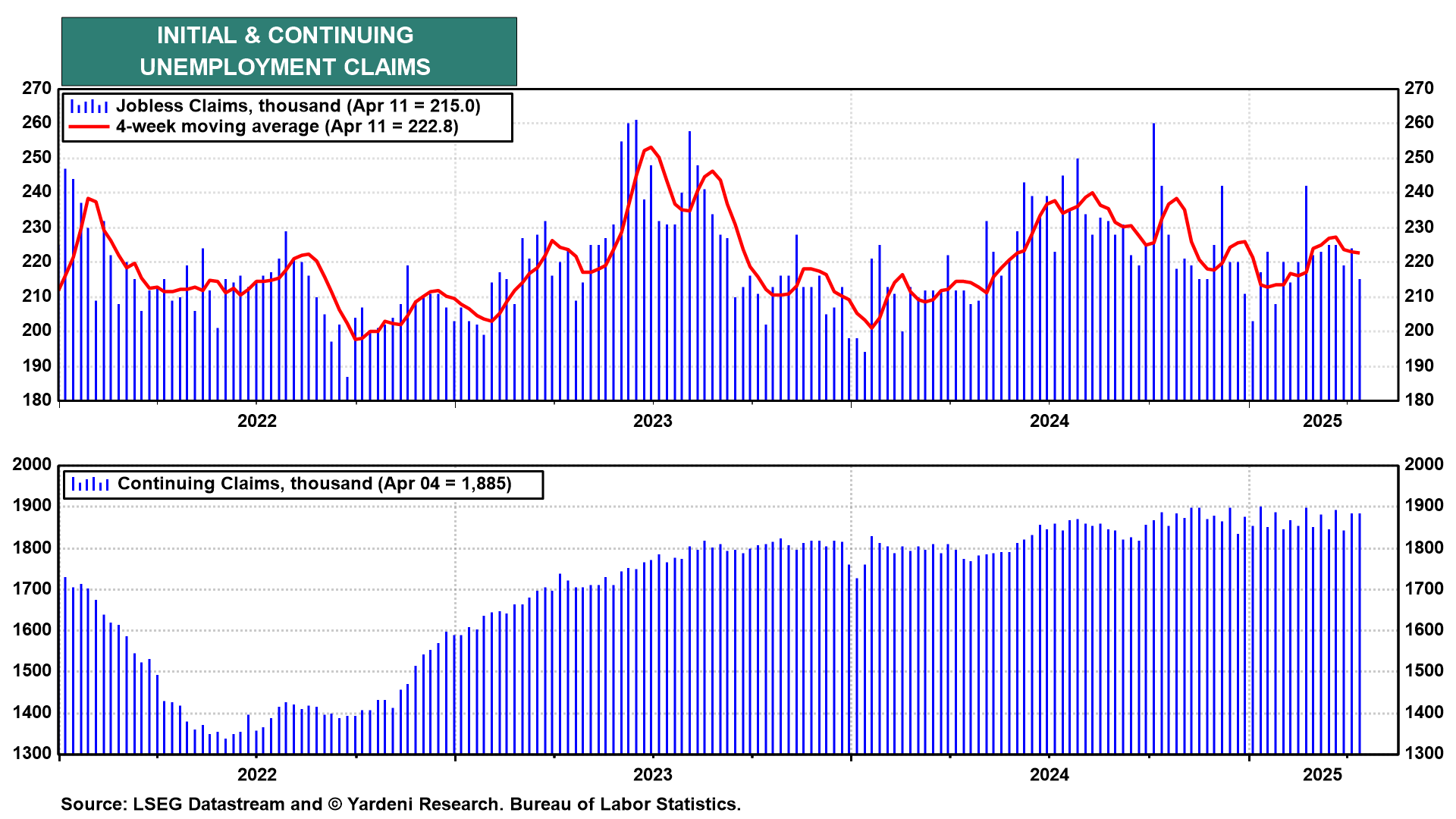

(2) Unemployment. It's been smooth sailing for initial and continuing unemployment claims thus far (chart). These data continue to show that the labor market remains resilient. The Fed will be happy if initial jobless claims remain below 250,000.

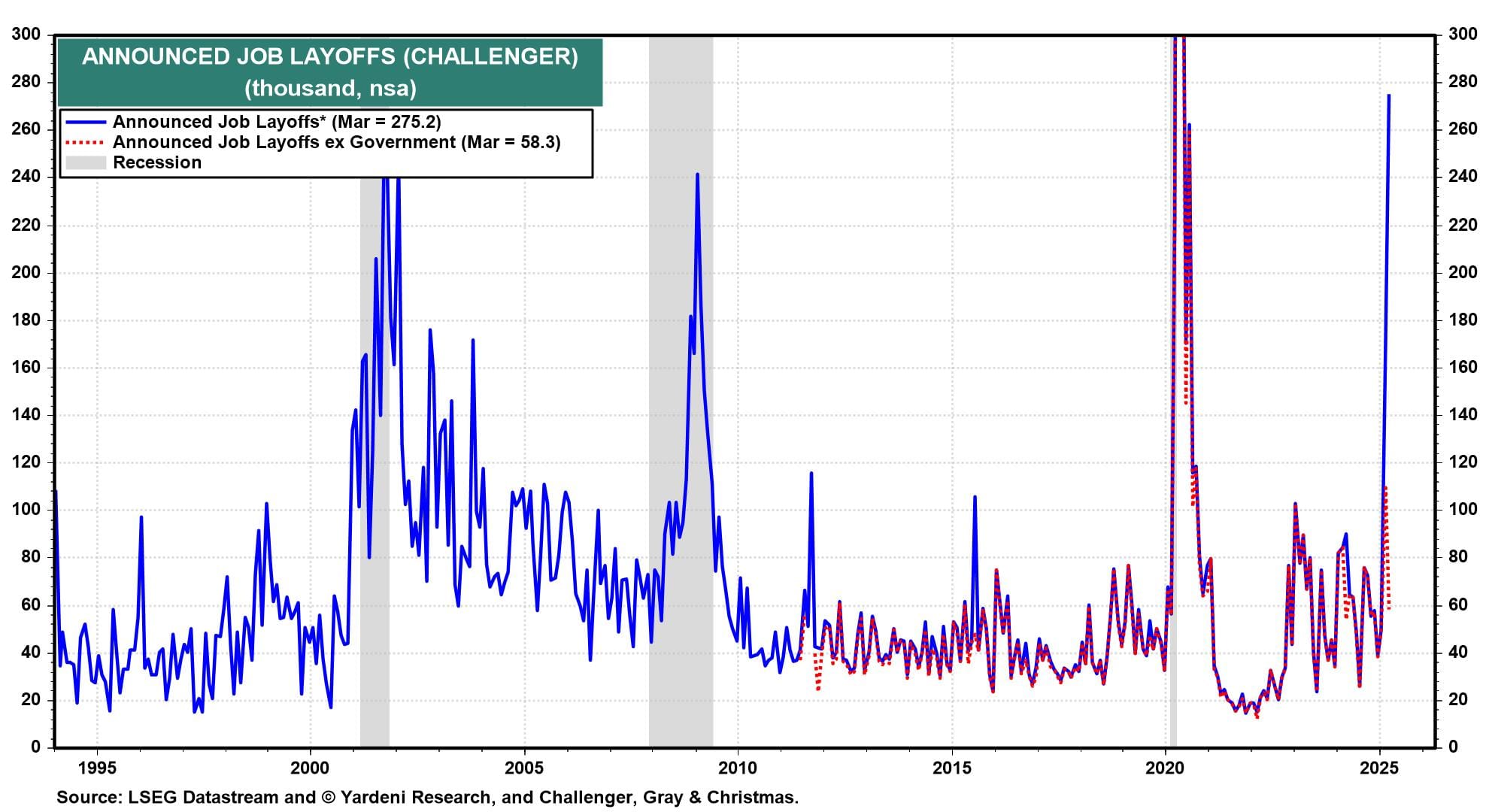

However, anecdotes about layoffs due to tariffs are starting to pop up. Also, Challenger announced that layoffs have spiked, though mostly in the government sector (chart). Federal unemployment claims have actually been falling lately.

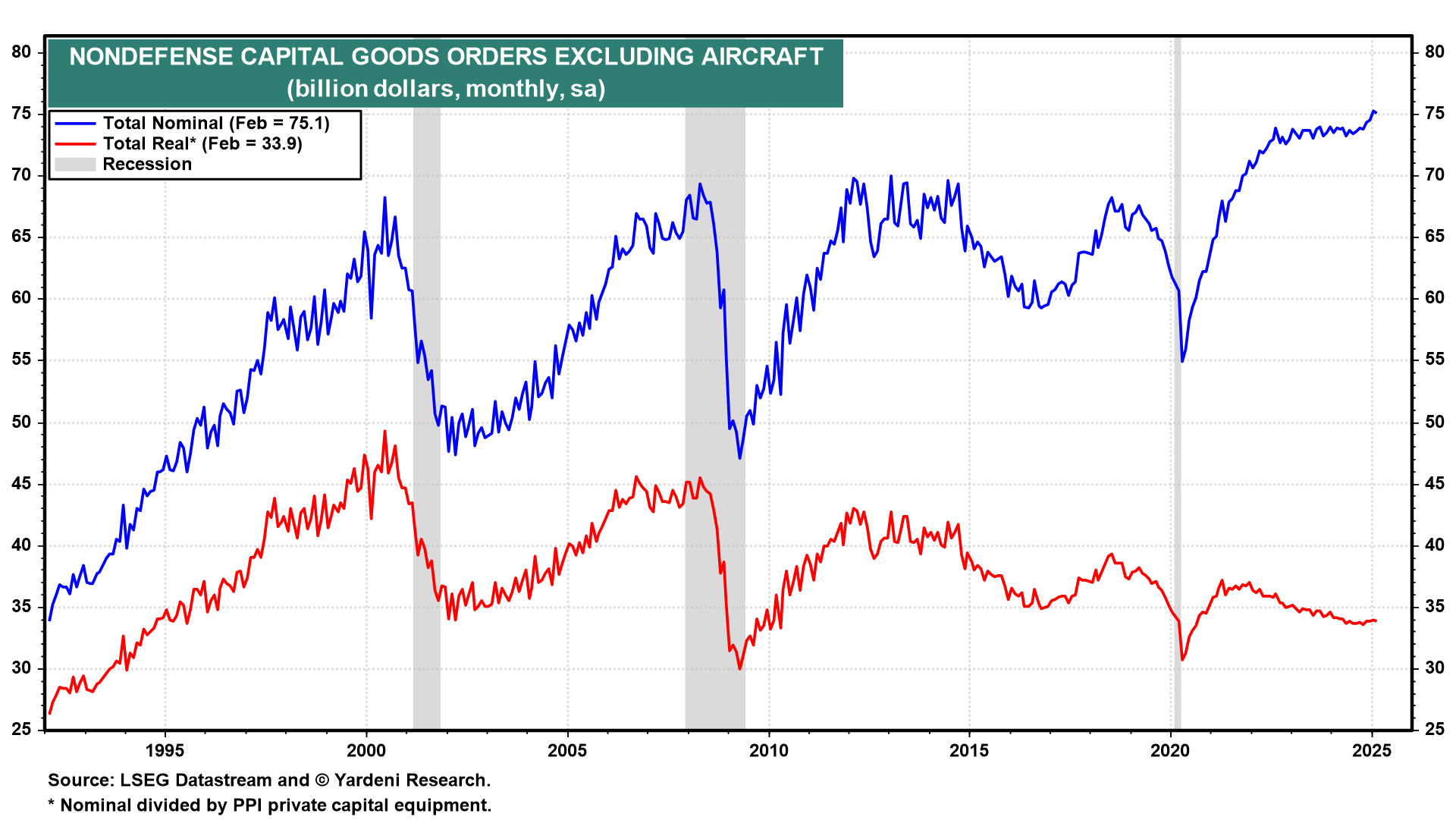

(3) Manufacturing. Nondefense capital goods orders ex-aircraft has climbed to record highs in nominal terms; but adjusted for inflation, it is relatively low (chart). Sentiment among manufacturers is quite depressed due to trade uncertainty and higher input costs. If tariffs lead to even less industrial production, that would be a negative for economic growth and markets. The backlash may be enough to create a policy response, especially as stock prices increasingly discount a recession.