Bearish stock market narratives have been pervasive since early 2022. They are becoming more so now with each headline coming out of Washington. Duties, deportations, duties, and de-bureaucratization (the four "Ds") can have a shock-and-awe effect. But financial markets broadly have been unperturbed because the US economy continues to be rock solid.

Then again, reining in the budget deficit and trade deficit is no easy task. President Donald Trump has even acknowledged that the cost of doing so may be some short-term pain. But we remain optimistic on the economy and therefore bullish on the stock market. Notwithstanding all the commotion in Washington, including frequent shifts in fiscal and monetary policies, the US economy's resilience speaks for itself. Currently, we see signs that not only is growth strong but it might be getting stronger.

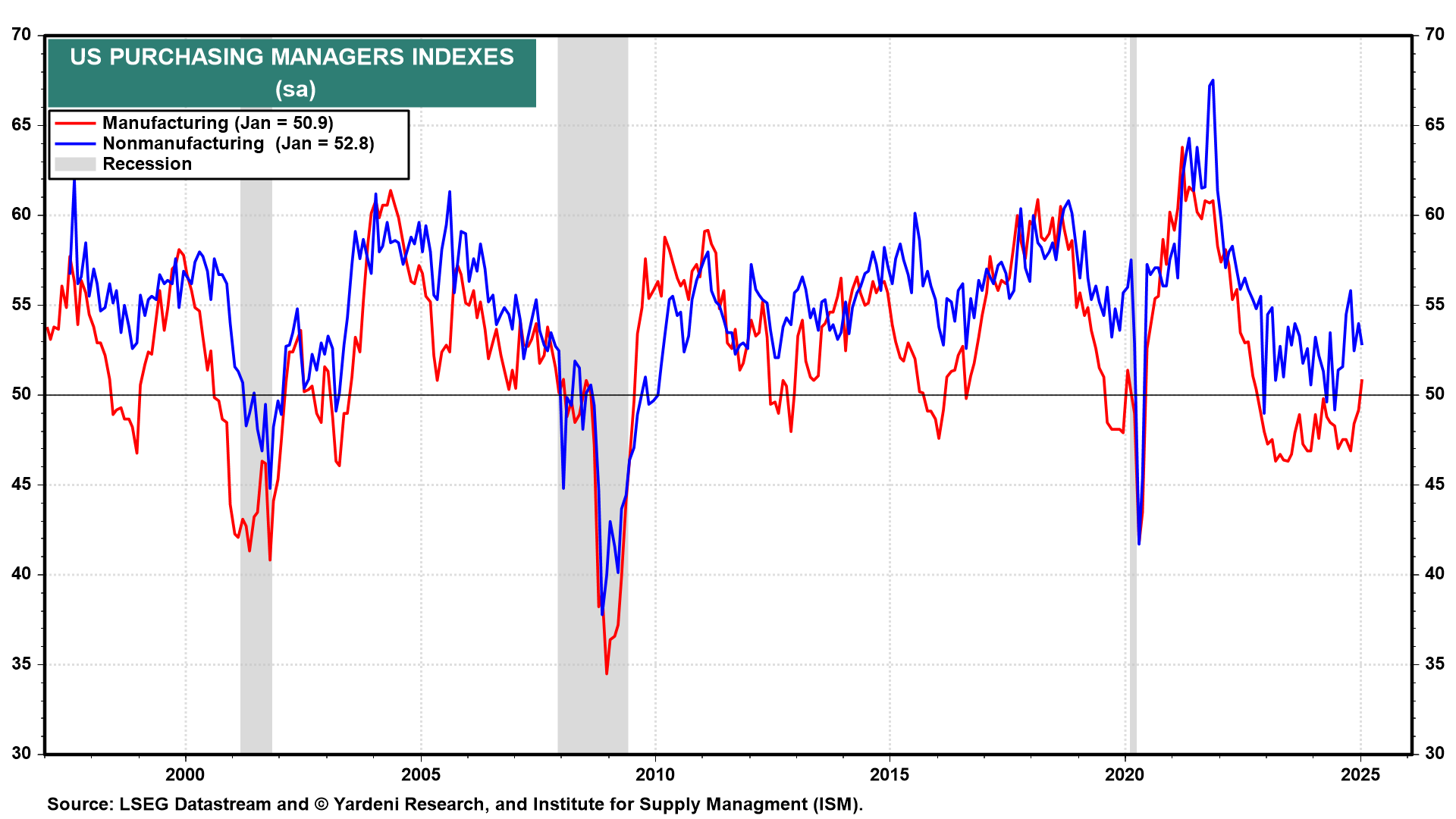

Here are a few charts to illustrate this point:

(1) Manufacturing. After contracting for nearly the entire post-pandemic period, the ISM M-PMI suggests that the manufacturing sector is starting to expand (chart).