One of our accounts in Luxembourg requested that we determine how well industry analysts’ earnings estimates anticipate recessions. The recent weakness in the S&P 500’s forward P/E has been partly offset by the continued rise of consensus earnings estimates to record highs. Some of these increases probably reflect steady profit margins as companies pass their rising costs through to their selling prices.

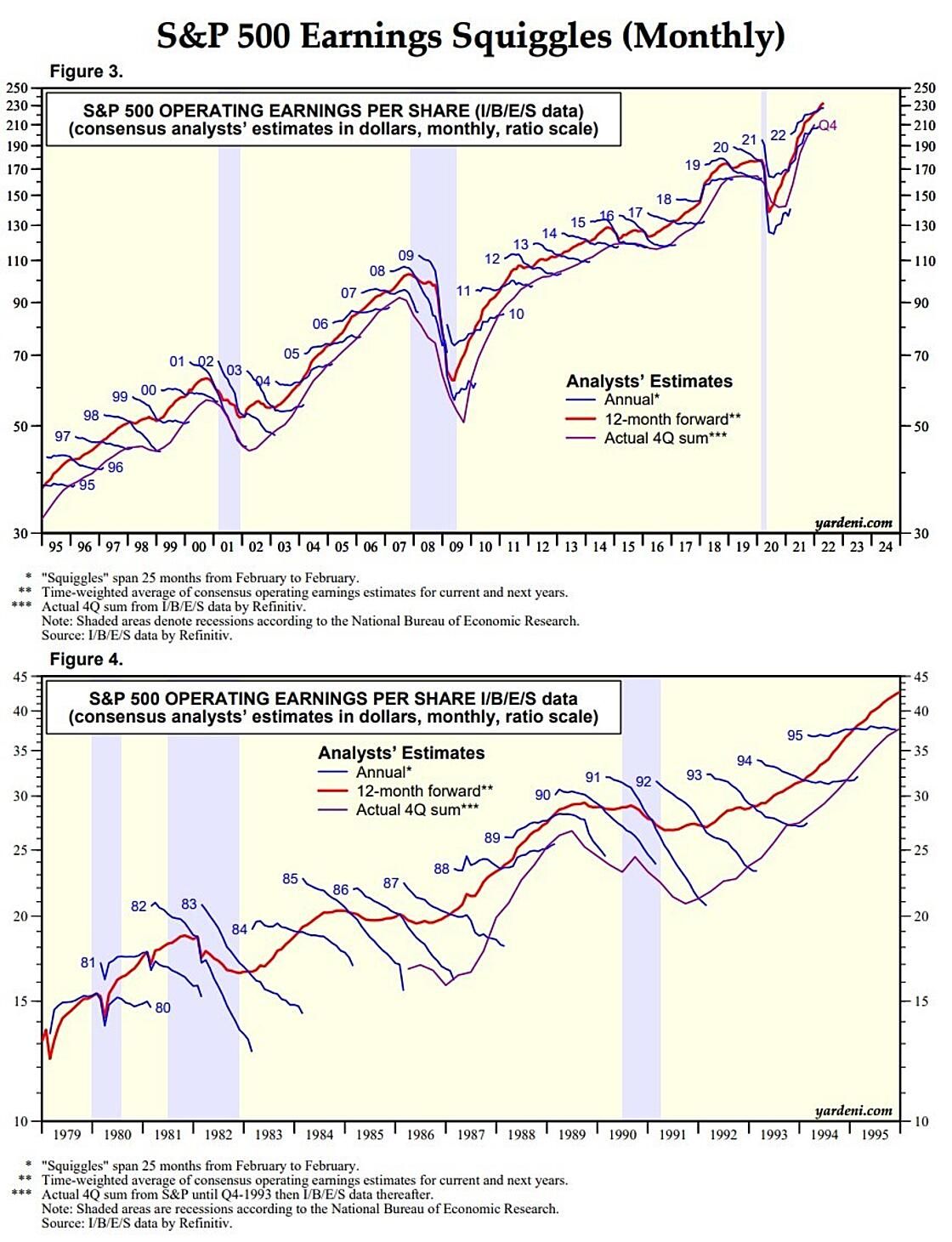

It’s widely recognized that the risks of a recession are rising. Yet there’s no sign that industry analysts’ estimates are reflecting that concern. In fact, the data show that analysts don’t anticipate recessions. They chop their estimates only when a recession becomes widely recognized. They are, however, very good at predicting earnings when the economy is growing. Here are a few more insights from the charts below:

(1) Forward earnings per share (in red) is the time-weighted average of analysts’ earnings estimates for the current year and coming year (in blue). It tends to lead actual operating earnings by about 12 months.

Forward earnings can go up even when analysts are lowering their annual estimates, as long as the coming year’s expectations continue to exceed those of the current year. But forward earnings always plunges during recessions, indicating massive downward estimate revisions and confirming that analysts don’t see recessions coming. On the other hand, they are quite good at calling recession troughs, when forward earnings tend to bottom.

(2) In the past, analysts’ annual earnings estimates often tended to start out too optimistic when first projected and to get whittled down as the end of each year approaches. However, they were actually too pessimistic following the previous three recessions and had to be revised higher. Currently, inflation also seems to be driving earnings estimates higher.

(3) If you think a recession is imminent, then you can expect to see declining forward earnings and weakening valuation multiples, resulting in a bear market. If you think the economy will continue to grow, then you can expect forward earnings to grow too, resulting in a valuation-led correction. For now, we are in the correction camp, though we expect this will continue to be a tough year for stock investors to make money.