TAMED I: Technical Analysis Of Macro Economic Data.

Over the past two years, the hard landers had innumerable theories and charts to explain why higher interest rates would undoubtedly plunge the economy into a recession. Now, the diehard hard landers are again insisting that their long-held recession call will be proven correct soon. Others among them say we’re already in a recession.

So far, these forecasts have been wrong. The economy continues to grow, and the labor market remains robust. The S&P 500 and Nasdaq are both at all-time highs despite the Federal Open Market Committee (FOMC) informing market participants last week that they should expect no more than one cut in the federal funds rate (FFR) this year.

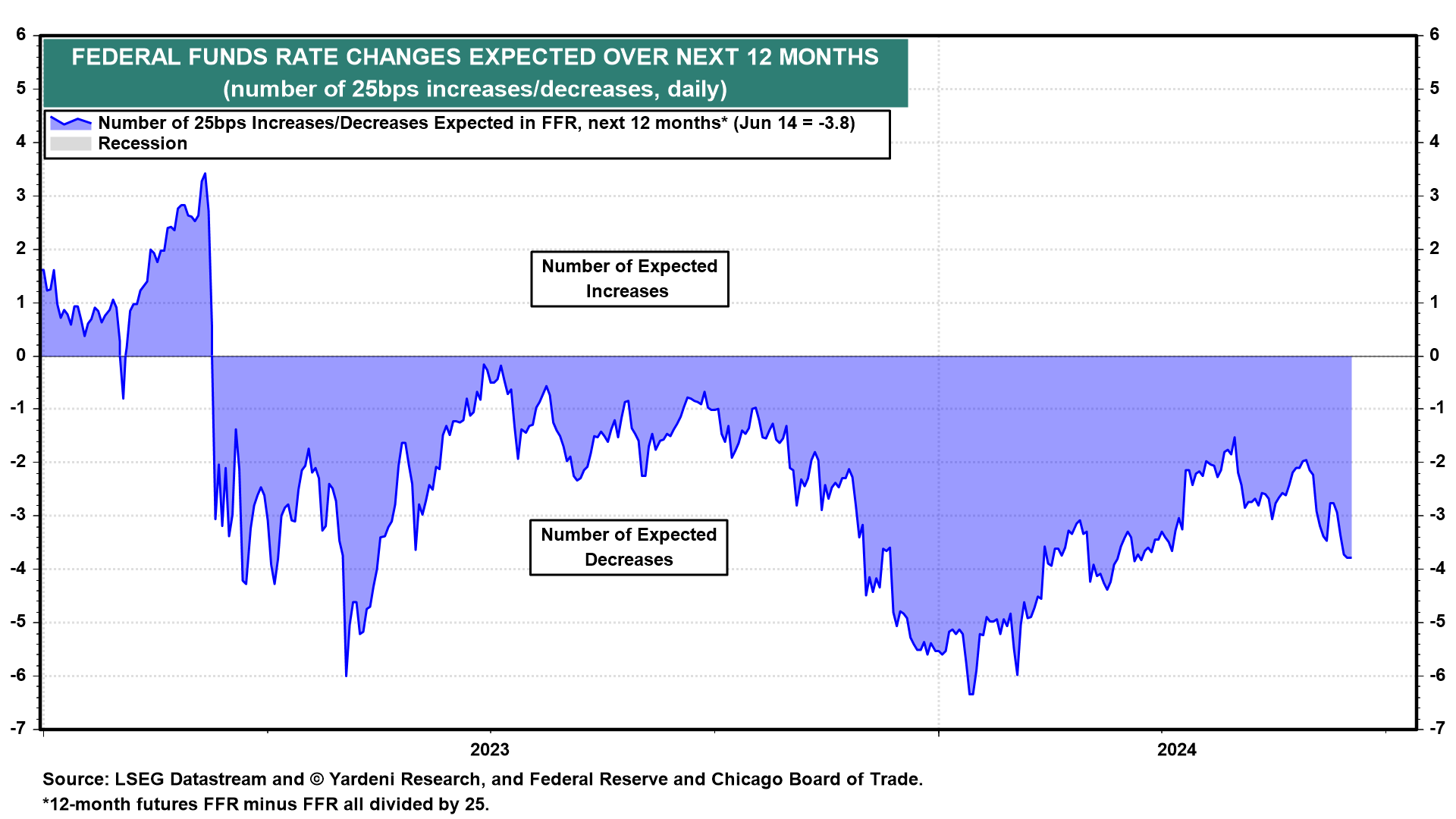

Markets started the year anticipating up to seven rate cuts (Fig. 1 below). The hard landers argued that the Fed would have to engineer a recession to bring down inflation by tightening monetary policy. When inflation turned out to be more transitory than they expected, the hard landers reversed course and argued that the Fed would have to ease aggressively to avoid a recession.

The common denominator underlying the gloomy forecasts of the hard landers has been a reliance on what we call Technical Analysis of Macroeconomic Data (TAMED). Causal effects and correlations that occurred during previous Federal Reserve tightening cycles were flashing red, and therefore, a recession was inevitable.

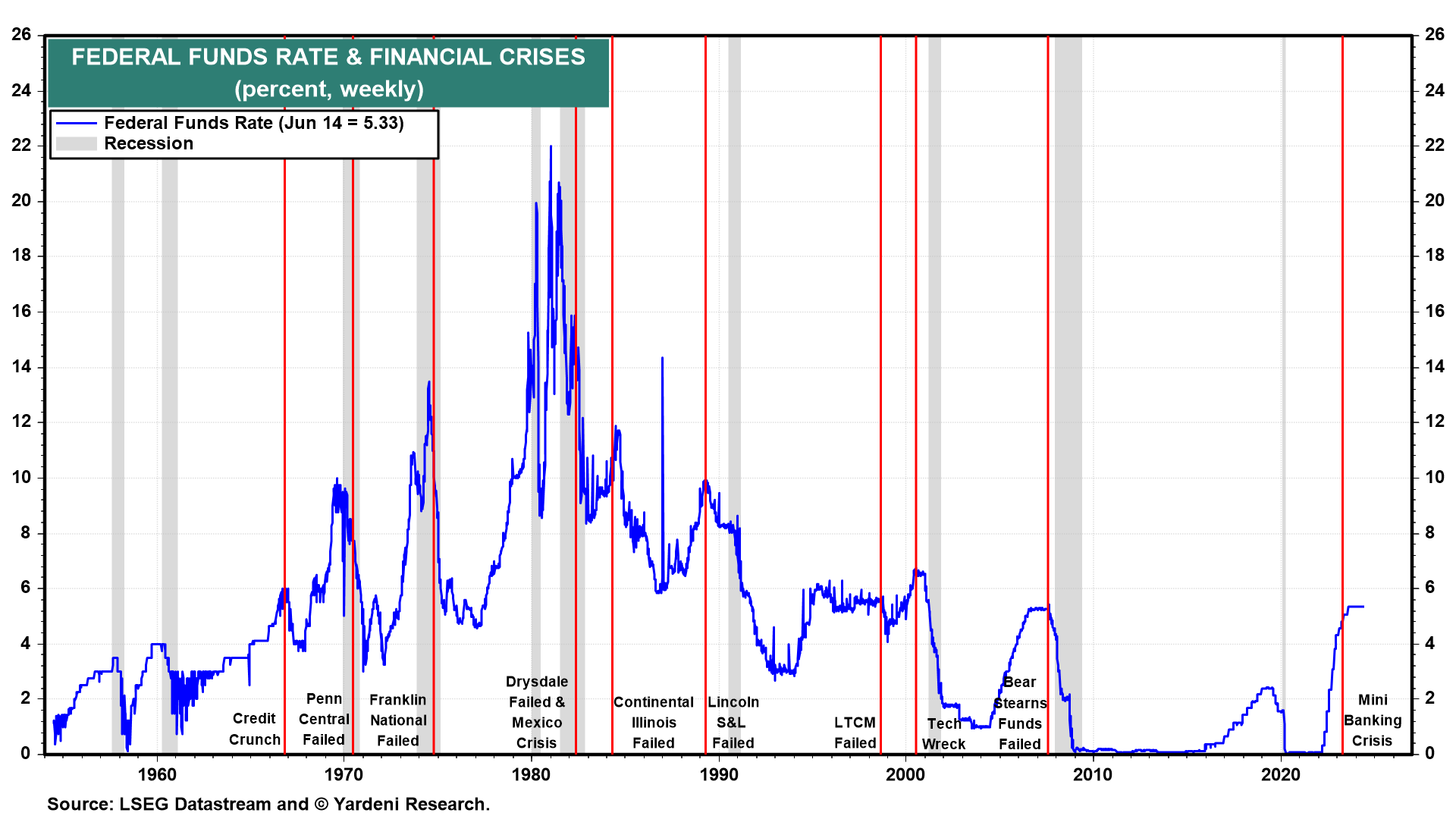

The hard landers correctly observed that previous Fed tightening cycles were followed by financial crises that turned into economy-wide credit crunches and recessions (Fig. 2 below). But the US and global economies are much different in the post-pandemic world than they were before, rendering many recession indicators with high success in the past, misleading now. Here’s how the TAMED approach to forecasting missed the mark:

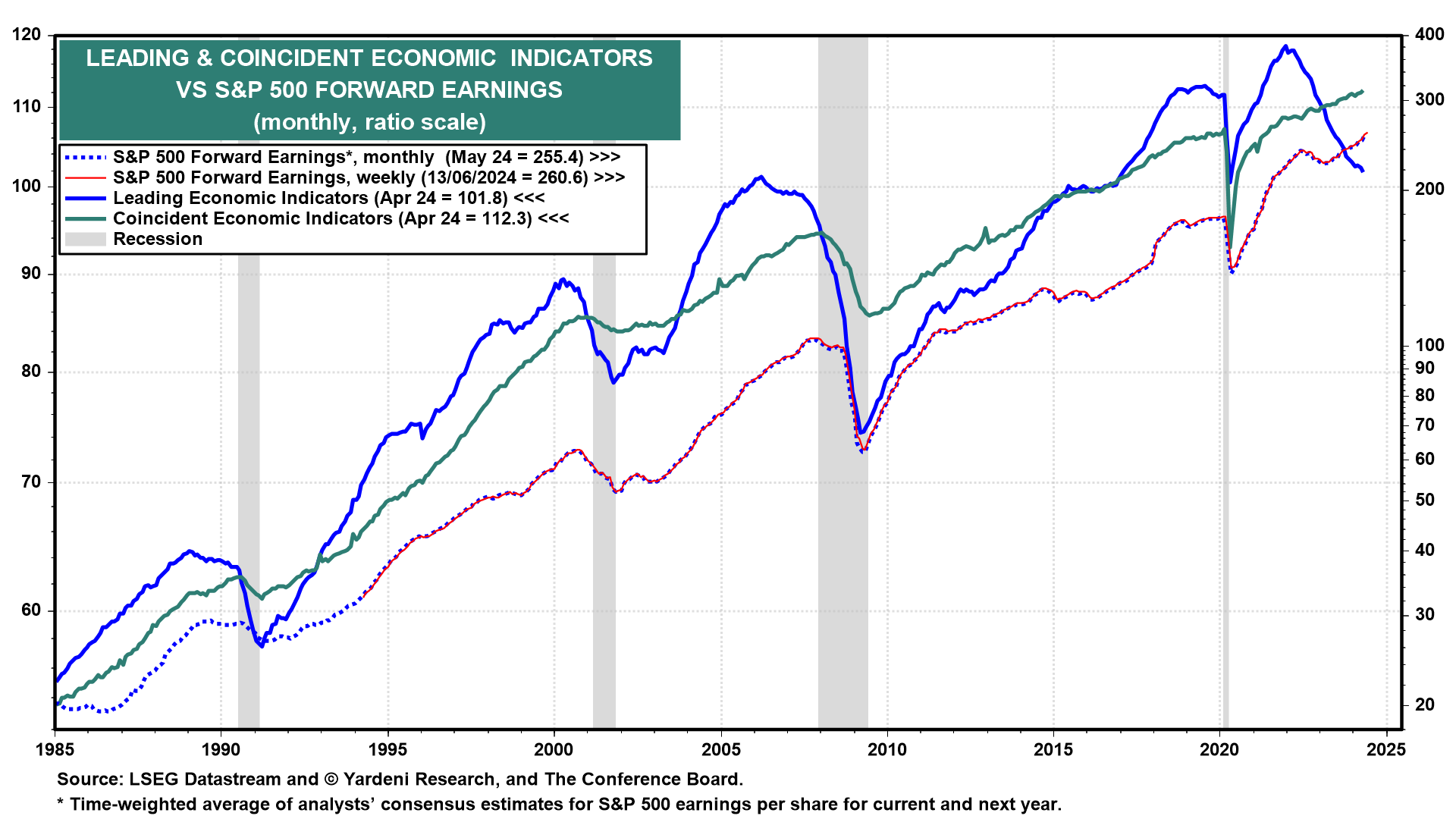

(1) Leading vs. Coincident Economic Indicators. The Conference Board’s Index of Leading Economic Indicators (LEI) has plunged since it peaked during December 2021. It is down more than 14% since then through May of this year (Fig. 3 below). The Index of Coincident Economic indicators (CEI), meanwhile rose to another record high last month. It has risen steadily for several years after returning to its pre-pandemic trend relatively quickly. The CEI has been hitting new records since July 2021, despite the downbeat forecasts of the LEI.

The CEI probably rose to a new record in May, given its close correlation with S&P 500 forward earnings, which rose to a record of $260.02 per share in the week ended June 13. Earnings expectations are nearing our year-end target of $270 per share.

(2) Industrial vs. digital economy. The LEI, on the other hand, could easily continue to sink. One reason the index’s recession forecast has failed is because five of its ten components are manufacturing and construction related. As a result, the LEI very highly correlated with the national manufacturing purchasing managers index (M-PMI) (Fig. 4). LEI was a much better predictor of economic downturns when the US economy was more industrial, and a greater share of workers produced goods. Employment in manufacturing, mining, and construction is now just 10% of total payrolls, down from a third in the early 1950s (Fig. 5). Today’s US economy is more oriented toward services and technology-related industries.

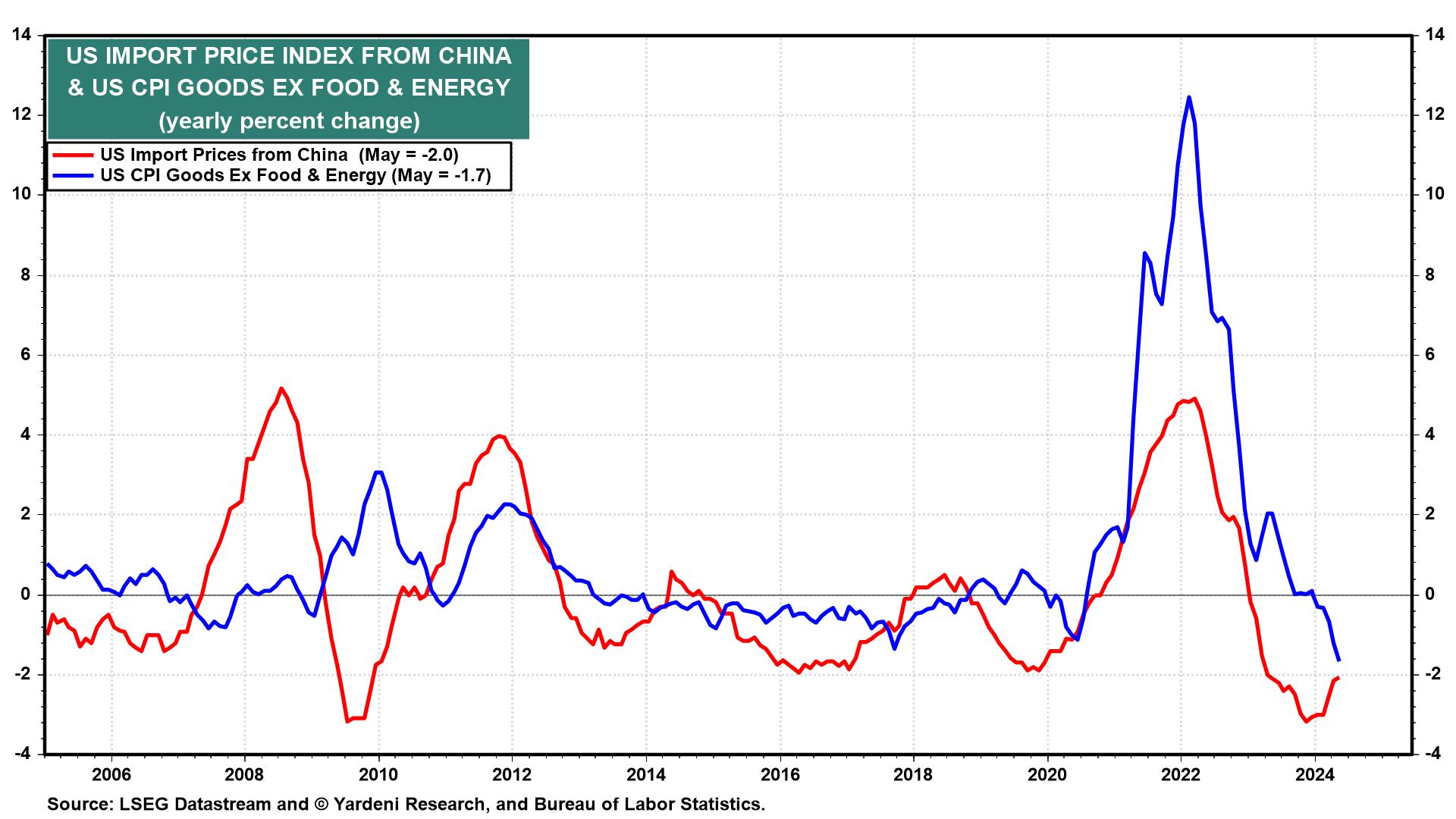

(3) China exporting deflation. Most hard landers asserted a recession would be required to bring inflation back down. They missed that a property-led recession in China did the trick. In the US, the core goods CPI fell -1.7% y/y in May from a peak of 12.5% in February 2022. Contributing significantly to that decline was a -2.0% drop in import prices from China (Fig. 6 below).

TAMED II: Inverted Yield Curve.

One component of the LEI gets more attention than the others for its predictive power in previous cycles: the inverted yield curve. It accurately predicted US recessions in the past, with only a couple of false positives. We think the LEI has become increasingly misleading as the economy has turned less industrial and more digital: