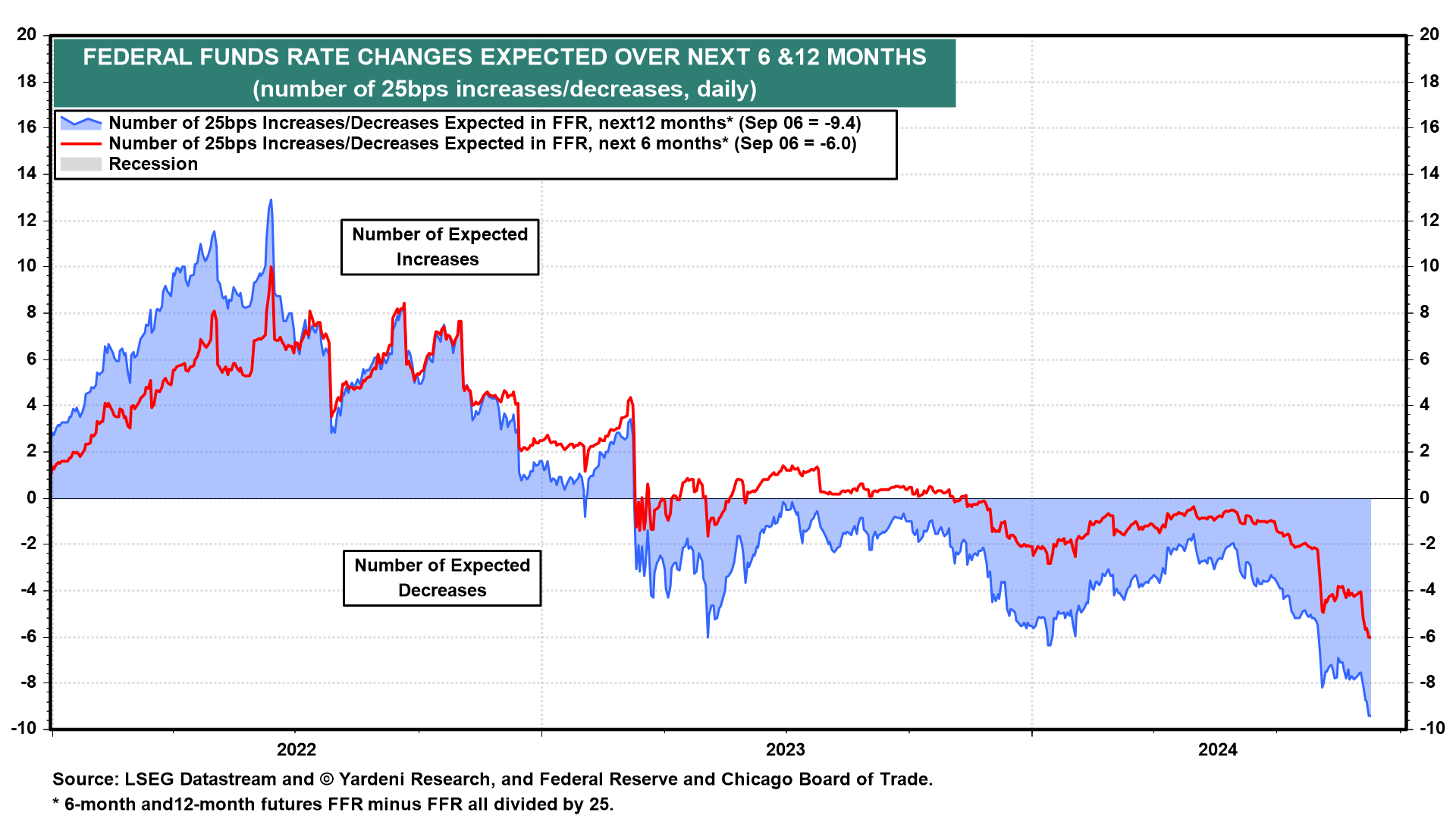

The financial markets have been expecting more cuts in the federal funds rate (FFR) than Eric and I have all year so far. At the start of this year, the markets anticipated six to seven rate cuts in 2024 (Fig. 1 below). We expected two to three at most.

The markets were more dovish on the rate outlook than we were because of investors’ widespread belief that the Fed would have to lower interest rates several times to avert a recession, following the historical script. At such times in the past after a round of tightening, the economy fell into a recession even though the Fed eased in response to its weakening. This time, we’ve had more confidence in the resilience of the economy. Since the summer, we’ve been predicting one rate cut in September for the rest of this year and thinking maybe two to four cuts in 2025. We’ve been more on the mark than the market so far in 2024: There hasn’t been even a single rate cut yet this year.

Now our one-and-done outlook for the remainder of 2024 looks less likely after Friday’s weak employment report. Consider the following:

(1/5) September odds at 100%. The market’s odds of a 25bps cut on September 18, when the latest FOMC Statement will be released, are now at 70%. The odds that the cut might be 50bps are 30% currently. That’s according to the CME Group’s FedWatch. Five of the last six rate cutting cycles began with 50bps rate cuts. (Hat tip to John Mauldin.) Rate cuts now are also widely expected following the November and December FOMC meetings.

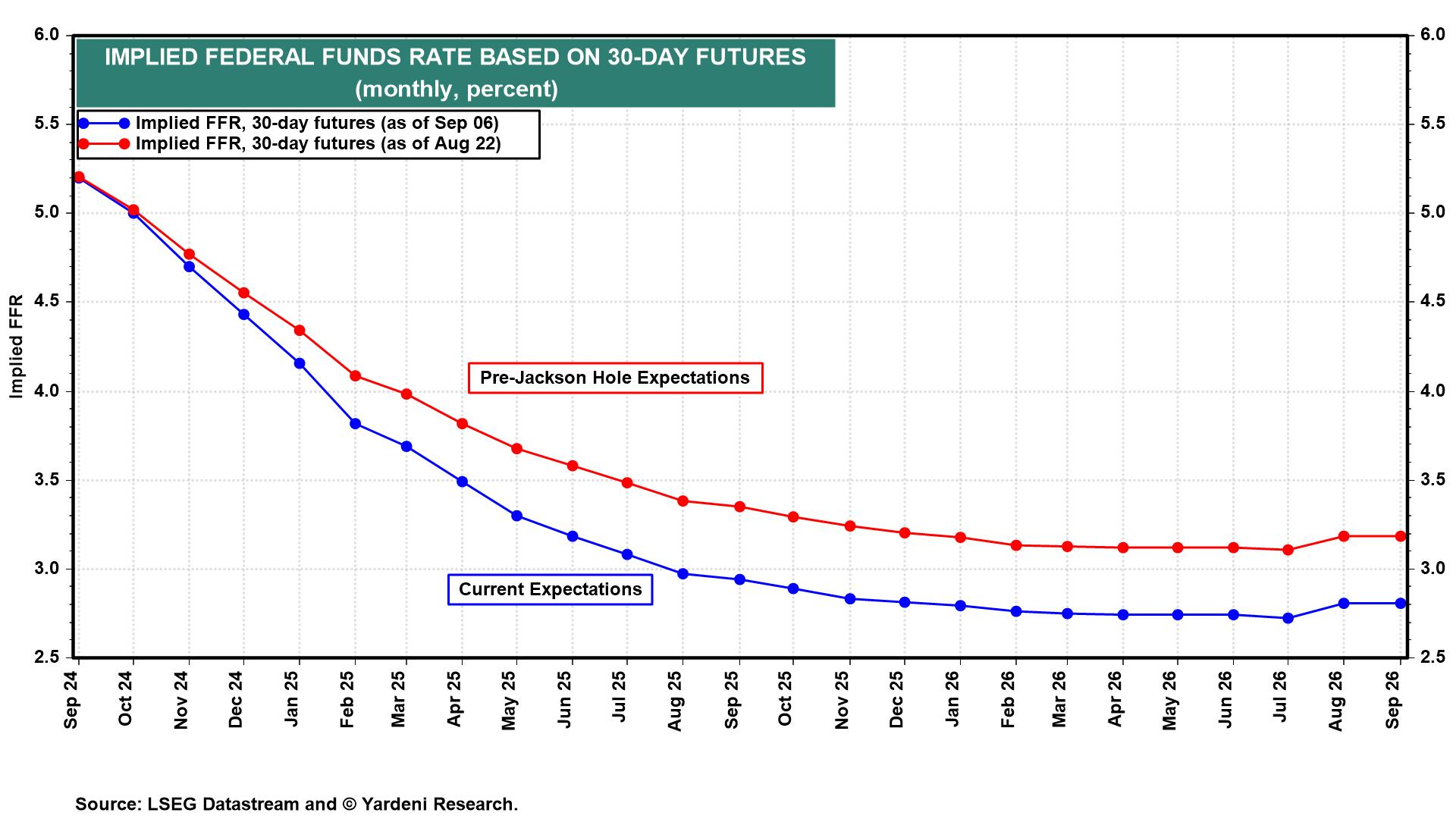

(2/5) Markets expecting multiple cuts. The federal funds rate (FFR) futures market is currently anticipating 25bps rate cuts in November and December (Fig. 2 below). Six and nine 25bps cuts in the FFR are expected over the next six and 12 months. Those expectations suggest that the FFR will fall 150bps to 3.75% in six months and 225bps to 3.00% in 12 months. Of course, those expectations were heightened by Fed Chair Jerome Powell’s Jackson Hole speech on August 23, when he said: “The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”