US Economy I. Banks Versus Nonbanks.

The resilience of the US economy has been impressive over the past two years in the face of the Fed’s dramatic tightening of monetary policy. Nevertheless, there are still a few hardcore hard-landers predicting that the economy either is already in a recession or soon will be. They’re convinced that there are long and variable lags between restrictive monetary policy and its depressing impact on the economy. Among them is one of our competitors who seems to give a lot of weight to the Senior Loan Officer Opinion Survey (SLOOS). SLOOS, she says, suggests that credit conditions remain tight.

Eric and I disagree with this assessment. Here is why:

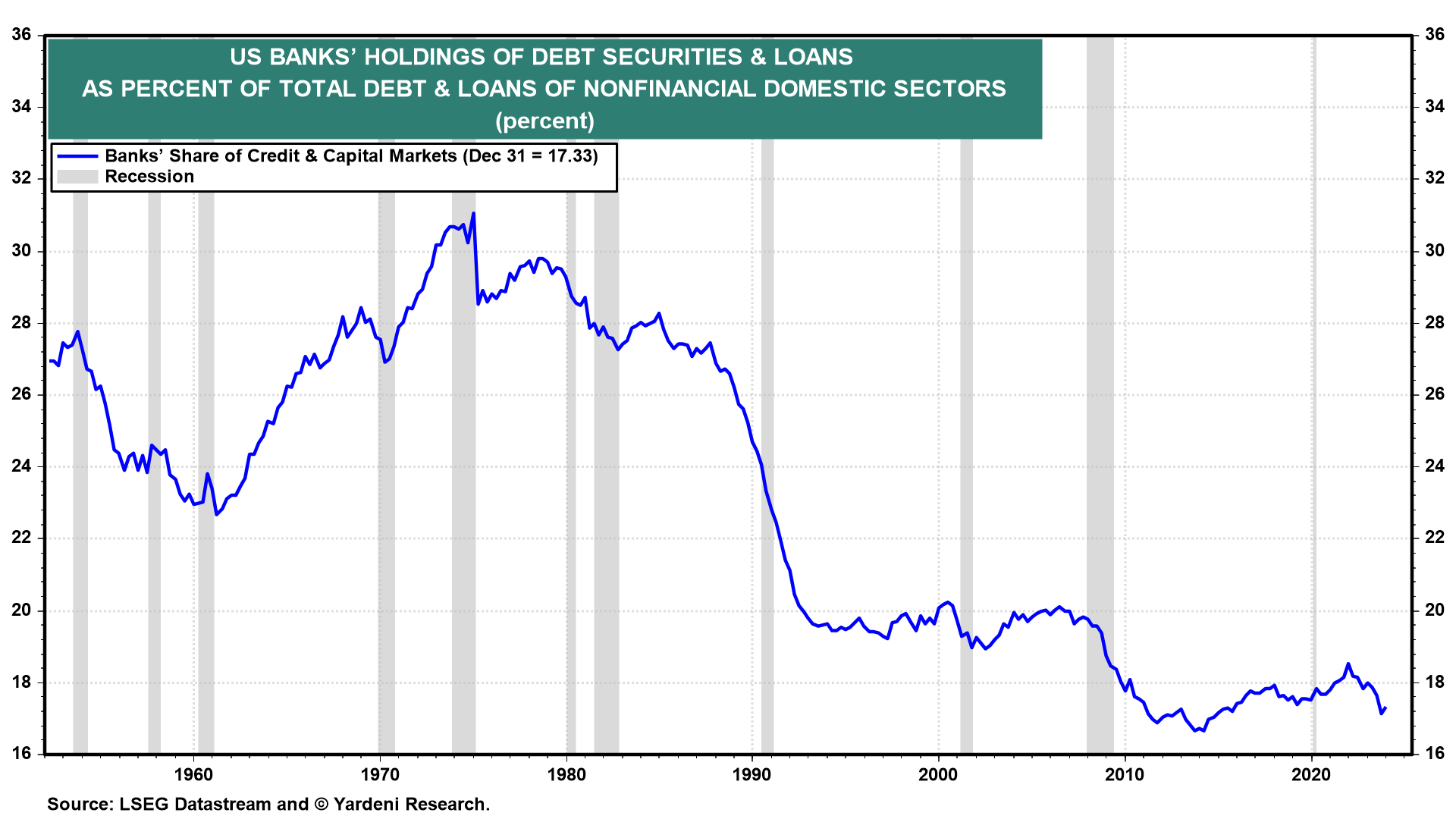

(1) We aren’t saying that SLOOS suggests credit is loose. We are saying that it has become a less important indicator of credit conditions in our economy than it used to be. That’s because banks have become less important agents of capital allocation in our economy as nonbanks have become more important sources of financing (Fig. 1 below). Private debt and private equity funds have been growing rapidly in recent years. So have distressed asset funds that have plenty of money available to restructure overleveraged assets, buying at significant discounts and then reselling at a premium.

(2) In addition, in recent years, economic growth has been driven by services and technology companies. They tend to have higher margins and cash flow and less debt than goods-producing companies, so they’re not as affected by rising interest rates and tightening credit conditions.

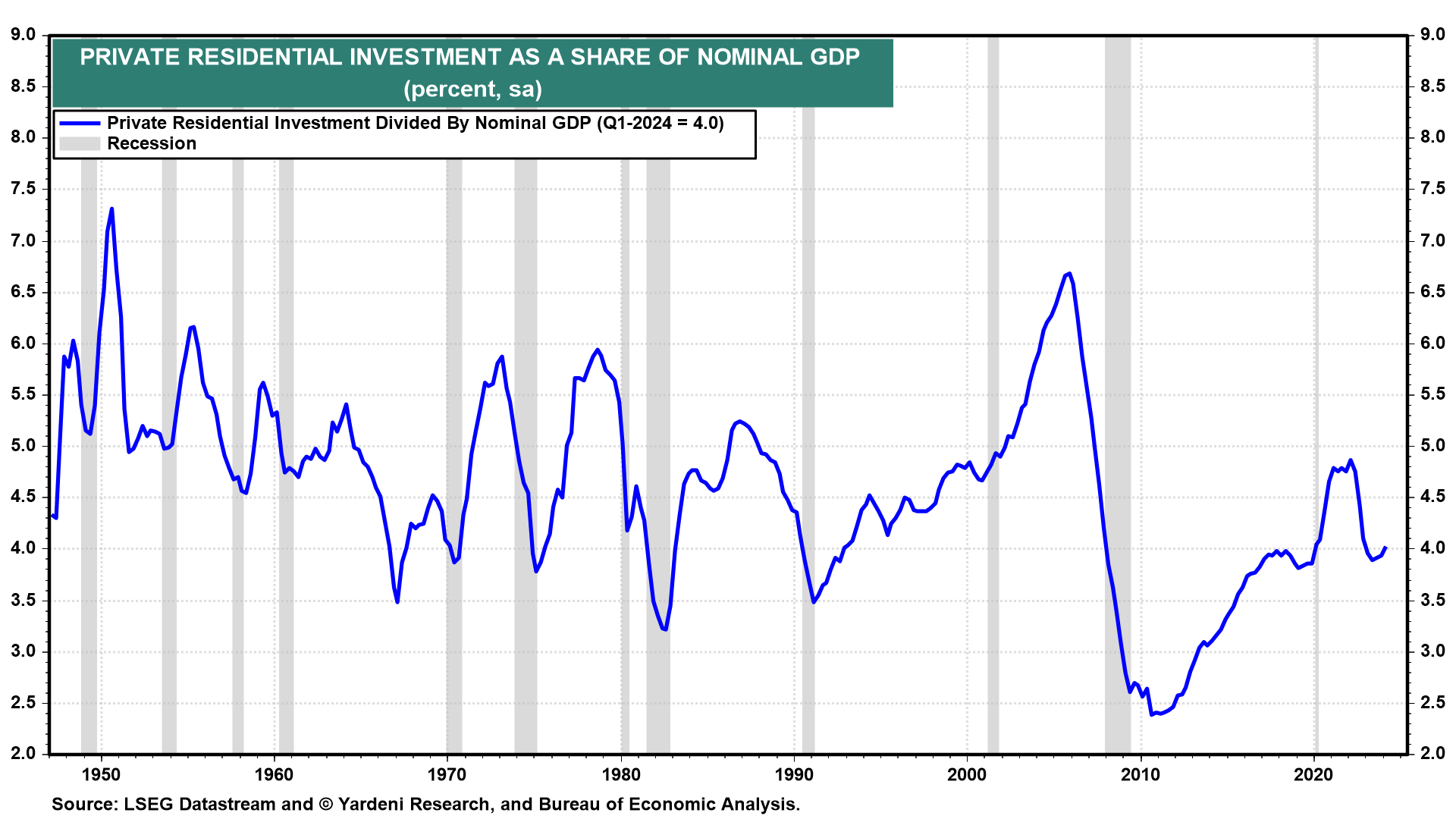

(3) Of course, the housing market remains very interest-rate sensitive. But residential construction’s share of nominal GDP has been falling (Fig. 2 below). It is currently only 4.0%, which is near the previous cyclical lows prior to the Great Financial Crisis (GFC).

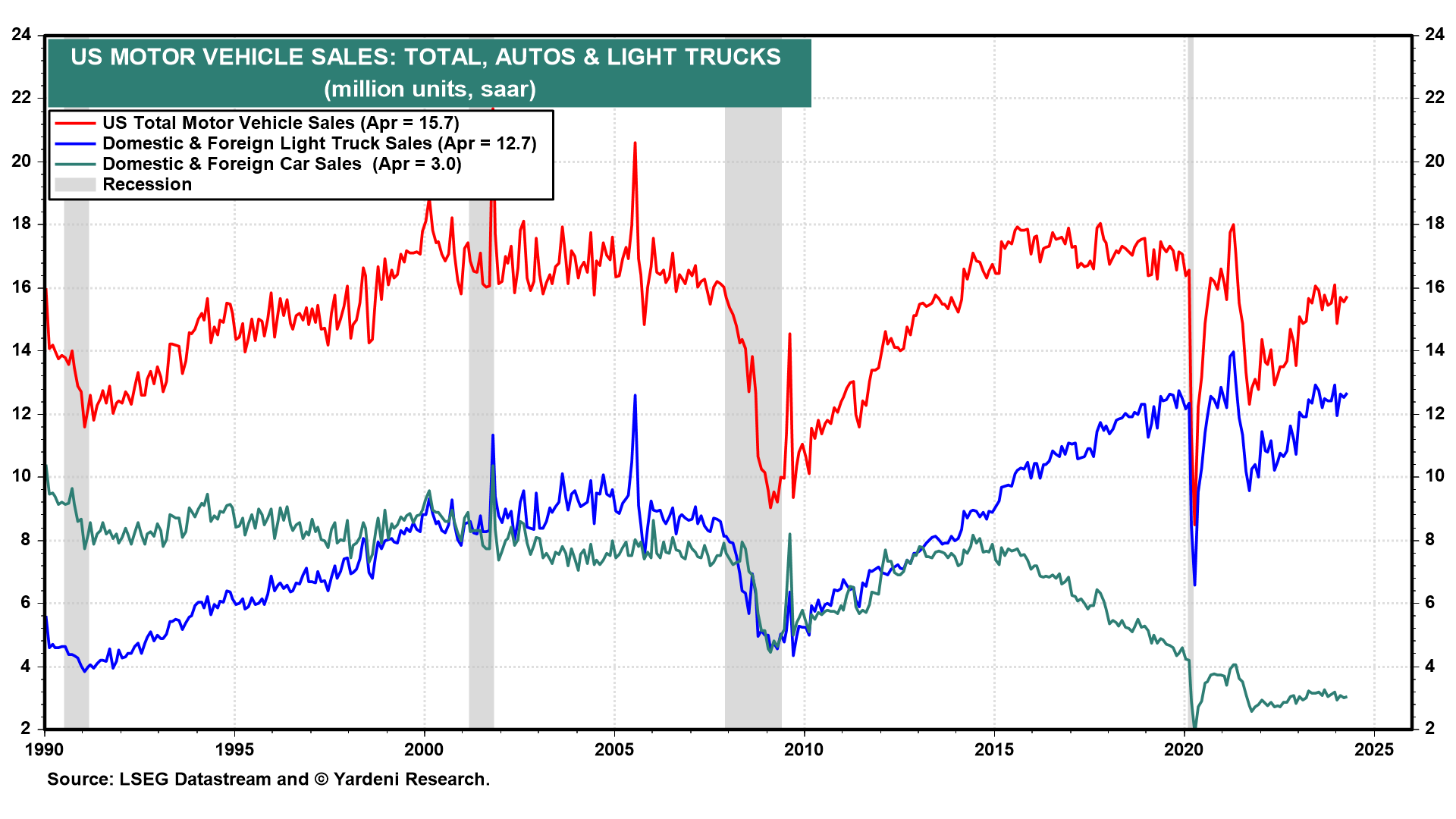

(4) Auto sales also seem to have become less sensitive to credit conditions. Over the past 13 months, the total has fluctuated around 15.5 million units (saar) despite higher auto loan rates and slowing consumer credit for auto loans (Fig. 3 below, Fig. 4, Fig. 5, and Fig. 6). Americans have been buying the bigger and more expensive motor vehicles. Light trucks now account for 81% of retail unit auto sales, up from 50% during 2012-13 (Fig. 7).

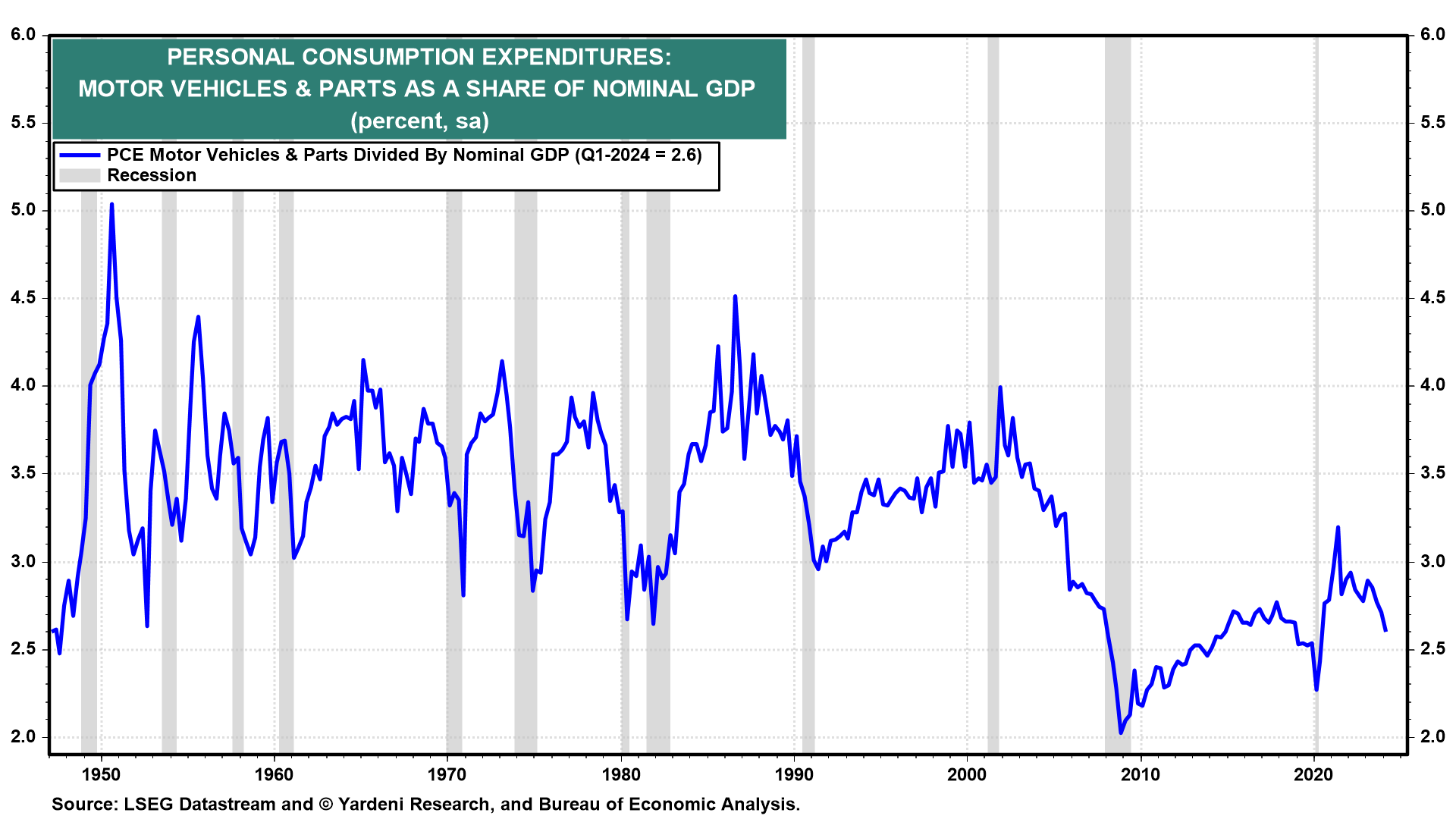

In any event, personal consumption expenditures of new autos as a share of nominal GDP has also been falling (Fig. 8 below). It is currently only 2.6%, which is the lowest since the previous cyclical lows prior to the GFC.

In the following section, Eric reviews the evolution of the US economy from a goods-producing one to a more high-tech and services-providing one, making it less interest-rate sensitive.

US Economy II: Goods Versus Services.

Last week’s S&P Global flash PMI report for the US suggests that the manufacturing sector (i.e., the M-PMI) may be starting to recover from its rolling recession, or at least to bottom (Fig. 9 below). It rose to 50.9 in May. The flash PMI for US services (NM-PMI) was stronger, rising to 54.8. We are expecting a lackluster recovery in goods-producing industries that should continue to be offset by strength in services-providing ones.