Strategy I: Trump Turmoil 2.0.

We haven’t had to change our subjective probabilities for our three alternative economic scenarios for quite some time. We are doing so today and may have to do so more frequently in coming months or even coming weeks in reaction to the volatile nature of policymaking under President Donald Trump. The initial animal spirits of Trump 2.0 have been trumped by the uncertainty unleashed by Trump Turmoil 2.0. The administration has been in office for less than two months. The whirlwind of tariffs imposed on America’s major trading partners, federal job cuts implemented by the DOGE Boys, and the upending of the world order have been head spinning.

We held off changing our probabilities because we expected that the master of the art of the deal was going to get a deal with Canada and Mexico that would allow him to declare victory and bury his threat to impose 25% tariffs on America’s only two neighbors and biggest trading partners. In fact, on February 28, US Treasury Secretary Scott Bessent said Mexico proposed matching Washington’s tariffs on China and urged Canada to do the same—signaling a potential path for Mexico and Canada to avert levies on their own exports in the coming days.

“I do think one very interesting proposal that the Mexican government has made is perhaps matching the US on our China tariffs,” Bessent told Bloomberg Television. “I think it would be a nice gesture if the Canadians did it also, so in a way we could have ‘Fortress North America’ from the flood of Chinese imports,” he said.

Here is a quick timeline of related events since then:

(1) On Monday, March 3, Trump said that that there was “no room for delay,” and he implemented the tariffs on Canada and Mexico on Tuesday. Trump has said the tariffs are means to several ends: force the two US neighbors to step up their fight against fentanyl trafficking, stop illegal immigration, eliminate the Americas’ trade imbalances, and push more factories to relocate in the US.

(2) Trump had already put a 10% tariff on imports from China in February. The rate was doubled to 20% on Tuesday. Instead of rapid-fire trade deals, the US has triggered a trade war. Canada imposed retaliatory tariffs on the US on Tuesday. Mexico will announce similar measures on Sunday.

(3) On Tuesday, a foreign ministry spokesperson in Beijing warned, “China will fight to the bitter end of any trade war.” China is one of the biggest customers for US agricultural produce such as chicken, beef, pork, and soybeans, and now all those products will face a 10%-15% tax, which will take effect on March 10. Beijing’s relatively limited response suggests that the Chinese would like to negotiate with the US on trade issues.

Beijing is not ramping up the rhetoric or the tariffs in the same way as it did in 2018, during the last Trump administration. Back then, it imposed a tariff of 25% on US soybeans.

(4) Last weekend, Warren Buffett made a rare comment on Trump’s tariffs, warning of the negative effects on consumer spending. “[W]e’ve had a lot of experience with [tariffs]. They’re an act of war, to some degree,” said Buffett. “Over time, they are a tax on goods. I mean, the tooth fairy doesn’t pay ’em! … And then what?”

Strategy II: Recalibrating the Odds.

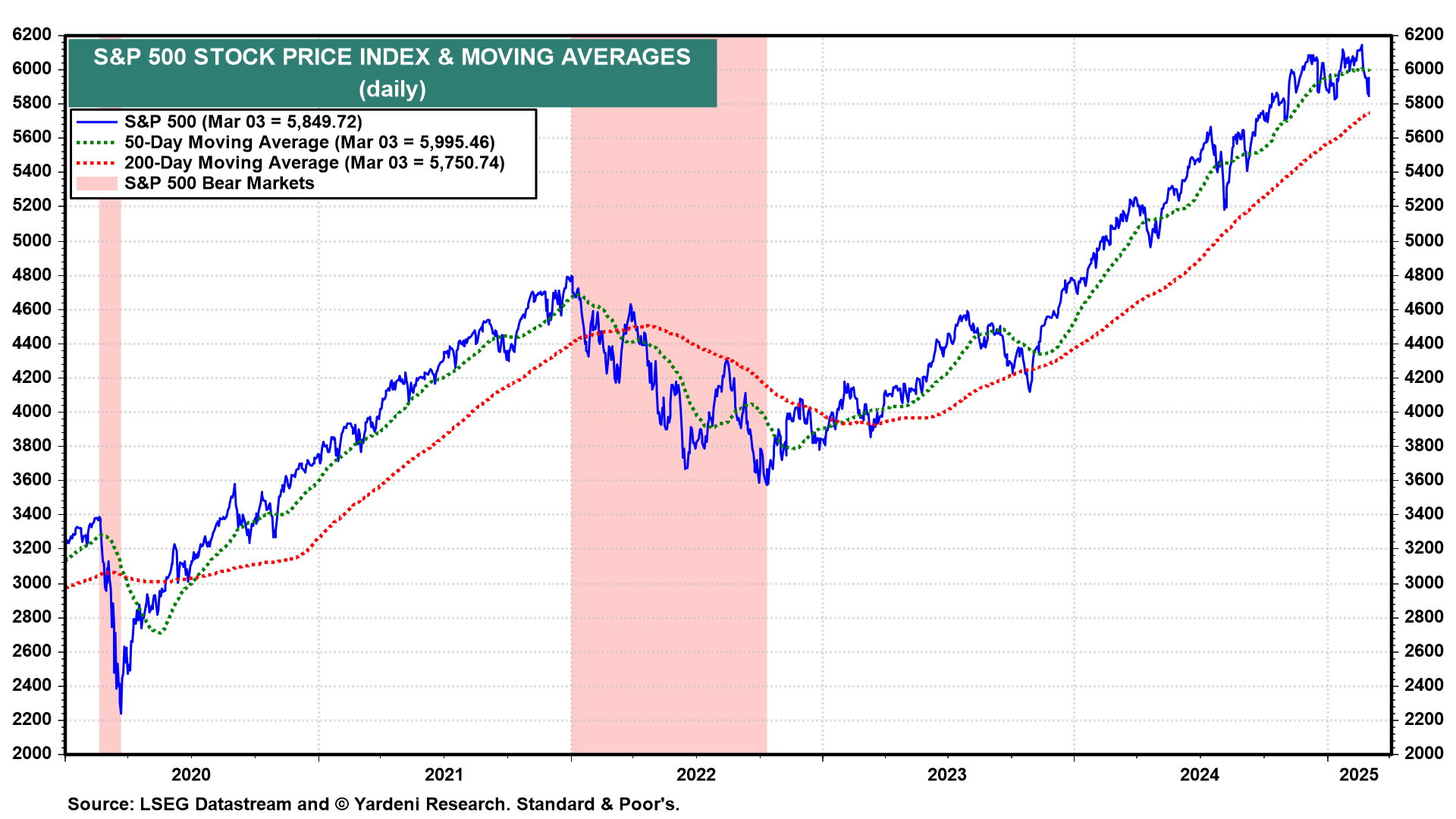

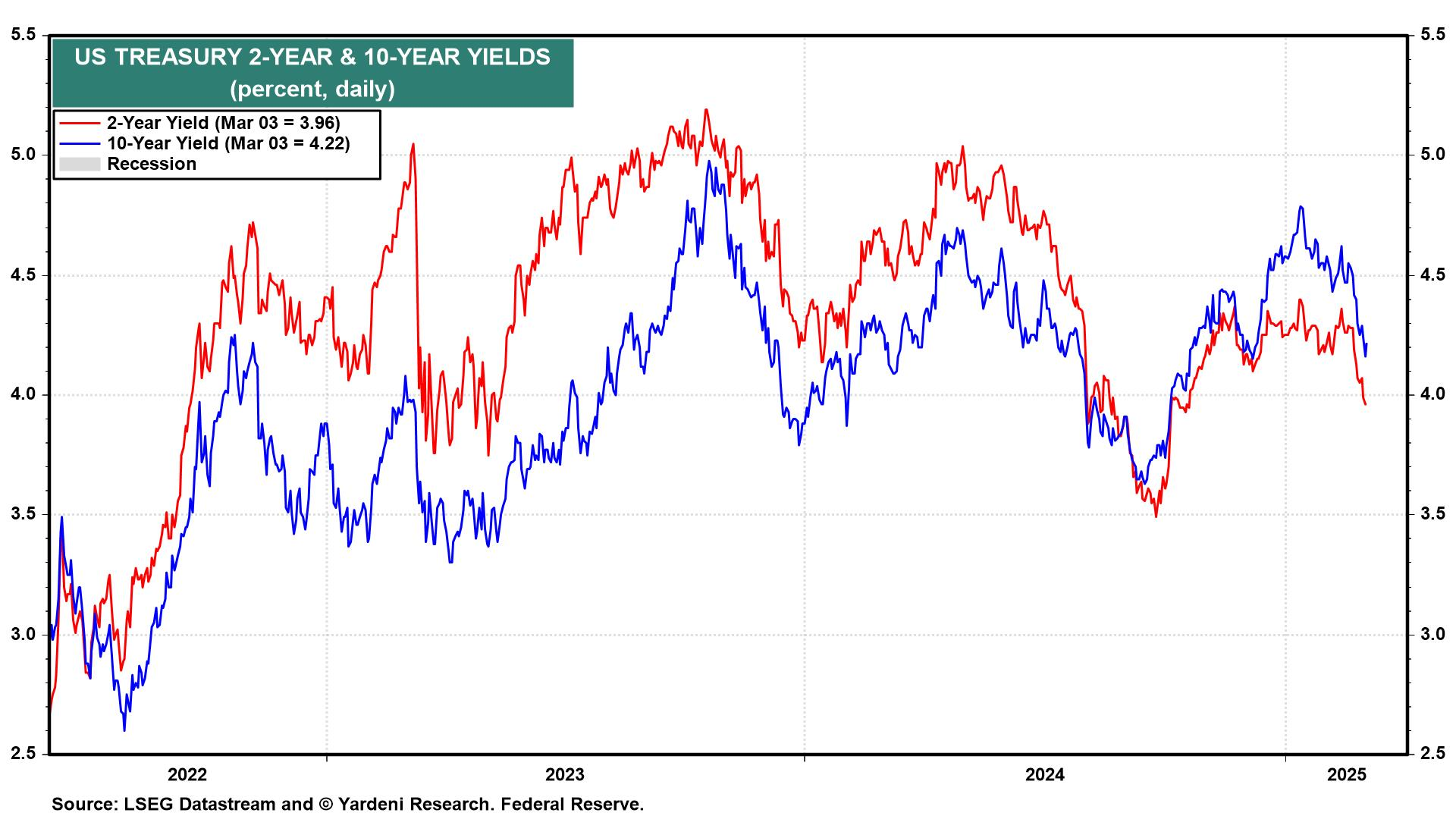

Now that Trump has started a trade war, it could escalate. Or it could de-escalate. Either way, uncertainty has increased significantly, as evidenced by the sharp decline in stock prices on Monday and Tuesday (Fig. 1 below and Fig. 2). Interest rates have continued their recent decline, as the odds of more Fed rate cuts have increased—notwithstanding evidence that inflation remains stuck above the Fed’s 2.0% target and the likelihood that tariffs will boost inflation, at least initially (Fig. 3 below and Fig. 4).

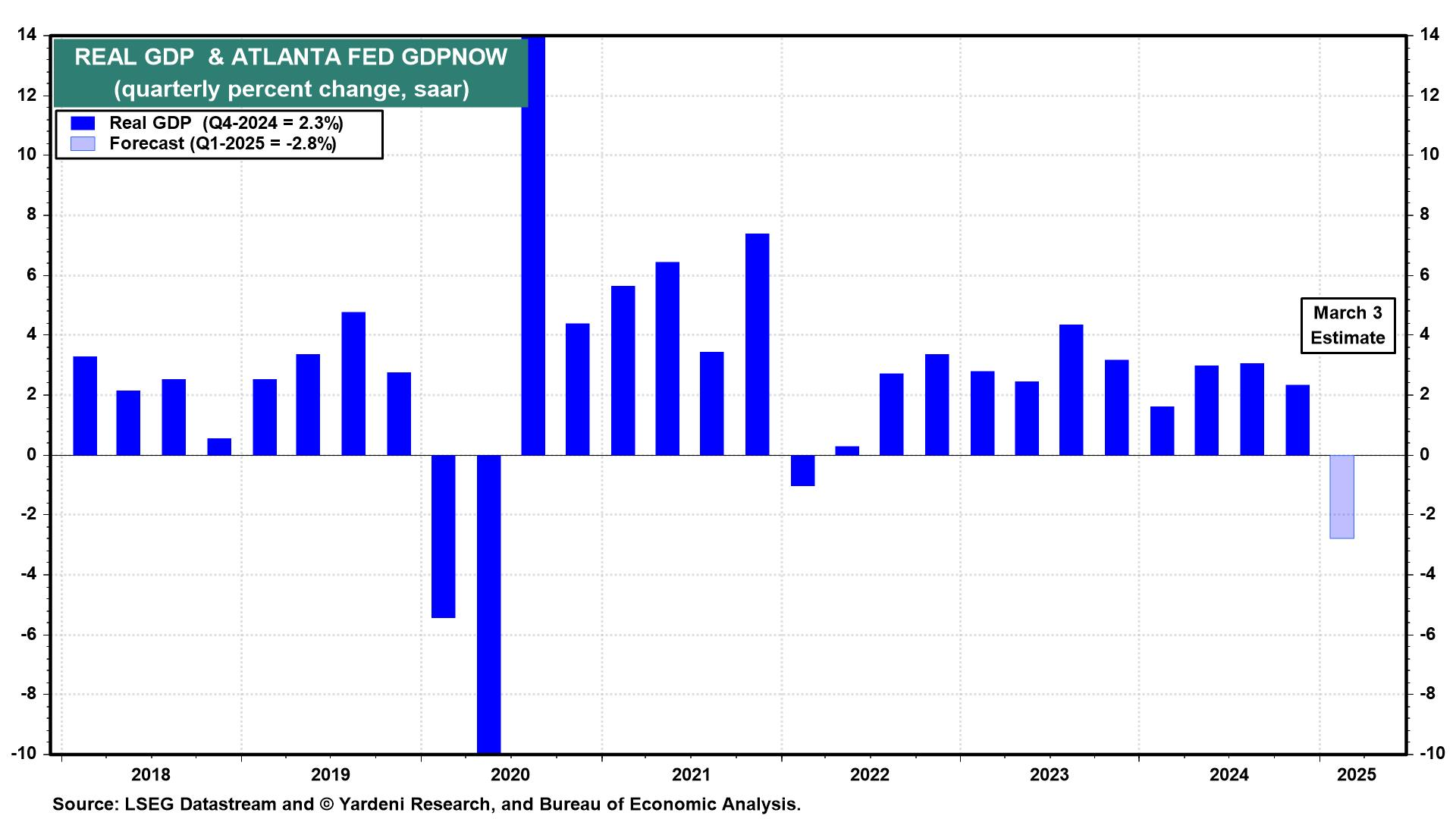

In recent commentaries, we’ve downplayed the likelihood of a recession in 2025. Indeed, in recent days, we’ve observed that the downward revision in the Atlanta Fed’s GDPNow tracking model from 2.3% (q/q saar) on Thursday to an estimated -2.8% for Q1 reflects two temporary factors: a surge in January’s imports, due to importers’ frontrunning tariffs, and the coldest January since 1988, which depressed consumer spending (Fig. 5 below, Fig. 6, and Fig. 7). We expect that these big drags on GDP will be reversed in February and March. So we are projecting that real GDP will be up by at least 1.5% during Q1.

However, the negative consequences of Trump 2.0 policies are occurring before the positive ones. Tariffs, deportations, and federal government job cuts are weighing on the economy. An extension of the 2017 tax cuts has yet to occur. Business deregulation is unfolding slowly. Onshoring is underway, and more companies are committing to increase their capital spending in the US.

Considering the above, we are recalibrating our subjective probabilities for our three scenarios:

(1) Roaring 2020s (55%, unchanged). Our subjective probability of our base case remains the same at 55%. We are assuming that the trade war doesn’t escalate. We are continuing to bet on the resilience of the economy and on a technology-driven boost in the growth rate of both productivity and real GDP.

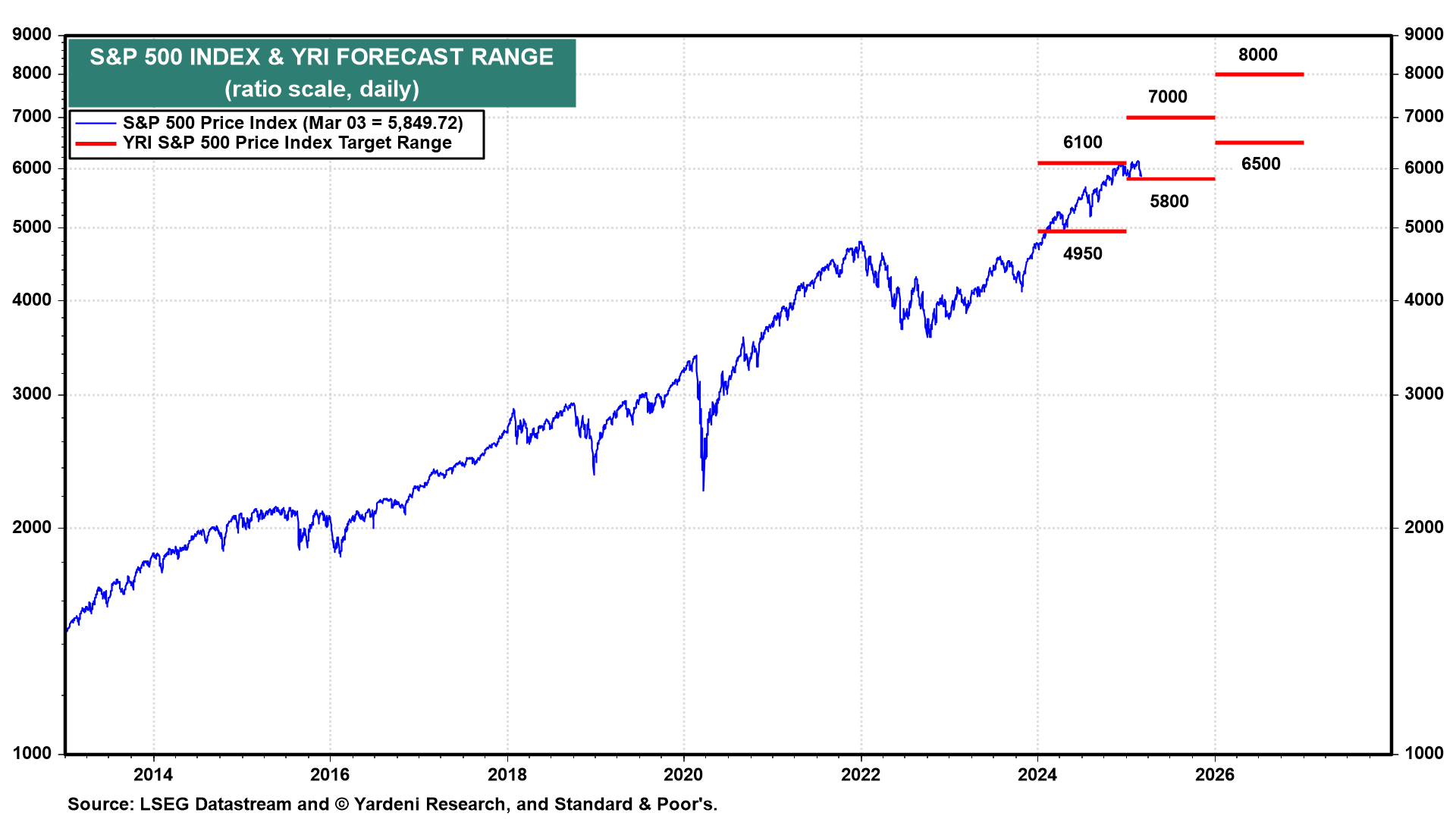

In this scenario, the economy continues to grow, a tariff-related spike in inflation proves transitory, and the stock market remains choppy during the first half of the year, with the S&P 500 remaining below its February 19 record high. The index resumes its climb in record-high territory during the second half of the year, reaching 7000 by year-end (Fig. 8 below).

(2) Meltup/meltdown (10%, down from 25%). Arguably, there has already been a meltup in some areas of the stock market. They’ve been melting down since mid-February. Combining the odds of these two bullish scenarios reduces the odds that the bull market remains intact, without a correction or bear market in 2025, from 80% to 65%.

(3) Bearish bucket (35%, up from 20%). Over the past three years, we’ve assigned a 20% subjective probability to the various prospects that could go wrong for the economy, resulting in a recession and a bear market for stocks. We are raising it to 35%. During 2022 and 2023, our main concern was that geopolitical crises (including the war between Russia and Ukraine and the proxy war between Israel and Iran) would cause oil prices to soar, forcing the Fed to maintain a restrictive monetary stance and causing consumers to retrench. That seems less likely, as the oil price has remained weak.

Over the past couple of years, the risk of a federal government debt crisis also rose a few times along with bond yields. But now the 10-year US Treasury yield is down from a recent high of 4.79% on January 13 to 4.24% today. That’s despite signs that Trump Tariffs 2.0 are already boosting expected and actual inflation. Bond investors are giving more weight to the “stag” than the “flation” components of a stagflation scenario. We are doing the same by raising the odds of a tariff-induced recession from 20% to 35%.

Trump’s tariffs and DOGE-mandated job cuts are depressing consumer confidence. Trump delivered on his promise to stop illegal immigration. Oil prices are falling as he promised, though that may have more to do with weak demand than more supply. Mortgage rates are falling. However, he promised to lower consumer prices. Instead, his tariffs will drive these prices higher.

We are still betting on the resilience of consumers and the economy. However, Trump Turmoil 2.0 is significantly testing the resilience of both. That’s why we’ve recalibrated our subjective probabilities.