This is an excerpt from our October 7, 2024 Yardeni Research Morning Briefing. It was written after the release of September's blowout employment report on Friday, October 4.

Pagliacci (Clowns, 1892) is an opera in a prologue and two acts with music and libretto by Ruggero Leoncavallo. The play tells the tragedy of a jealous husband and his wife in a commedia dell'arte theatre company. At the end, the husband kills his wife and her lover. In tears, he declares the chilling words “La commedia è finita!,” which in Italian mean “The comedy is over!”

Rudi Dornbusch, a renowned German macroeconomist, once said, “Expansions don’t die of old age. I like to say they get murdered.” Eric and I have observed that economic expansions usually are murdered by the Fed when monetary policy is tightened to fight inflation, triggering a credit crisis that quickly turns into an economy-wide credit crunch and a recession. We’ve referred to this repetitive pattern as the “Credit Crisis Cycle.”

Ever since the Fed started to raise the federal funds rate (FFR) in March 2022 (when the latest monetary policy tightening cycle began), most economists predicted that it would cause a recession. This consensus forecast was supported by the inversion of the yield curve and the decline in the Index of Leading Economic Indicators. We dissented from this consensus view for numerous reasons that we discussed numerous times since early 2022.

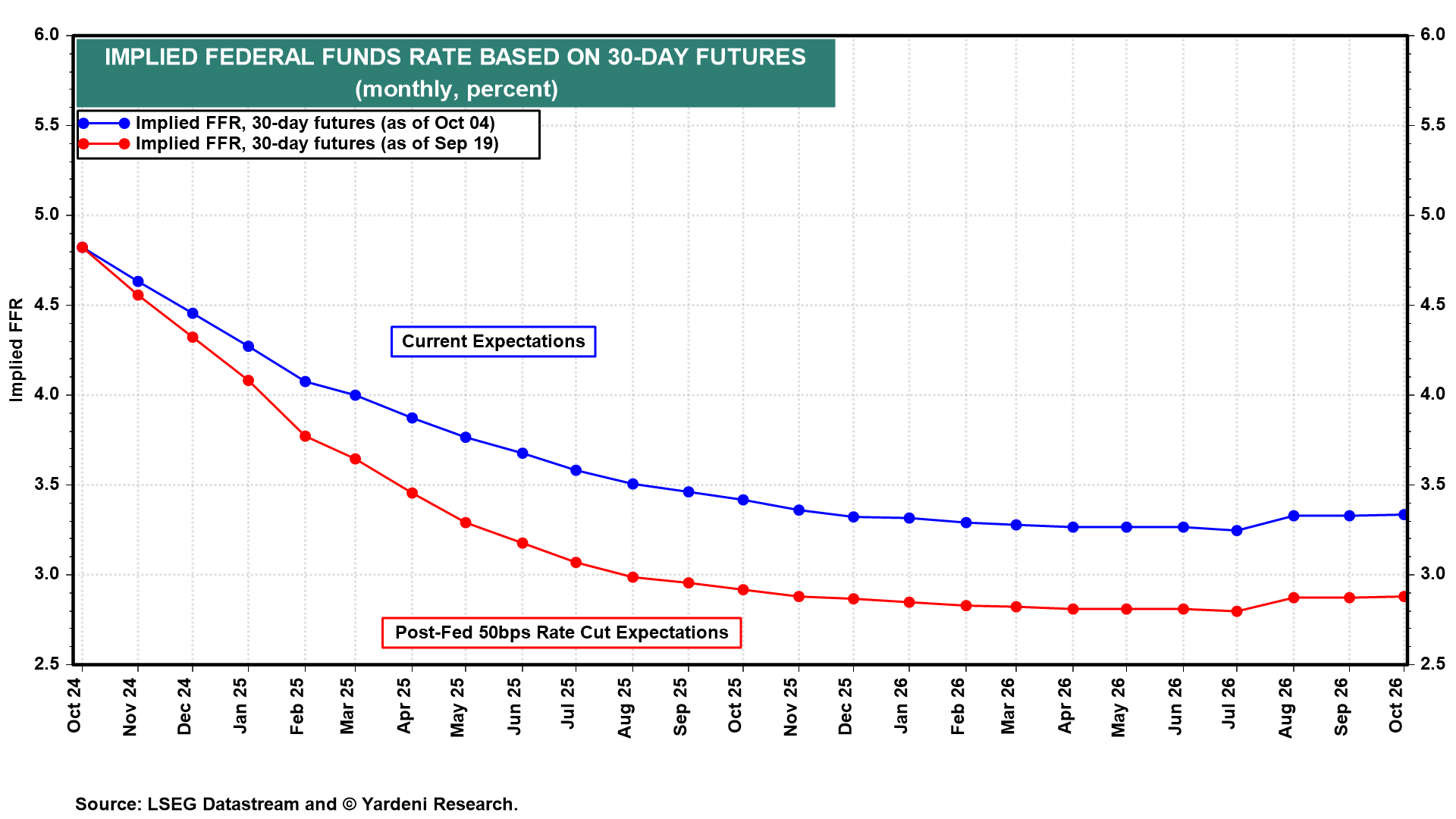

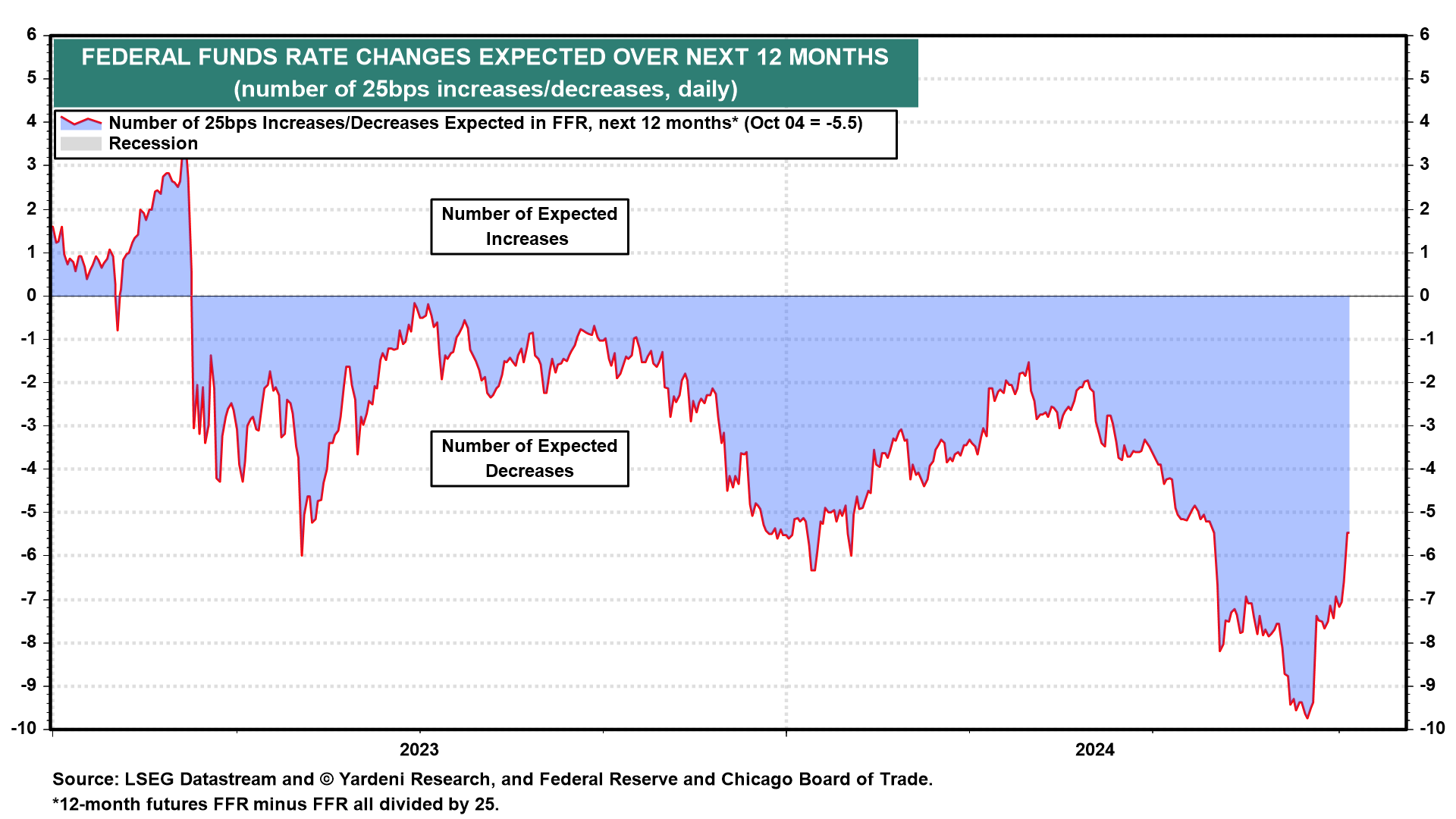

The Fed stopped raising the FFR in July 2023, and fears of a recession began to subside. Nevertheless, at the start of 2024 the financial markets along with most economists believed that the Fed would have to significantly lower the FFR five or six times by 25bps each to avert a recession in 2024 caused by the so-called “long and variable lags” of monetary policy (Fig. 1 below). That made no sense to us, so we predicted two cuts, three at most. There were no cuts until September 18, when the FFR was cut by 50bps.

Even so, the next day the FFR futures market indicated another seven cuts of 25bps in the FFR over the next 12 months, including another 50bps of rate cuts by the end of the year (Fig. 2 below). Again, that made no sense to us since we believed that the summer’s economic weakness was just a soft patch, and didn’t require an aggressive Fed easing response.