President-elect Donald Trump nominated Robert Kennedy Jr., known for challenging the safety of vaccines, to head Health and Human Services (HHS), a huge organization that encompasses an alphabet soup of agencies including the Food and Drug Administration (FDA), the National Institutes of Health (NIH), the Centers for Disease Control and Prevention (CDC), Medicare and Medicaid, and the Office of the Surgeon General. Trump reportedly has asked Kennedy—whose presidential campaign slogan was “Make America Healthy Again”—to clean up the corruption at the federal agencies, to return them to the “gold-standard science,” and to end the chronic disease epidemic.

While critics might write Kennedy off as a crackpot who had a worm living in his brain, Kennedy made some interesting points on a June 27 Joe Rogan podcast. Children are suffering from chronic diseases ranging from autism and diabetes to allergies and eczema. Common today, these ailments were rare when 70-year-old Kennedy was young, he asserts.

Kennedy believes that these chronic diseases are occurring more often because of toxic substances in the environment and that those substances should undergo testing that’s free from the influence of their manufacturers. Among the potential culprits are pesticides; perfluorooctane sulfonic acid (PFOS, a chemical present in many water supplies that’s used in products like non-stick cookware, stain-resistant carpets and fabrics; food packaging, and fire-fighting foam); mercury-containing vaccines; glyphosate (an ingredient in weedkiller Roundup); WiFi devices and cell phones; and chemicals in our food.

With a budget of more than $3 trillion and 80,000 employees, HHS is full of civil servants who might resist Kennedy’s ideas. Trump, who boasts about the speed and success of Covid vaccines and often dines on McDonald’s fare, may object as well.

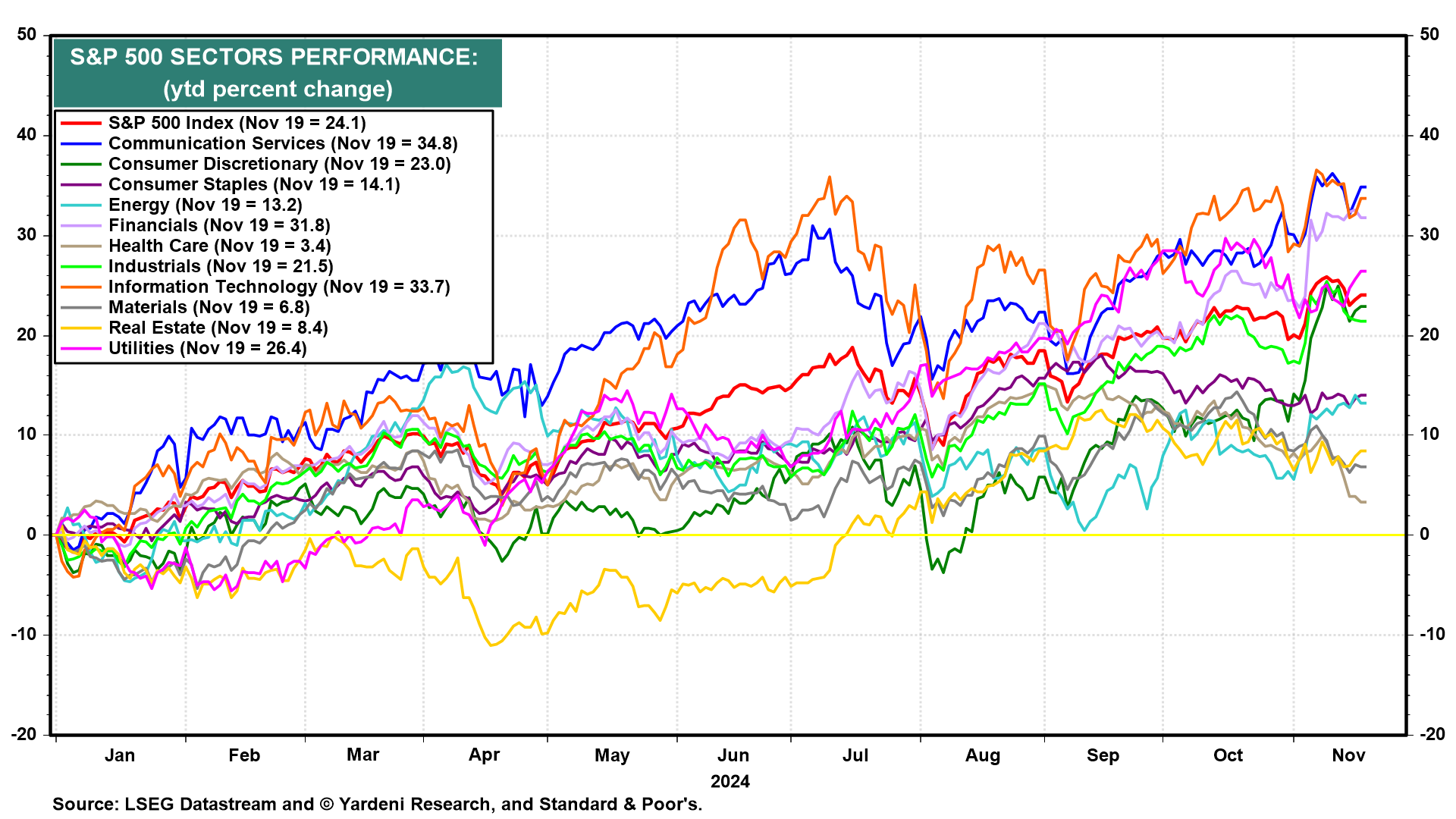

But investors aren’t sticking around to find out whether Kennedy can push his ideas through the bureaucracy. The Health Care sector has lagged far behind the other 10 sectors in the S&P 500 ytd through Tuesday’s close: Communication Service (34.8%), Information Technology (33.7), Financials (31.8), Utilities (26.4), S&P 500 (24.1), Consumer Discretionary (23.0), Industrials (21.5), Consumer Staples (14.1), Energy (13.2), Real Estate (8.4), Materials (6.8), and Health Care (3.4) (Fig. 1 below).

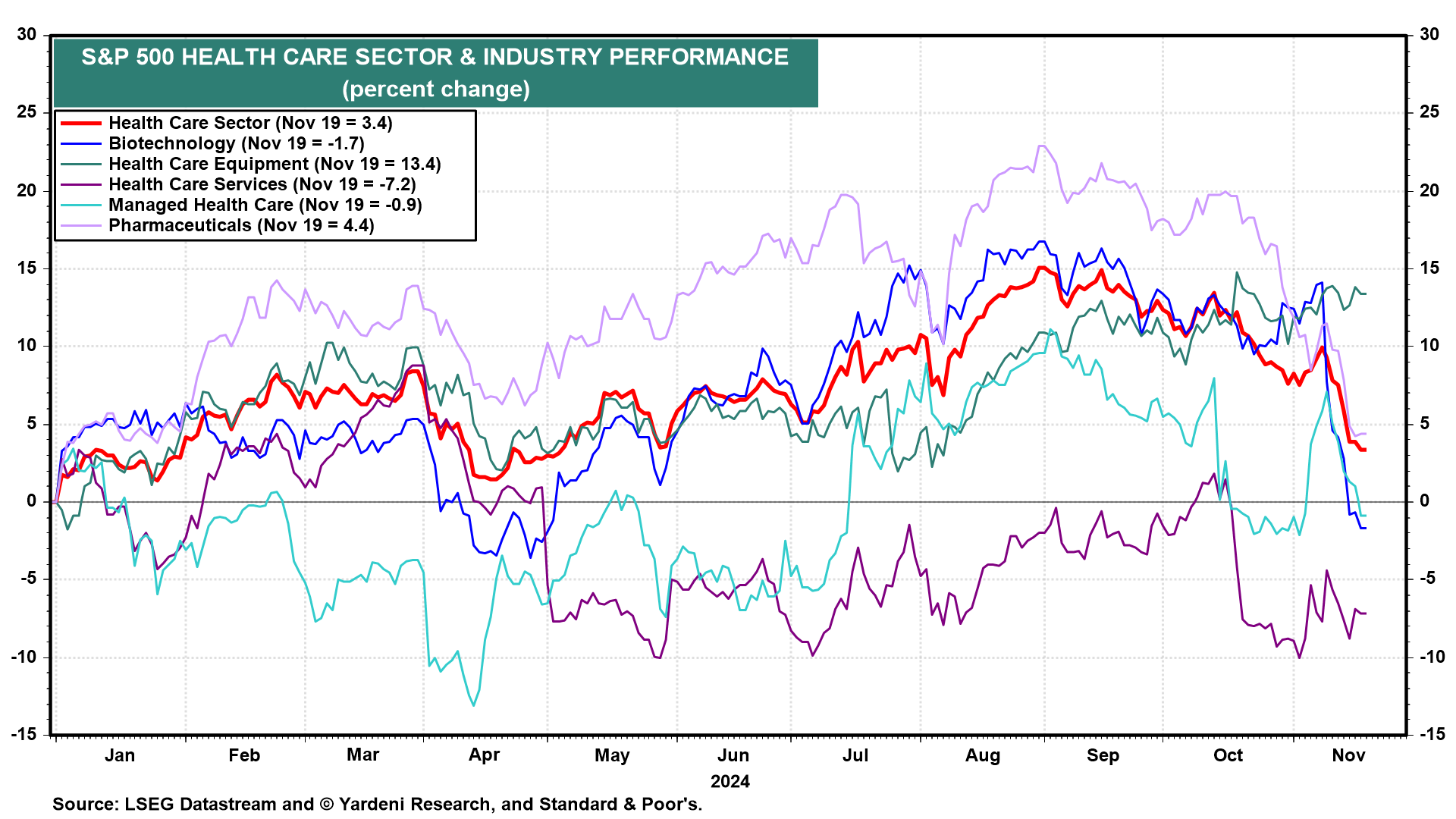

The moves in the S&P 500 Biotechnology and Pharmaceutical stock price indexes are even more notable: They rose 16.3% and 21.5%, respectively, from the start of the year through August 23, when Kennedy suspended his presidential bid and endorsed Trump. Since then, the indexes have tumbled sharply. The Biotech index is now down 1.7% ytd through Tuesday’s close, and the Pharma index is only up 4.4% (Fig. 2 below).

Here are some of Kennedy’s views on health espoused before his HHS appointment: