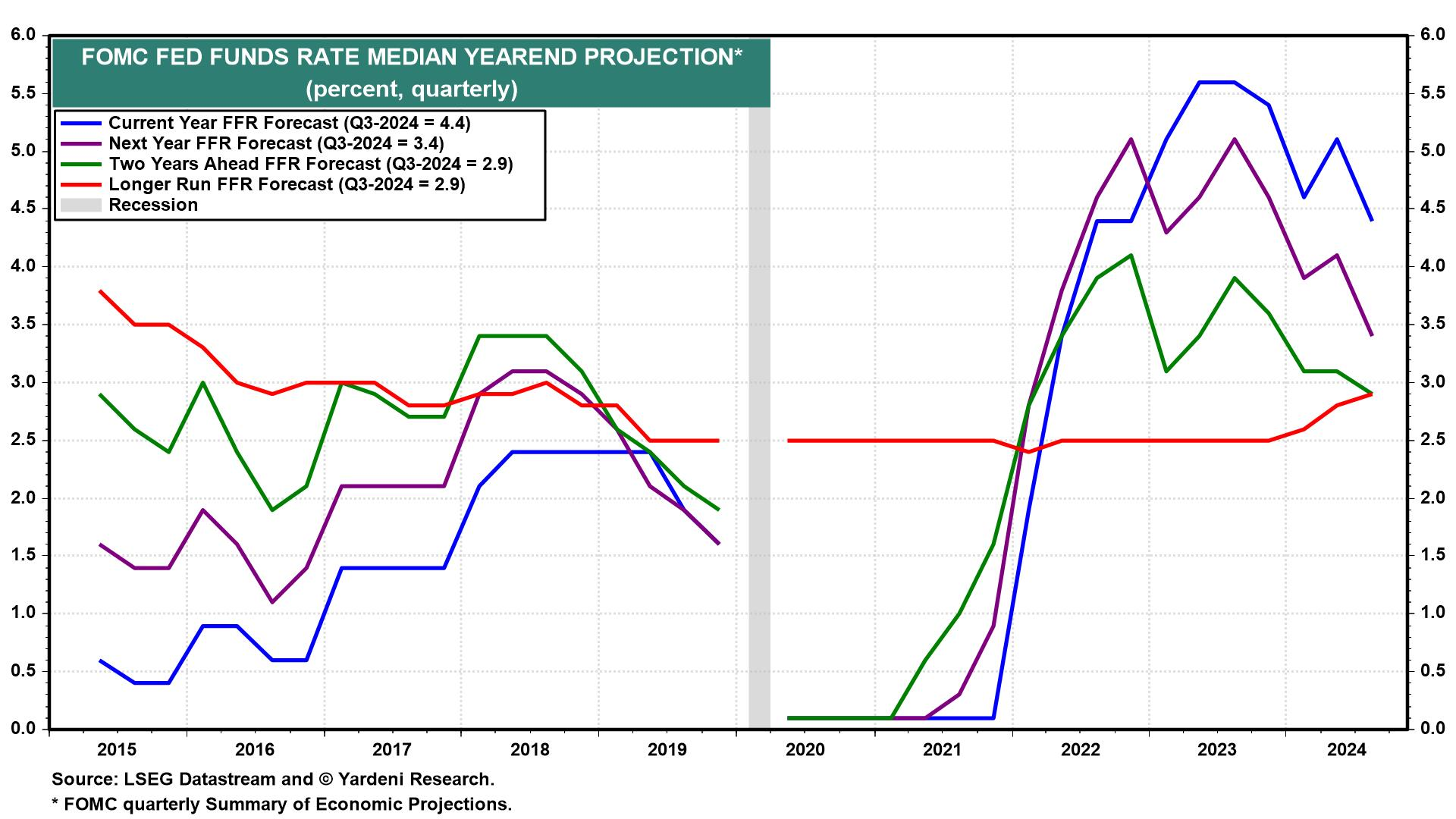

Fed officials indicated that the September 18 rate cut was likely to be followed by more cuts. They deemed that 5.25%-5.50% was too restrictive, which is why they cut it by 50bps to 4.75%-5.00%. That’s still restrictive, in their opinion. According to their September 18 Summary of Economic Projections, collectively they seem to be aiming to lower the federal funds rate to 2.9% over the next couple of years. That’s their estimate of the “longer-run” inflation rate (Fig. 10 below).

The SEP defines it as follows: “Longer-run projections represent each participant’s assessment of the rate to which each variable would be expected to converge under appropriate monetary policy and in the absence of further shocks to the economy. The projections for the federal funds rate are the value of the midpoint of the projected appropriate target range for the federal funds rate or the projected appropriate target level for the federal funds rate at the end of the specified calendar year or over the longer run.”

In other words, it is the Fed’s assessment of the so-called “neutral” federal funds rate. We’ve often referred to it as a theoretical concept with no realistic usefulness. Everyone agrees that it can’t be measured and that it probably isn’t constant.

Sure enough, the latest SEP shows little agreement among even the 19 FOMC meeting participants, whose estimates of this long-run rate varied from 2.37% to 3.75%. Based on the performance of the economy, we think the rate is currently 4.00% and probably higher. Here’s why:

(1) First and foremost, the economy has continued to grow in the face of monetary tightening. The economy is at full employment. Inflation has subsided without a recession. The labor-market part of the Fed’s dual mandate certainly has been accomplished and inflation is fast approaching the Fed’s 2.0% target. In other words, the resilient economy is demonstrating that if there is such a thing as the neutral federal funds rate, we are there.