Blaming the Sahm Rule, Carry Trades & Too Many Bulls. The stock markets’ adverse reaction to Friday’s jobs report apparently was to price in a hard landing and to expect a series of federal funds rate (FFR) cuts by the Fed, including a 50-basis-point cut in September. Helping to unnerve investors was that the increase in the unemployment rate might have triggered the Sahm Rule, implying that the jobless rate is about to soar, as it has in the past once the rule was triggered.

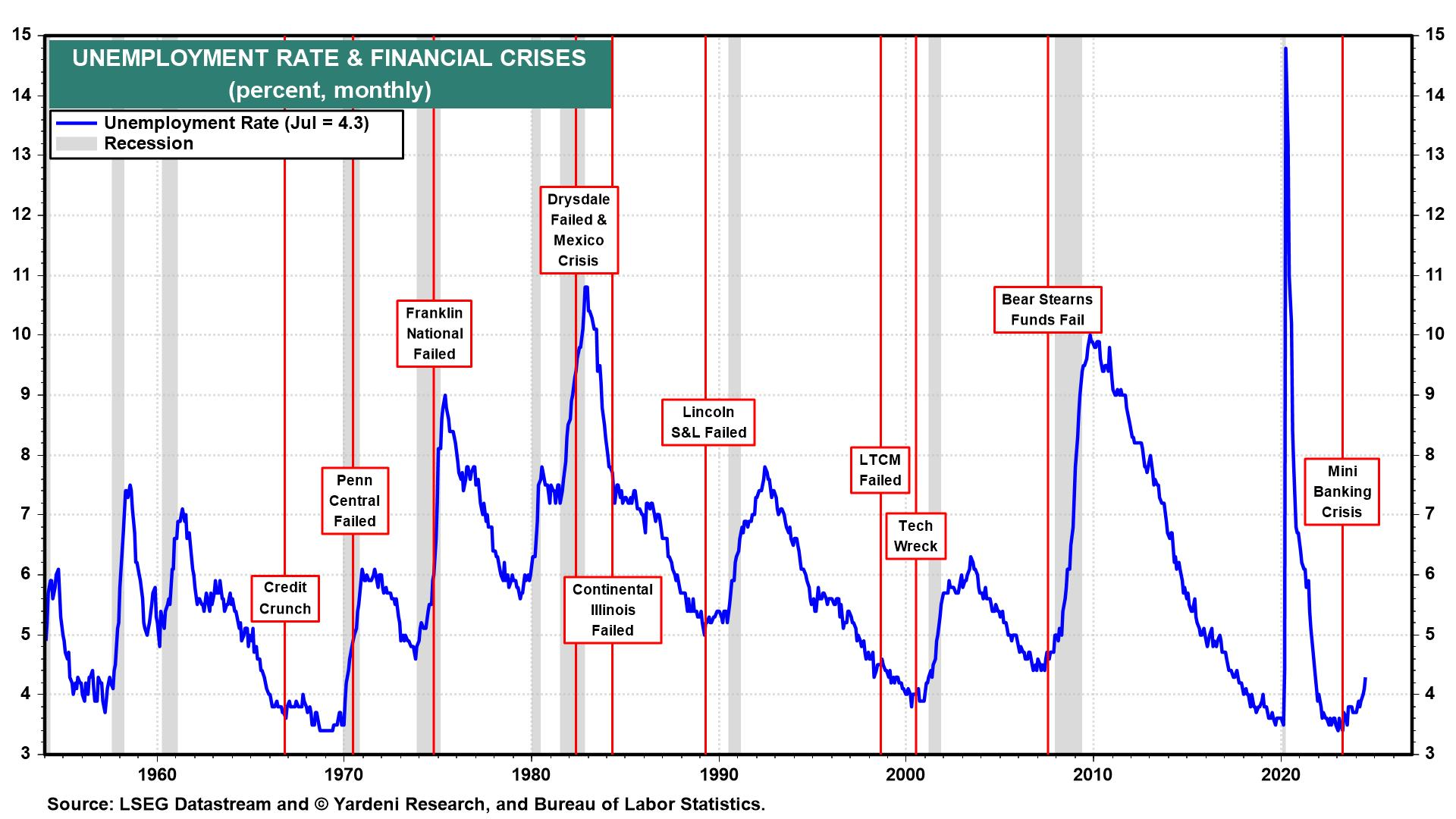

In his presser, Powell dismissed the Sahm Rule as a “statistical regularity.” We agree. We acknowledge that the tightening of monetary policy in the past led to gradually rising unemployment followed by big spikes in the unemployment rates. But those spikes were attributable to financial crises that morphed into credit crunches that forced employers to cut payrolls and consumers to retrench (Fig. 14 below). There was a credit crisis last year, but the Fed averted an economy-wide credit crunch and recession.