Strategy I: Roaring Ahead

In Sunday’s QuickTakes, Eric, Joe, and I raised our outlook for S&P 500 earnings as well as our price targets for the index. We did so because we believe that Trump 2.0 represents a major regime change from Biden 1.0 (or was that Obama 3.0?). The corporate tax rate will be lowered from 21% to 15%. Personal income from tips, overtime, and Social Security might not be taxed. Many onerous regulations on business will be eliminated. This was already set to happen when the Supreme Court ruled earlier this year that businesses could challenge regulatory overreach in court.

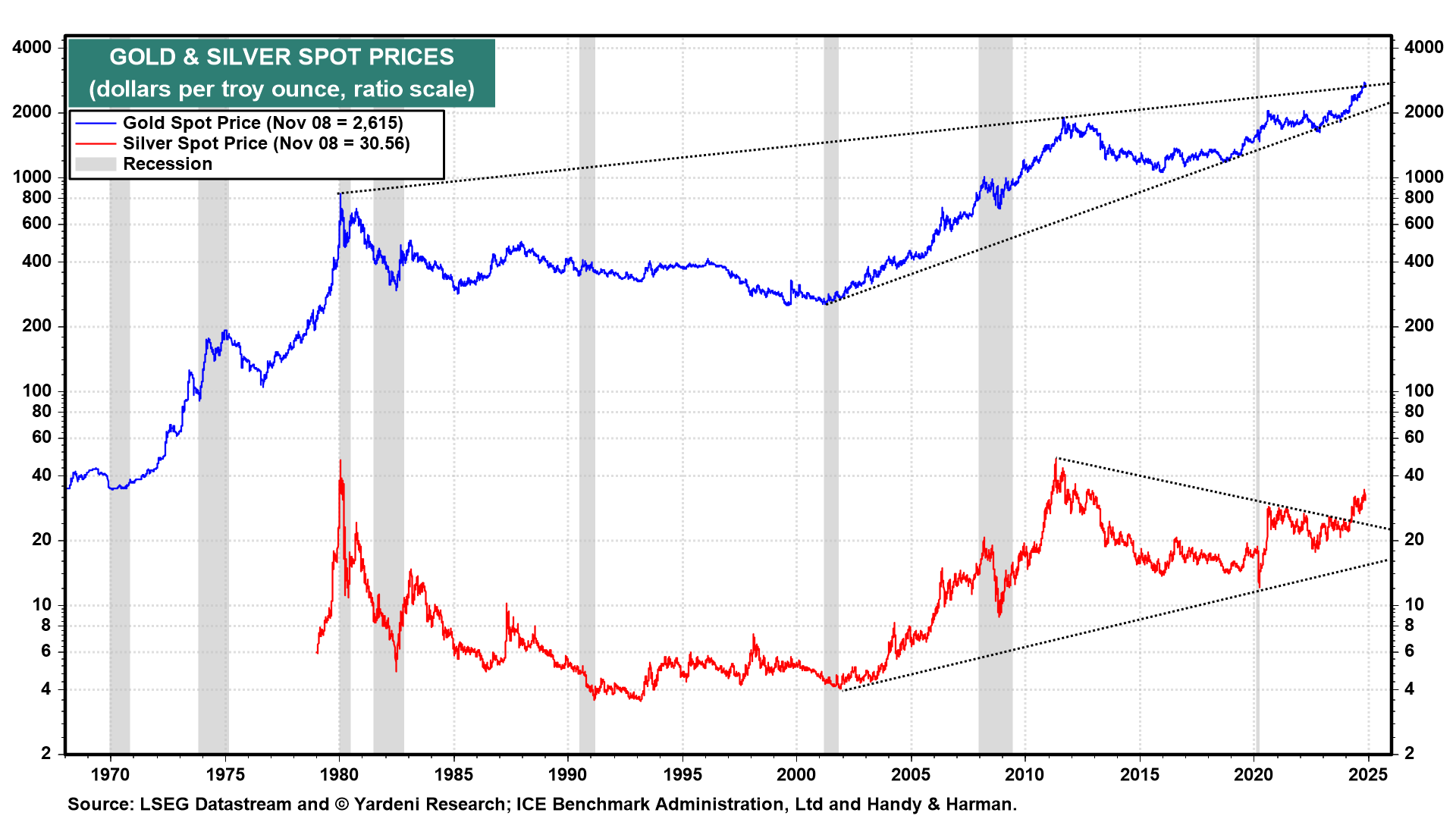

In addition, today’s major geopolitical crises might be settled sooner rather than later. That certainly is reflected in the weakness in the price of gold as well as the price of oil in recent days (Fig. 1 below and Fig. 2 below).

We expect that better economic growth will boost federal government revenues and that Elon Musk will succeed in slowing the growth in federal government spending. GDP growth might actually keep pace with mounting government debt.

The Fed’s cut in the federal funds rate (FFR) by 25bps on November 7 together with the 50bps cut on September 18 suggest to us that Fed officials are oddly oblivious to the strength of the economy, the backup in bond yields, and the outlook for more fiscal stimulus. If Fed officials continue to cut the FFR, they risk a rebound in price inflation rates and a meltup in the stock market.

We concluded the QuickTakes note with: “So, we are changing the subjective probabilities of our three scenarios as follows: Roaring 2020s (55%, up from 50%), 1990s-style meltup (25%, up from 20%), and 1970s-style geopolitical and/or domestic debt crisis (20%, down from 30%).”