This is an excerpt from the Yardeni Research Morning Briefing dated January 6, 2025.

Strategy I: What Could Go Right.

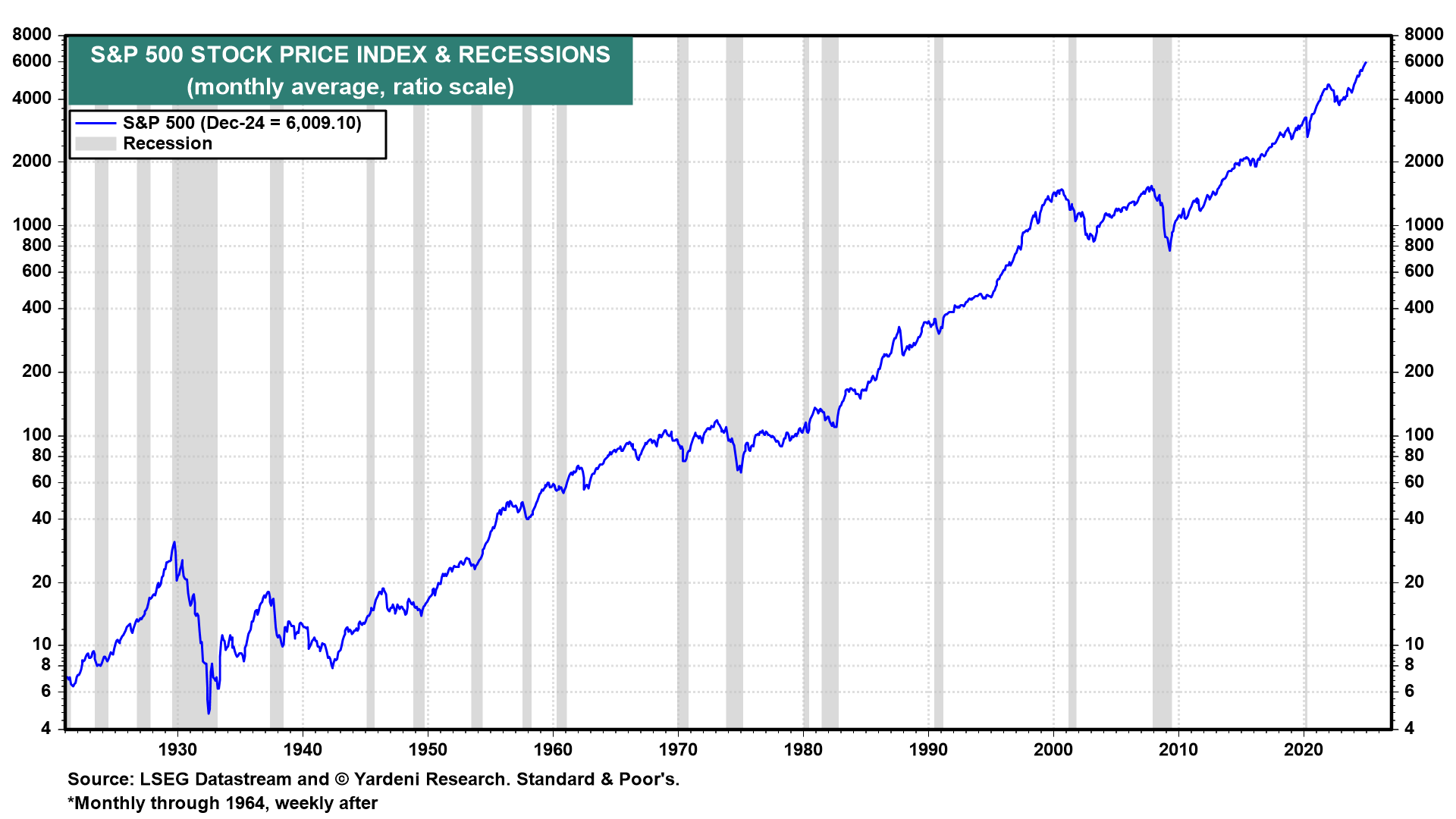

We are biased by the stock market’s bullish bias. We tend to be permabulls because bear markets are infrequent and are usually relatively short compared to bull markets, which tend to last for some time. Since January 1978, the S&P 500 is up 66.6-fold (Fig. 3). In that entire 47-year period, there were just six bear markets that lasted only a bit more than one year on average. Bear markets tend to be caused by recessions. There have been only six of them since 1978, lasting just 14 months on average (Fig. 4 below). (See our Stock Market Historical Tables: Bull & Bear Markets.)

As we’ve previously noted, we regularly follow the growlings of the permabears as an efficient way to assess what could go wrong for the economy and the stock market. Very rarely do we find that they’ve missed all the things that could go wrong, while we frequently find that they’ve mostly ignored an assessment of what could go right. (See our December 23, 2024 QuickTakes titled “Permabulls Versus Permabears.”

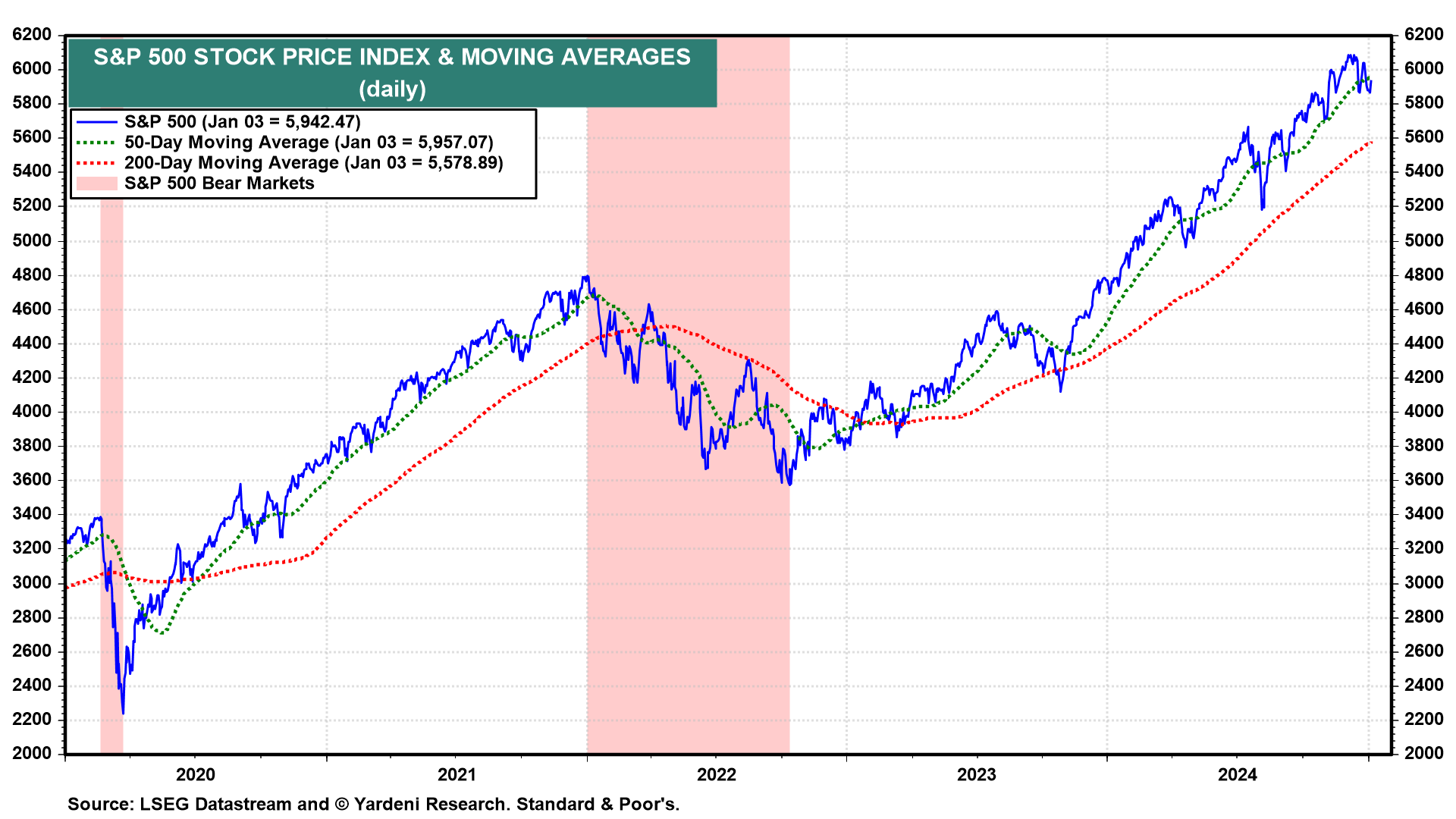

The S&P 500 peaked at a record high of 6090.27 on December 6. It ended 2024 at 5881.63. The index ended the first week of the new year at 5942.47, just below its 50-day moving average (Fig. 5 below). The Nasdaq peaked last year at a record 20,173.89 on December 16 and bounced off its 50-day moving average last week to close at 19,621.7 (Fig. 6).

On balance, we expect that the next few weeks could be choppy for the stock market before the S&P 500 and Nasdaq resume climbing to new record highs during the spring.

Here is a list of what could go right in early 2025, followed by a review of what could go wrong:

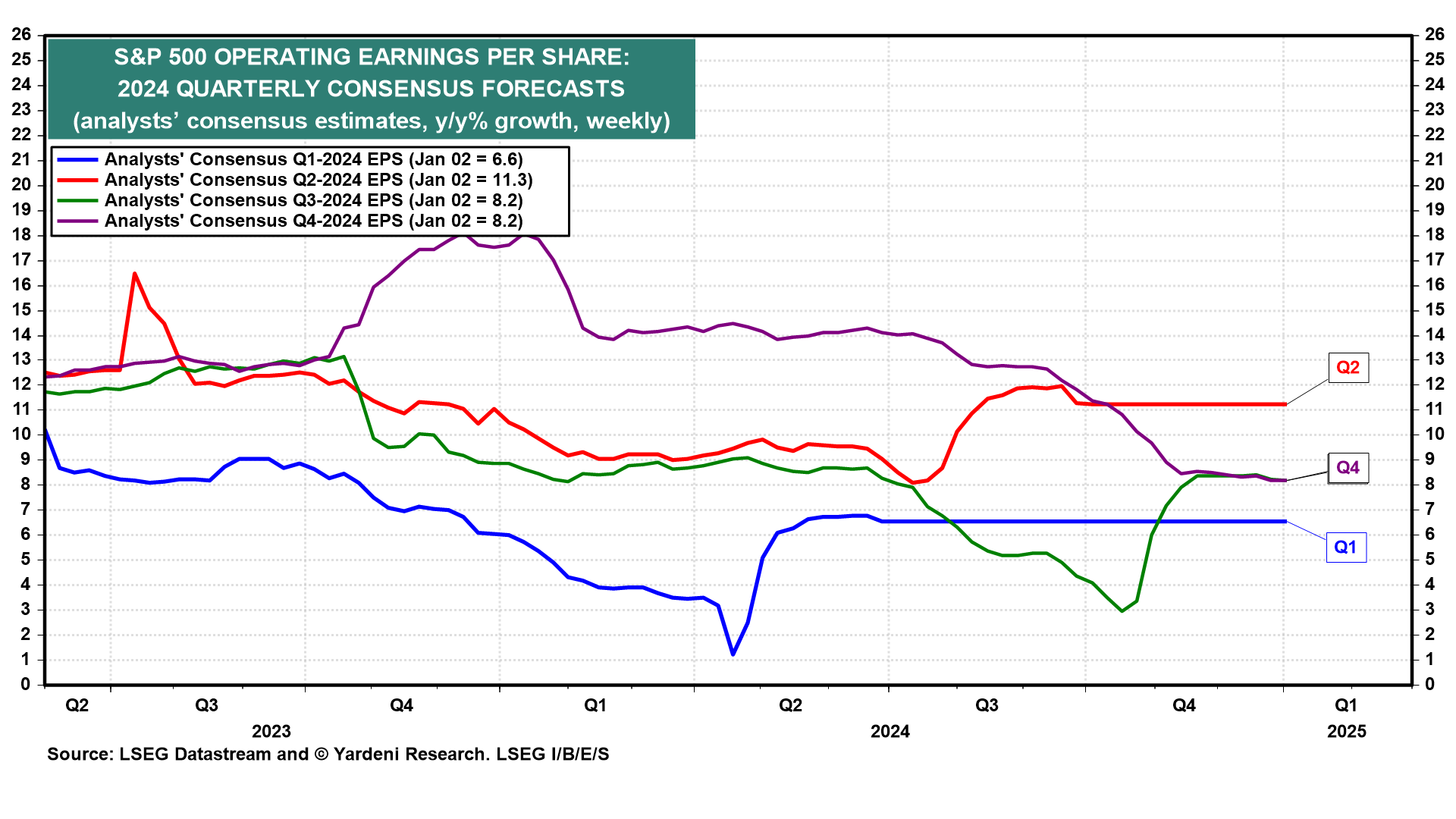

(1) Q4’s earnings reporting season over the next few weeks might be better than expected. They usually are when the economy is expanding. The analysts’ consensus estimate for Q4 earnings growth is 8.2% (Fig. 7 below). There were typical upside earnings surprises during the previous three earnings seasons. There should be another during the Q4 earnings season. Leading the way should be banks, semiconductors, cloud computing, retailers, and restaurants.