Raphael Bostic is the president and CEO of the Federal Reserve Bank of Atlanta. He is a 2024 voting member of the Federal Open Market Committee. In a March 4 post on his bank’s website, he warned about “pent-up exuberance.” He acknowledged that inflation has slowed, but he fears that it could accelerate quickly if the Fed stops tapping on the economy’s brakes and begins to step on the accelerator instead. He wrote:

“As my staff and I have talked to business decision-makers in recent weeks, the theme we’ve heard rings of expectant optimism. Despite business activity broadly moderating, firms are not distressed. Instead, many executives tell us they are on pause, ready to deploy assets and ramp up hiring when the time is right. I asked one gathering of business leaders if they were ready to pounce at the first hint of an interest rate cut. The response was an overwhelming ‘yes.’ If that scenario were to unfold on a large scale, it holds the potential to unleash a burst of new demand that could reverse the progress toward rebalancing supply and demand. That would create upward pressure on prices. This threat of what I’ll call pent-up exuberance is a new upside risk that I think bears scrutiny in coming months.”

Bostic also observed that price pressures are still widespread: “Further, while headline inflation is moving in the right direction, a closer analysis reveals that it’s not time to give the all-clear signal. First, the number of individual prices that are climbing briskly is still higher than we typically see when inflation is under control. The share of items in the PCE price index rising at rates above 5 percent remains well above the roughly 20 percent share that would be consistent with inflation at its target. So, price pressures are still a little broader than I’d prefer.”

Bostic wrote that he and his staff follow the Dallas Fed’s trimmed-mean PCE inflation rate. He noted that “It removes outliers at the very high and very low ends of the price change distribution to arrive at a central tendency, and it has often been a good predictor of future inflation.” Over the past several months, the Dallas trimmed-mean measure has been stuck at around a 2.6% annualized increase. He concluded, “That suggests that underlying inflation is still loitering just outside the neighborhood of 2 percent.”

Debbie and I don’t pay as much attention to the various alternative inflation indexes that have been devised by the Fed’s research staffs in Atlanta (flexible and sticky CPI), Cleveland (median and trimmed mean CPI), and Dallas (trimmed mean PCED). There’s enough to track in the official CPI and PCED data. When we do so, we conclude that inflation is on course to be down to the Fed’s 2.0% target during the second half of this year.

Consider the following:

(1/3) Our forecast.

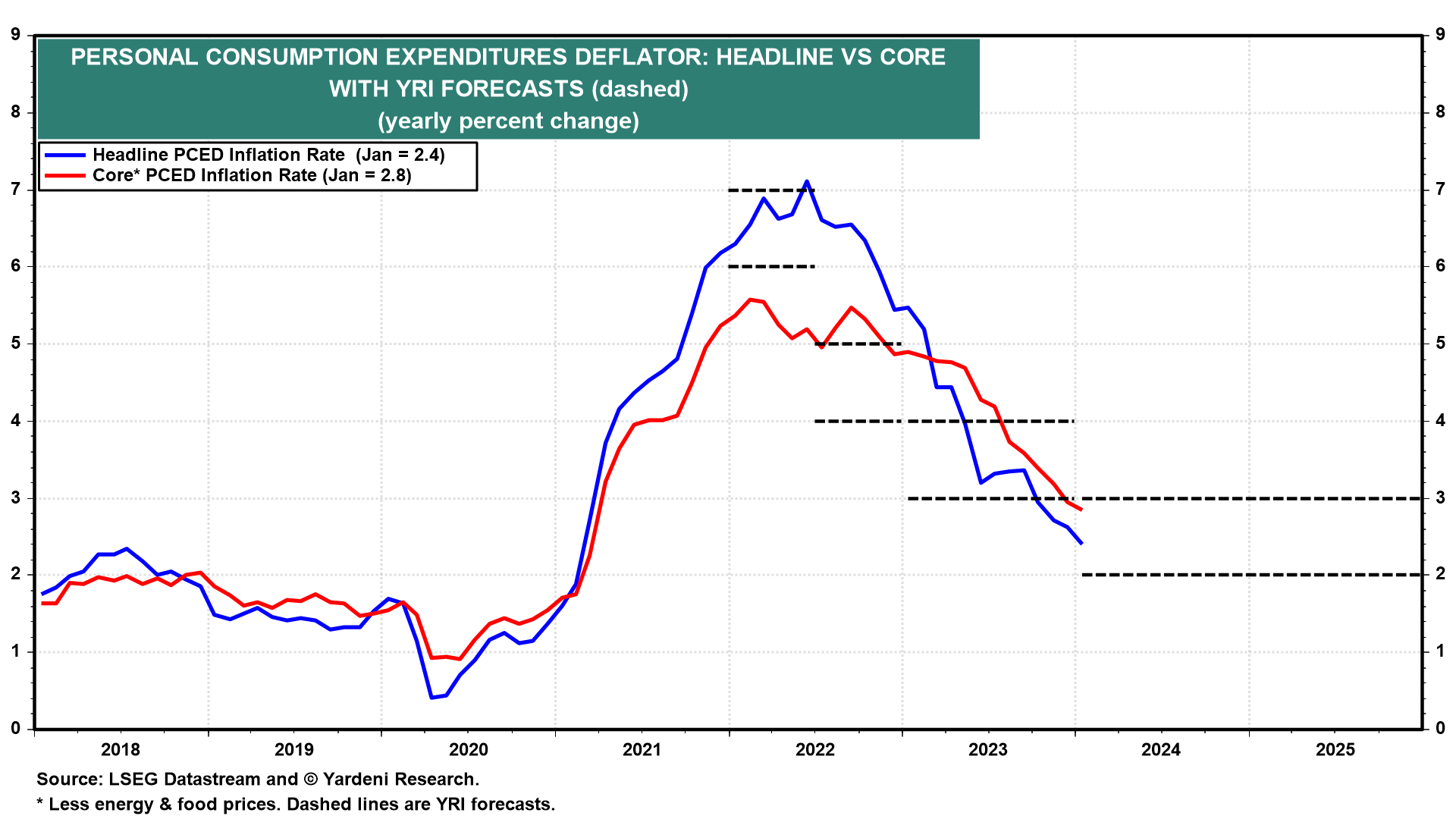

During the spring of 2022, we predicted that inflation was peaking (Fig. 1 below): “In our scenario, the PCED headline inflation rate peaks during H1-2022 between 6%-7%. Led by consumer durable goods prices, it moderates to 4%-5% during H2-2022. Next year, it falls to 3%-4% as persistently rising rent inflation offsets moderation in other consumer prices.” We wrote that in our April 19, 2022 Morning Briefing. We expected that goods inflation would decline faster than rent inflation. In our September 11, 2023 Morning Briefing, we predicted that inflation will fall to 2%-3% in 2024.