Trump 2.0 I: Lots of Moving Parts

So far, it has been the Roaring 2020s for the US economy and US stock market. Real GDP is at a record high, and so is the S&P 500. That’s impressive considering that the global economy was hit by a pandemic at the start of the decade, there was a radical regime change from Trump 1.0 to the Biden administration in 2021, the Fed raised interest rates significantly from March 2022 through August 2024, and there have been two major geopolitical crises that remain unresolved. Oh, yes: There was also that widely anticipated recession that never happened.

The economy has been resilient. Will it remain so during Trump 2.0? That’s the #1 question that Eric and I have been fielding ever since Election Day resulted in a Republican sweep.

The naysayers continue to raise doubts about the resilience of the economy. Some of them concede that they were wrong about expecting a recession in response to the tightening of monetary policy over the past three years. However, they blame their error on fiscal policy, which they (now) correctly observe has been very stimulative but doubt it will be for long. (We’ve identified several additional reasons for the economy’s resilience over the past three years.)

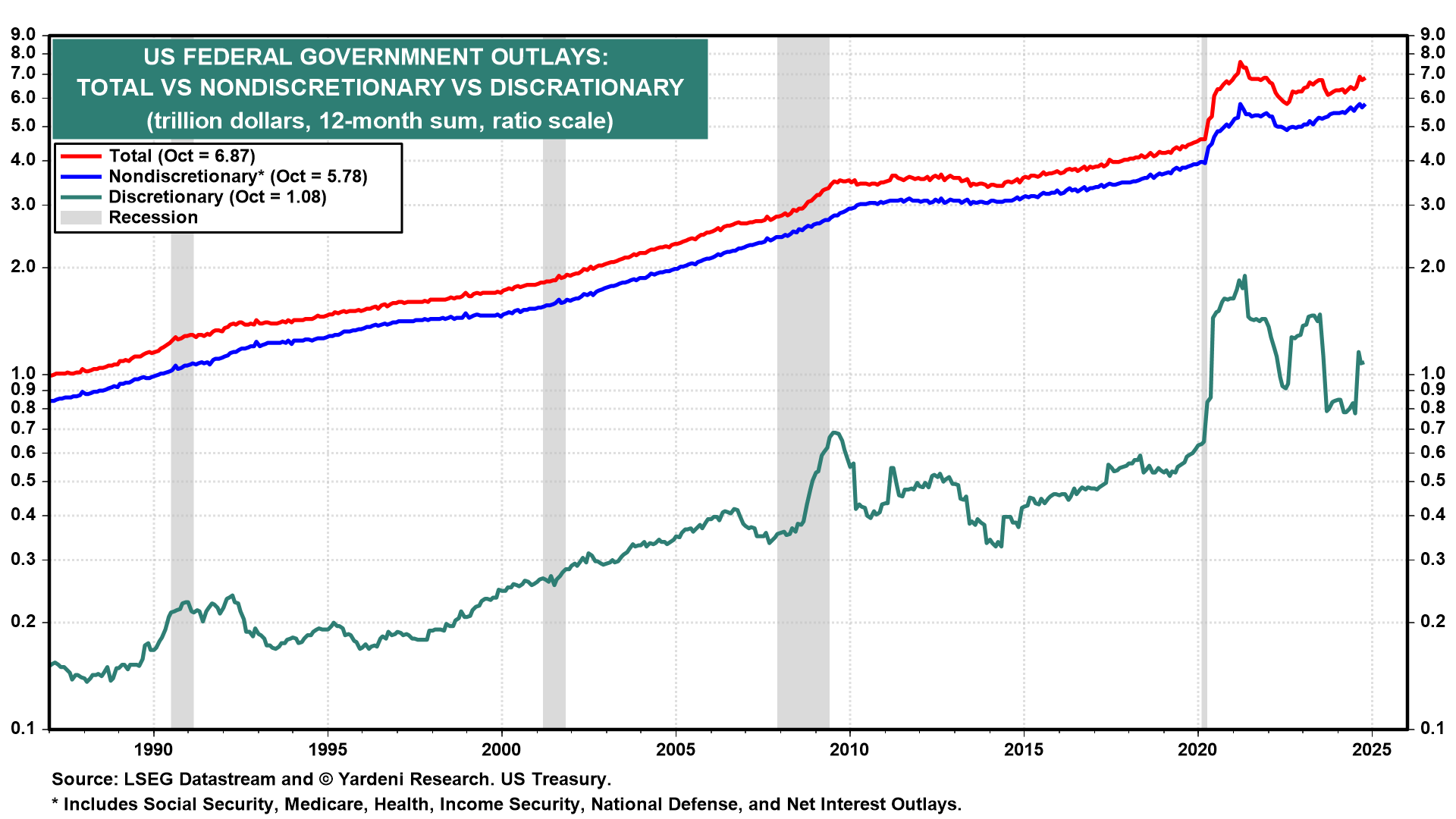

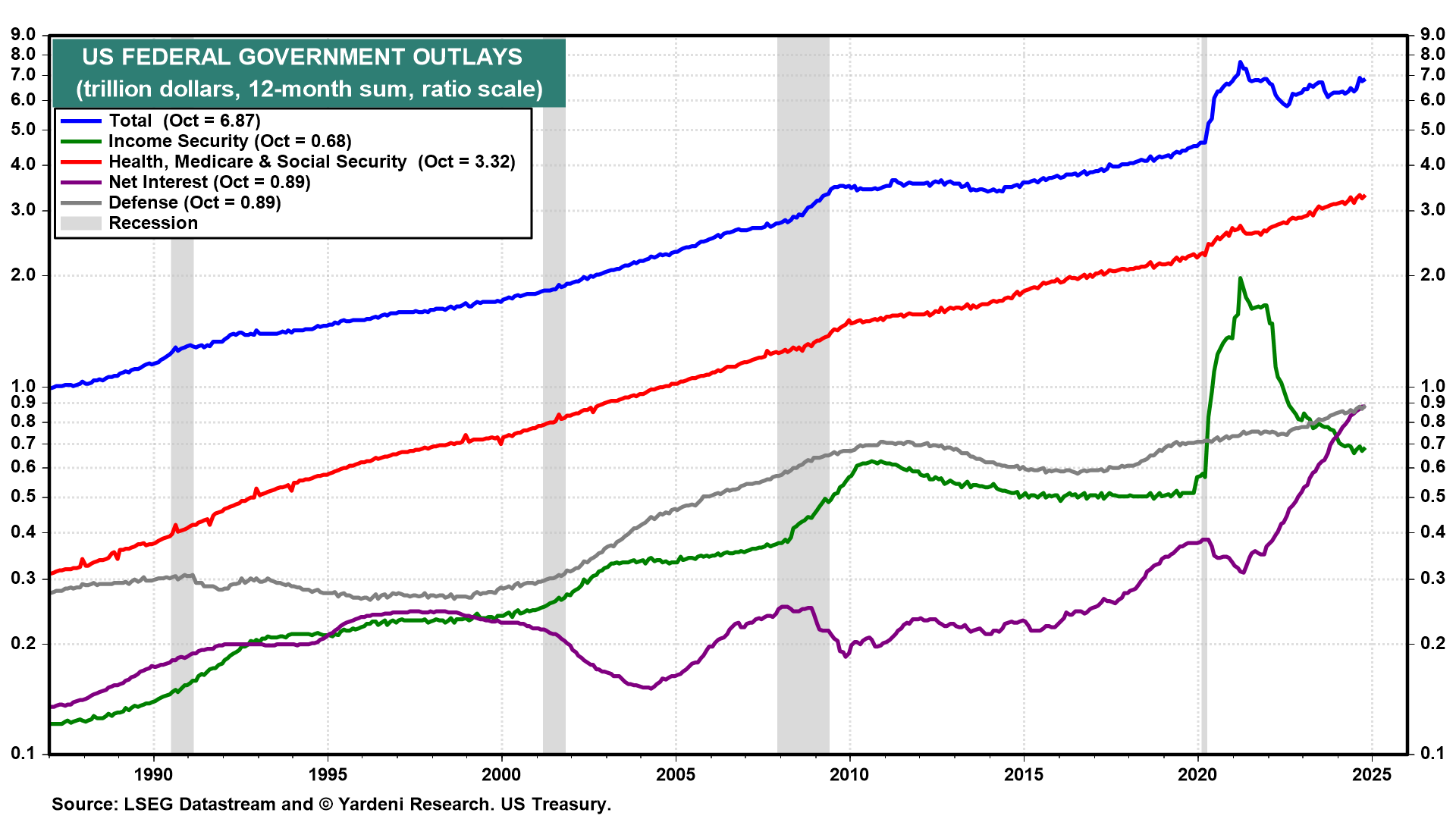

Since the start of 2022 through October of this year, total federal government spending is up $192 billion (using the 12-month sum) to $6.9 trillion (Fig. 1 below). Government spending on Health, Medicare, and Social Security rose $623 billion to a record $3.3 trillion over this period. There was a big drop in government spending on income security by $806 billion to $0.7 trillion, but that was almost completely offset by a $139 billion increase in defense spending to a record $0.9 trillion and, even more significantly, by a $510 billion increase in net interest outlays to a record $0.9 trillion (Fig. 2 below).

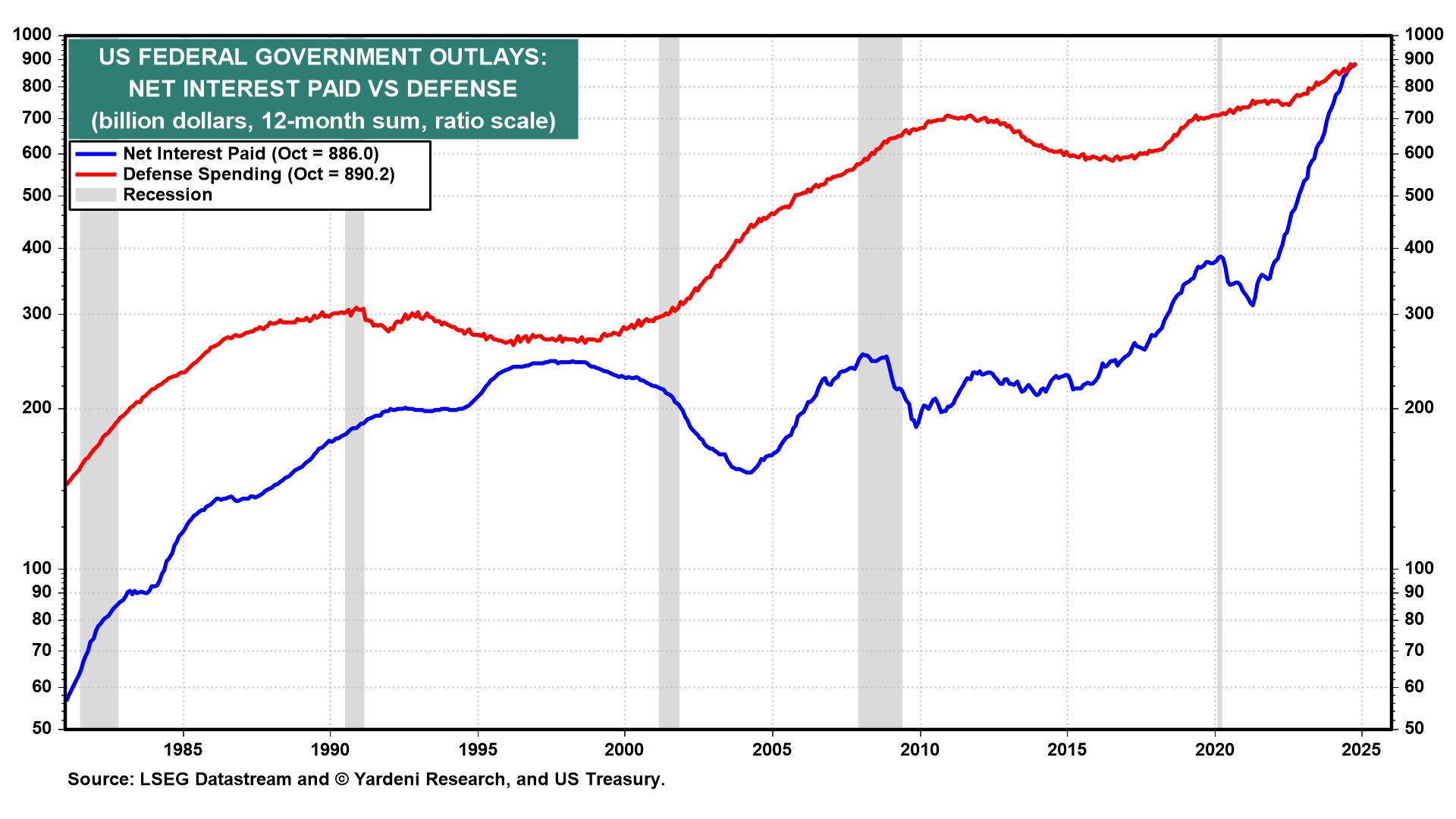

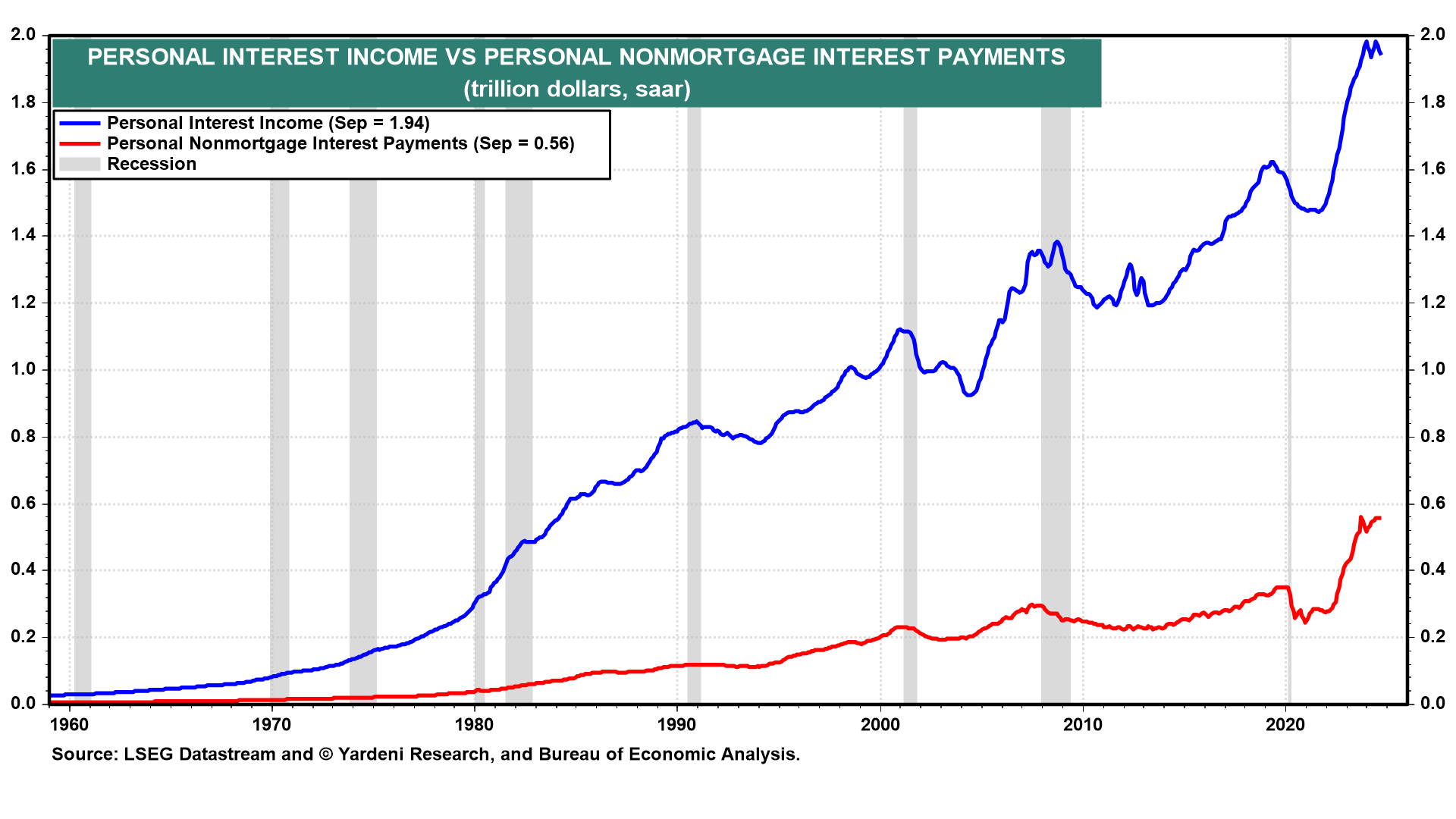

Focus on those numbers for a minute. The decline in the government’s spending on pandemic-related income support after the contagion abated has been largely offset by the government’s outlays on net interest as the federal debt and interest rates have soared (Fig. 3 below). Most of those interest payments have boosted personal income. Since January 2022 through September of this year, personal interest income has soared by $432 billion to $1.94 trillion (Fig. 4 below). Over the same period, personal nonmortgage interest payments rose $278 billion to $0.6 trillion.

The bottom line is that federal government spending remains very stimulative, and so do government deficits. Government spending that is deficit financed rather than paid for with tax revenues is more stimulative than spending based on a pay-as-you-go budget rule.