Among the hottest topics at dinner tables and at corporate boardrooms tables across the country—not to mention election campaign offices—is inflation. The topic of inflation has heated up along with inflation itself but doesn’t seem to be cooling off along with it.

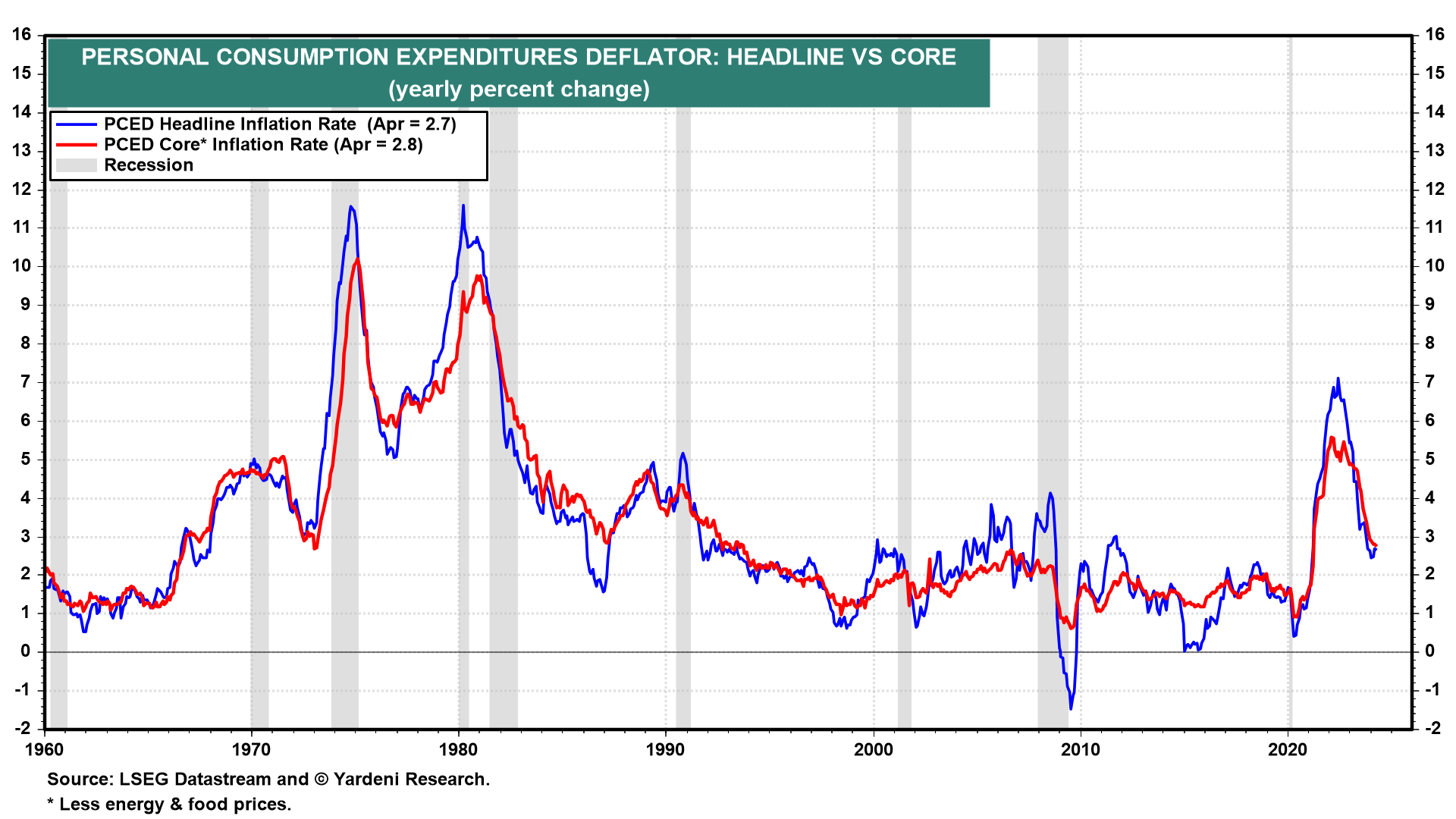

The US economy contended with its first significant bout of price pressures since the 1980s after pandemic stimulus measures boosted demand in the face of dramatically reduced supply. But consumer price inflation is falling—the PCED is below 2.7% now, well off its peak of 7.1% two years ago and finally nearing the Fed’s 2.0% target (Fig. 14 below).

So why does it seem that everyone is still so upset about inflation? In fact, more and more economists are worrying less and less about it because they are tracking the y/y inflation rate. On this basis, inflation has certainly moderated well enough. On the other hand, most consumers recall how much lower prices were at the start of the pandemic around March 2020. In other words, consumers are looking at the four-year percent change in prices and don’t like what they see! And rightly so!

Consider the following:

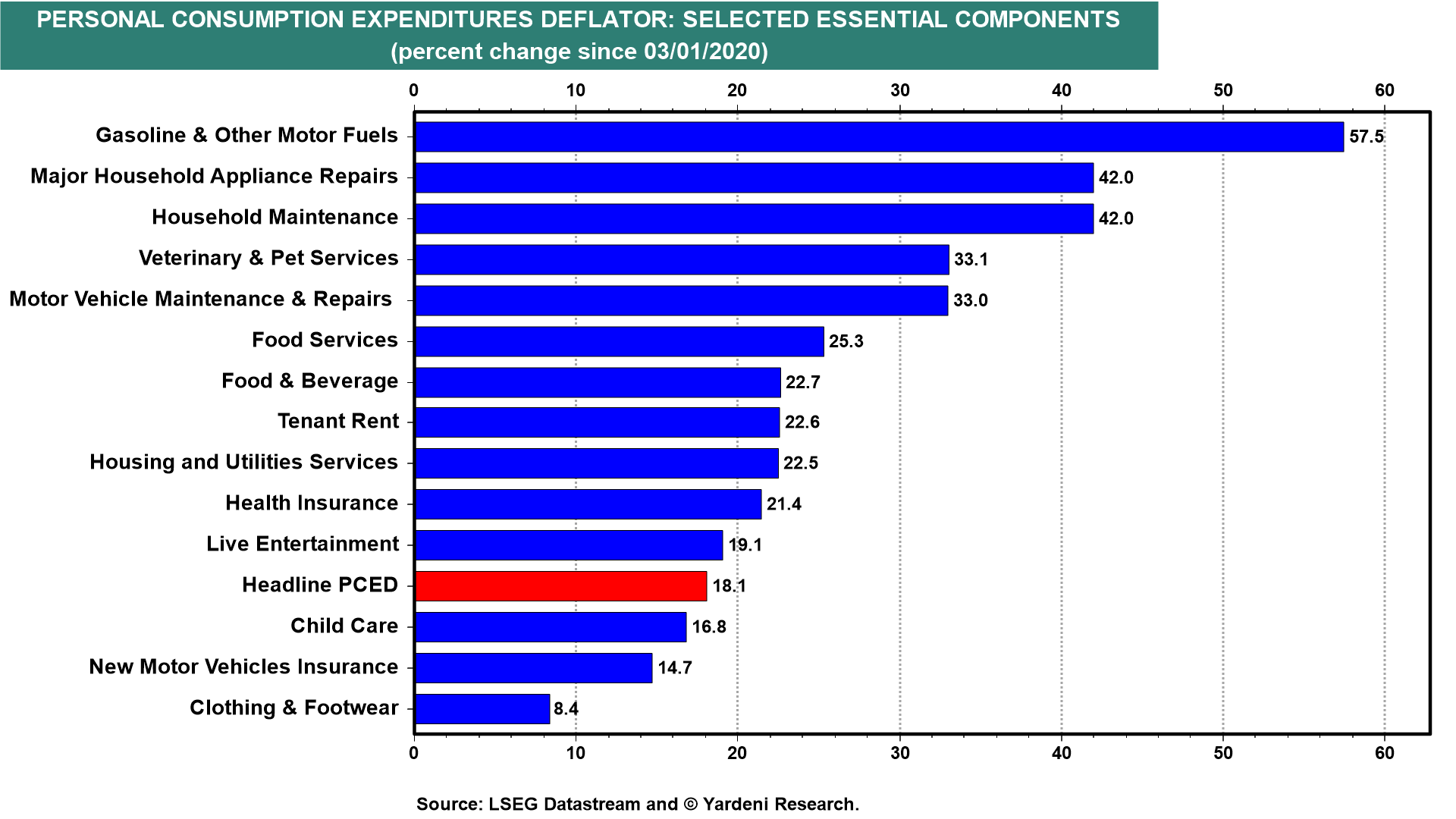

(1/3) Four-year inflation rates. Inflation frustration stems from the simple fact that prices are dramatically higher than they were at the start of the pandemic—the PCED is up 18.1% since March 2020 (Fig. 15 below). Inflation hits consumers and businesses in waves: Snarled supply chains and an influx of demand sent the prices of commodities and durable goods like cars and furniture soaring during 2020 and 2021.

Now goods prices are actually deflating while services grow costlier, though at a slowing rate. But even though the prices of gas and food are barely rising, if not falling, what sticks in consumers’ craw is that gasoline and other motor fuels are 57.5% more expensive and food services 25.3% more expensive than at the start of the pandemic in March 2020.

Several other essentials are also much more expensive than they were before the pandemic, including: household appliance repairs (42.0%), veterinary and pet services (33.1%), auto maintenance and repairs (33.0%), tenant rent (22.6%), housing and utilities (22.5%), and health insurance (21.4%).

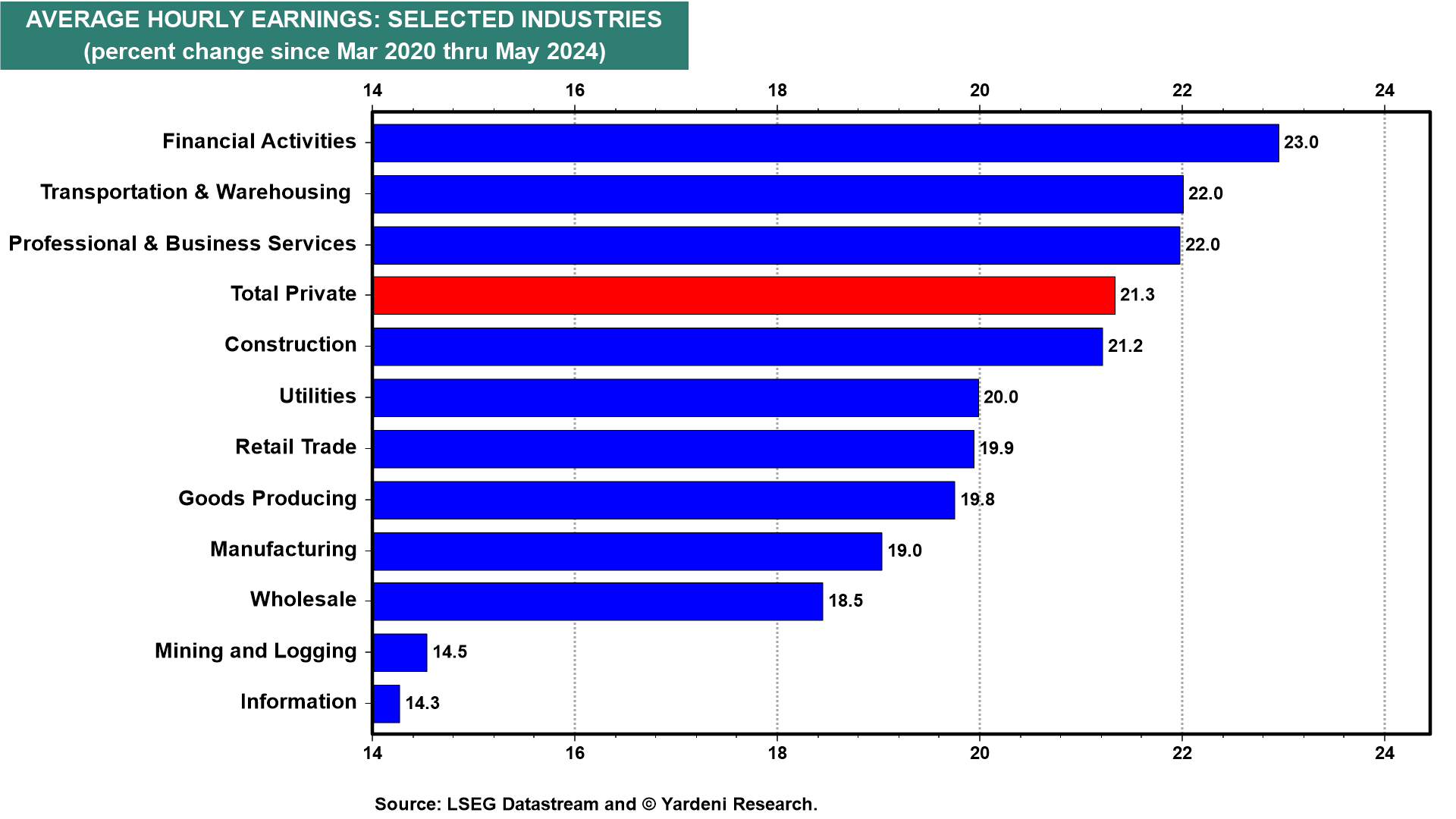

That said, wage increases for low-income workers have largely kept up with the pace of inflation. Average hourly earnings for production and nonsupervisory wages are up 24.2% since the pandemic began. Total private wages are up 21.3% (Fig. 16 below).