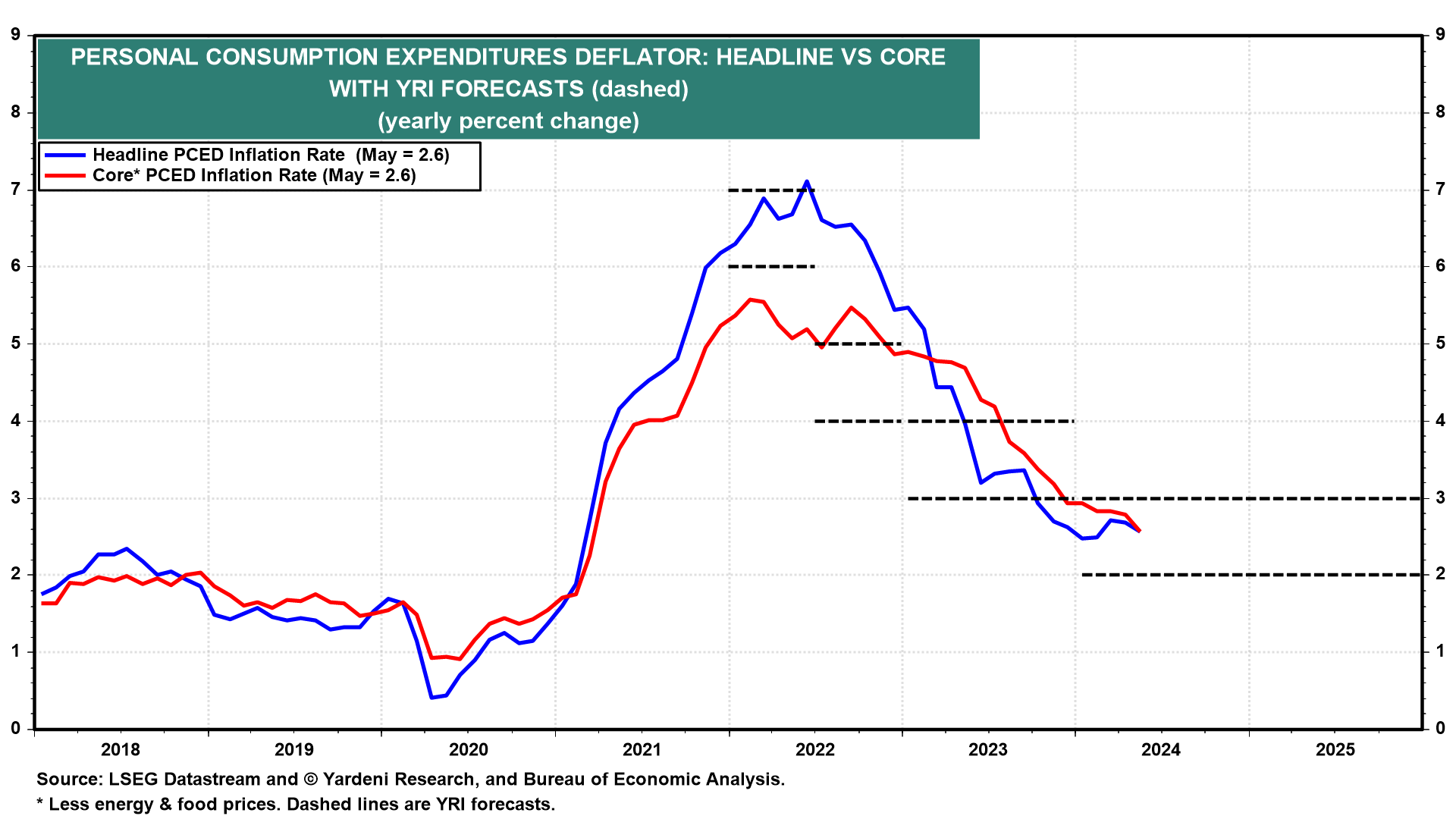

During the spring of 2022, Debbie and I predicted that inflation was peaking: “In our scenario, the PCED headline inflation rate peaks during H1-2022 between 6%-7%. Led by consumer durable goods prices, it moderates to 4%-5% during H2-2022. Next year, it falls to 3%-4% as persistently rising rent inflation offsets moderation in other consumer prices.” We wrote that in our April 19, 2022 Morning Briefing. We expected that goods inflation would decline faster than rent inflation. In our September 11, 2023 Morning Briefing, we predicted that inflation would fall to 2%-3% in 2024.

We first wrote about “immaculate disinflation” in the September 6, 2022 Morning Briefing:

“Is immaculate disinflation possible? History shows that inflation rarely falls on its own without a recession. But we don’t think history necessarily has to repeat itself (despite how often it rhymes). … What seems to be different this time (so far) is that the credit system is less vulnerable to a credit crunch than it was in the past. The result is what we now have: a rolling recession hitting different sectors of the economy at different times; we expect it to bring inflation down without precipitating an economy-wide downturn.”

Since the start of the year, we’ve forecast that the PCED inflation rate will fall to 2.0% by the end of this year (Fig. 11 below). So far, so good. June’s CPI report suggests we are still on the right track:

(1) CPI vs PCED. The CPI is released by the Bureau of Labor Statistics (BLS) a couple of weeks before the PCED comes out for each month. The PCED measure is compiled by the Bureau of Economic Analysis (BEA). The components of the CPI are used to calculate the PCED. Most of the component series are identical. A few differ because different methods are used to estimate them by the BLS and by the BEA. Many of the component series have different weights.