Strategy I: Valuation & Growth.

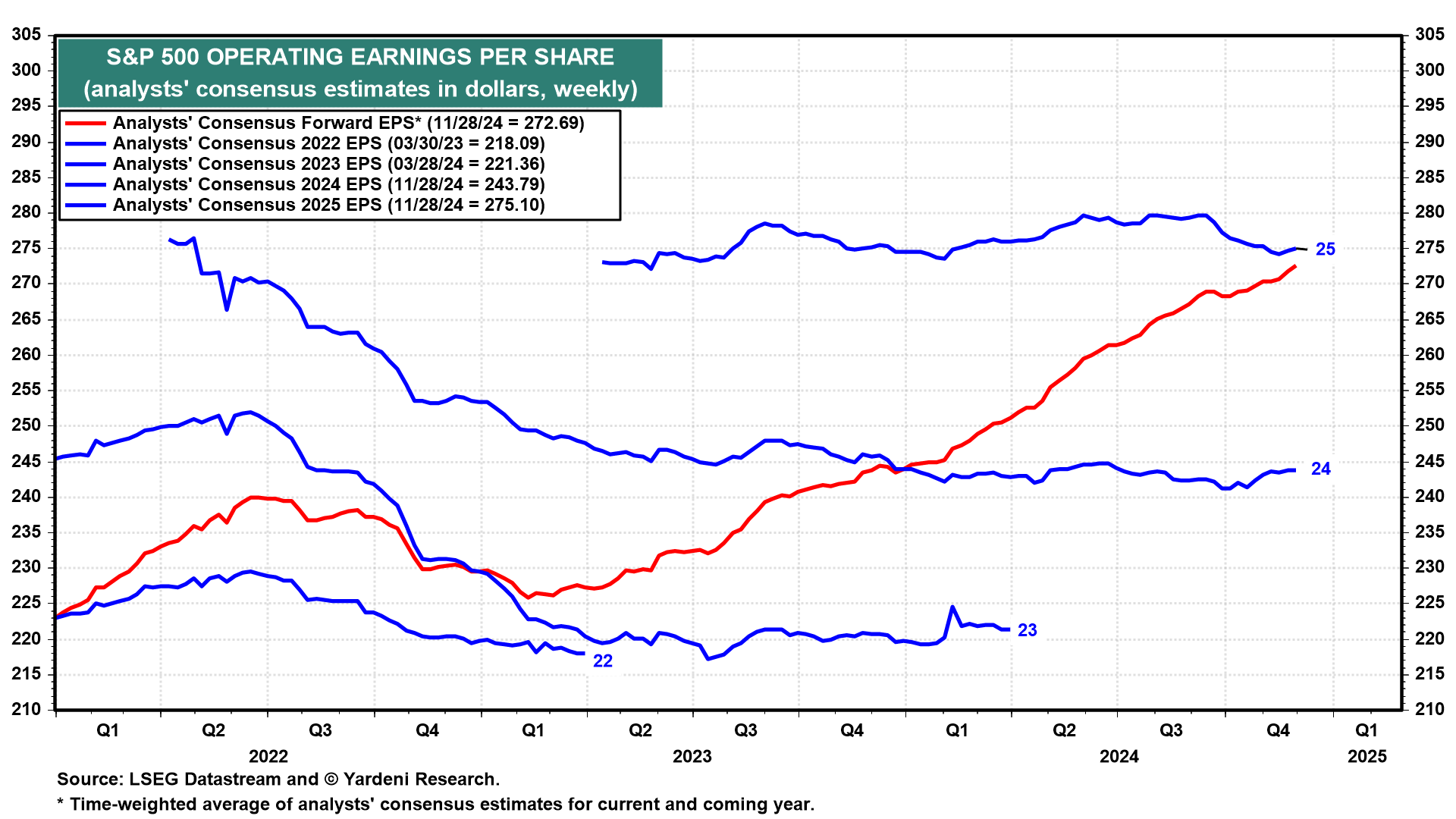

As we’ve seen over the past three years, stock investors don’t like recessions, not even the no-shows. There was much anxiety about an imminent recession from January 3, 2022 through October 12, 2022, as reflected by the 25.4% drop in the S&P 500 over that period. Over that period, industry analysts confirmed investors’ fears by lowering their consensus expectations for the operating earnings per share (EPS) of the S&P 500 companies by 0.2% and 1.9% for 2022 and 2023. These were very modest cuts, so the forward earnings estimate based on the analysts’ annual estimates rose 5.8% (Fig. 1 below). (“Forward” earnings is the time-weighted average of the analysts’ consensus estimates for the current year and following one; the forward P/E is the multiple based on forward earnings.)

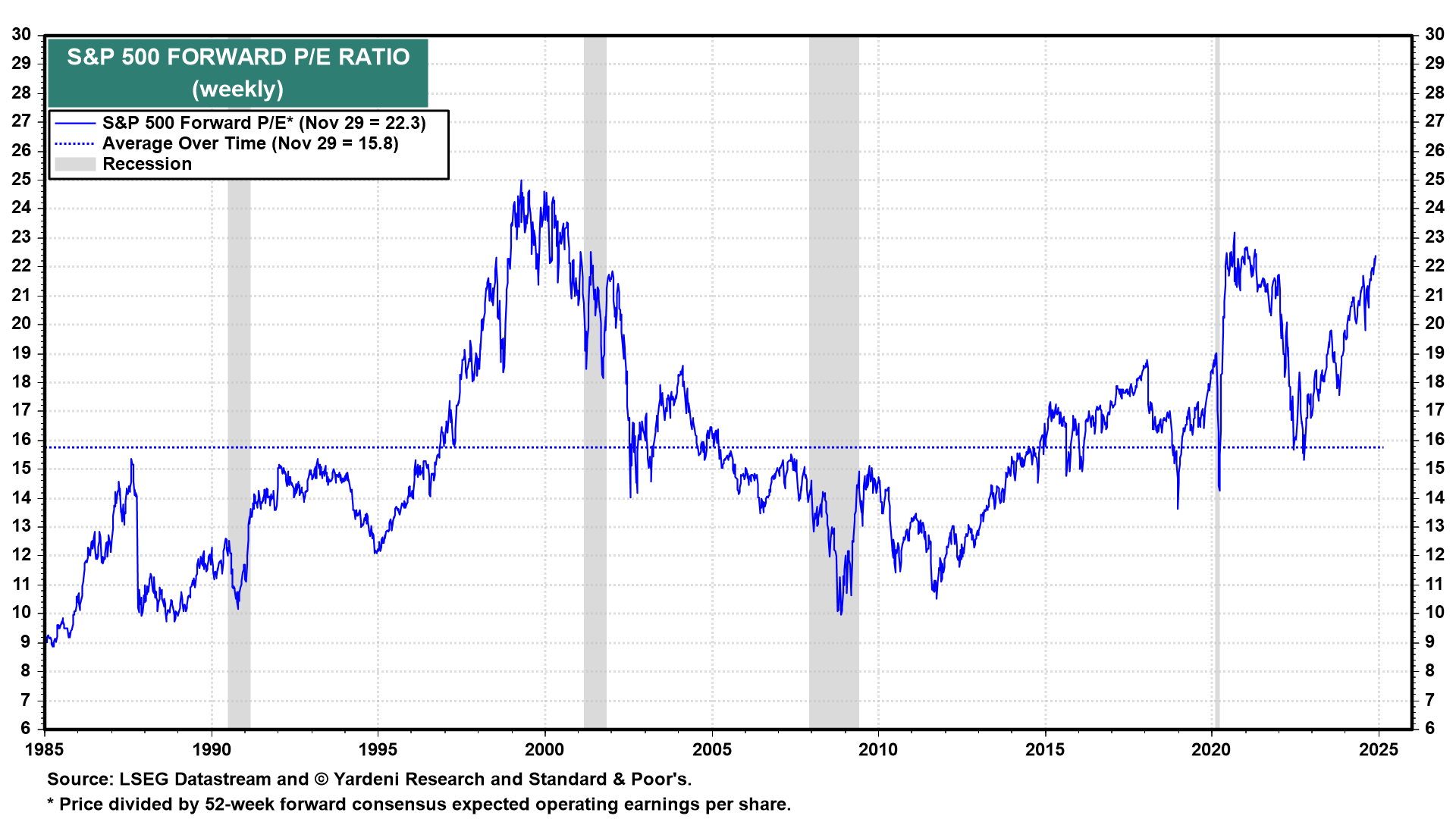

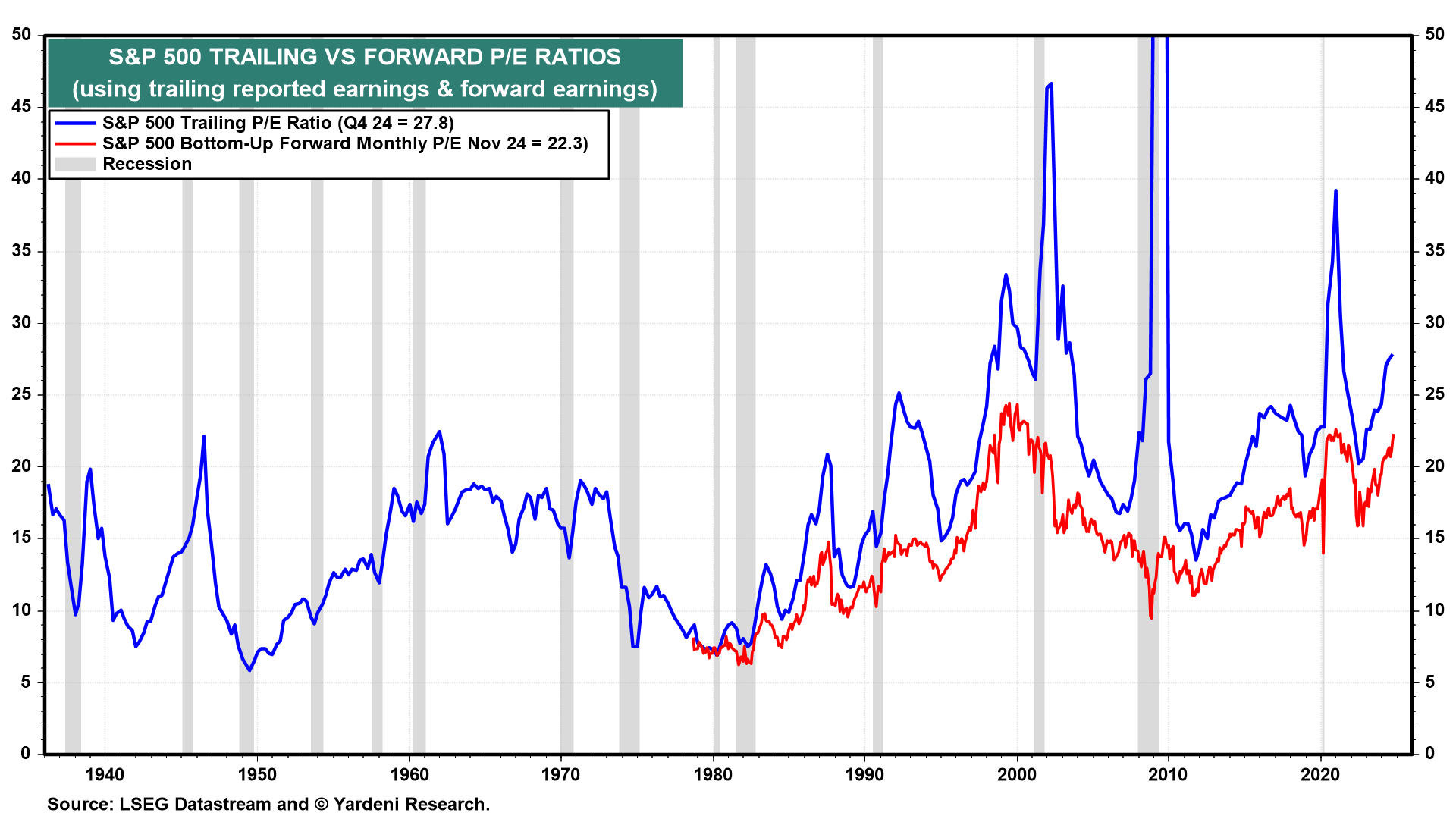

Nevertheless, recession fears caused investors to slash the forward P/E for the S&P 500 from 21.7 at the start of 2022 to 15.3 on October 12, 2022 (Fig. 2 below). That was a 29.5% drop that was only partially offset by the 5.8% increase in forward earnings. The result was a P/E-led bear market.

Bear markets tend to bottom with forward P/Es well below the historical average of 15.8 (Fig. 3 below). But the latest one bottomed at a relatively high forward P/E because investors started to anticipate that recession fears might start to abate, as the economy proved remarkably resilient in the face of the significant tightening of monetary policy from March 2022 through August 2023.

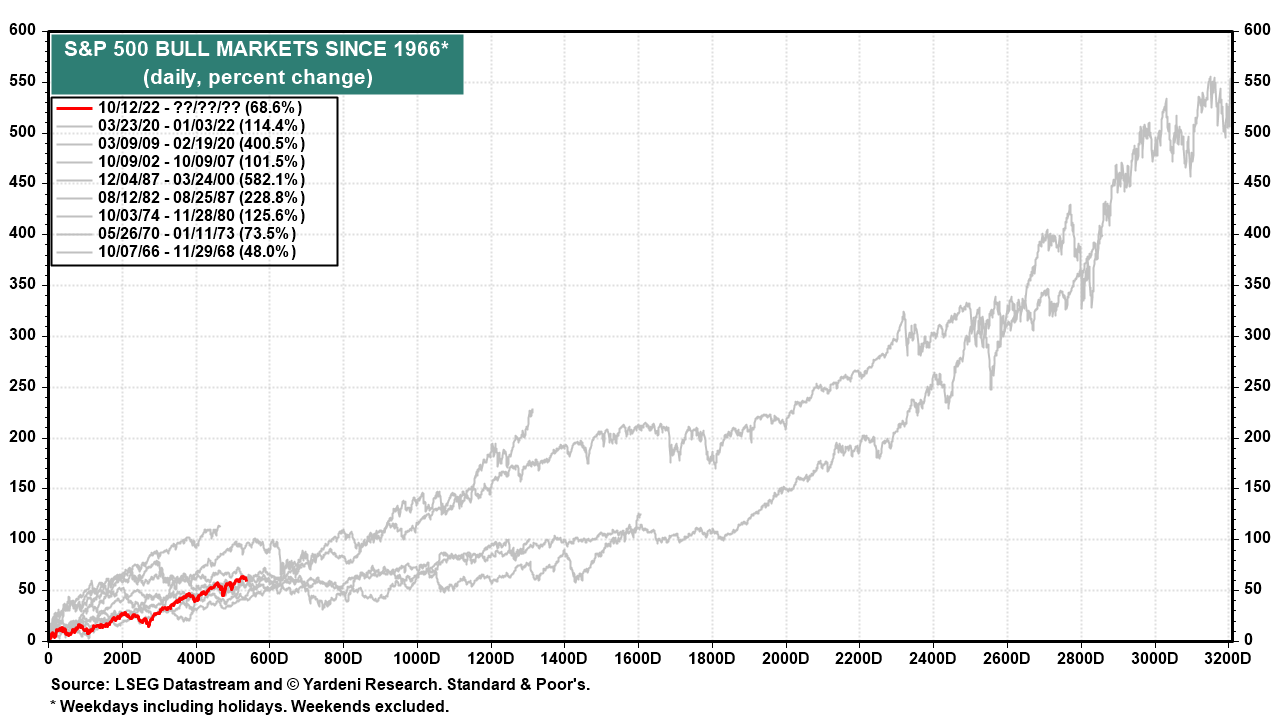

So from 15.3 on October 12, 2022, the forward P/E rebounded impressively to 22.3 during the final week of November this year. That 45.8% increase in the S&P 500’s valuation multiple was bolstered by a 15.5% increase in the forward EPS. The result has been a solid bull market, so far, that has kept pace with the previous eight bull markets (Fig. 4 below).

The point of this walk down Memory Lane is that the valuation multiple is a significant determinant of the stock market’s gains and losses. Through investors’ willingness to buy and sell at particular valuation levels, they amplify and anticipate changes in the consensus analysts’ expectations for EPS.

In our opinion, the key driver of the forward P/E is investors’ perception of how much and for how long earnings can grow before the next recession depresses earnings and the valuation multiple. Economic growth drives earnings growth, and investors’ expectations for both drive the forward P/E.