Bears have been growling since mid-2022 that the US consumer will soon be “tapped out” of the excess savings accumulated during the Covid-19 fiscal stimulus spree from 2020 to 2021, forcing them to rein in spending. Consumers also may soon have maxed out their credit cards, according to this gloomy narrative.

Consider the following:

(1/4) Sure enough, two San Francisco Fed economists in a May 3 post observed that “[t]he latest estimates of overall pandemic excess savings remaining in the U.S. economy have turned negative, suggesting that American households fully spent their pandemic-era savings as of March 2024.” Nevertheless, they came to the same conclusion that we have: “The path of consumer spending in the United States is difficult to forecast with any degree of accuracy. Nevertheless, the depletion of these excess savings is unlikely to result in American households sharply cutting their spending levels as long as they are able to support their consumption habits through continuous employment or wage gains, other forms of wealth—including non-pandemic-related savings—and higher debt.”

According to this post, cumulative pandemic-era excess savings peaked at $2.1 trillion during August 2021. It then fell and turned negative (-$72 billion) during March 2024.

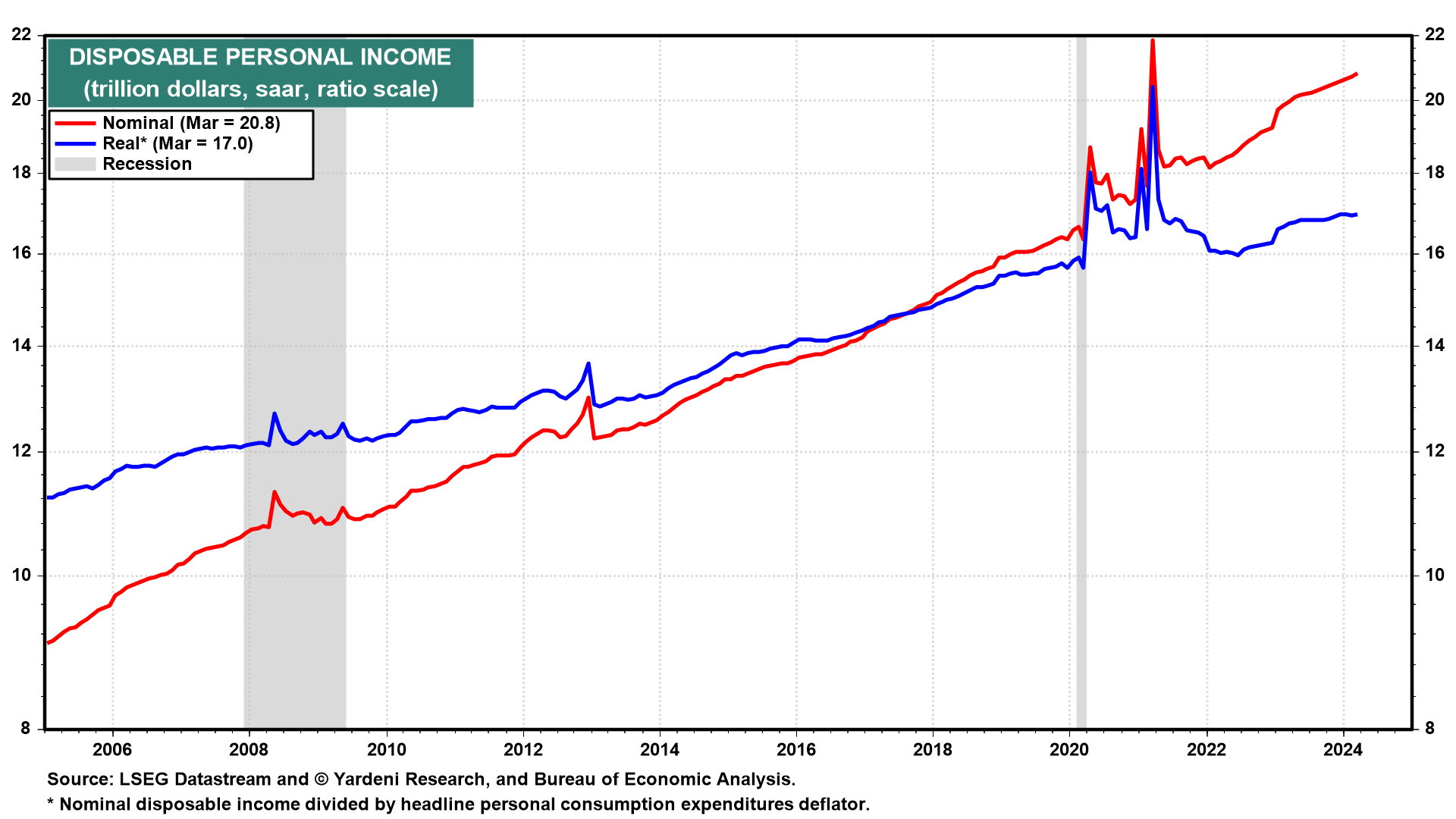

(2/4) Underlying the consumers-are-cracking story is the flawed presumption that even if real disposable income continues to grow, it will be offset by a rising personal saving rate (Fig. 10 below and Fig. 11). The result, the thinking goes, will be weaker consumer spending, which will depress employment, which will further depress consumer spending, resulting in a consumer-led recession.

Our story is that the personal saving rate won’t rise but will remain low. So real consumer spending will continue to increase along with real personal disposable income. The saving rate dropped from 26.1% during March 2021 (i.e., at the peak of excess saving) to 3.2% during March this year. If it remains this low as we expect, it will be because more and more Baby Boomers are retiring and living off the income from their retirement savings or spending more of the principal.

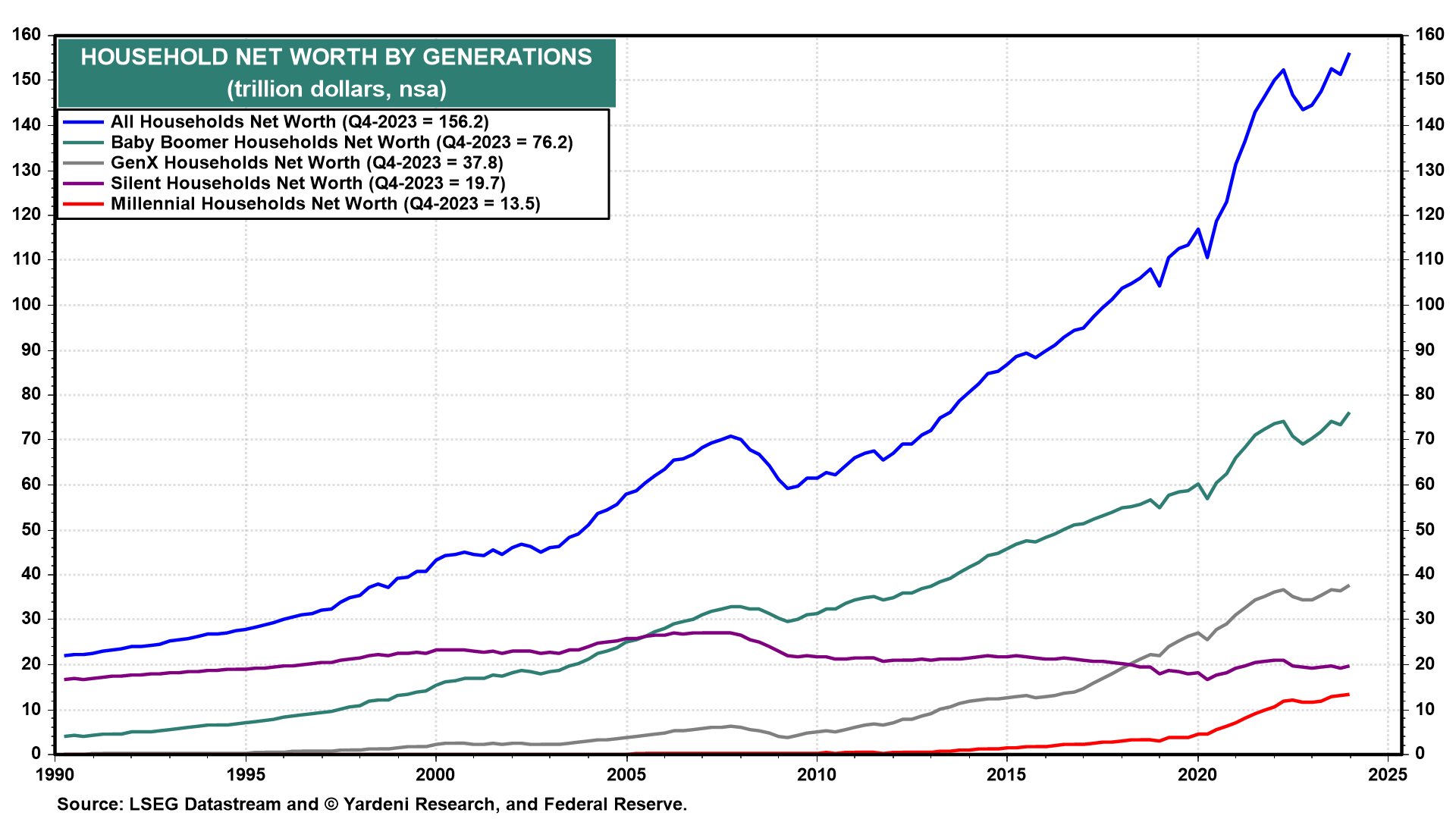

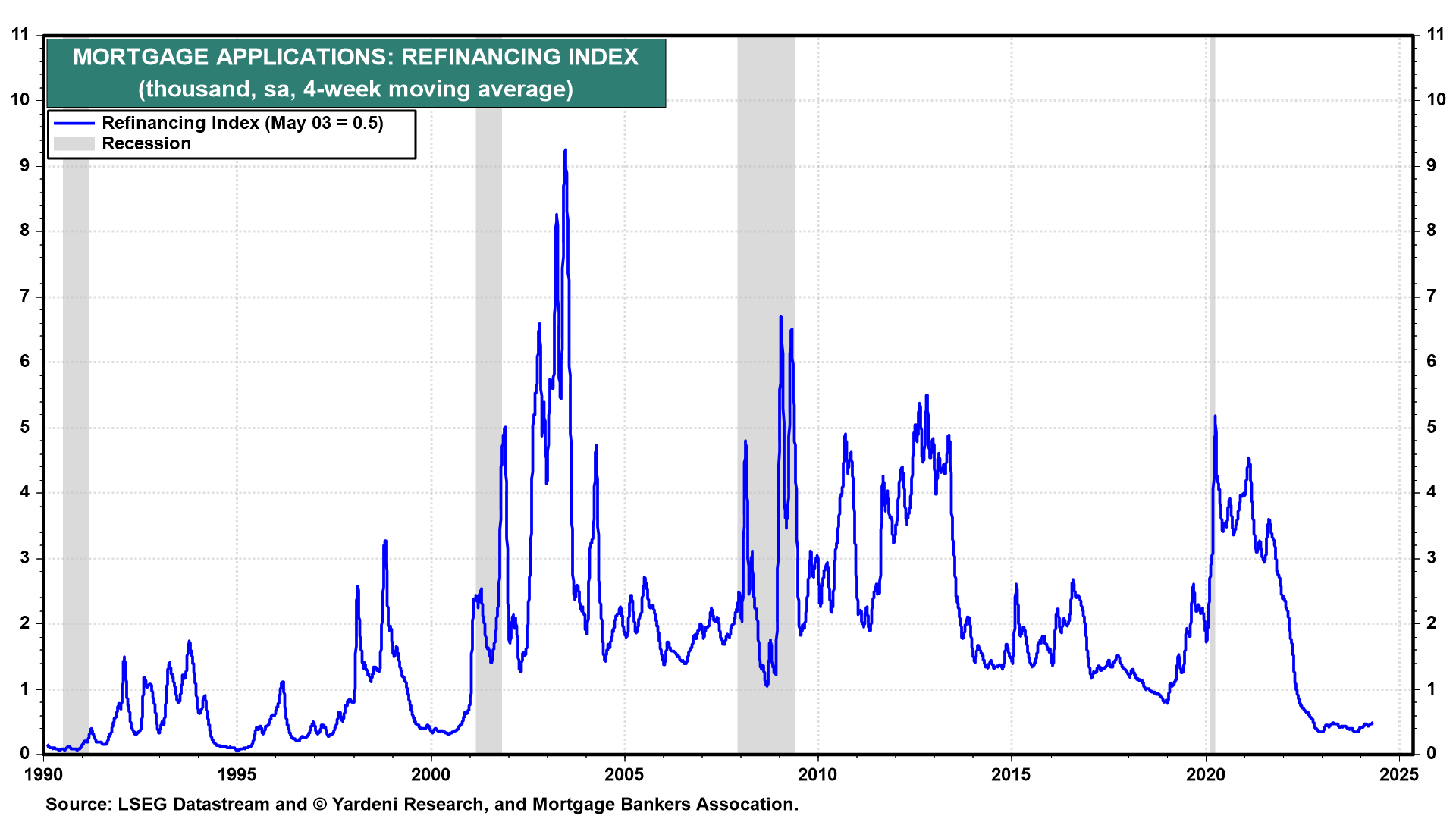

As Melissa and I have observed before, Baby Boom households have a record $76.2 trillion in net worth (Fig. 12 below). They are the richest cohort of seniors ever. According to Census data, of the 86 million households who own their own homes, almost 40% had no mortgage in 2022. Most of them are probably Baby Boomers. And many of those who have mortgages refinanced them at record-low rates during 2020 and 2021 (Fig. 13 below).