When the Fed started to raise interest rates aggressively last year, there was lots of speculation that it would cause a recession. Housing certainly fell into a recession as housing starts plunged 25.7% from a peak of 1.80 million units (saar) during April 2022 to a trough of 1.34 million units during January and April 2023 (Fig. 1). Consumer spending adjusted for inflation has been on a modest uptrend from October 2021 through May of this year, led by services spending (Fig. 2). However, real consumer spending on goods was flat over this same period.

Late last year, the consensus view was that the recession could start during H1-2023. Now the common explanation for the no-show recession despite the 500bps hike in the federal funds rate is that consumers were still spending their excess savings from the pandemic (Fig. 3). But once this cash is spent over the rest of this year, the thinking goes, a consumer-led recession is likely in 2024.

Debbie and I disagree.

Consumers may run out of their excess pandemic savings by the end of this year, but they have lots of other sources of purchasing power. These include not only fast-rising wages and salaries but also a record $7.6 trillion in unearned income including interest income ($1.8 trillion), dividend income ($1.7 trillion), proprietors’ income ($1.9 trillion), rental income ($0.9 trillion), and Social Security ($1.3 trillion) (Fig. 4).

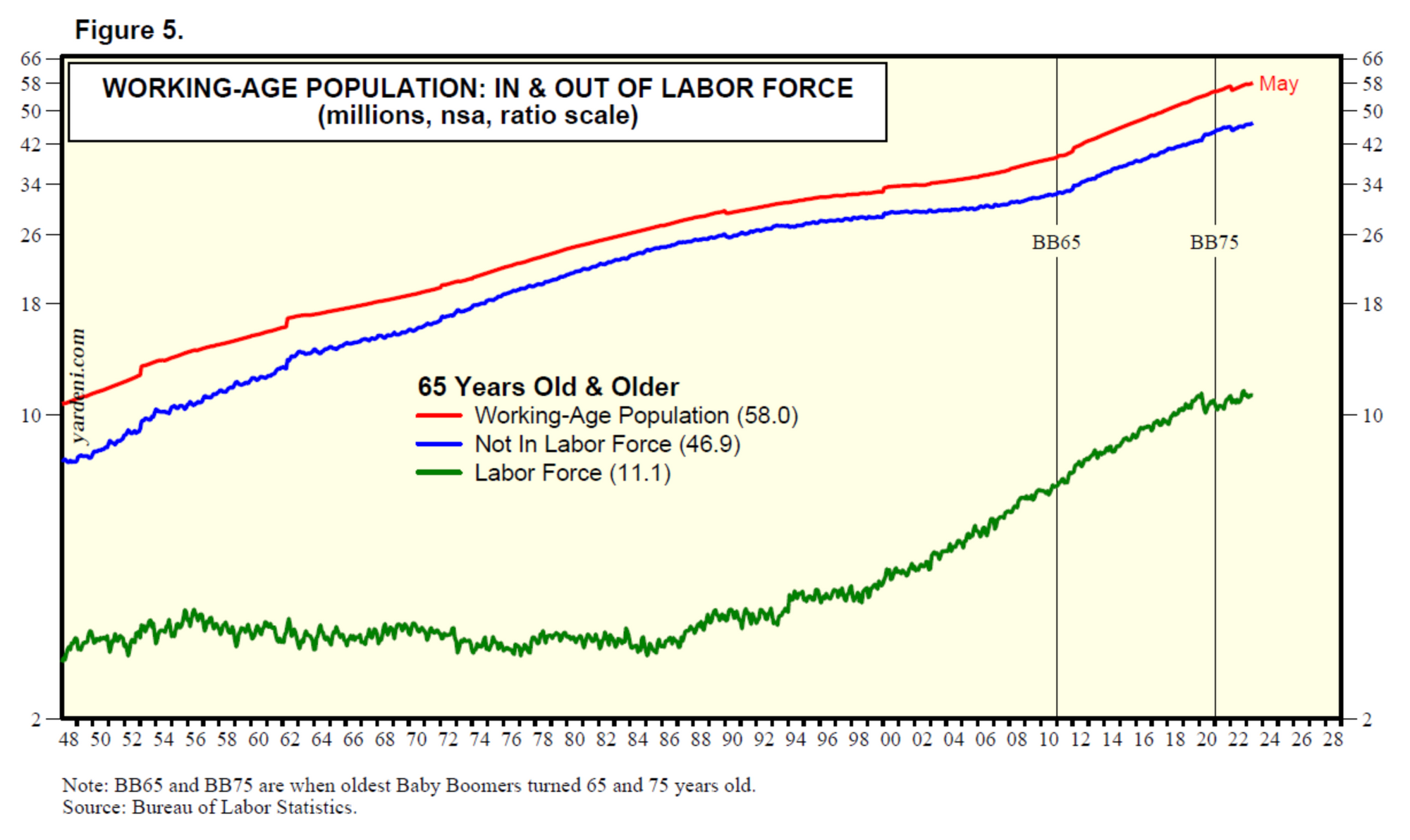

Melissa and I recently observed that consumers’ excess savings of roughly $0.5 trillion currently is dwarfed by the net worth held by the Baby Boom generation that is retiring. The Baby Boomers are currently 59-77 years old. The number of seniors (65 years old and older) rose to a record 58.0 million in May (Fig. 5 below). Of this total, a record 46.9 million are not in the labor force, leaving 11.1 million still in the labor force. The Baby Boomers will all be seniors by 2029.

The Baby Boomers had $74.8 trillion in net worth at the end of Q1-2023 (Fig. 6). They have just started to spend it. Their progeny undoubtedly expects to inherit some of that wealth and therefore can save less. In any event, the net worths of the GenX and Millennials generations are much smaller, at $39.9 trillion and $7.9 trillion currently. Adding the net worth of the Silent Generation ($18.0 trillion), the total is $140.6 trillion in net worth for all US households.

Let’s have a look at the distribution of assets among the Baby Boomers compared with other generations:

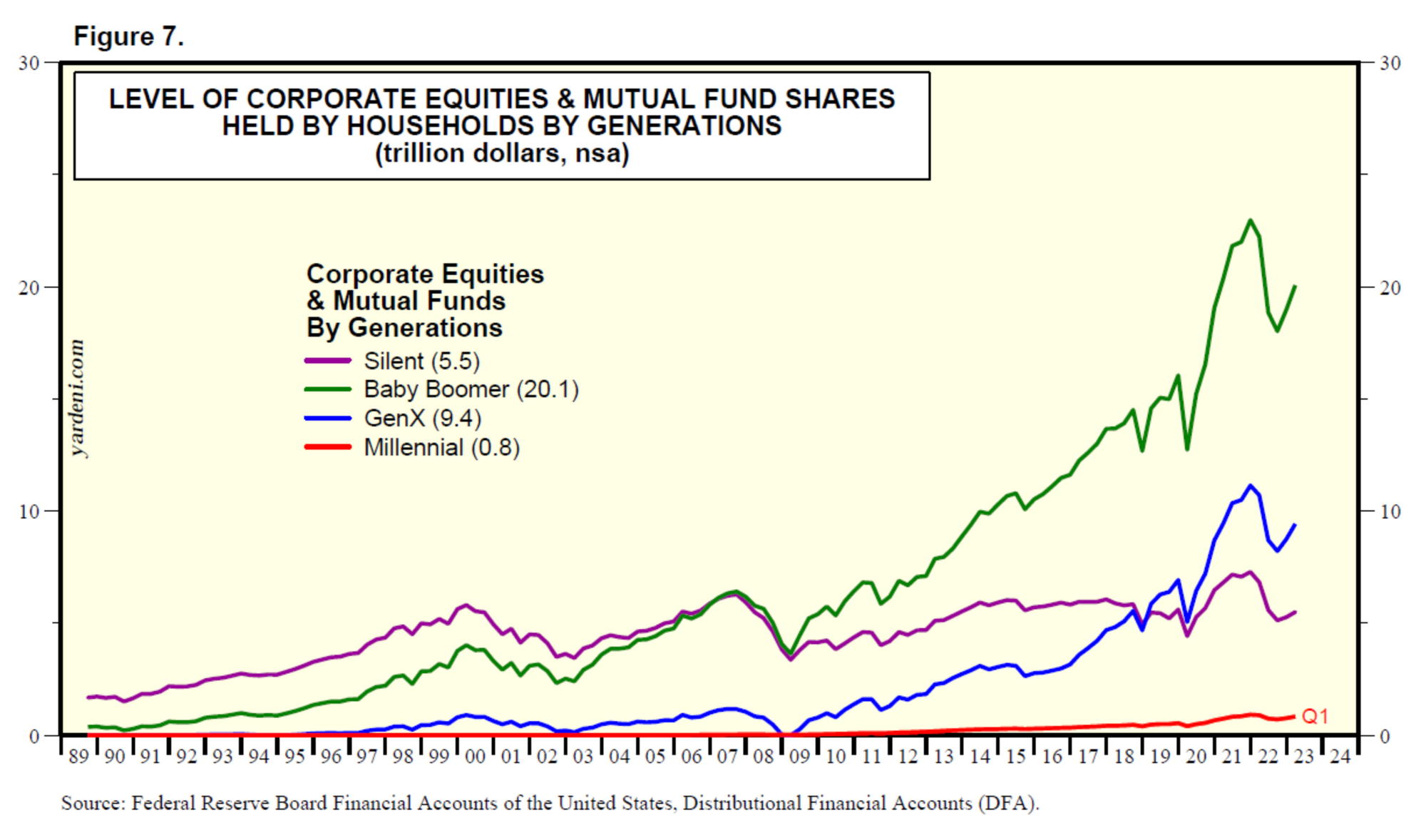

(1) Corporate equities & mutual funds is the largest asset class held by the Baby Boomers, at $20.1 trillion (Fig. 7 below). None of the other generations’ holdings of stocks and mutual funds come close: Silent Generation ($5.5 trillion), GenX ($9.4 trillion), and Millennials ($0.8 trillion).