Stock prices fell sharply today in response to President Donald Trump's recent unseemly barrage of hostile tweets directed at Fed Chair Jerome Powell. Trump seems to be setting Powell up to be the fall guy if Trump's Tariff Turmoil (TTT) causes a recession later this year. Also unnerving stock prices was a warning from Beijing to all its trading partners against succumbing to US pressure to isolate China in Trump's tariff war, as part of its carrot-and-stick approach to win over countries caught between the world's two largest economies. "China firmly opposes any party reaching a deal at the expense of China's interests. If such a situation arises, China will not accept it and will resolutely take reciprocal countermeasures," a Chinese government spokesman stated.

Let's assess the latest damage resulting mostly from TTT:

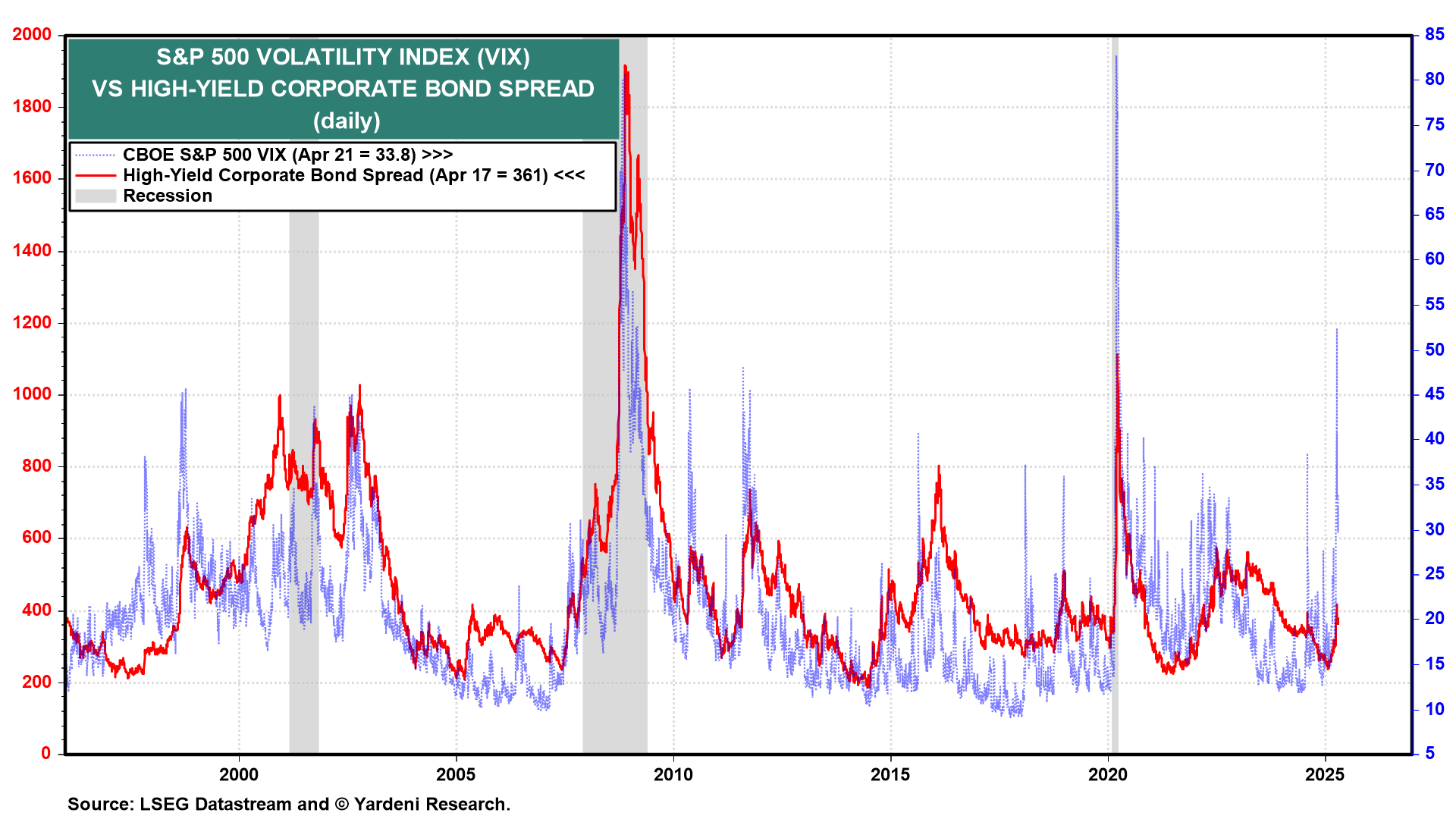

(1) The VIX was relatively high today. The yield spread between the high-yield corporate bond composite and the 10-year US Treasury bond is widening, flashing orange about the rising odds of a credit crisis resulting from the stress of TTT on the financial system.

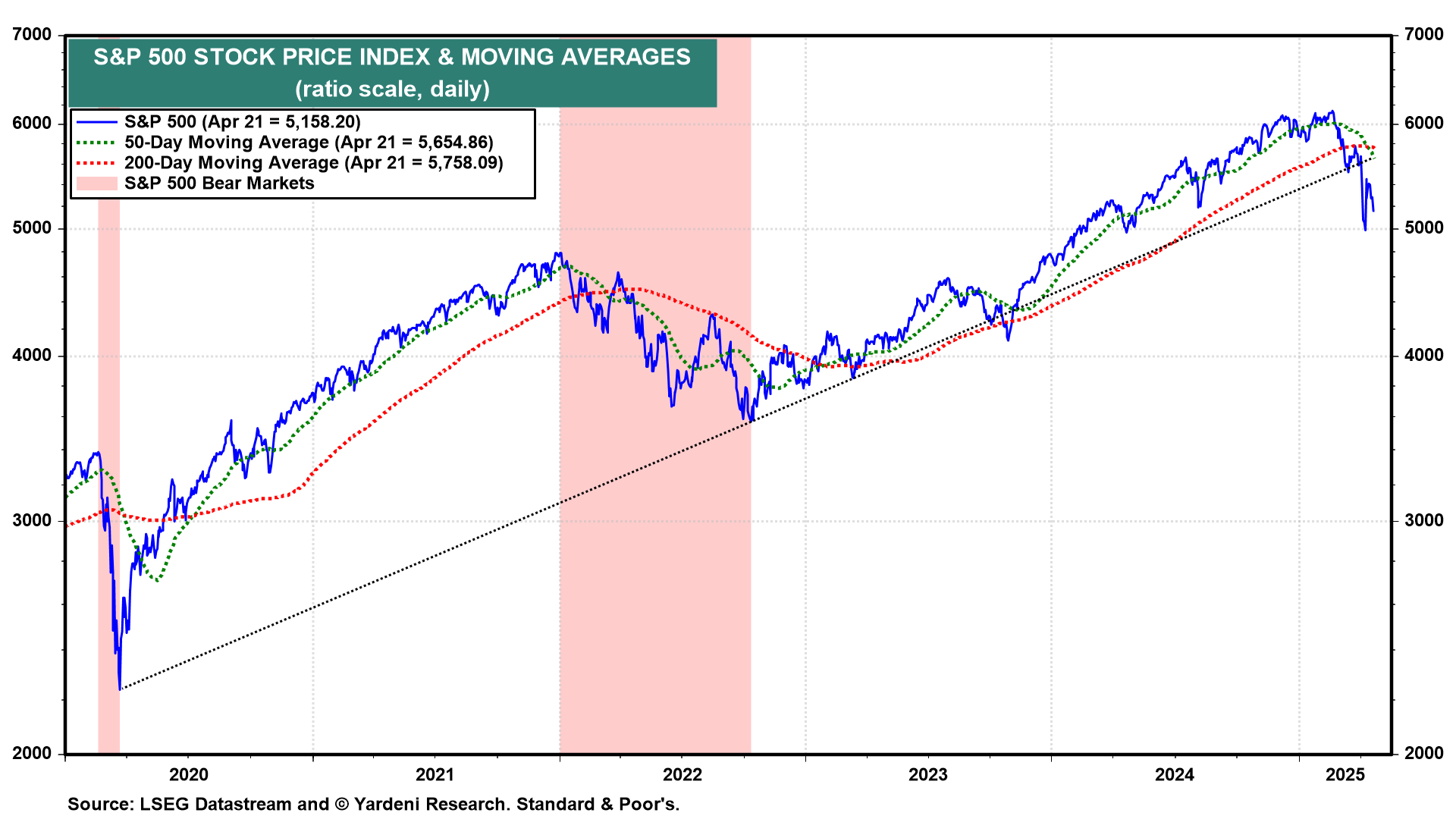

(2) The S&P 500 remains in correction territory with a 16% drop since February 19. It is likely to retest its April 8 low and probably find support there. If so, then the market may be forming a bottom.

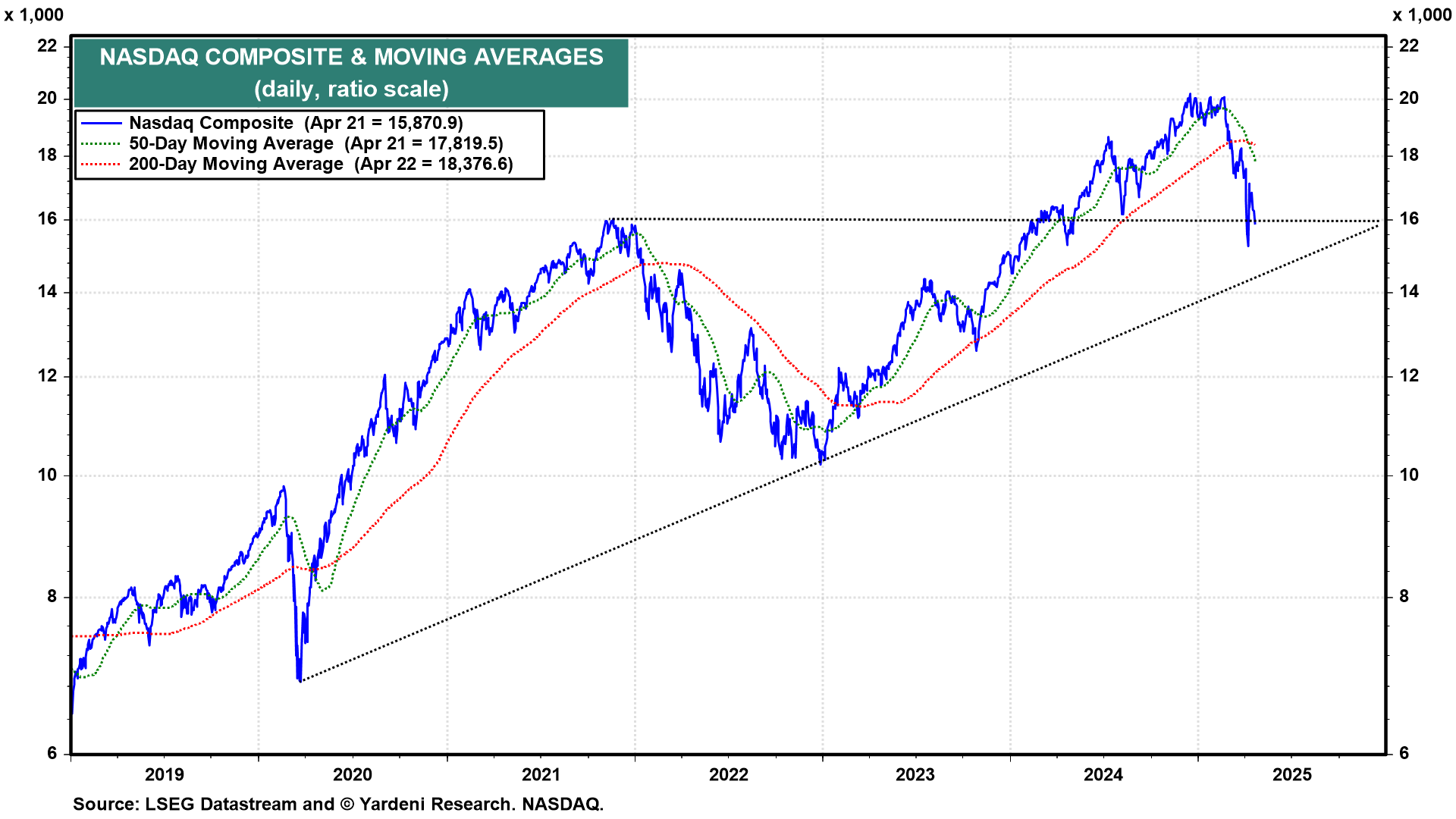

(3) The Nasdaq was down to 15,870.90 today nearing a retest of its bear-market low on April 8. It is now a bit below its previous bull market peak at the end of 2021.

(4) On a ytd basis, the 10.2% decline in the S&P 500 has been led by a 21.9% drop in the Magnificent-7. The S&P 493 is down just 5.2% so far.