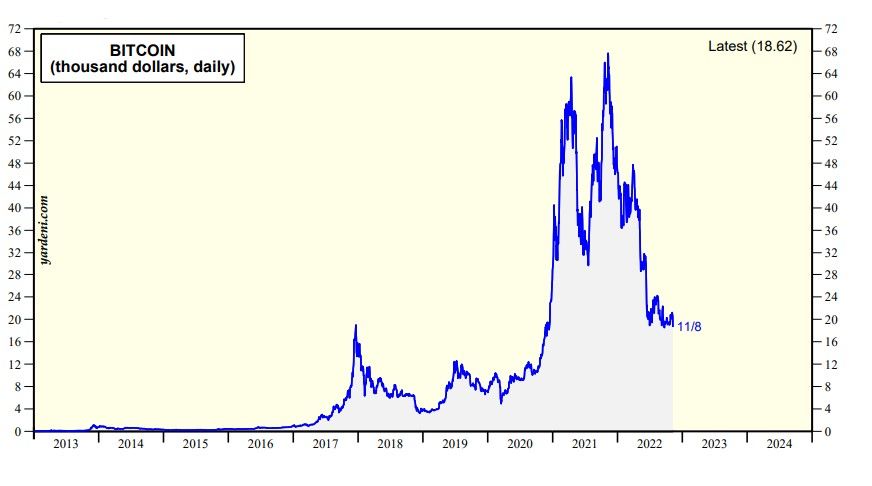

Stocks sold off today partly as a result of the turmoil in cryptocurrencies markets. It was a risk-off day.

Here is what I wrote in our May 11, 2021 Morning Briefing about this asset class: "I had been thinking of cryptocurrencies as 'digital tulips,' reminiscent of the 17th century tulip mania in Amsterdam that drove up tulip prices beyond reason. The difference is that cryptocurrencies are traded 24-by-7 around the world. On second thought, they might be more like a financial virus that won’t stop until enough speculators have been infected that herd immunity is achieved." Or perhaps, cryptocurrencies are the dotcoms of the 2020s.

The Fed’s May 6, 2021 Financial Stability Report (FSR) mentioned cryptocurrencies just once—as the ninth-greatest risk to US financial stability as determined by a survey of wide-ranging viewpoints.

Here is an important excerpt on cryptocurrencies from the Fed's November 4, 2022 FSR: "The turmoil in the digital assets ecosystem did not have notable effects on the traditional financial system because the digital assets ecosystem does not provide significant financial services and its interconnections with the broader financial system are limited ."

This is just one of many speculative bubbles that have burst since early last year (i.e., ARK, SPACs, meme stocks) without causing a credit crunch or a recession, which is consistent with our rolling recession scenario.