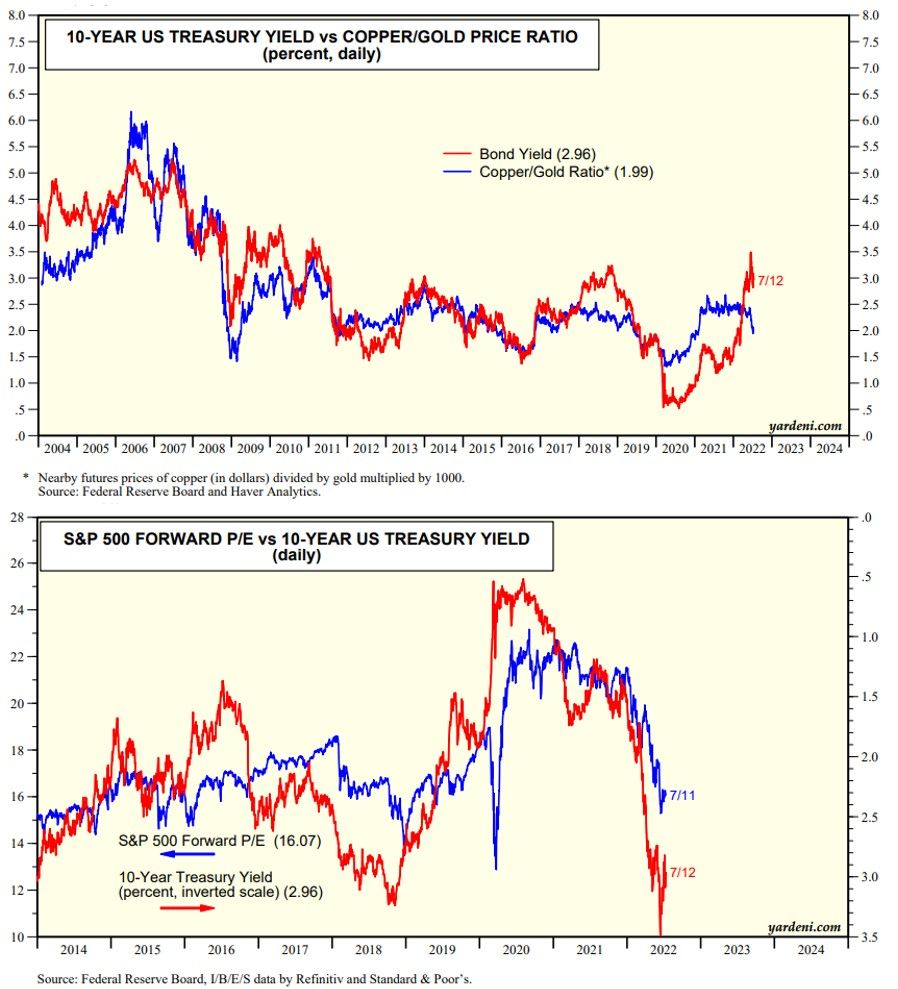

The ratio of the nearby futures prices of copper to gold has been falling lately. Weakening global economic growth is depressing commodity prices, especially the price of copper. The ratio has been a remarkably good indicator for the 10-year US Treasury bond yield (chart below). It currently suggests that the yield should be closer to 2.00% than 3.00%.

The ratio suggests that the yield is more likely to fall than to rise once the Fed raises the federal funds rate by 75bps at the end of this month, as widely expected. The yield might drop if commodity prices continue to fall and more economic indicators show rapidly slowing global economic growth. The yield curve spread between the 2-year and 10-year Treasury notes is zero, consistent with a short and shallow recession.

The bond yield peaked at 3.48% on June 14 and was down to 2.97% today. The S&P 500 bottomed at 3666 on June 16 with the forward P/E down to 15.3 (chart below). The drop in the bond yield has helped to boost the forward P/E back around 16.0.