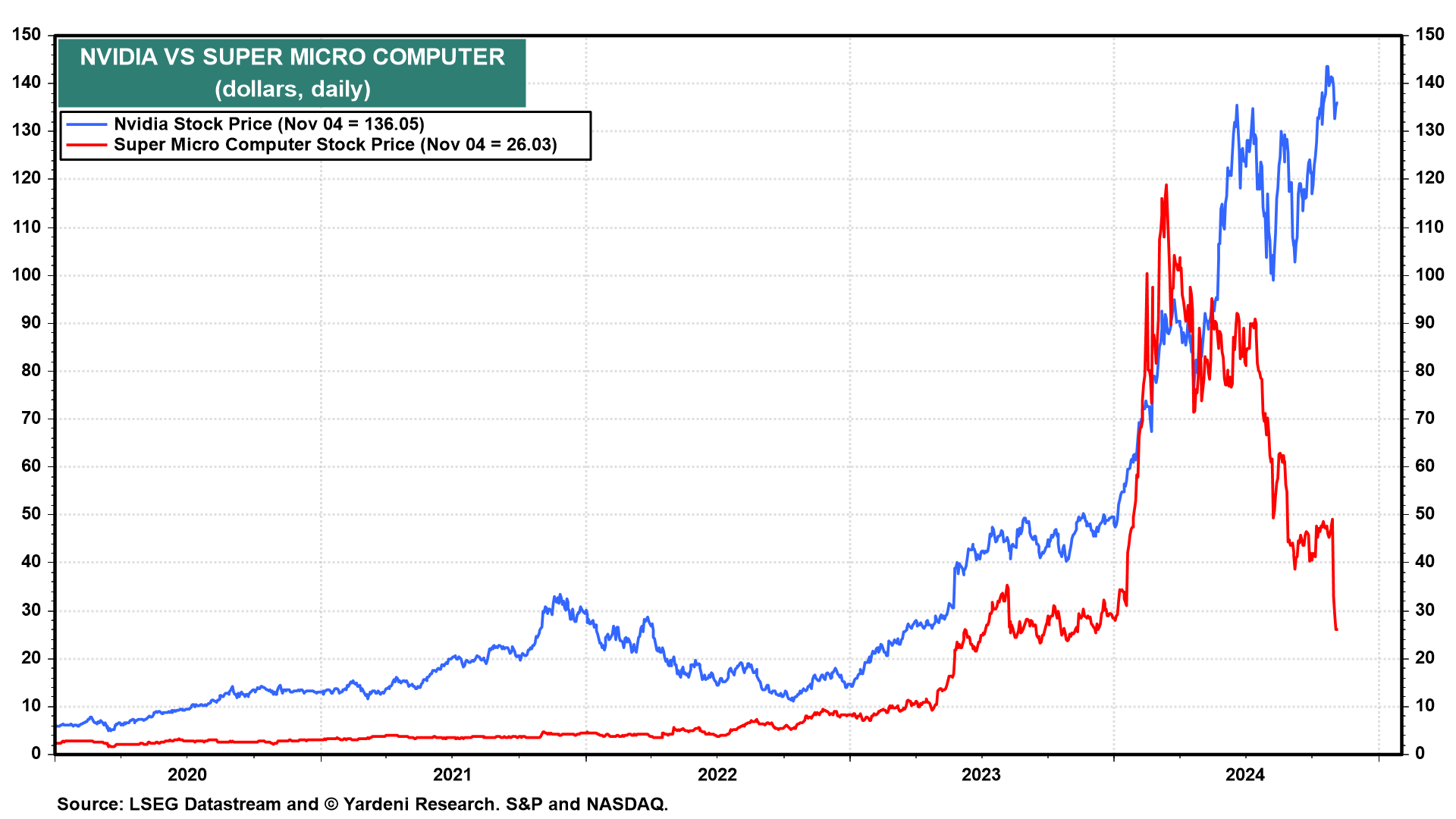

Investors often rejoice when a stock they own is selected to join a major market index. Index funds collectively have trillions of dollars in AUM and must buy the stock in bulk, giving a boost to its price. But sometimes these bestowed honors can be a curse for the newbie. Super Micro Computer, for instance, joined the S&P 500 on March 18. It had peaked at a record high a few days earlier and is down 74% since (chart).

That might spook Nvidia investors after Friday's announcement that the AI superstar will replace Intel in the DJIA this Friday (chart). Sometimes, getting dumped by an index committee can be a blessing for the oldie. It certainly was in the case of GE, which was booted from the DJIA on June 19, 2018. It's up 156% since then--and that's excluding the success of spin-offs such as GE Vernova (up 125% ytd). Interestingly, NIXT is a relatively new ETF launched to buy companies that were recently kicked out of major indexes.

Meanwhile, the stock market has been dealing with some tricky crosscurrents ever since bond yields have been rising after the Fed cut the federal funds rate by 50bps on September 18: