This morning's data tsunami showed that the labor market remains in good shape and is fueling consumer spending. The latest data support our view that betting against consumers when jobs are expanding is a bad bet. In addition, cautious guidance by several consumer-related companies during the latest earnings reporting season might have been too cautious. Today on a call with analysts, Walmart's CEO Doug McMillon said, “So far, we aren’t experiencing a weaker consumer overall.” Bond yields and stock prices shot higher on the news that there's no recession looming.

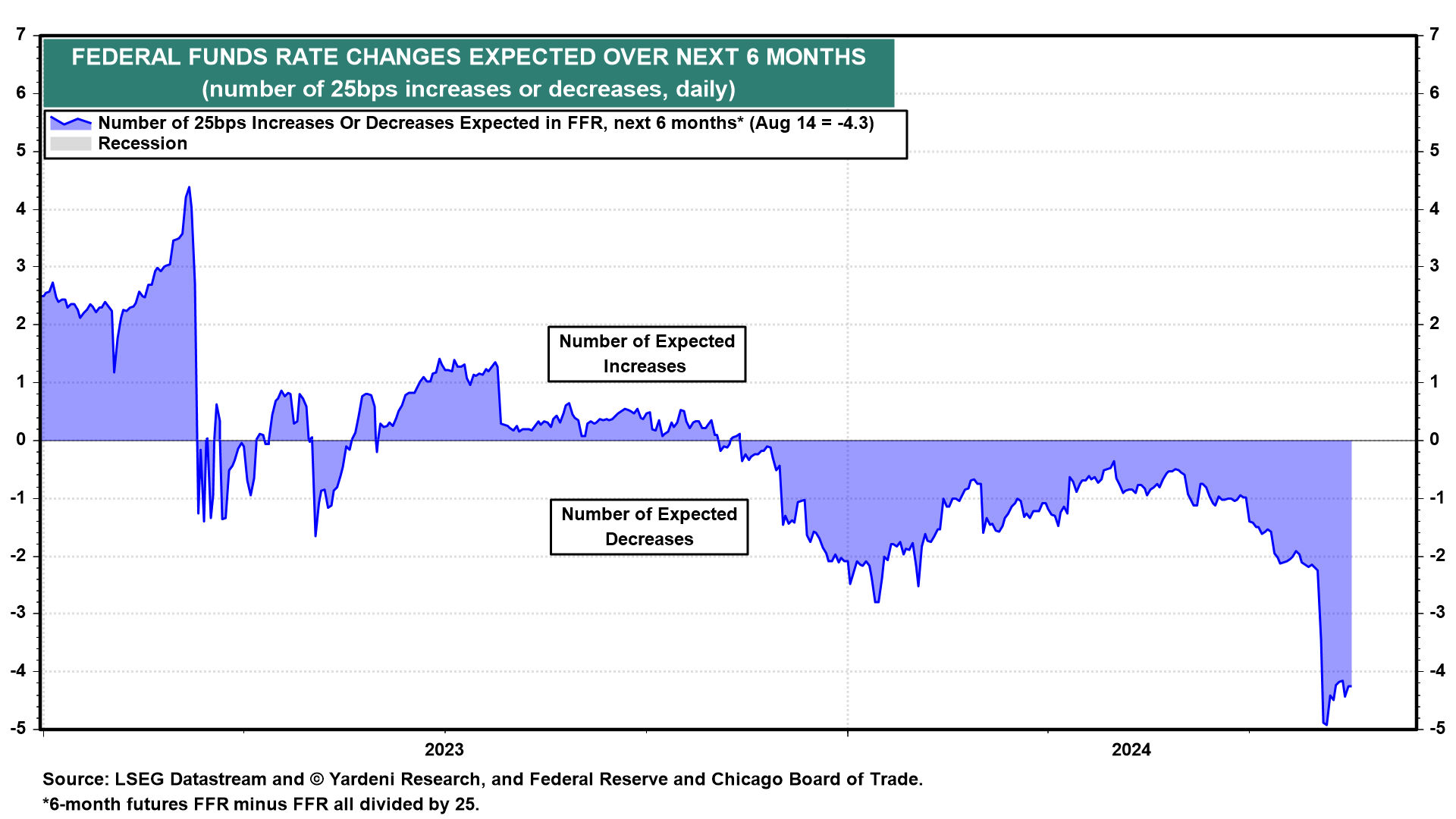

We continue to expect the Fed will cut the federal funds rate (FFR) by 25bps in September. That may be its only cut this year, too. Market expectations for 100+ bps of rate cuts over the next six months are overdone, as they were at the start of the year (chart). We remain in the one-and-done camp for the remainder of 2024.

Here's more on today's data:

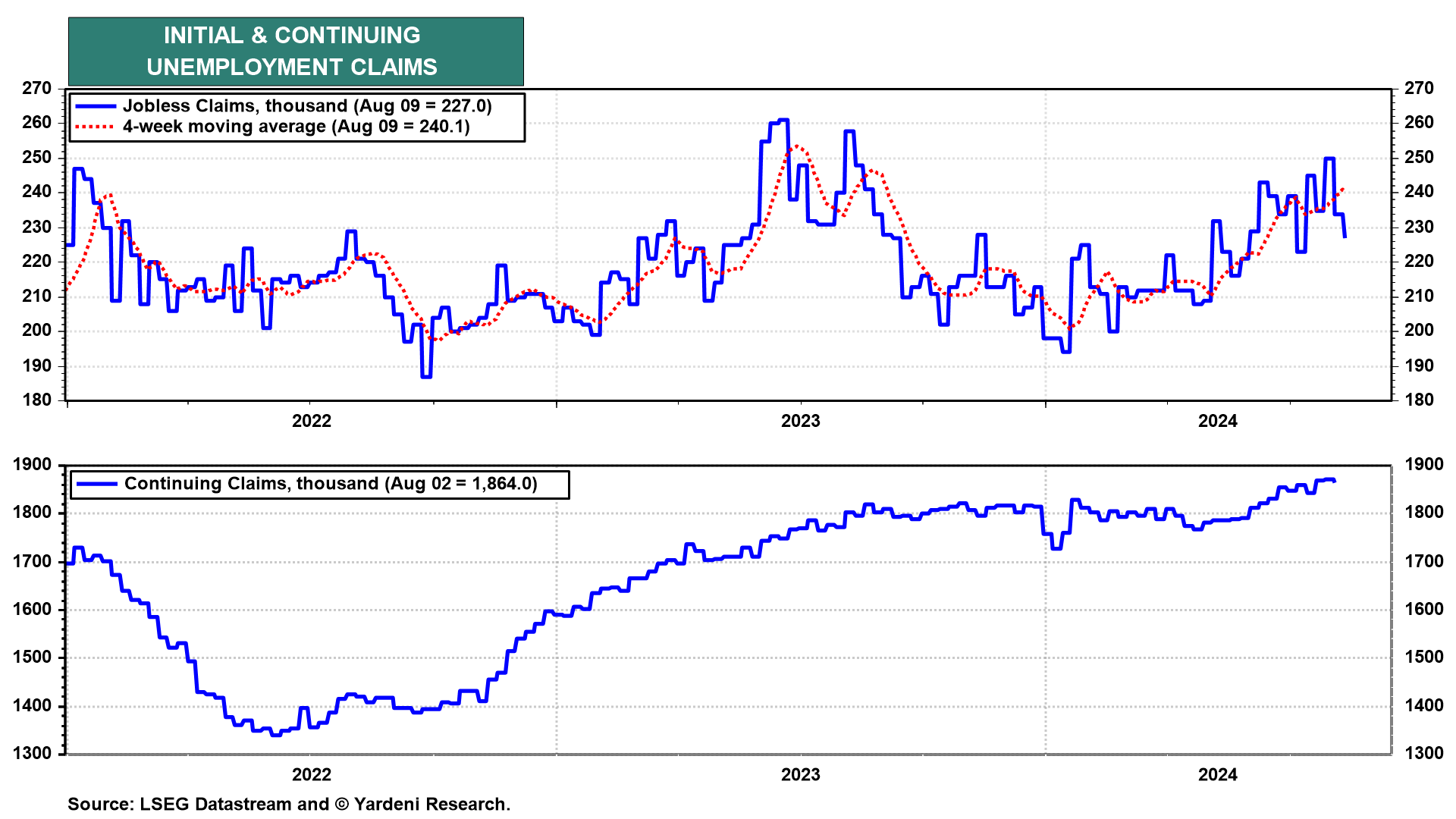

(1) Unemployment claims. Today's unemployment insurance claims release corroborates our non-consensus view that last month's weak employment report was due to bad weather. Initial claims fell 7,000 to 227,000 (sa) in the week ended August 10 (chart). Continuing claims also fell 7,000, to 1.864 million, in the week ended August 3 (sa). We expect the August payroll employment report to reverse July's weather-related weakness.

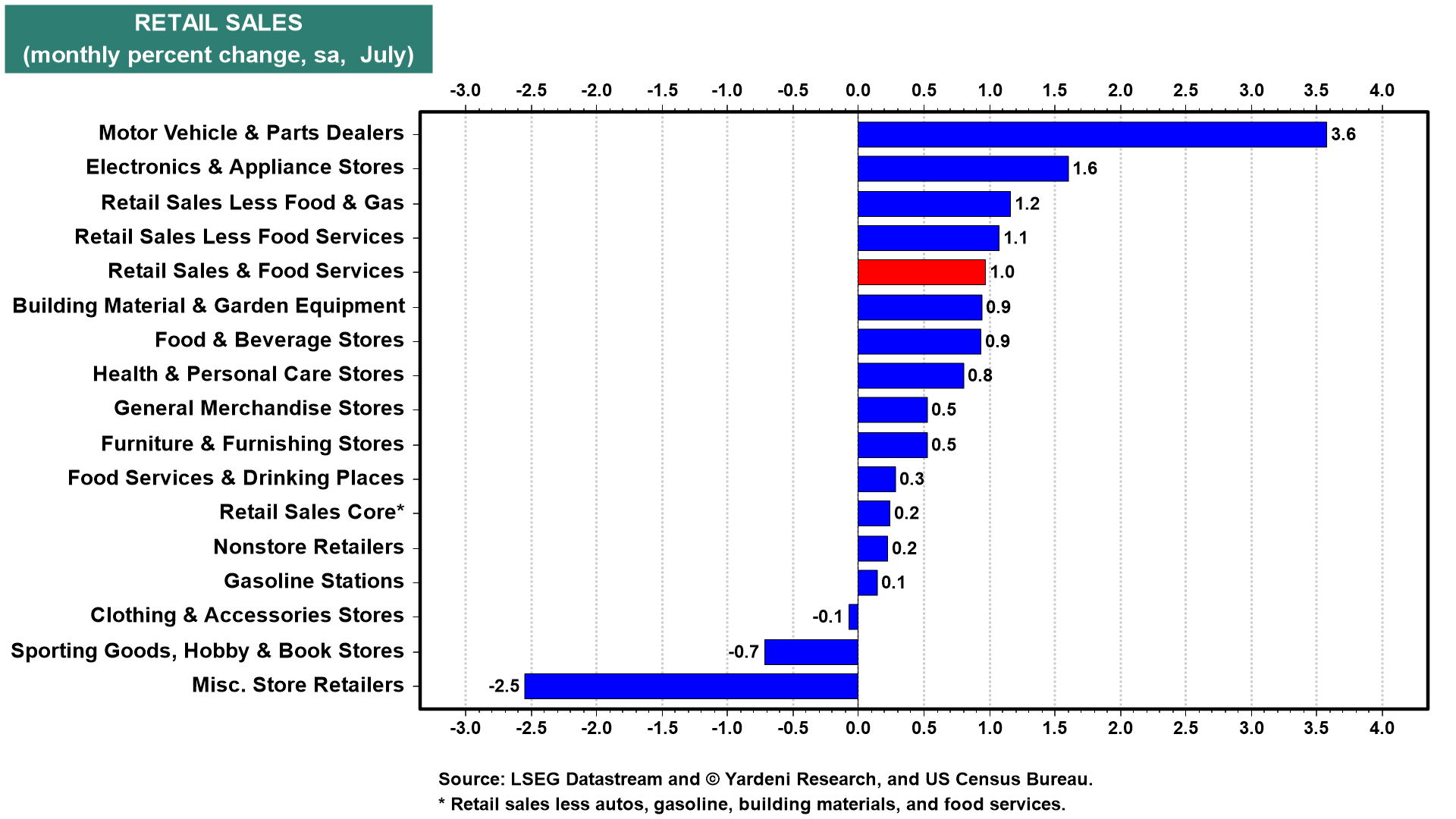

(2) Retail sales. The ability to find gainful employment seems to be all that US consumers need to keep spending. Even bad weather didn't stop them from going to the malls last month. Retail sales rose 1.0% m/m in July as auto sales surged following a cyber-attack on auto dealerships that sidelined them in June (chart). The solid gains were widespread. Keep in mind that the CPI for goods fell 0.1% m/m during July.