China’s economy is in a property-led and fertility-led depression. That’s bad news for China’s people and for the Chinese Communist Party (CCP) but benefits countries that import Chinese goods at depressed prices. China’s weak economy is good news for the US in particular, helping to moderate goods inflation without a recession here, a.k.a. "immaculate disinflation." It would be in China’s interest to attract more foreign direct investment to shore up its economy. To achieve that, the Chinese government may have to become less confrontational in matters of foreign affairs, especially vis-vis Taiwan. On balance, these are all positive developments for the US stock market.

With home prices and stock prices falling, China’s consumers are experiencing a significant negative wealth effect on their spending. That is a particularly painful experience for China’s rapidly increasing older population. Chinese consumers are likely to spend less and save more to offset the erosion of their wealth as their holdings in real estate and stocks depreciate. Here are a few updates on China’s geriatric demographic profile:

(1) In 2022, there were 9.56 births in China, the lowest on record (chart). That’s down 50% from 10 years ago.

(2) The fertility rate (births per woman) has been below 2.00 since 1991. It was down to only 1.16 in 2021 (chart). The Chinese aren’t having enough babies to replace themselves.

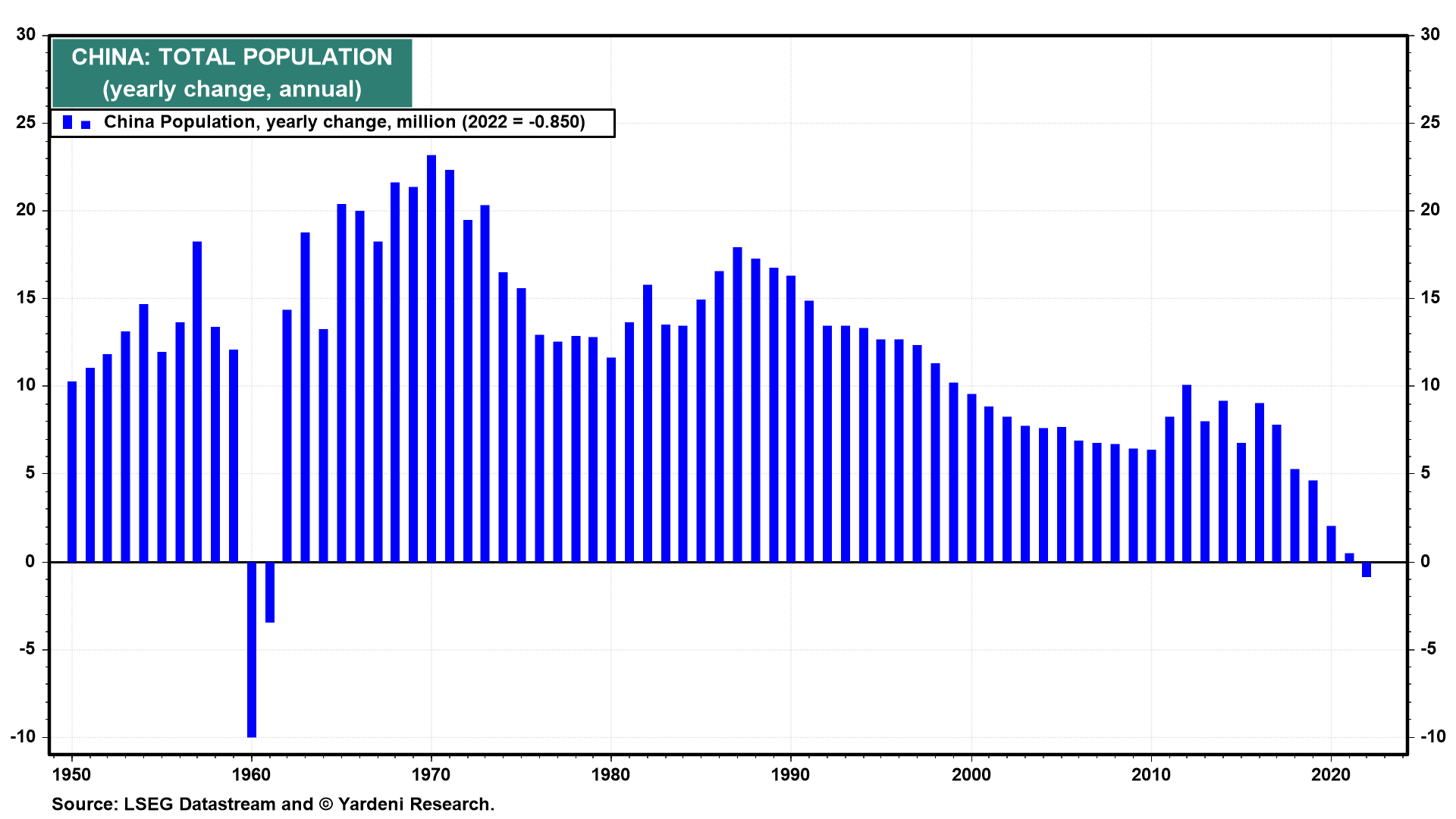

(3) As a result, the population is shrinking (chart). It peaked during 2021 at 1.41 billion. It declined by 850,000 during 2022, the first decline since 1961.