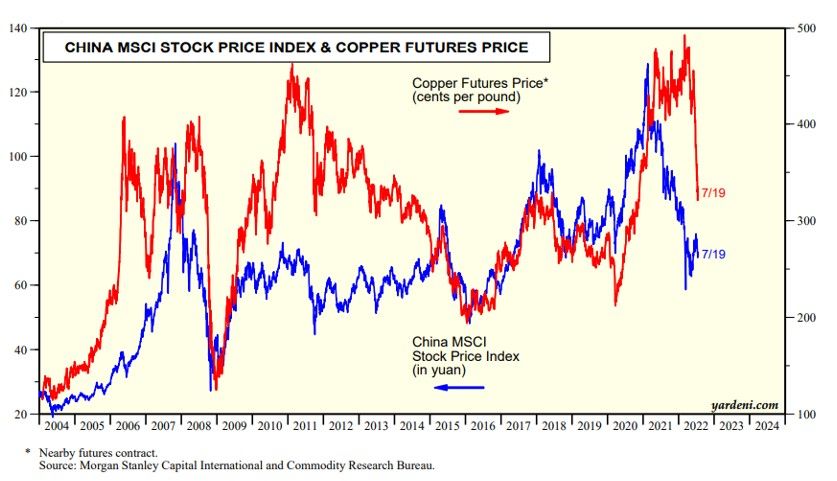

How do you say "Lehman Moment" in Chinese? The Chinese government is scrambling to avert such a calamity resulting from China's real estate bust. There's a global housing recession underway, led by China. That's why the price of copper has been in a freefall, plunging 33% from $4.94 on March 4, 2022 to $3.31 today (chart).

We’ve been tracking Chinese property developers that have filed for bankruptcy protection after borrowing too much. Now their customers are showing signs of distress too. Buyers of 35 projects across 22 Chinese cities have stopped paying their mortgages as of July 12 due to project delays and a drop in real estate prices, a July 13 Bloomberg article reported, citing research from Citigroup. Average selling prices of properties in nearby projects were 15% lower than the purchase price over the past three years, the research states.

Mortgage defaults could reach 561 billion yuan ($83 billion), or about 1.4% of outstanding mortgage balances, according to the article. China Construction Bank, Postal Savings Bank of China, and Industrial & Commercial Bank of China may have outsized exposure to mortgage loans.

Now according to a July 17 Bloomberg article. Chinese regulators are leaning on the banks to increase lending to developers so they can complete unfinished housing projects.