In recent weeks, the Chinese government has introduced several measures to prop up the stock market. This week, the government was expected to announce measures aimed at boosting the economy. In a surprise announcement today, a spokesman said China’s Premier Li Qiang will not brief the media at the close of this year’s annual parliamentary meeting, which begins on Tuesday in Beijing. The government may be concerned that its plans to stimulate the economy will be badly received by the stock market as too little, too late.

Here are a couple of related developments:

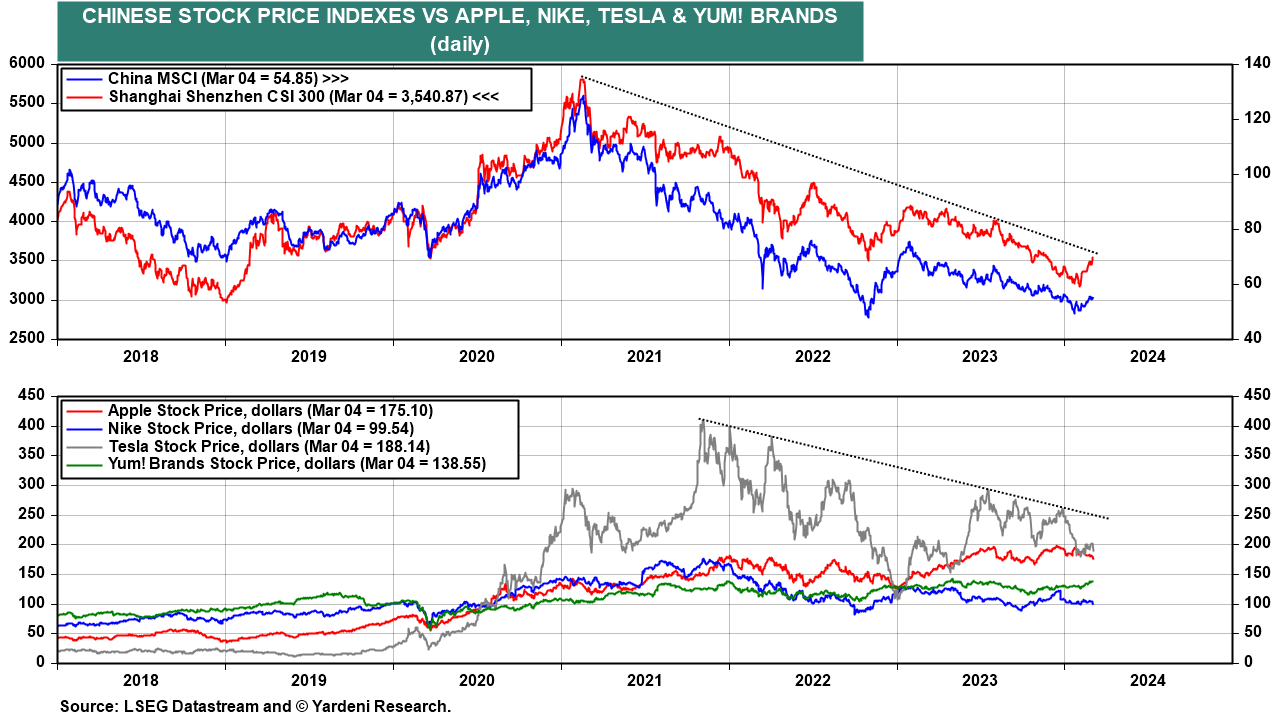

(1) Both the China MSCI stock price index (in yuan) and the Shanghai Shenzhen CSI 300 have rebounded in recent days (chart). But they remain on downward trends.

We are also monitoring the stock prices of Apple, Nike, Tesla, and Yum! Brands These companies have significant exposure to Chinese consumer spending, and their stocks have been going nowhere since mid-2023. Shares of Tesla fell more than 7% today after its sales declined in February in China, where it faced rising competition and a slowdown during the Lunar New Year holidays.

(2) The Shenzhen Real Estate stock price index is also still on a steep downward trend, reflecting the depression in the property market, as does the flat trend in the price of copper (chart).