The US doesn't have to experience a recession to bring inflation down if China's export prices are falling because China is already in a recession. Consider the following:

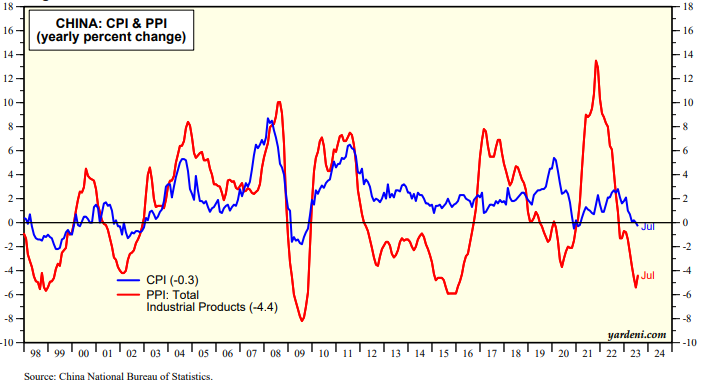

(1) This evening we learned that China's CPI fell 0.3% y/y during July, the first such drop since February 2021. The PPI fell 4.4% over the same period (chart).

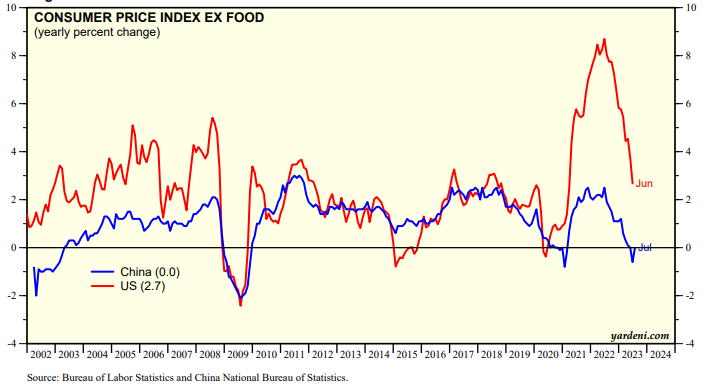

(2) The CPI inflation rate excluding food in the US tracked the comparable Chinese measure from late 2008 through early 2020, before the pandemic started (chart). They've diverged significantly since then with the former well exceeding the latter. China's measure was unchanged y/y through July. The US measure was 2.7% through June. It would be quite a surprise if they converge again somewhere in the middle, maybe.

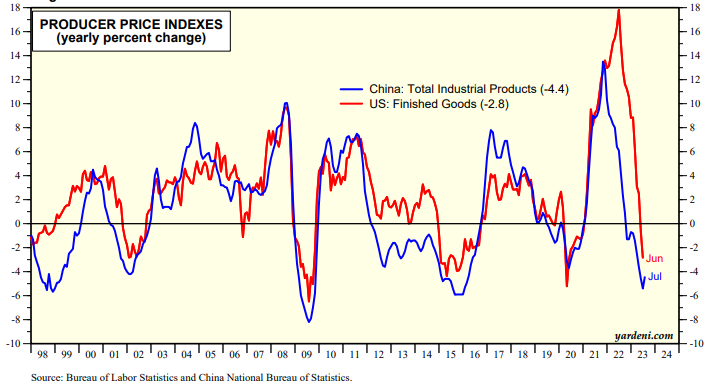

(3) There is even a closer fit between the Chinese and US PPI inflation rates (chart). The latter will be released on Friday for July. It was down 2.8% during June. It probably fell deeper into deflation territory during July.