Over the past three years, most American economists believed that a recession would be necessary to bring inflation down to 2.0% in the US. While the US economy managed to avoid a downturn, those predictions may have been right. The recession, however, was in China as the huge negative wealth effect of falling property and stock prices caused Chinese consumers to retrench.

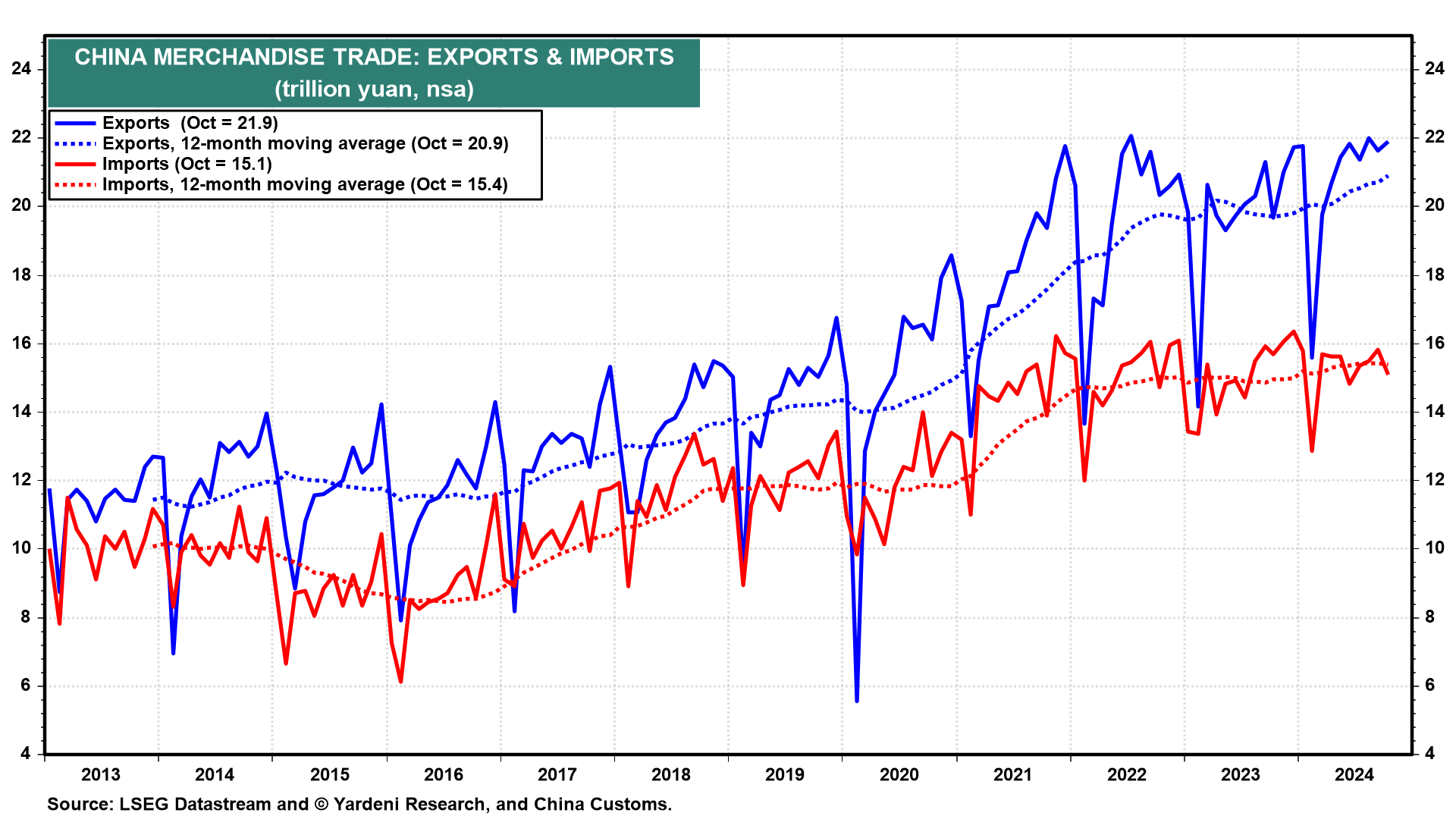

China's government encouraged manufacturers to export more goods, which has deflated consumer goods prices in the US and in other importers of Chinese goods. But China's economy remains weak as evidenced by flat imports (chart). The government seems to lack the will, or the way, to stimulate consumer demand. China announced a $1.4 trillion financing package on Friday. That's a big number, but it will mostly go to cleaning up and refinancing local government debt.

Here's more:

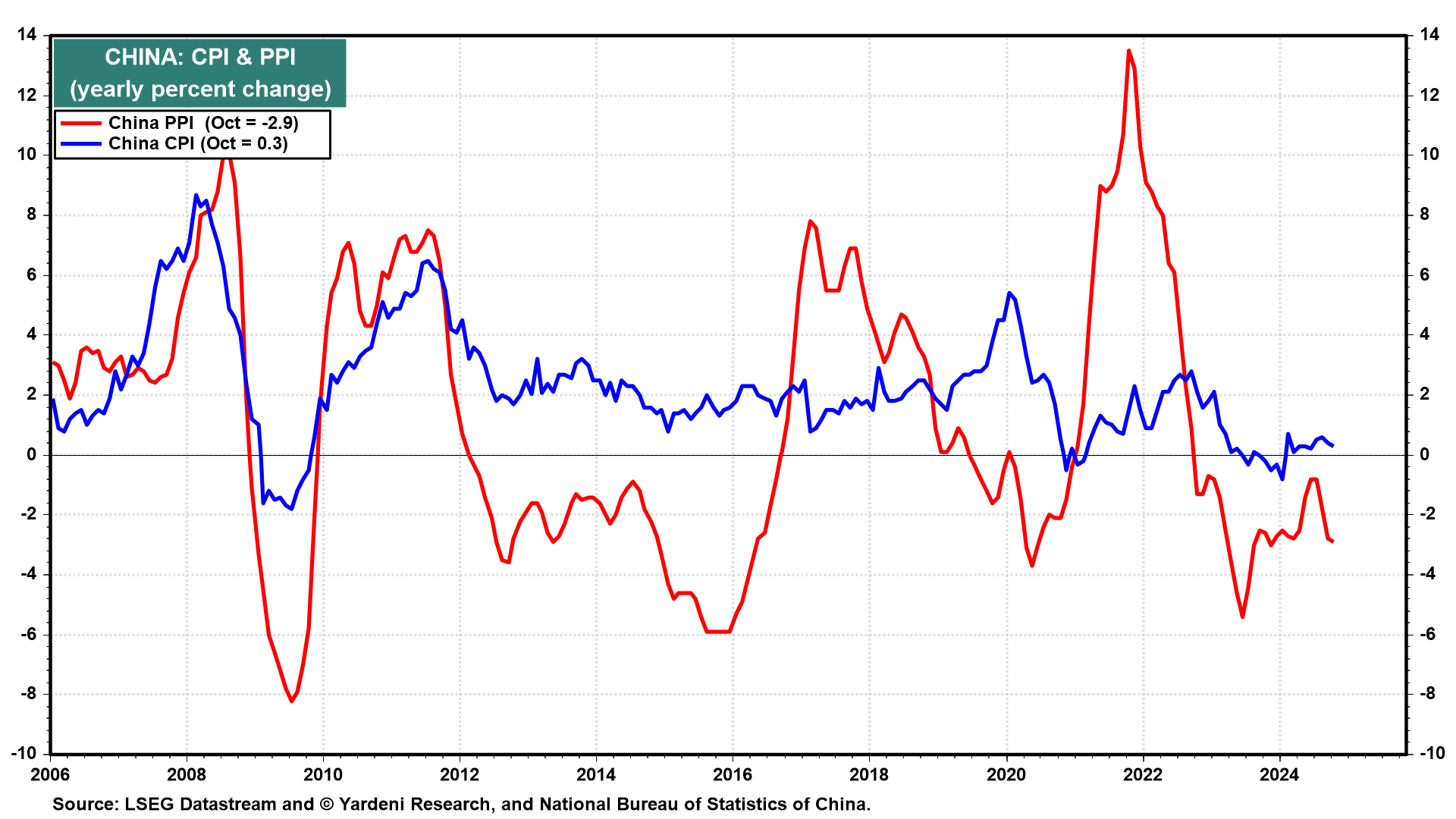

(1) China's CPI rose just 0.3% y/y in October, down from 0.4% (chart). Core CPI "surprised" by rising 0.2% y/y, up from 0.1% in September. October's PPI inflation rate sank further from -2.8% to -2.9%. That will continue to weigh on US import prices and therefore on the core goods CPI (chart).