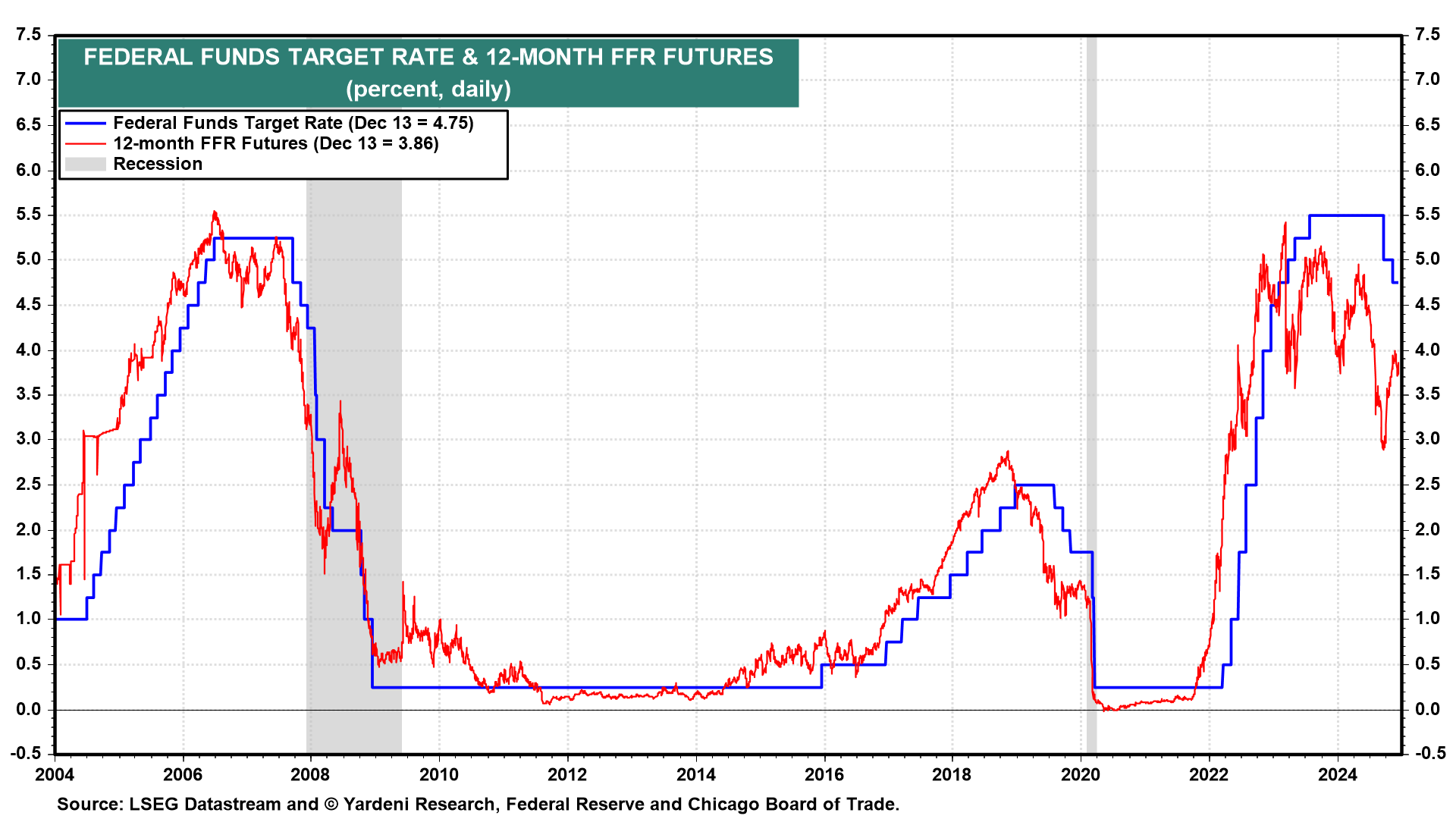

The main focus of the economic week ahead is the FOMC's interest-rate decision on Wednesday. The most likely outcome will be a 25bps cut of the federal funds rate (FFR) to a target range of 4.25% -4.50%. After a full 100bps of cuts since September 18, we expect Fed Chair Jerome Powell will use his press conference after the FOMC meets to signal that the Fed is on pause from further easing for now. The FOMC's updated quarterly Summary of Economic Projections will likely support the case for a pause by showing expectations for stronger growth and higher inflation over the next two years.

Our guess is that a few FOMC participants likely agree with us that the FFR doesn't need to be cut any further for now. However, the FOMC may be handcuffed by the near 100% odds of a rate cut expected by the FFR futures market (chart).

The reason for not cutting the FFR again early next year is not just because growth and inflation remain strong, but they might both get hotter. This week's regional manufacturing surveys may show that even the weak patches of the economy are getting stronger thanks to rate cuts, fiscal spending, and Trump 2.0. Here's more: