The S&P 500 and Dow Jones Industrial Average closed at records today. Leading the charge were technology stocks. Bank stocks also performed well. At the beginning of September, we wrote: "We are hard pressed to find what could possibly go wrong in September. So perhaps, the path of least resistance will continue to drive stock prices higher."

We wrote the same at the start of October. So far, so good. However, be warned: Israel may be on the verge of attacking Iran. That could certainly unsettle the stock market and create another buying opportunity.

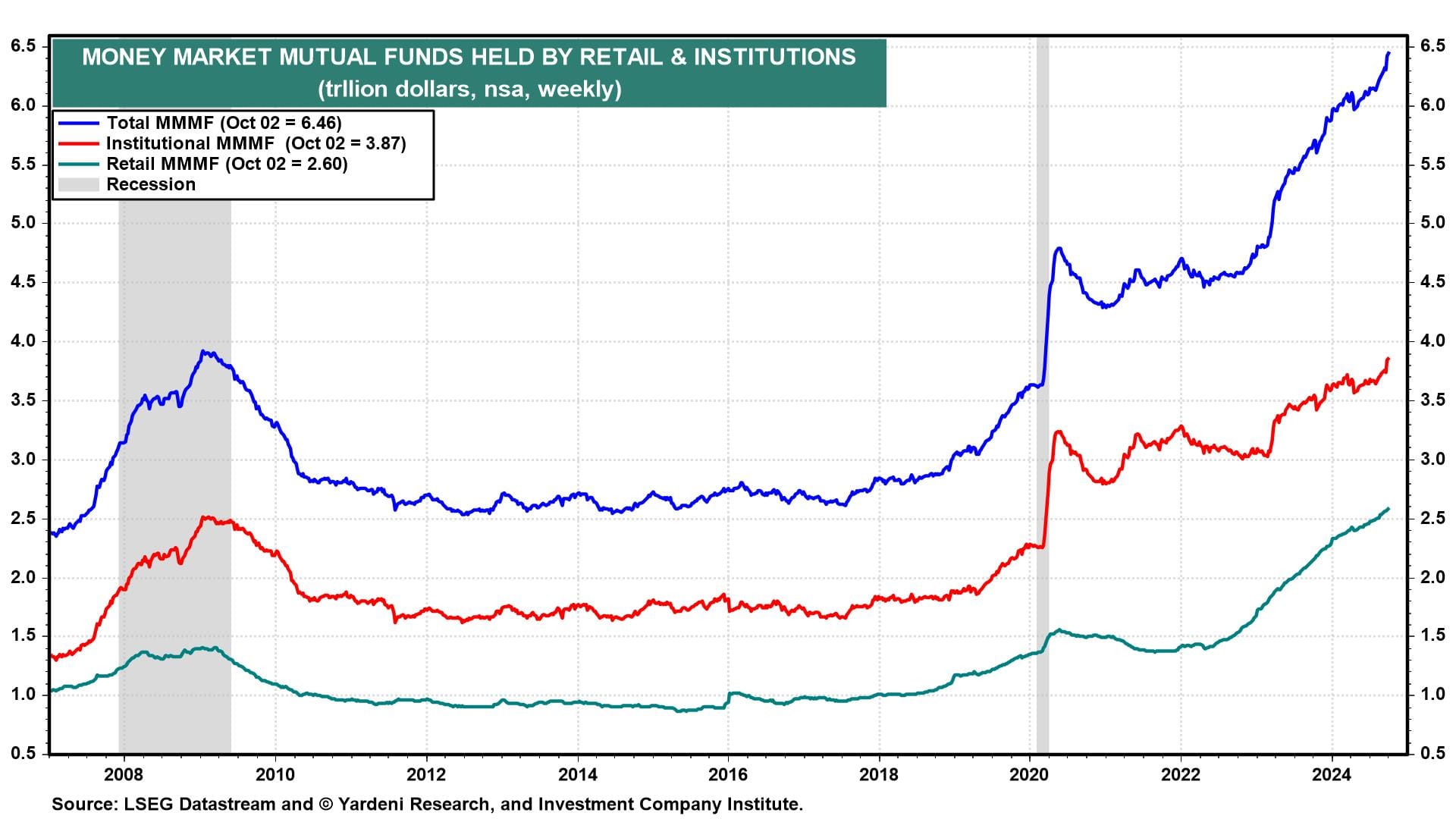

By the way, the stock market is reaching new heights even as assets in money market mutual funds (MMMF) rose to a record $6.5 trillion during the October 2 week (chart). That's quite remarkable. Imagine the meltup in stock prices if the Fed continues to lower interest rates.

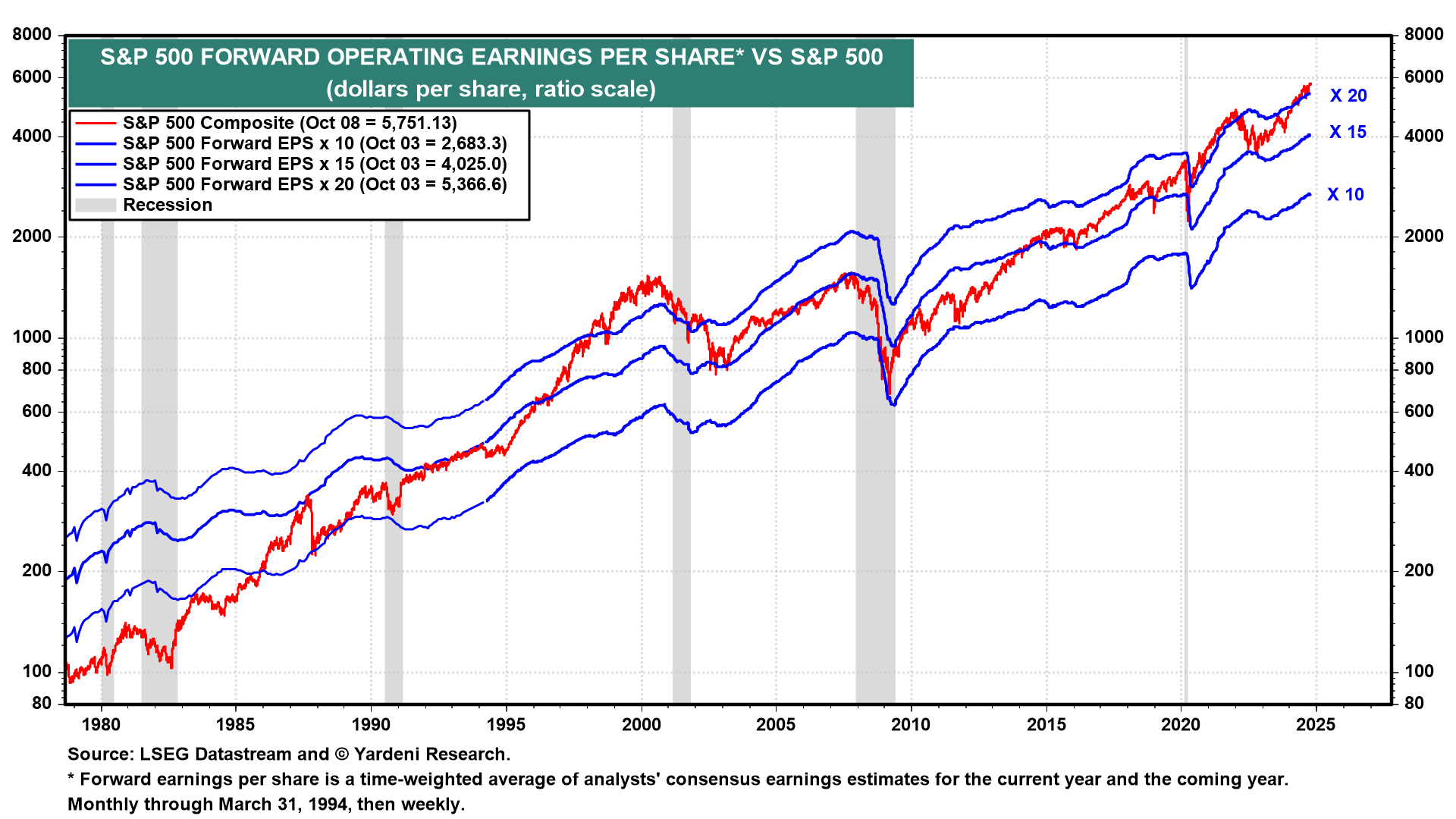

The S&P 500's forward earnings has also been rising in record high territory since early September 2023 (chart). During the current bull market, the S&P 500 forward P/E has increased from 15.3 during the October 12, 2022 week to 21.6 currently. That's not quite a record high, but it is getting closer to the 25.5 reached in 1999.

The stock market rally continues to broaden as more stocks participate. The percentage of S&P 500 companies with positive y/y price changes is at 85% (chart).

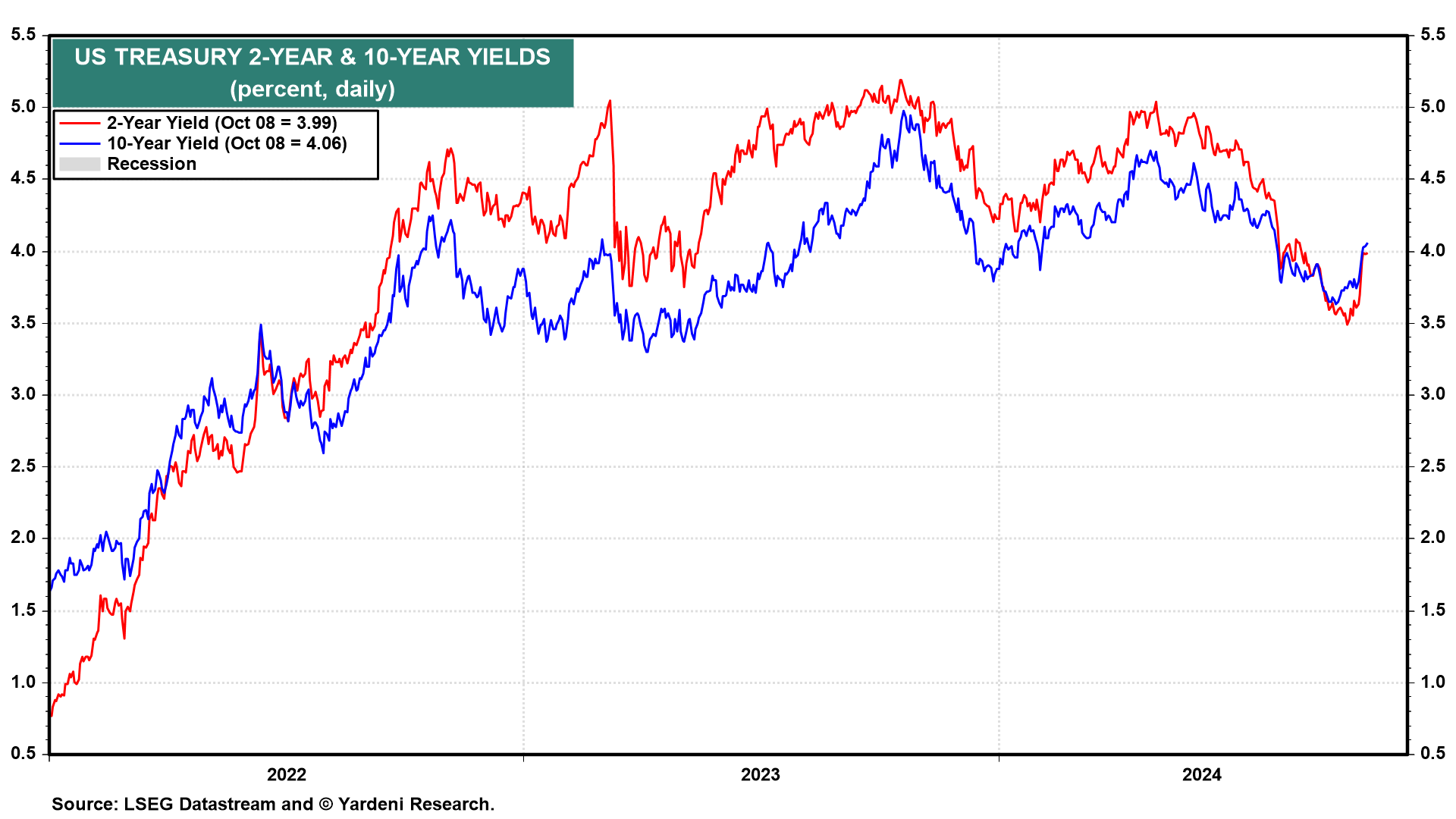

The stock market has rallied even as the 10-year Treasury bond yield rose from 3.62% on September 16 to 4.07% today (chart). That surprised plenty of bond investors who expected the Fed's 50bps cut in the federal funds rate (FFR) and very dovish forward guidance to push yields lower.

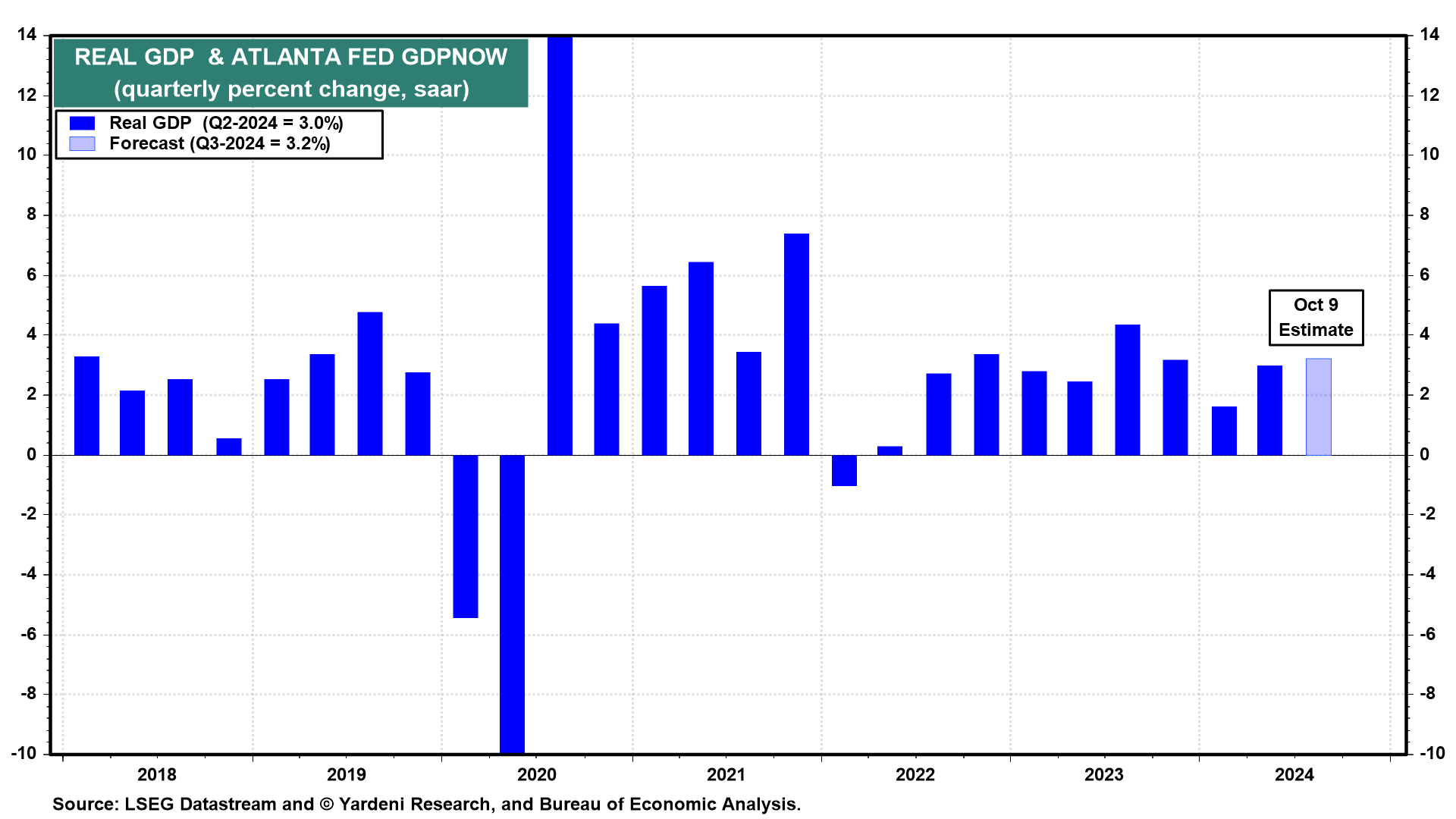

We weren't surprised because the backup in the bond yield confirms our view that the Fed is stimulating an economy that doesn't need additional stimulus. Today's reading of the Atlanta Fed's GDPNow tracking model shows a 3.2% (saar) increase in Q3's real GDP, following Q2's 3.0% (chart). In other words, real GDP also continues to notch new record highs.

Stock prices rose today despite relatively hawkish minutes from the September 17-18 FOMC meeting. The minutes showed that more members than just Governor Michelle Bowman--the lone dissenter--favored a smaller 25bps cut to the FFR last month. The 2-year Treasury yield rose 6bps today to 4.03% as a result.

The committee seemed quite worried about the labor market when they met. Since then, September's strong payroll employment report (along with upward revisions to July and August) should have allayed their concerns. So the Fed officials who were less dovish at the September meeting may have more sway at the November 6-7 session. We think the FOMC will leave rates unchanged next month. None-and-done is still our outlook for the rest of this year.