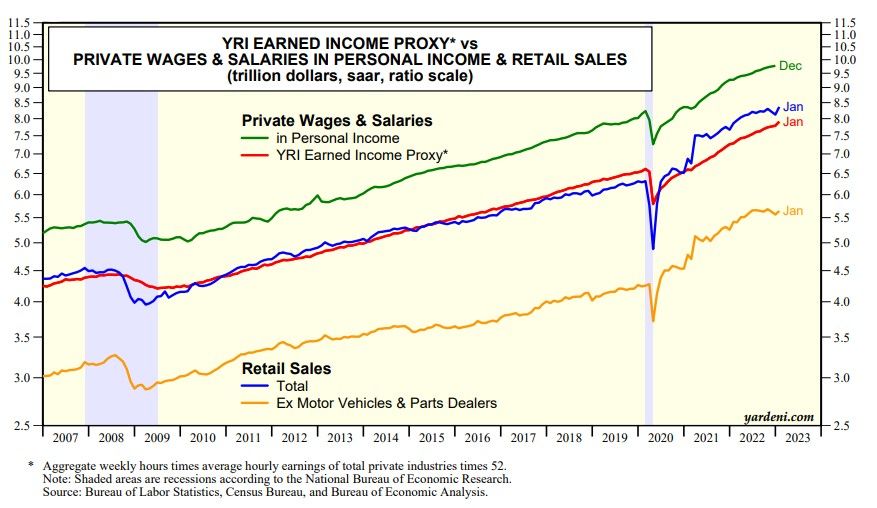

We aren't that surprised by the 3.0% m/m jump in retail sales reported today. When January's employment data were released, we calculated our Earned Income Proxy for private wages and salaries in personal income (chart). It soared 1.5% m/m as the average workweek jumped 0.9%, payrolls increased 0.3%, and average hourly earnings rose 0.3%. American consumers are doing what they do best. They aren't in the mood for a soft or hard landing.

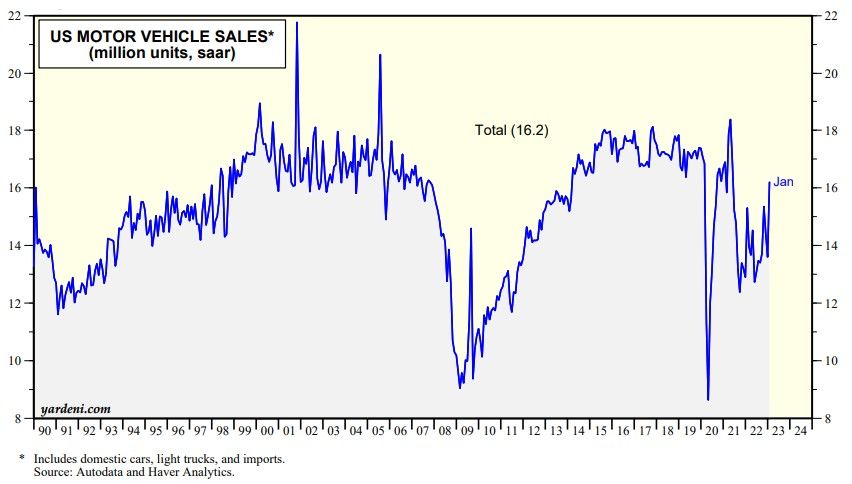

We also observed that January’s auto sales jumped to 16.2 million units (saar) from 13.6 million units during December (chart). The increase was led by domestic light trucks and imported autos. Even excluding motor vehicles & parts, retail sales rose 2.3% m/m.

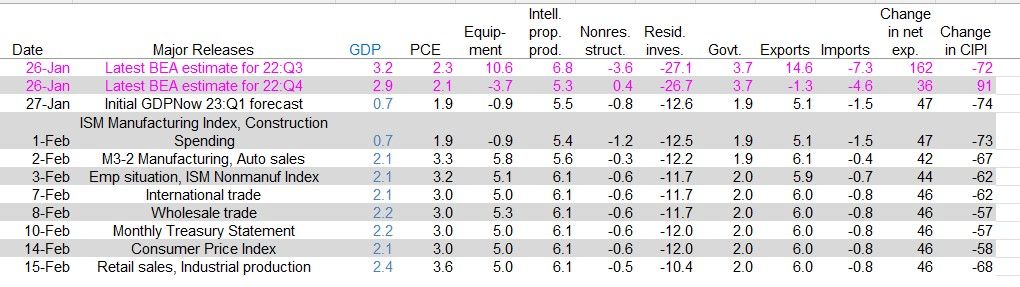

The Atlanta Fed's nowcast of Q1 was raised from 2.2% to 2.4%. Real personal consumption expenditures growth increased from 3.0% to 3.6% and was slightly offset by a decrease in Q1 real gross private domestic investment growth from -5.6% to -6.5% (table).