The S&P 500 is down roughly 10% from its record high on February 19. Considering Trump's Tariff Turmoil (TTT), that's not too bad. Also recall all the angst unleashed when the 10-year US Treasury bond yield spiked from 4.00% to 4.50% right after President Donald Trump announced his "Liberation Day" reciprocal tariffs. Now it is back down to 4.20% (chart). The stock and bond markets may be getting support from expectations that the Fed may ease soon.

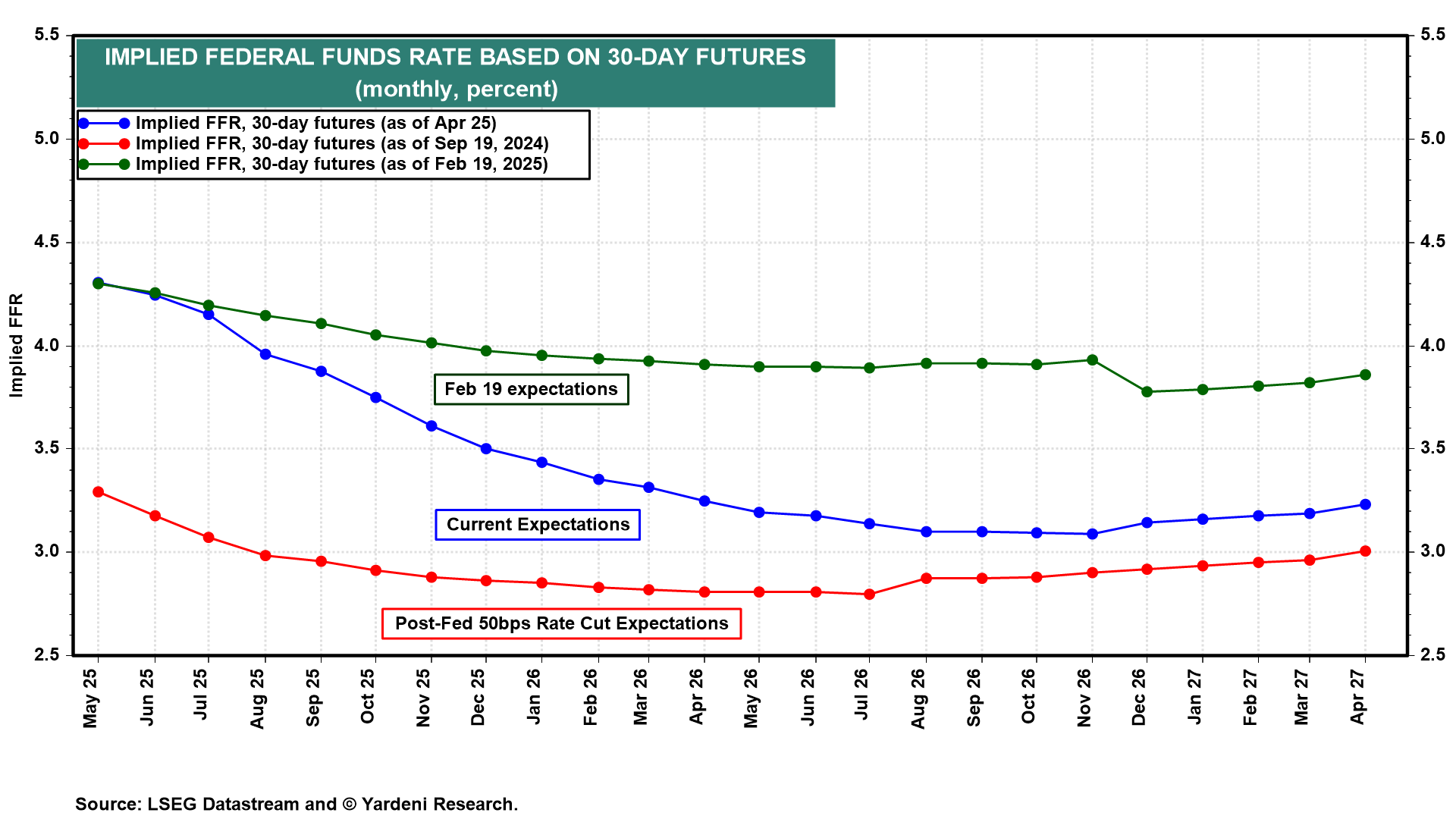

Federal funds rate (FFR) futures show that tariff-related growth fears are real, and the Fed will likely look through tariff-related price increases and cut the FFR. Futures suggest that the FFR will be cut from 4.33% to 3.50% by year-end, and continue to be cut through the first half of next year down close to 3.0% (chart).