The 10-year Treasury bond yield jumped by 10bps on Wednesday's hotter-than-expected January CPI report (chart). In his congressional testimony on Wednesday, Fed Chair Jerome Powell acknowledged that the Fed has more work to do to get inflation down. Today, the bond yield fell 10bps on a hotter-than expected January PPI report and an upward revision in December's PPI. Huh?

You read that right. Some of the key components of the PPI that are used to calculate the Fed's preferred PCED measure of inflation were benign or lower. For example, healthcare, with a nearly 20% weighting in the core PCED, declined 0.1%. Airline passenger services fell 1.6% m/m (after soaring 6.5% m/m in December).

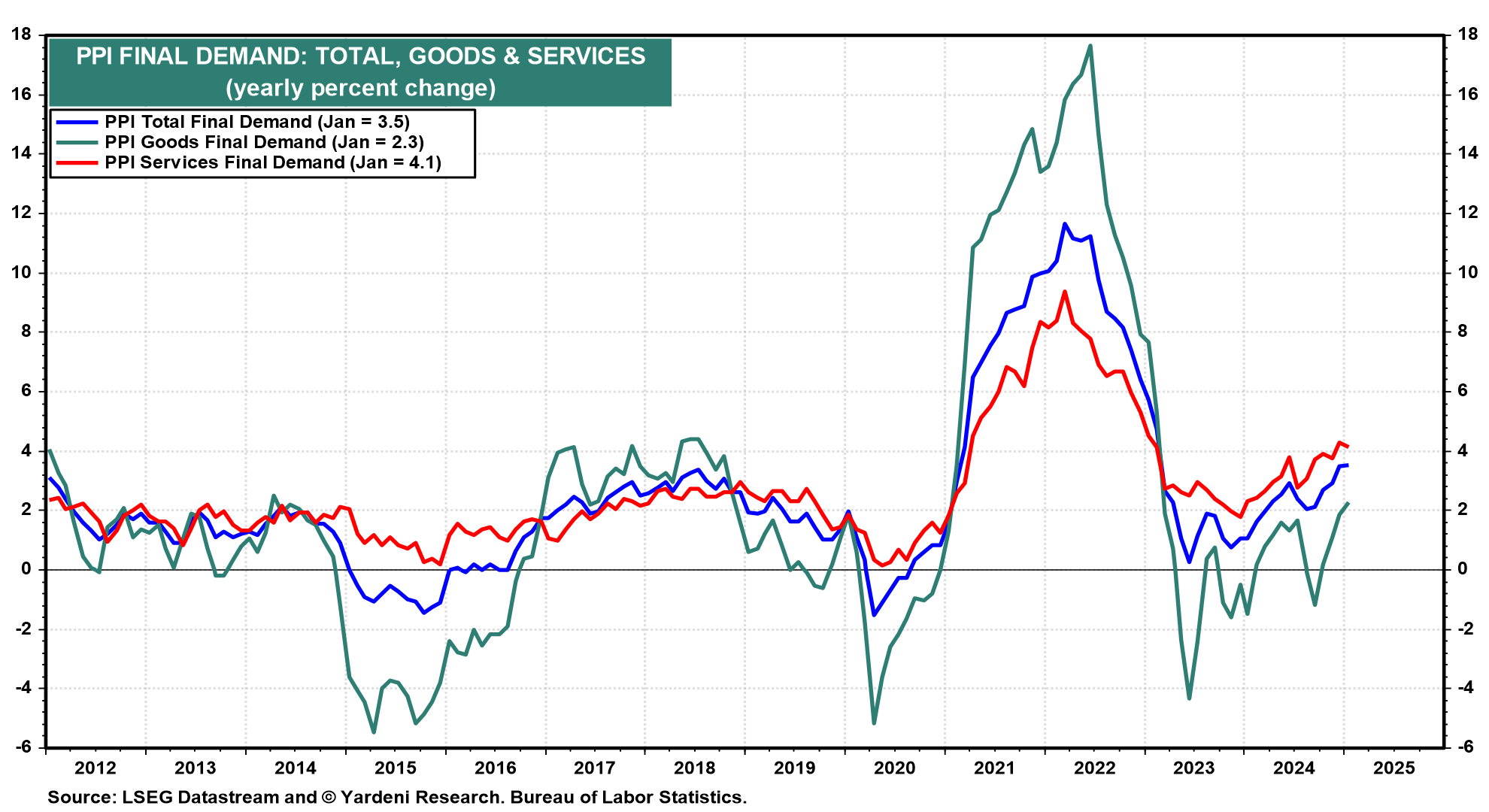

January's PPI rose 0.4% m/m, and December's increase was revised up from 0.2% to 0.5% m/m. The index is up 3.5% y/y (chart). PPI services inflation is above 4.0% y/y, and PPI goods inflation rose to its highest pace since 2022. The PPI inflation rate has been rising since June 2023, when it was close to zero.