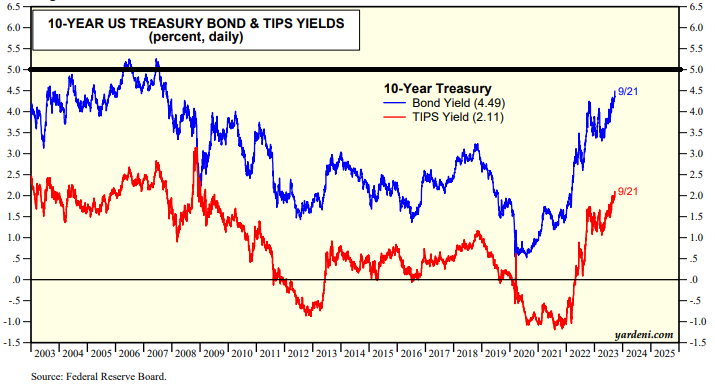

The Fed's hawkish pause, announced on Wednesday afternoon, has lifted the 10-year US Treasury yield to 4.50% this evening. We think it might consolidate here for a while consistent with our view that the yield has normalized back to where it was from 2003-2007, i.e., before the Great Financial Crisis (GFC). Back then, the 10-year TIPS yield and the expected inflation spread hovered around 2.00% and 2.50%, respectively (charts). Currently, the TIPS yield is 2.11% and the expected inflation spread is 2.38%.

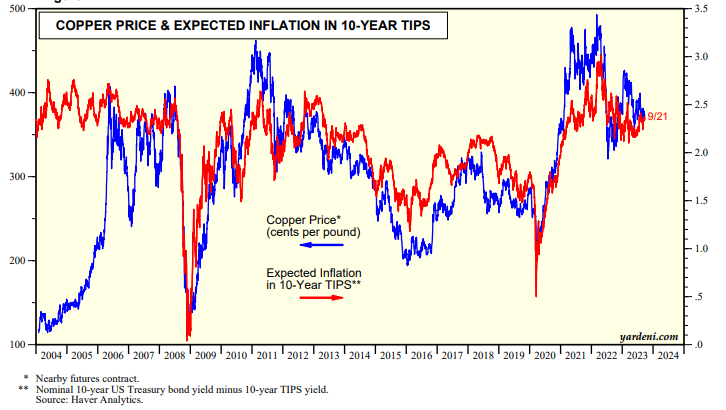

The yield might rise to 5.00% if the TIPS yield climbs to 2.50%, while the inflation spread rises to 2.50%. That would also be consistent with the pre-GFC old normal. (BTW: It's interesting to observe that the expected inflation spread is very highly correlated with the price of copper, which remains under $4.00 per pound despite recent attempts by the Chinese government to stimulate growth.)

The S&P 500 is down 5.6% from its July 31 bull market peak. That's mostly because the bond yield has been climbing above 4.00% since then. The forward P/E is inversely correlated with the 10-year TIPS yield, suggesting that there is still more downside for the S&P 500 (chart).

Here is the performance derby of the S&P 500 sectors and industries since the July 31 peak: Energy (2.3%), Health Care (-2.6), Communication Services (-3.6), Financials (-3.8), Utilities (-5.4), S&P 500 (-5.6), Consumer Staples (-6.0), Consumer Discretionary (-6.2), Industrials (-7.4), Materials (-8.4), Information Technology (-8.4), and Real Estate (-8.6).