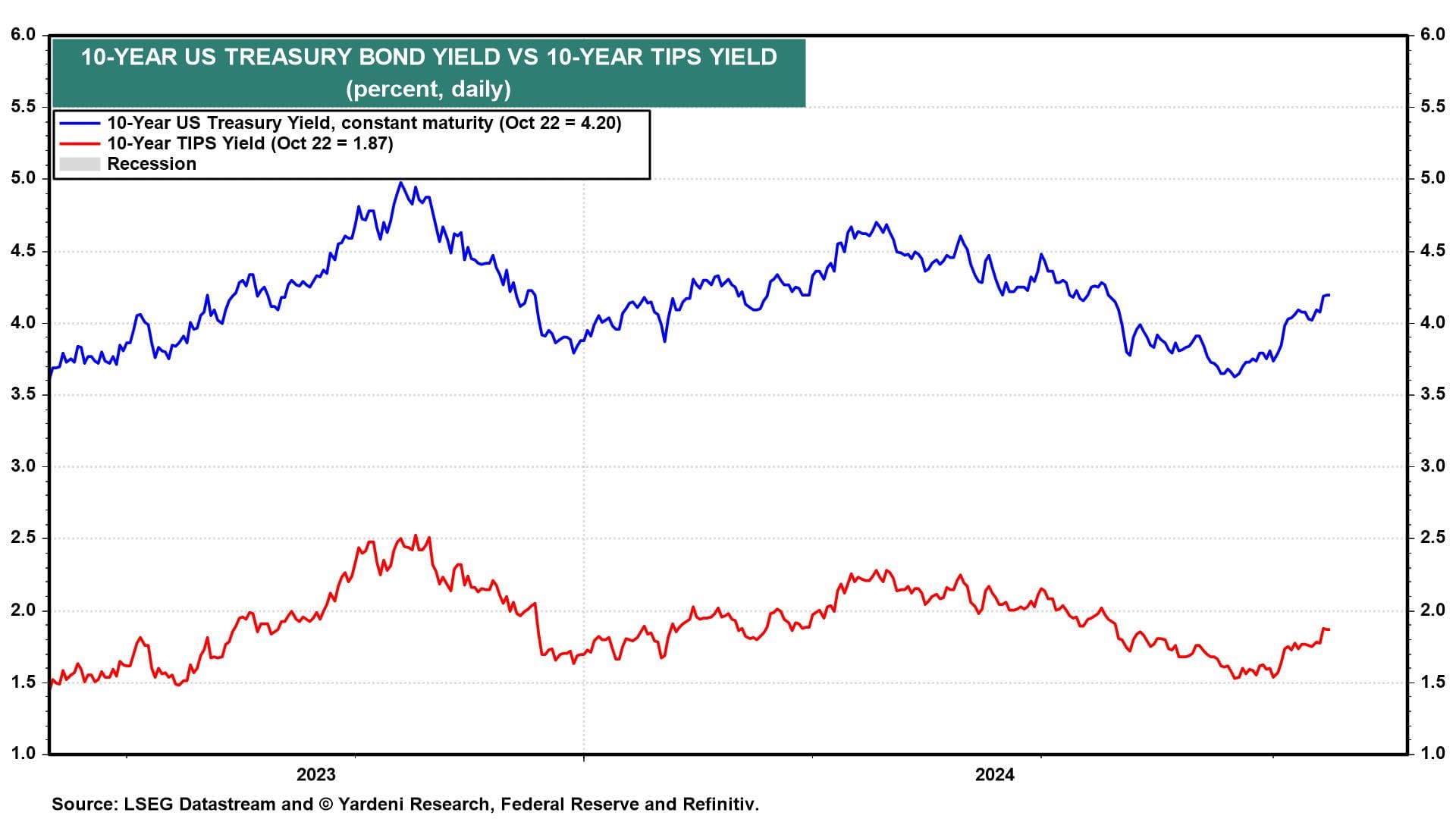

The US presidential and congressional elections aren't until November 5, but the Bond Vigilantes are voting early. The 10-year US Treasury bond yield has risen a whopping 63 basis points to 4.25% since the Fed's September 17-18 meeting (chart). In exit polls, the Bond Vigilantes are saying they are voting against Fed Chair Jerome Powell's dovish monetary policy because the economy is running hot, and the Fed's premature 50bps rate cut 0n September 18 raises the risk that it will overheat.

We anticipated this might happen. On September 2, we wrote that better-than-expected economic indicators were likely to rattle the bond market. On September 22, we wrote: "So now investors must consider the possibility that the Fed's easing will continue to drive the 2-year yield lower, but the 10-year yield might move higher on concerns that the Fed might heat up a warm economy." We are sticking with our 4.00%-4.50% range for the bond yield. We resisted raising our S&P 500 yearend target of 5800 when it rose above this level recently. We aren't lowering it now that it is back at that level.

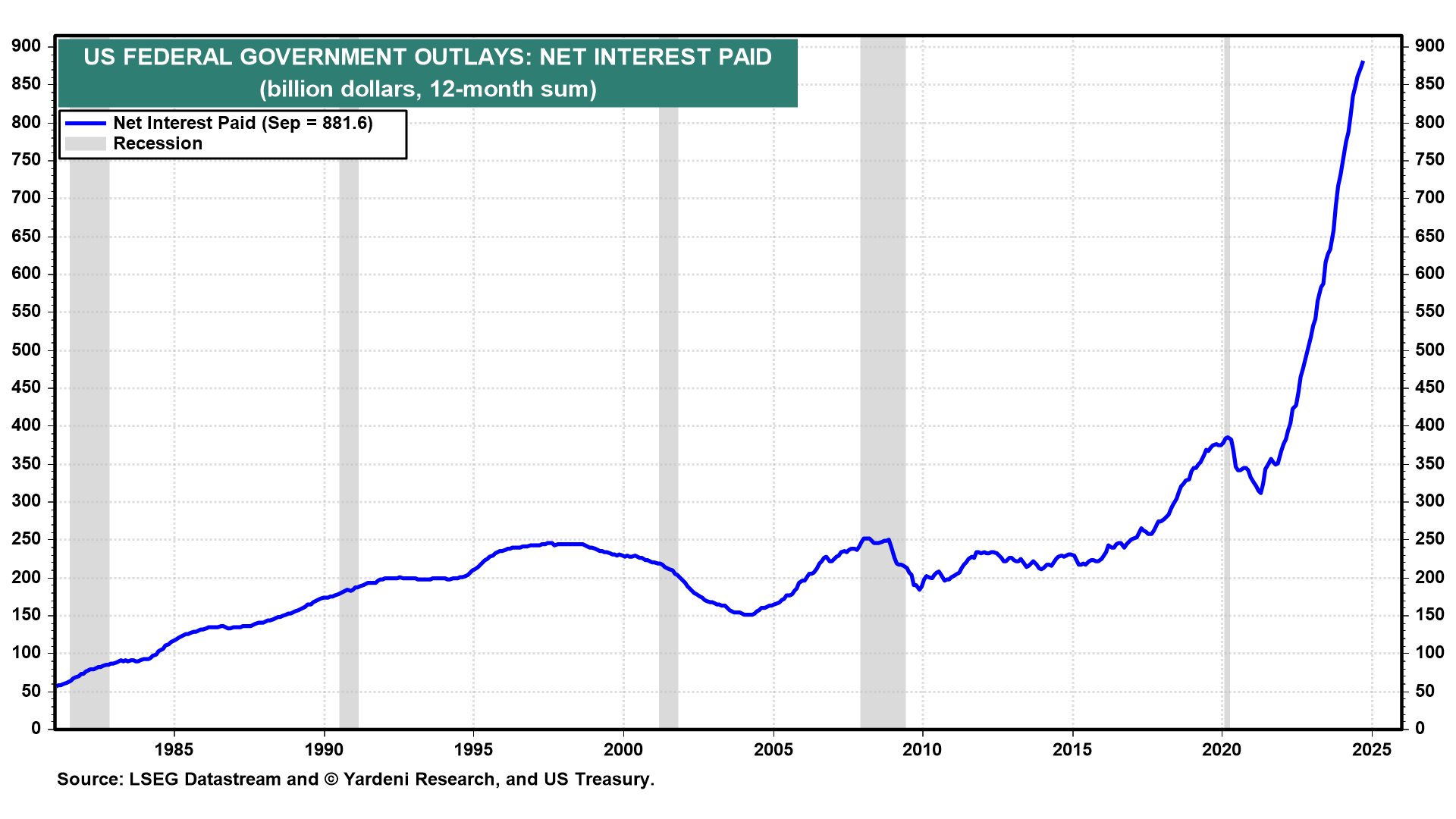

The Bond Vigilantes may also be voting against Washington, figuring that no matter which party wins the White House and the Congress, fiscal policies will bloat the already bloated federal government budget deficit and heat up inflation. The next administration will face net interest outlays of over $1 trillion on the ballooning federal debt (chart).

Consider some of the related developments in the financial markets:

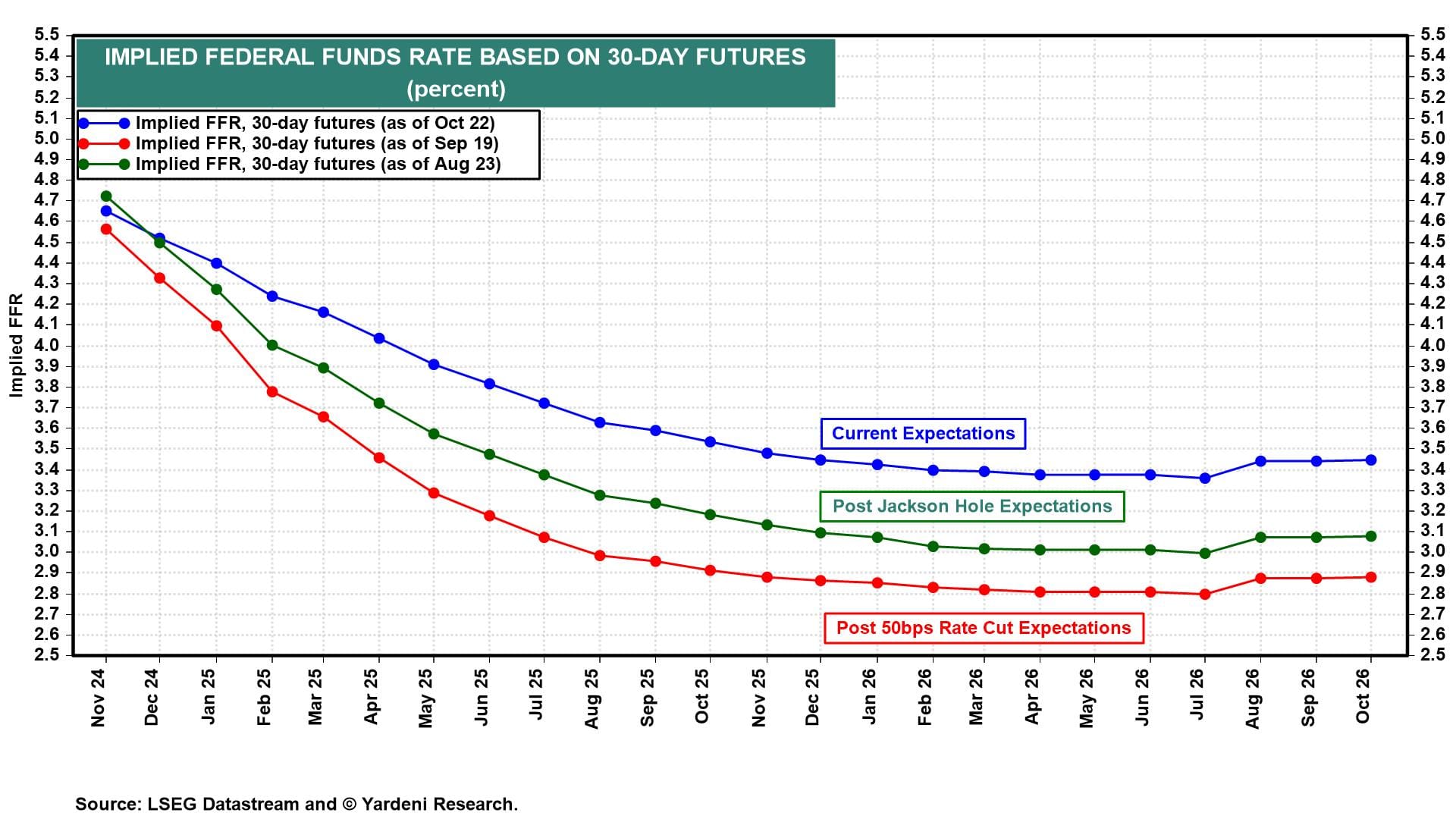

(1) Fed funds futures. Futures contracts tied to the federal funds rate (FFR) show where the market expects the FFR to be in the coming months and years. The futures curve has shifted dramatically higher from where it was just after the Fed cut the FFR rate last month (chart). After the 50bps cut and Powell's very dovish press conference on September 18, the futures market priced in rapid rate cuts taking the FFR down to 2.80% in the next 12 months. Now, the market expects a 3.60% FFR by then. We think even those expectations may prove too dovish.

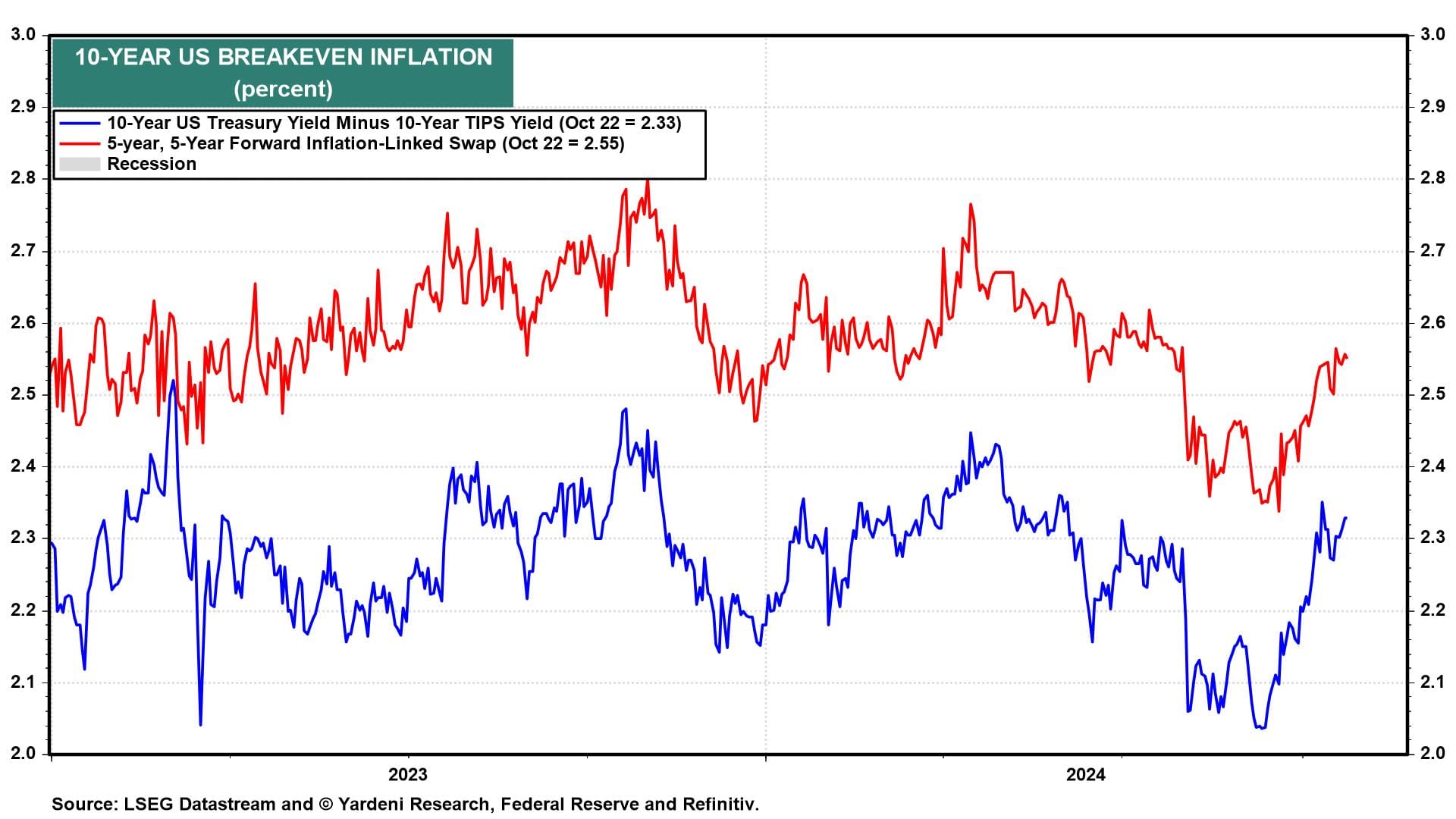

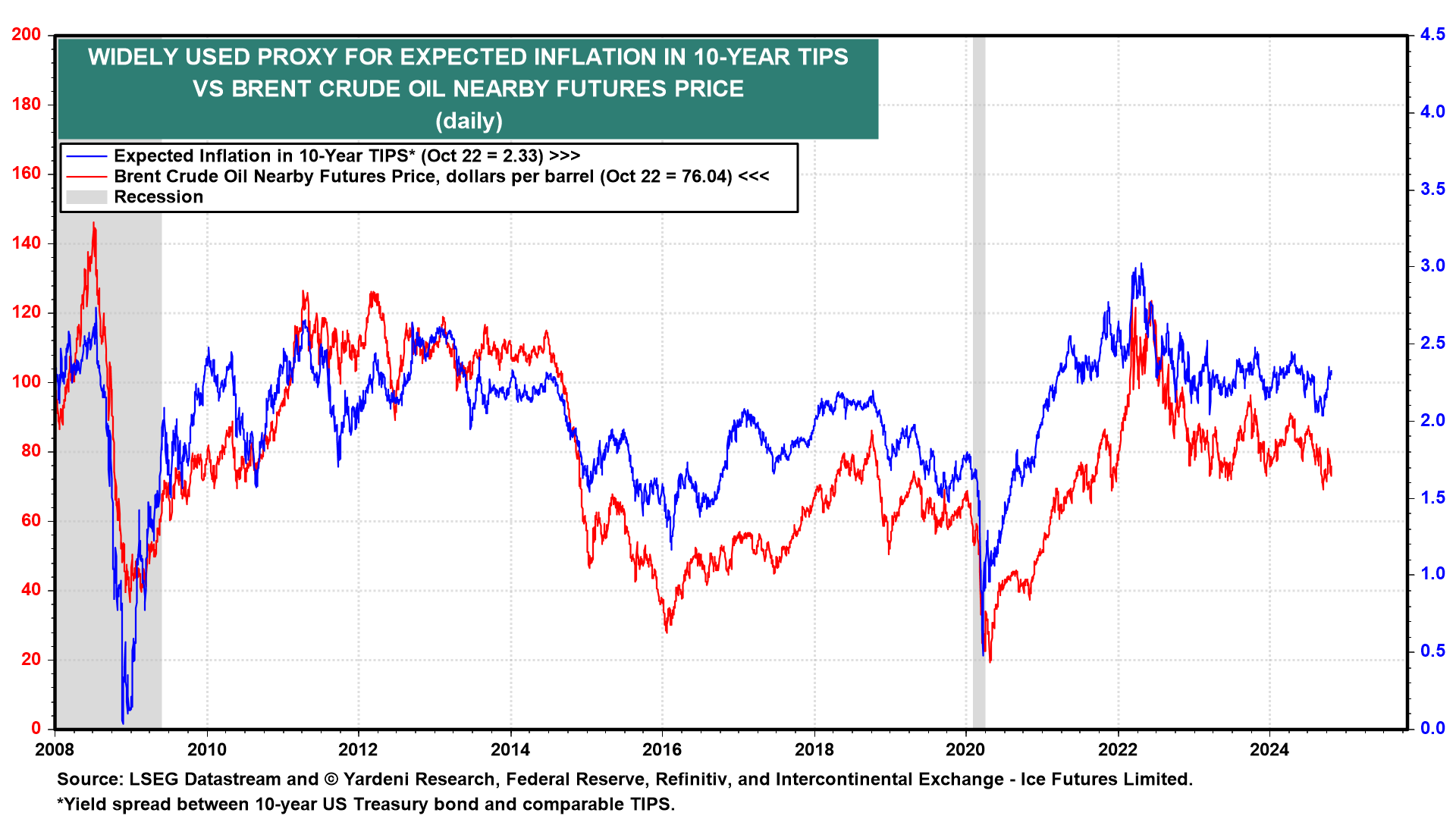

(2) Inflation expectations. The bond market has raised its expectations for both real growth and inflation over the long run. We can see that via the rising 10-year TIPS yield (in the first chart), and the climbing inflation expectations implied by the difference between nominal and TIPS yields (chart).

Breakeven inflation expectations tend to be highly correlated with the price of crude oil (chart). That relationship has broken down recently, suggesting that fears of the unsustainable US fiscal path are trumping global deflationary price pressures in determining inflationary expectations.

(3) The dollar. A less dovish outlook for monetary policy in the US is boosting the dollar, as we expected it might (chart). The yen has dropped from 140.61 US dollars/yen on September 16 to 152.87 today.

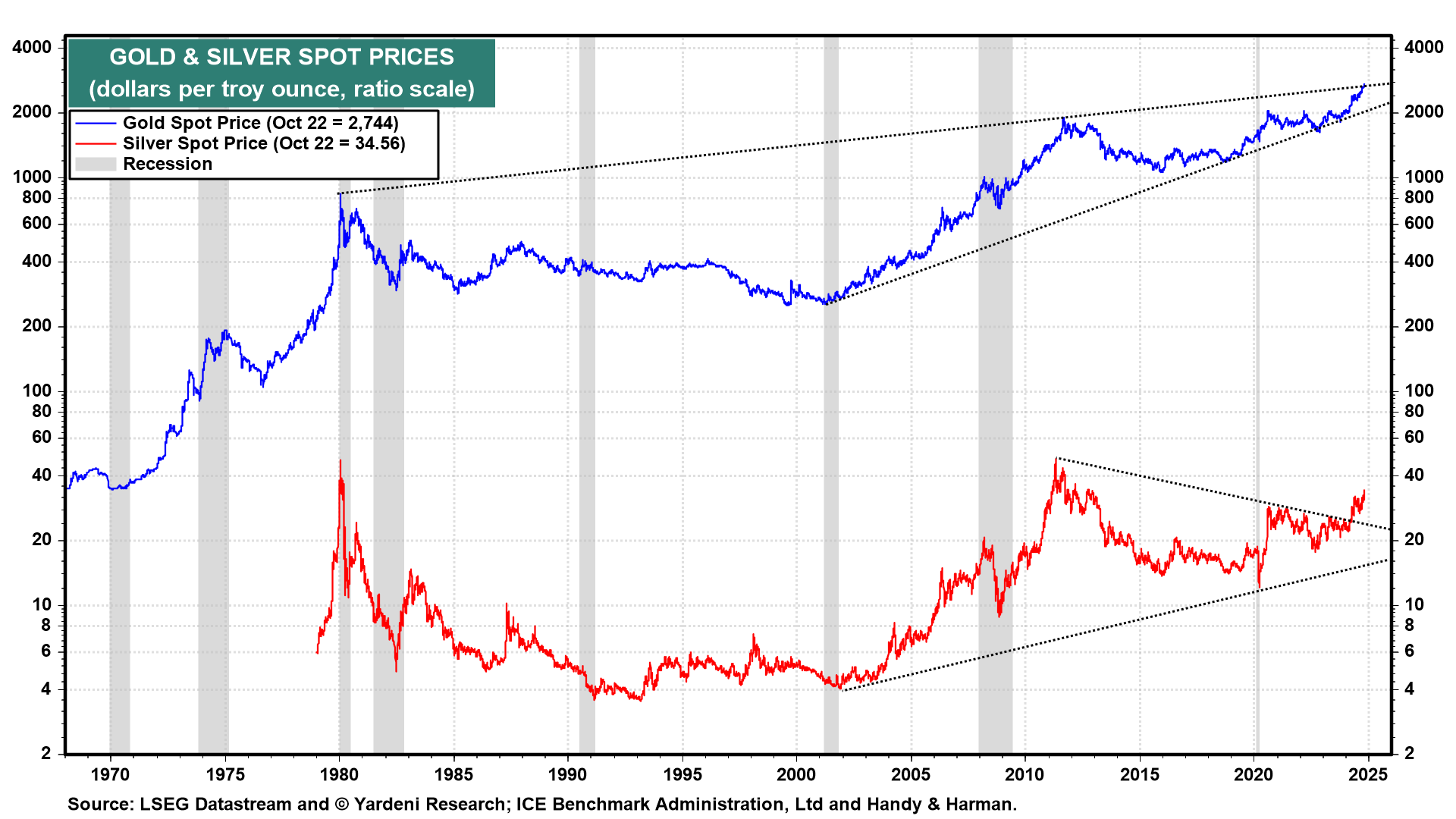

(4) Gold. The hedge against rising inflation, reckless fiscal policies, and geopolitical instability has shined this year, up nearly 33% ytd (chart). Investors are buying up precious metals to protect their portfolios from all the above risks. The foreign central banks of the Axis of Evil are building their gold reserves to skirt potential financial sanctions in the future.

See Dr Ed's op-ed in today's Financial Times titled, "The Federal Reserve should beware of wishing on an R-star."