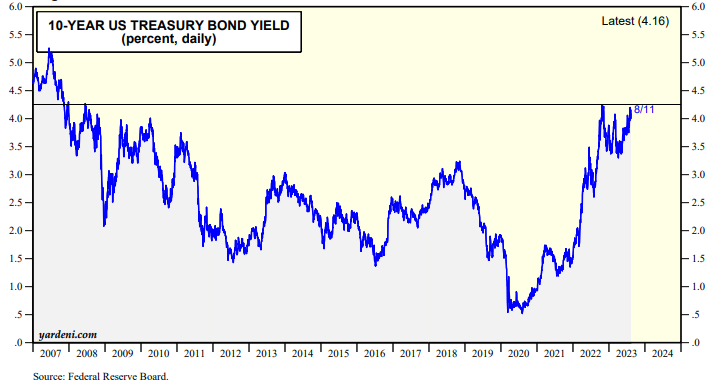

The 10-year US Treasury bond yield continues to run into resistance around 4.25%, which was last year's high (chart). The bond bears led by the Bond Vigilantes would like to see the yield rise well above that level to demonstrate that they are unhappy with the government's profligate fiscal policies. The bond bulls--including us, for now--see the current level as an attractive one if inflation continues to moderate and more Fed officials talk about lowering the federal funds rate next year if this happens.

In an August 2 NYT interview, Federal Reserve Bank of NY President John Williams suggested that’s a very plausible scenario: