It was not a happy day in the bond market. Neither was it a happy day in the stock market:

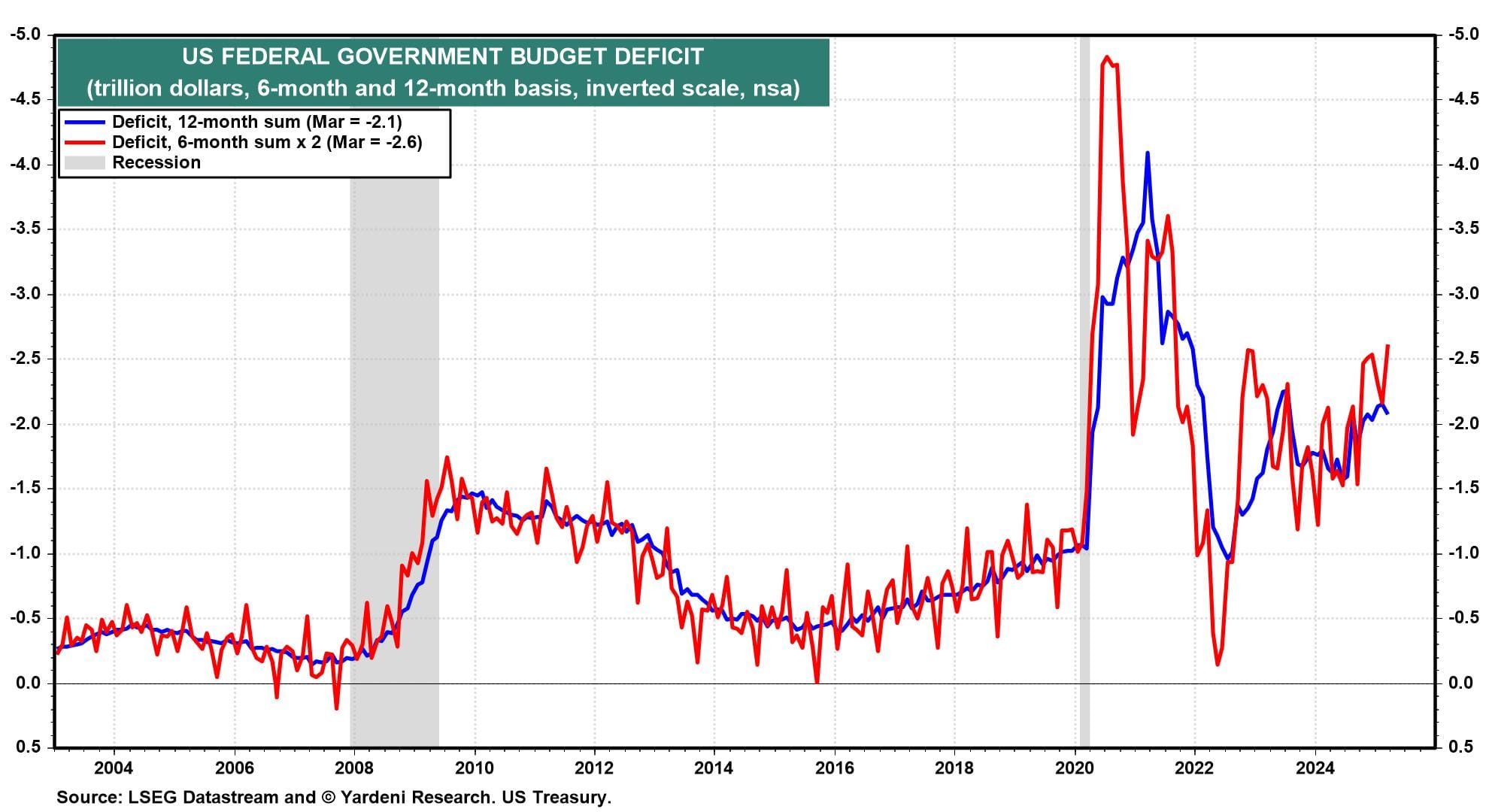

Bond Market. The 10-year Treasury bond yield rose to 4.45% this evening, up from a recent low of 4.01% on April 4, two days after Liberation Day. Yesterday, President Donald Trump partially postponed Liberation Day because the bond market was "tricky." It remained tricky today. Yields rose even though the March CPI inflation rate reported this morning was lower than expected. The Treasury reported today that the federal budget deficit totaled $2.1 trillion over the past 12 months (chart). It was $2.6 trillion over the past six months at an annual rate.

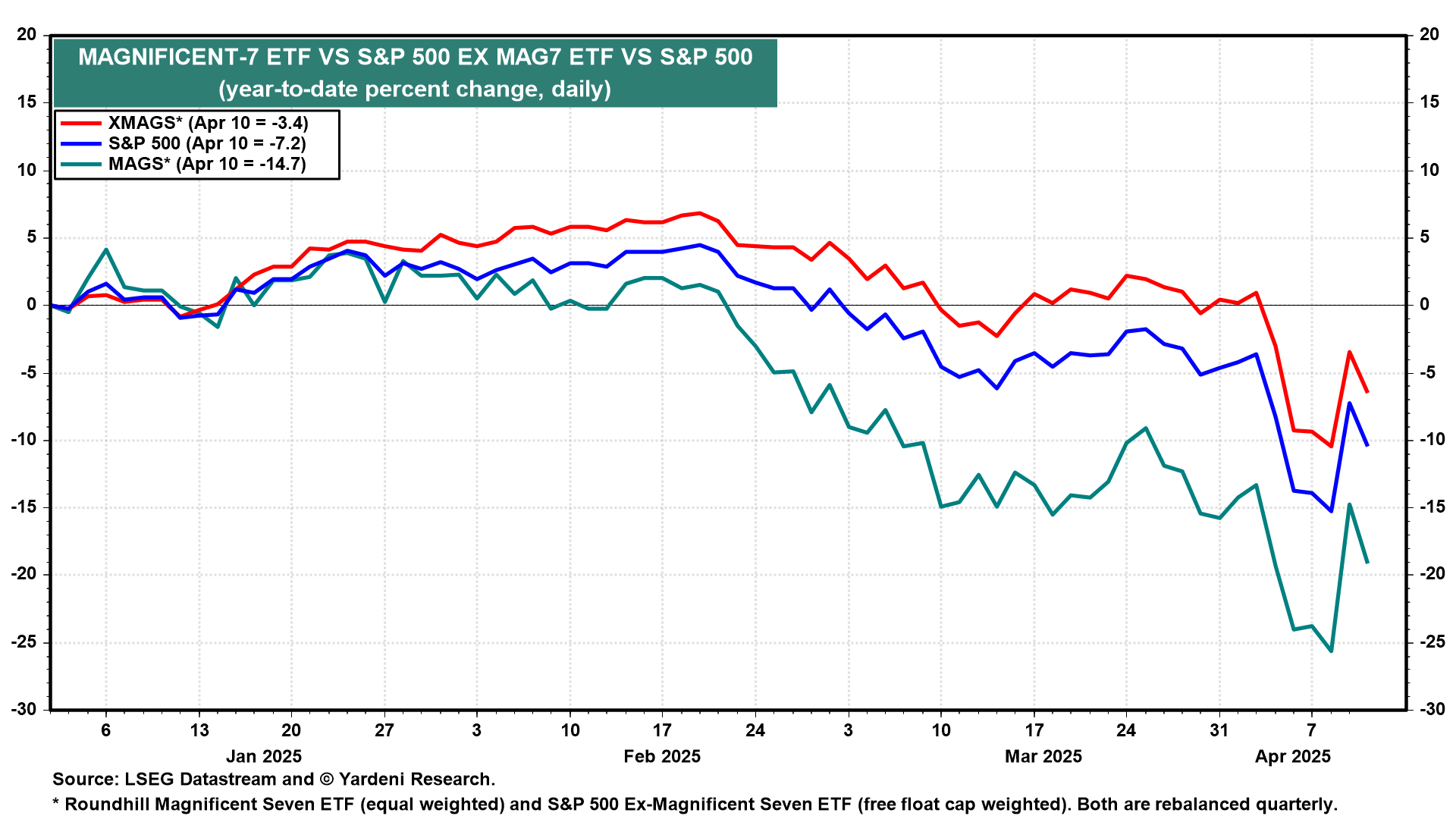

Stock Market. After one of the best one-day performances on record yesterday, the major US stock market price indexes fell more than 4% despite upbeat economic news (chart). Trump Tariff Turmoil (TTT) hasn't been significantly reduced by the President's 90-day postponement of reciprocal tariffs. The now 145% tariff on China will make various imports too expensive and disrupt business operations. Public and private companies will have to find new suppliers, reduce margins, and raise prices. The 25% tariff on auto imports will drive up their prices significantly along with the cost of auto insurance.

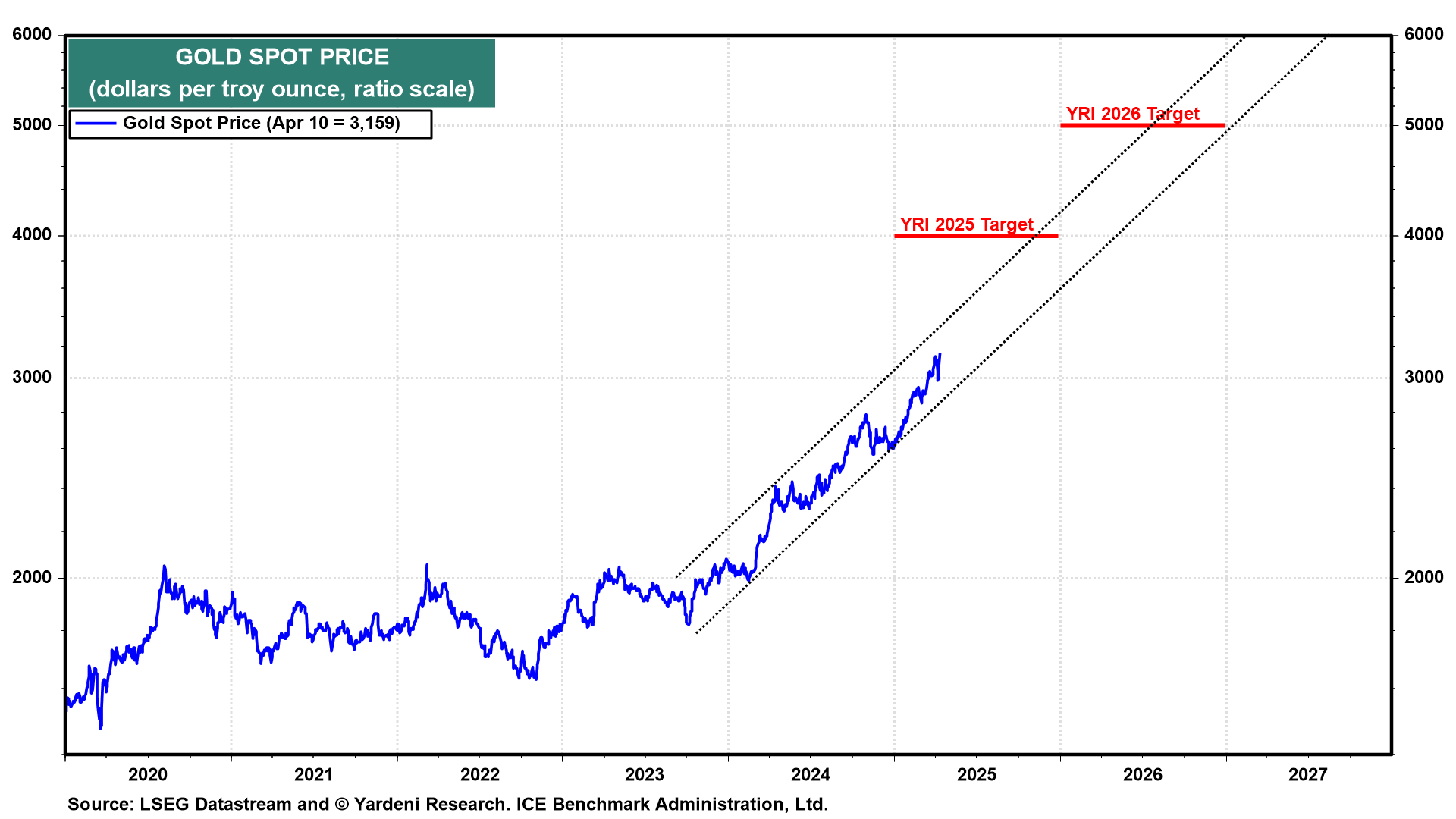

(3) Gold. The price of gold rose to a new record high today thanks to TTT (chart).

Now let's review the latest economic indicators:

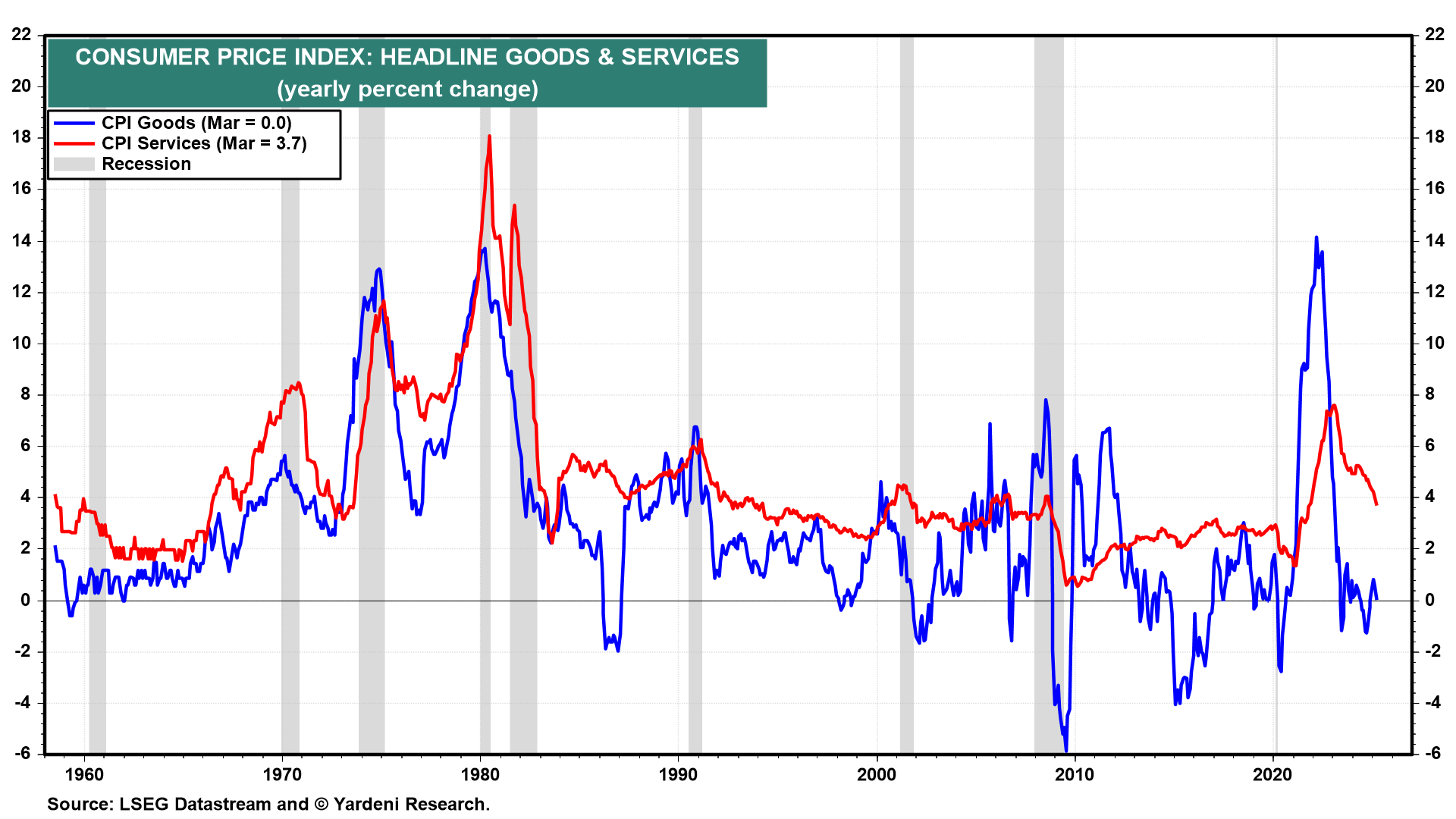

(1) Inflation. Today brought good news on inflation, as the March CPI fell 0.1% m/m (the first monthly deflation since 2020) and rose 2.4% y/y. Falling gasoline and airfare prices weighed on the index. Core CPI inflation rose 0.1% m/m and 2.8% y/y. In April, falling gasoline prices may continue to weigh on goods inflation, while services prices continue to disinflate (chart). By May and June, inflation is likely to be boosted by Trump's tariffs.

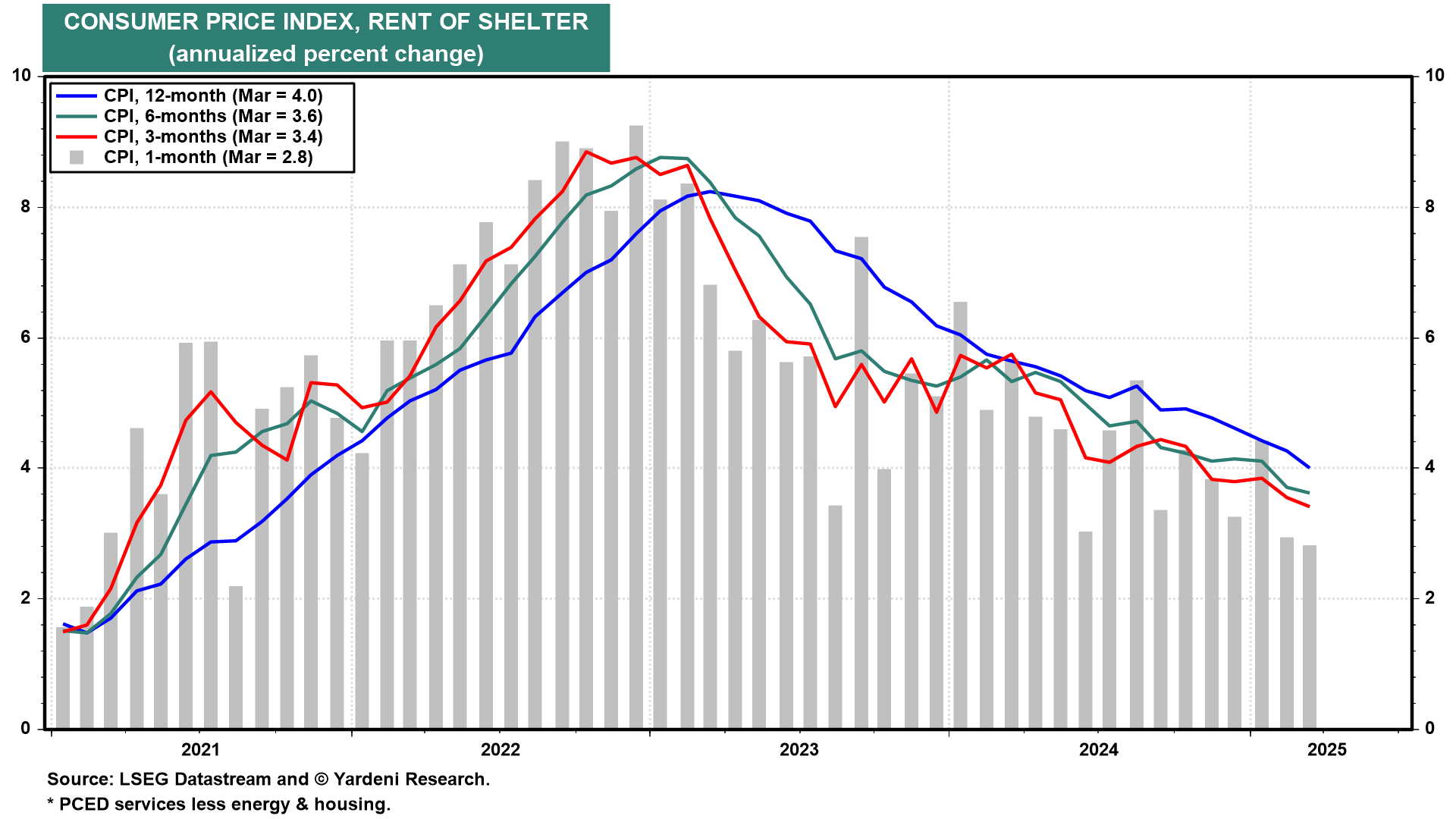

Shelter inflation is decelerating and could reach 3.0% y/y by year-end, which would be historically consistent with the Fed's 2.0% inflation target (chart).

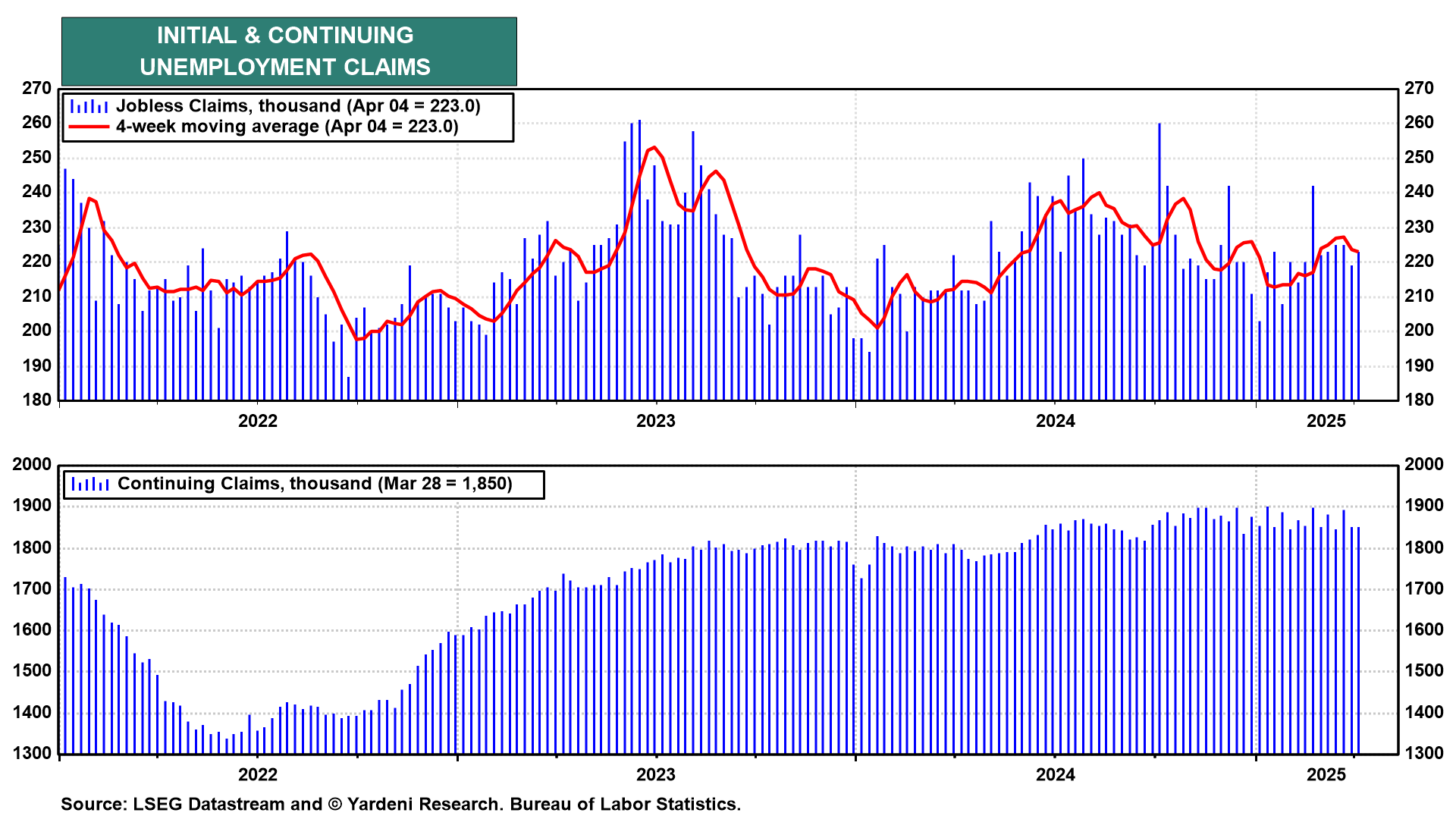

(2) Unemployment. Layoffs remain subdued. Initial unemployment claims rose just 4,000 in the first week of April, remaining historically low at 223,000. Continuing unemployment claims fell 53,000 in the final week of March (chart).

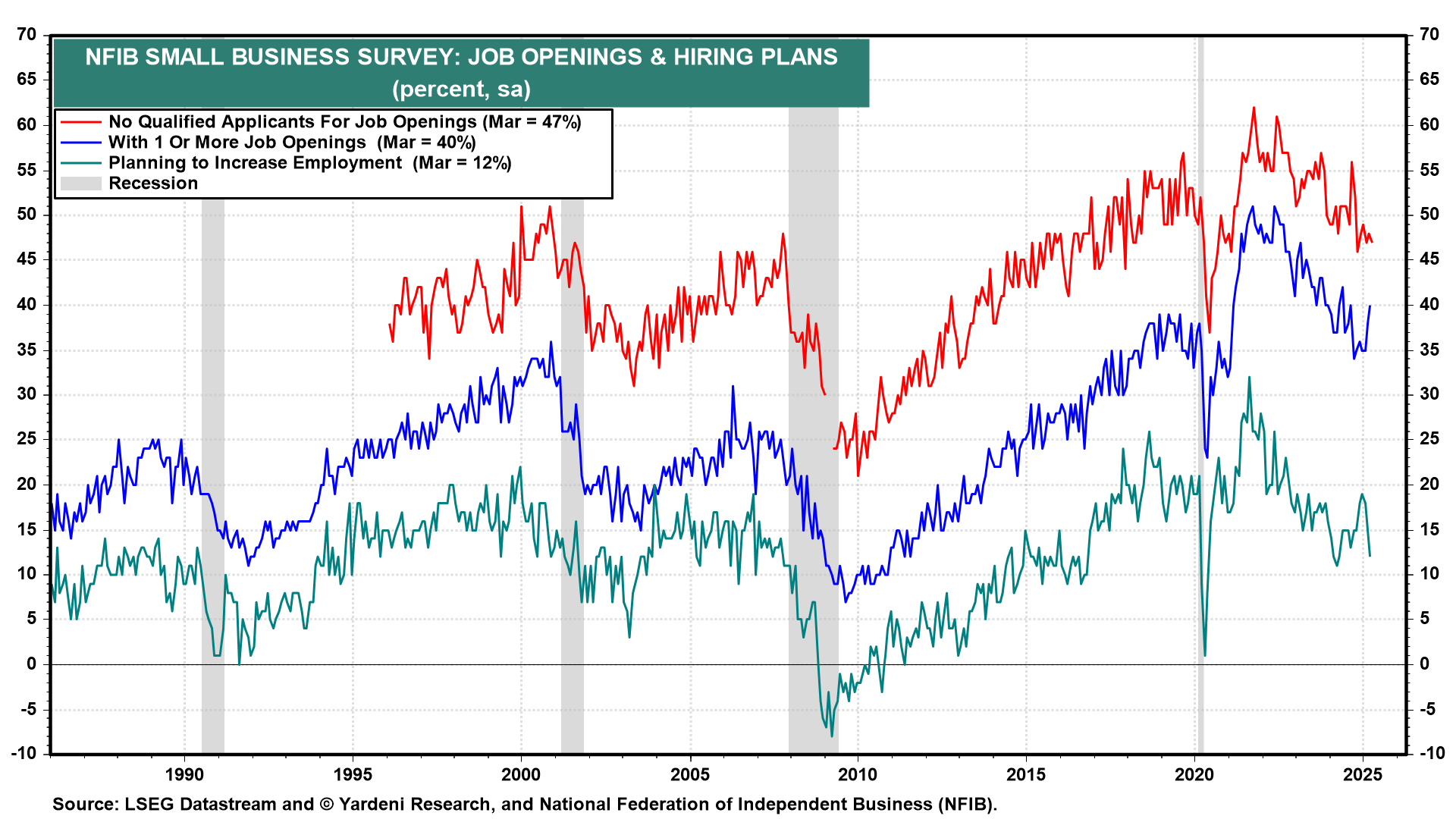

(3) NFIB. March's survey of small business owners showed declining optimism and an increasing likelihood of price increases. The survey's labor market indicators were mixed (chart). Job openings remained high, but plans to increase employment fell.