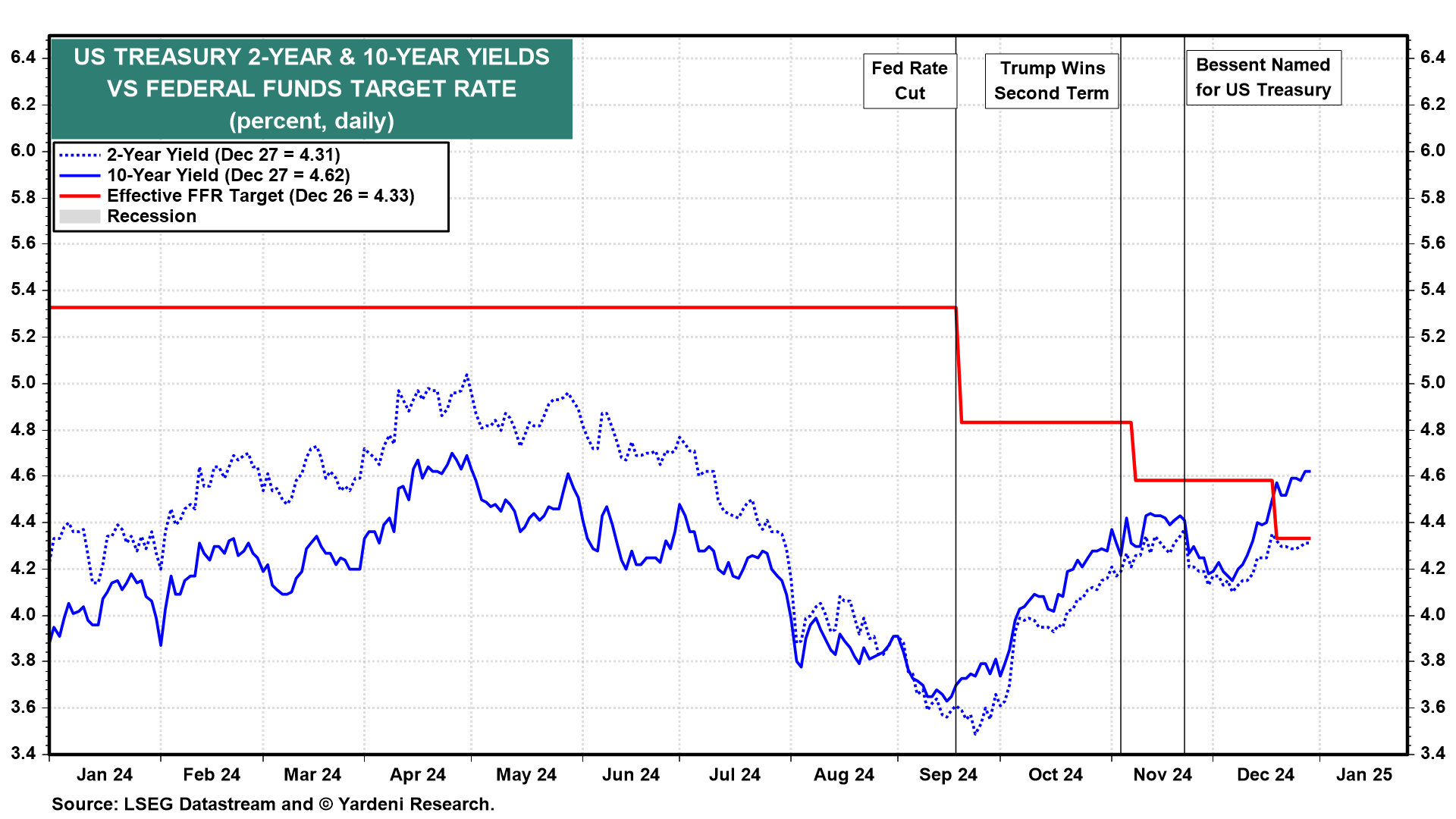

The 10-year Treasury bond yield is up 100bps since the Fed started lowering the federal funds rate (FFR) by 100bps on September 18 (chart). Even the 2-year Treasury yield is up about 75bps. We warned about this happening back in August. The Bond Vigilantes are sending a loud warning message. They aren't convinced Donald Trump, the new sheriff coming to town, will maintain fiscal law and order any better than the old sheriff. They are also losing their confidence in Jerome Powell, the deputy in charge of monetary law and order.

We still think that the 10-year yield should trade around 4.50% plus/minus 25bps in 2025. But we can't rule out a move back up to last year's high of 5.00% early next year (chart). That's another reason why we expect a stock market pullback/correction that might have started already. The S&P 500 peaked at a record 6090.27 on December 6.