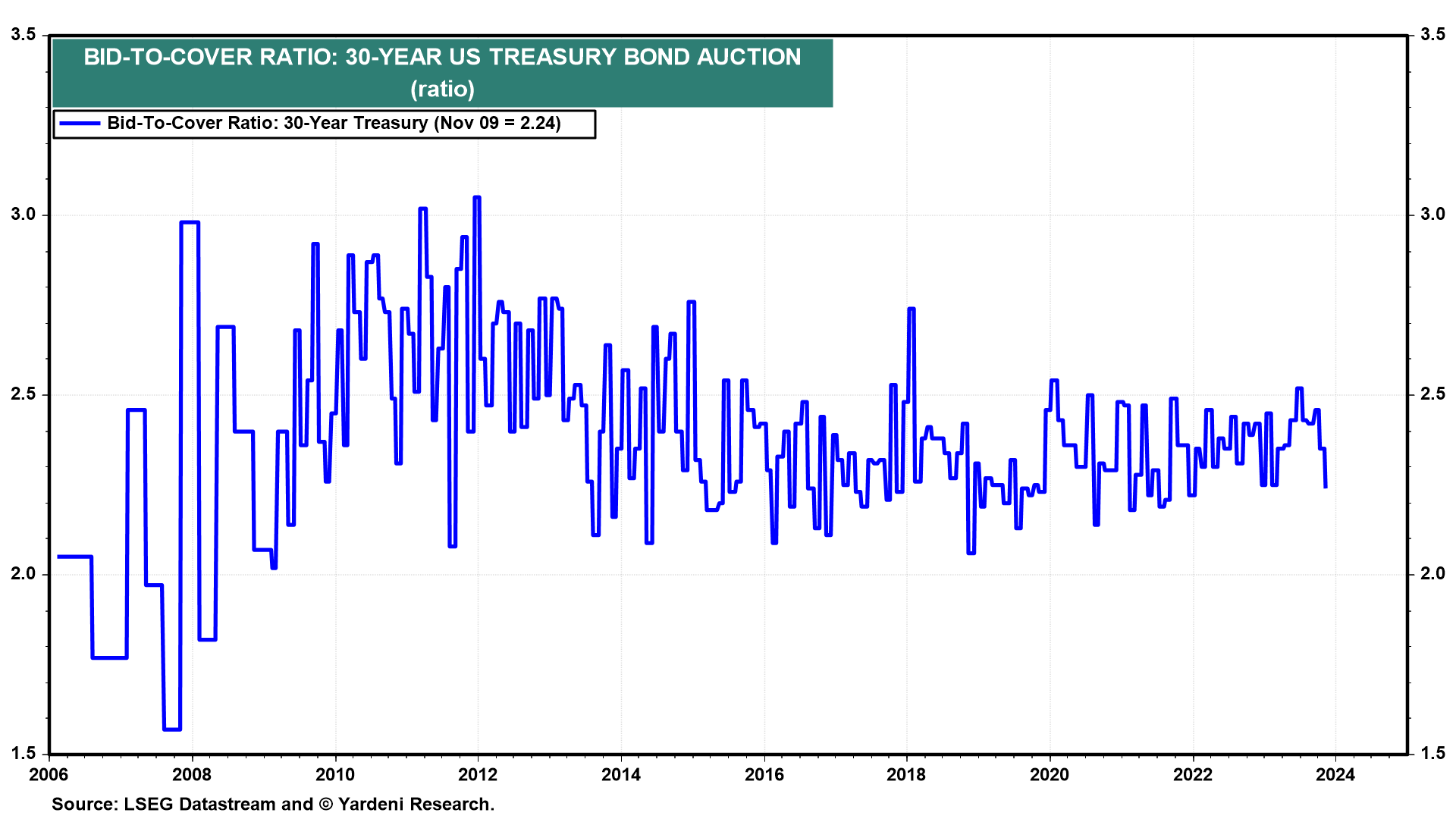

The bid-to-cover ratio is the dollar value of bids compared with the dollar value of debt offered. Falling bid-to-cover ratios indicate less robust interest from investors. Yields climbed today after a weak auction of $24 billion in 30-year Treasuries with demand for the debt at 2.24 times the bonds on sale (chart).

That helped to push stock prices lower today, snapping the longest winning streaks for the Nasdaq and S&P 500 in two years. Both indexes are running into some profit taking right around their 50-day moving averages (chart).