The 10-year US Treasury bond yield continued to rise today, yet stock prices rallied led by the MegaCap-8 stocks. The bond yield is returning to the levels seen prior to the period spanning the Great Financial Crisis (GFC) through the Great Virus Crisis (GVC) when the Fed kept interest rates abnormally low. And the stock market might be OK with bond yields returning to their old normal. Nevertheless, there might be more downside risk on fears that the yield could move still higher.

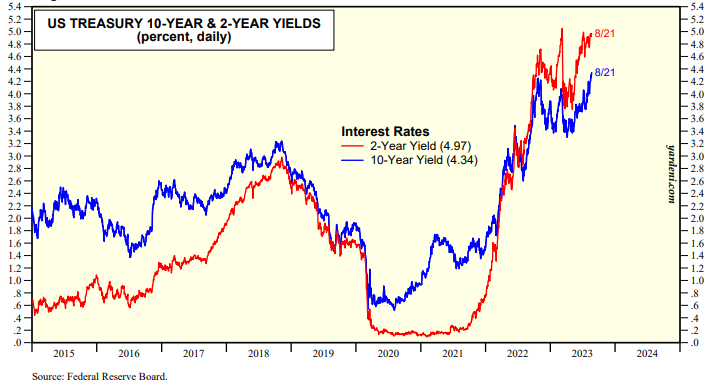

The yield curve continues to "disinvert" as the 10-year yield (currently at 4.34%) is rising toward the 2-year yield (currently at 4.97%) (chart). The former has been moving higher since it bottomed on April 6, following the March banking crisis, as investors concluded that the crisis wasn't turning into a credit crunch and that the economy is remarkably resilient and not in danger of falling into a recession after all.

The recent rebound in the nominal yield has been driven by the rebound in the 10-year TIPS yield from a low of 1.06% on April 6 to 2.00% today (chart). The latter seems to be normalizing back around 2.00%, which is where it was during 2003-06, the years just before the GFC of 2008 set the stage for the TIPS yield to fluctuate around 1.00% to -1.00% from 2010-22.