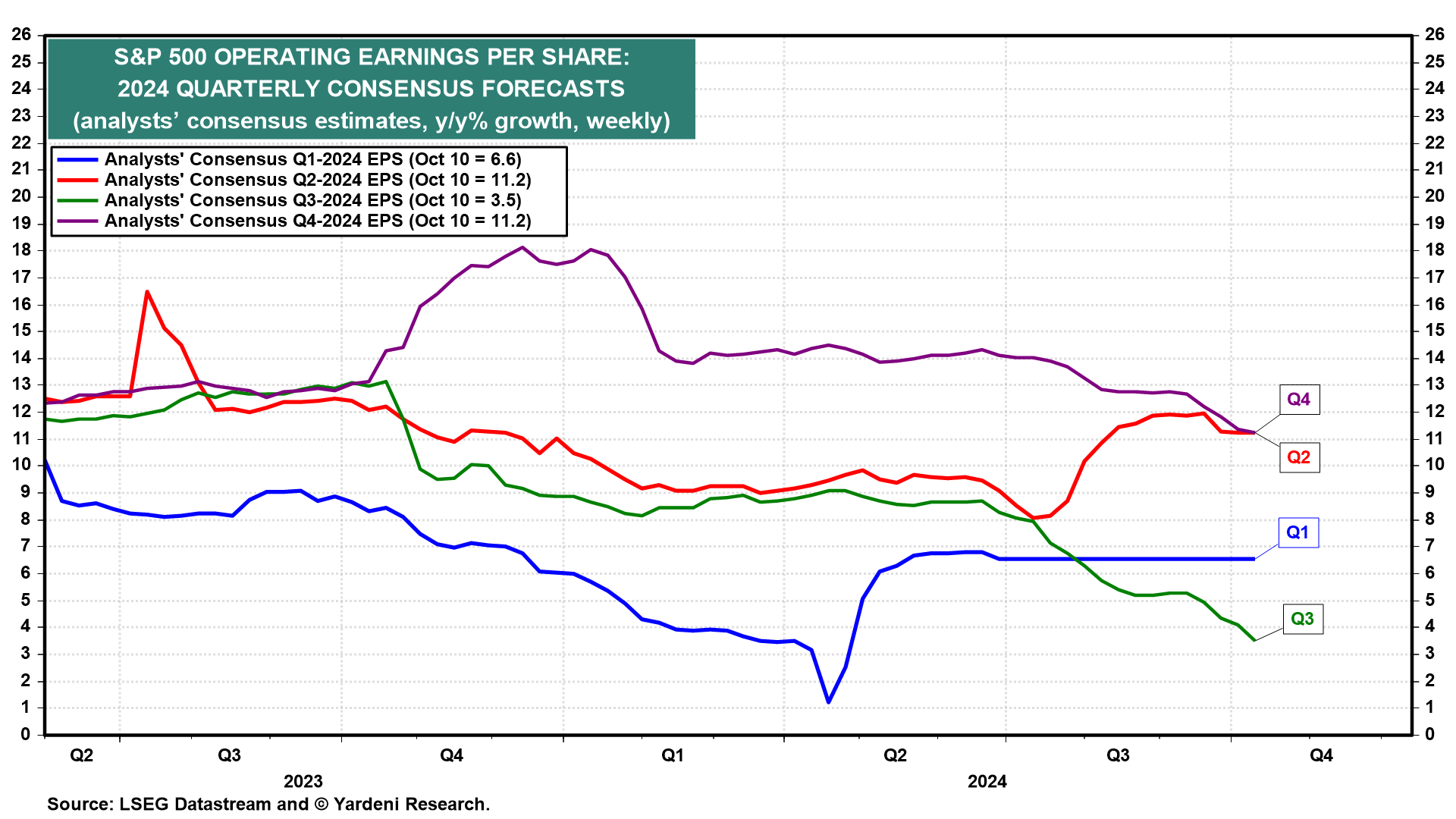

The third year of the current bull market in stocks got off to a good start this week. It's likely that the Q3 earnings reporting season will be better than expected as suggested by the results reported yesterday and today by some of the major companies in the S&P 500 Financials sector. On Sunday, we wrote that industry analysts expected S&P 500 earnings to be up 3.5% y/y during Q3, but we expect at least twice as much growth (chart). So far, so good.

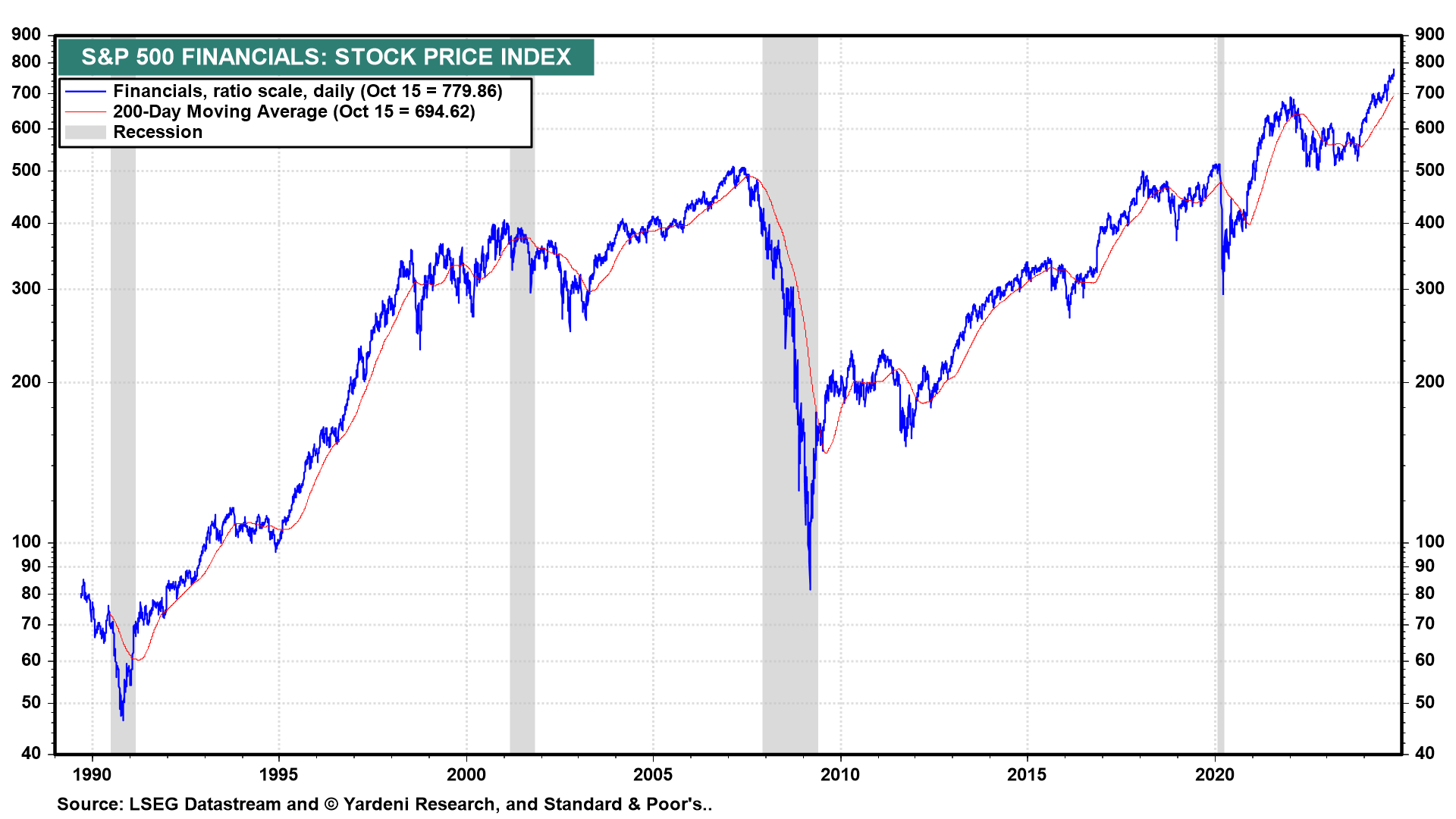

A coincident indicator of the economy, big banks' earnings are beating analysts' consensus estimates with soaring revenues from dealmaking, trading, and wealth management. Strong forward guidance from bank management teams is serving as a positive leading indicator for the broader market and economy. Shares of JPMorgan, Morgan Stanley, Bank of America, and Goldman Sachs are up several percentage points this week as a result, propelling the S&P 500 Financials sector to a new record high (chart). We continue to recommend overweighting it, as we have since the start of the bull market.

We monitor weekly commercial bank balance sheet data to get a sense of how lenders are doing broadly throughout the quarter. Here's what we have been seeing:

(1) Assets & liabilities. During Q3, commercial bank deposits have been rising despite the decline in short-term interest rates (chart). The same can be said for loans, which rose to a record high during the October 2 week. The banks also started buying more securities and borrowing less during Q3.