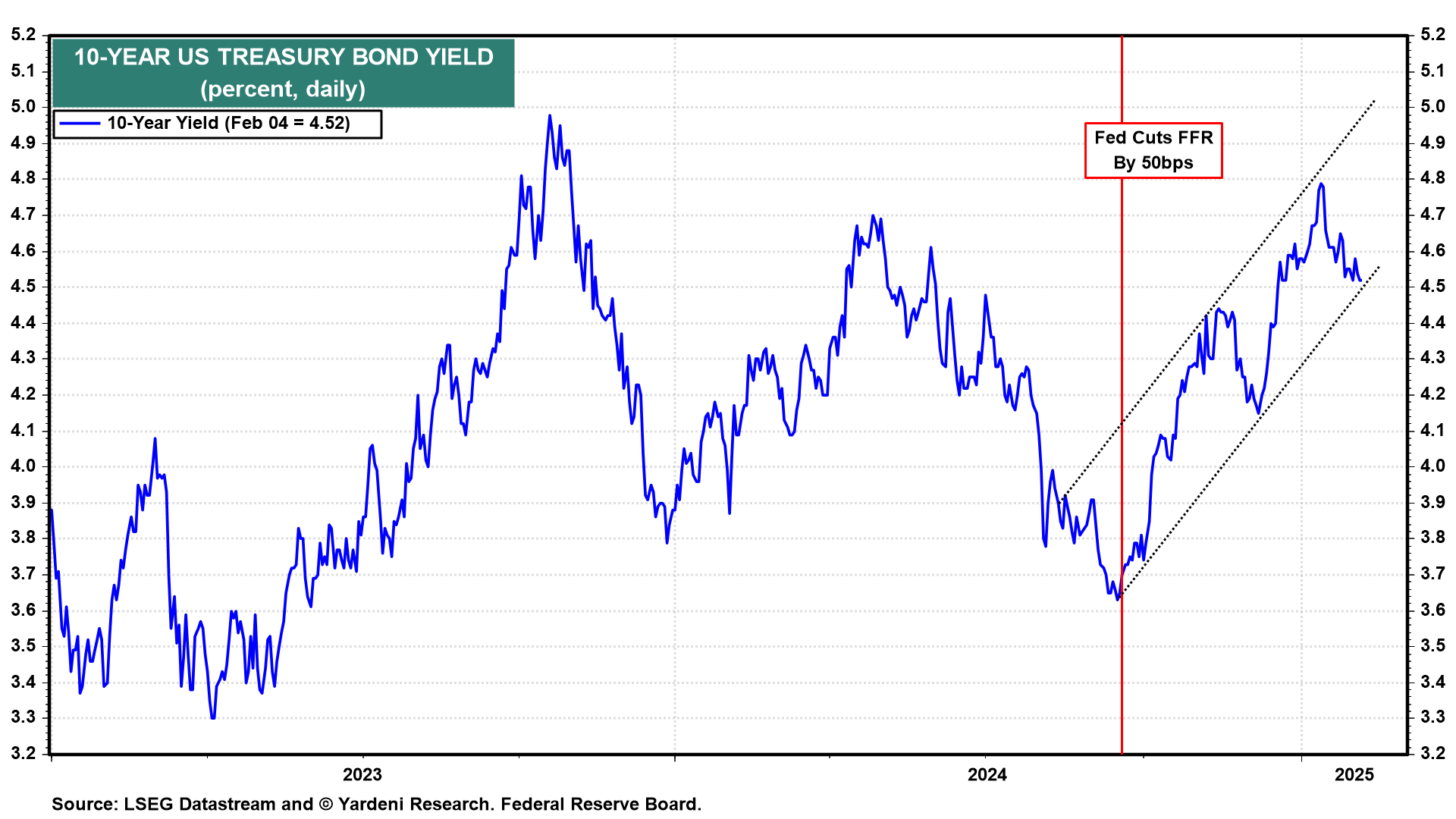

The bond market relaxed today after Treasury Secretary Scott Bessent's debut Quarterly Refunding Announcement (QRA) proved to be a non-event. The 10-year Treasury yield fell 9bps to 4.43%, its lowest level since the Federal Reserve's last rate cut, in mid-December (chart).

Bessent had been critical of Janet Yellen's usage of short-term Treasury bills to finance the federal budget deficit. Many investors, therefore, were worried that he would issue more longer-term notes and bonds, which would boost bond yields. The QRA said that auction sizes for notes and bonds would remain the same for the coming quarters, which means that bills will remain at a historically high percentage of the Treasury market for the foreseeable future (chart). This also is a positive for the stock market.