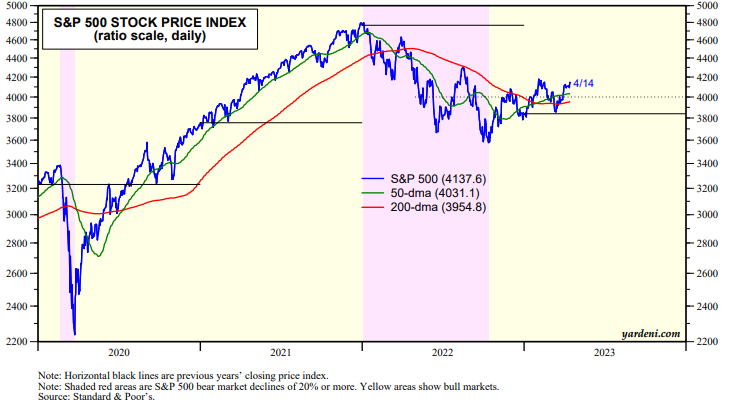

We've previously observed that any day without a banking crisis is a good day for stocks. SVB imploded on Friday, March 10. On Sunday, March 12, the Fed and FDIC took actions to avoid additional bank runs. The S&P 500 is up 7.1% since March 10 led by Information Technology (9.8%), Health Care (8.6), and Utilities (7.6%) (chart). All of the sectors are up since then including even the Financials (0.1).

An economy-wide credit crunch isn’t likely to result from the latest banking crisis, which may be abating already. We are monitoring the situation by tracking the Fed’s weekly H.8 report titled “Assets and Liabilities of Commercial Banks in the United States,” released on Fridays at 4:15 pm. We do so in our Commercial Bank Book. Here are the latest findings through the week of April 5 (chart):