Today, the US stock market quickly confirmed our view that DeepSeek is a positive for the proliferation of AI, which should boost productivity and economic growth, especially in the US. The Nasdaq added 2% as Nvidia rose 9%. Both regained much of Monday's losses from the DeepSeek mini panic. It was yet another buying opportunity in the current bull market, as we anticipated in Sunday's QT.

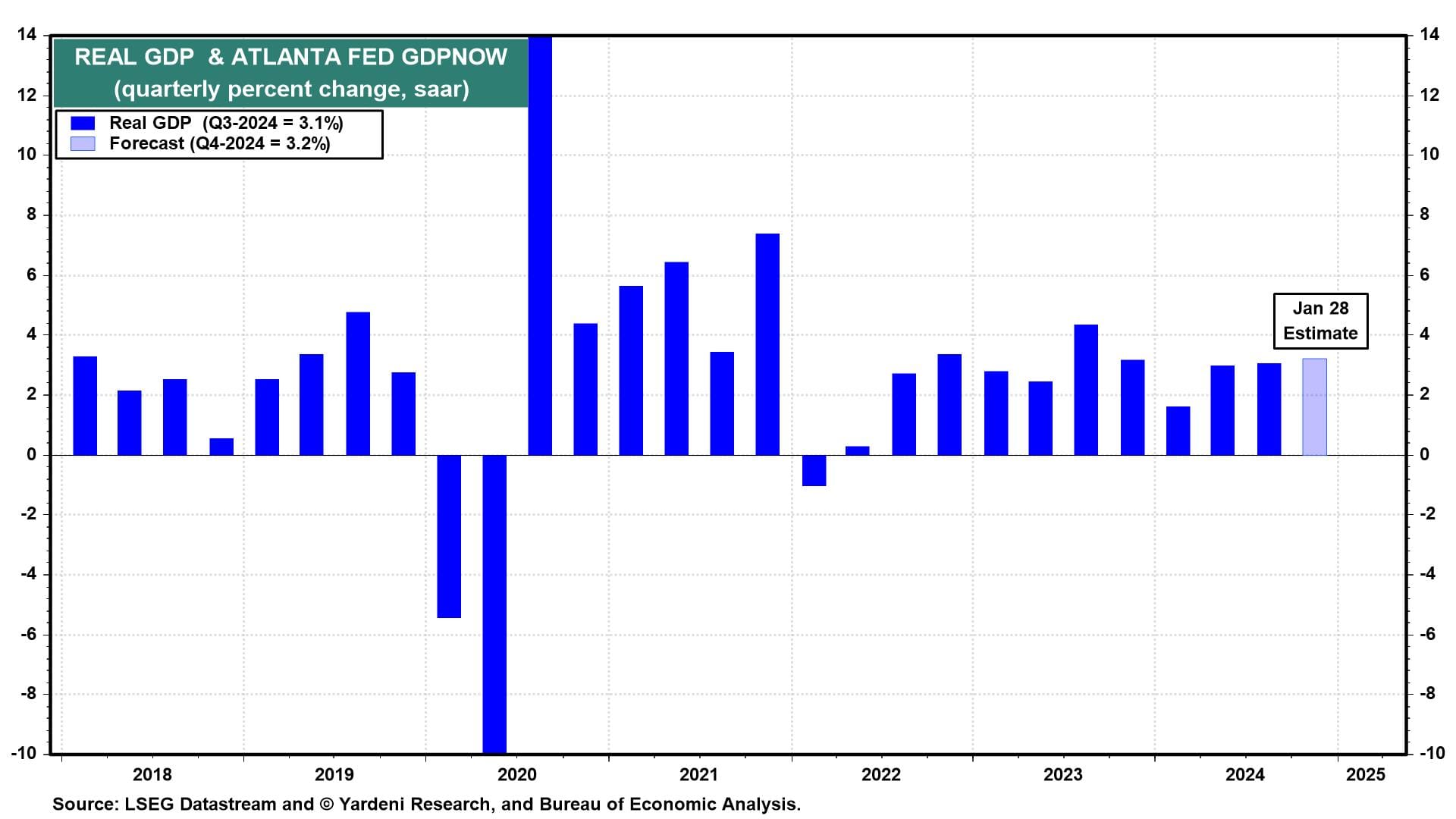

Tomorrow, investors will focus on Q4 earnings reports for big tech and the FOMC's interest-rate decision. We're expecting Q4 earnings will continue to positively surprise the market. The Fed is likely to pause rate cutting because of better-than-expected economic growth. Today, the Atlanta Fed's GDPNow tracking model raised the estimated Q4 real GDP growth rate from 3.0% to 3.2% (saar), which would be the strongest quarter since Q3-2023 (chart). Real consumer spending is projected to be up 3.8%.

The worst-case scenario for real GDP would be if the DeepSeek news causes the major AI companies to slash their capital spending on high-tech equipment and software. We seriously doubt that will happen. The big companies will benefit from increased AI demand and cheaper internal costs. DeepSeek increases our confidence in our technology-driven, productivity-led Roaring 2020s scenario.

Here is more of today's happy news: